Mobile electric microgrids address power demands of high-intensity fracing

Concurrent with the proliferation of clean-burning, electric-driven frac fleets is the challenge of how to optimally power this next-generation technology. While accessing power from the grid remains among the top goals for many operators, a number of significant hurdles must be overcome before grid-generated electricity can effectively handle the loads required for multi-well pressure pumping.

Those loads can be 10 times more power-intensive than other drilling and production activities. For perspective, running 500-to-600-hp electric submersible pumps (ESPs) on a 10-well pad pulls an aggregate of around 5 megawatts (MW) of electrical power. This is dwarfed by the 22-plus MW demanded of a single, electric frac spread, which is sufficient to power approximately 4,000 homes.

E-frac challenge. Completion activity is often located in grid-restricted plays, such as the Permian basin, where only basic infrastructure is in place. Even when tapping into a local substation is feasible, distance constraints—as well as the inability to meet the higher power demanded of the high-rate/high-pressure and long-lateral wells emblematic of contemporary frac jobs, while maintaining commitments to other utility customers—limit the viability of that option. Moreover, handling the intermittent power load profile that comes from starting and completing a frac stage poses a particularly daunting challenge.

Win-win solution. Bolstered by the development of powerful and easily deployable aeroderivative turbine generators, a field-proven solution has emerged in the form of mobile microgrids. They enable remote pressure pumping and allow operators to fully capitalize on the economic and environmental benefits of electric fracing, Fig. 1.

Specifically, trailer-mounted natural gas-fired turbines are installed directly at producing wells, with the field gas used to deliver up to 35 MW of nameplate electrical capacity. The generated currents flow through specially installed power lines to each electric, or e-frac, spread operating within a 3-mi radius or more. Once the completions are wrapped up, and the production crews take over, the microgrids and frac spreads are quickly mobilized to another multi-pad location to repeat the process. Notably, the microgrids are most beneficial when the turbines are powered with stranded gas that could not be piped from the frac site and would otherwise be flared, thereby eliminating fuel costs while helping advance operators' decarbonization objectives.

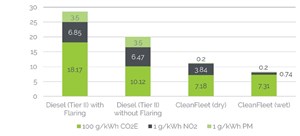

Compared to conventional diesel-fueled frac fleets, field-based data show that using well gas in the deployment of the electric fracing technology across the West Texas and New Mexico reaches of the Permian basin can save an operator more than $25 million, gross, in yearly fuel costs, depending on the pumping horsepower required and current commodity pricing, while substantially reducing greenhouse gas emissions. Comparative analysis with Tier II diesel fleets show that electric frac spreads burning field gas that likely would have been directed to flare stacks are capable of reducing carbon dioxide equivalent (CO2e ) emissions up to 60%, nitrogen oxide (NOx) by 89% and particulate matter up to 94%, Fig. 2. When flared gas is not utilized, CO2e emissions are still reduced by 29%, while NOx and particulate emissions rates are unchanged, compared to a Tier II diesel fleet.

E-frac evolution. The debut of electric frac fleets in unconventional oil and gas fields nearly a decade ago can be likened to the groundbreaking development of AC-powered drilling rigs, but it has come at a much more accelerated pace. Precipitated by the high operating costs of loud, diesel-driven pumping units and universal, net-zero emission mandates, the appearance of electric fracing spreads has multiplied since 2020, to emerge as a key element in the overall oilfield electrification push.1,2,3,4

Conceived to displace all-diesel frac fleets, electric-powered fracing displaces upwards of 10 million gal of fuel/yr,5 which, even with whipsawing commodity prices, represents a significant component in the total costs of a hydraulic fracing job. Furthermore, electric frac spreads slash the high greenhouse gas emission rates of their diesel-fueled counterparts. Specifically, e-frac technology effectively cuts costs and emissions by replacing the engine, transmission and associated lubes and filters in a conventional frac trailer with an electric motor and variable frequency drive (VFD), which typically receive power via gas-fueled turbines. It has been estimated that one Mcf of gas can displace around 8 gal of diesel.5

The inauguration of the groundbreaking Clean Fleet electric frac technology in 2014 was accompanied by an array of cables, cumbersome turbines and small electric motors that were underpowered by today's standards. Those earlier-generation fleets required no less than four 5.7-MW turbines, which were originally designed to be in a specific location for months at a time. Accordingly, the fleet demobilization and mobilization process could take upwards of a week. Subsequent generations focused on condensing equipment, making the spreads more nimble, along with initiatives aimed at increasing the horsepower and electrical power output necessary for modern pressure pumping.

Today, the newest generation technology (Fig. 3) is powered with 3,000-hhp motors per power end, a single power cable per pump trailer, and new-generation hyper mobile power generation units, thus enabling the fleet to mobilize between pads in less than 48 hr and to perform efficiently in some of the most hhp-intensive environments in the U.S., including the high-pressure Delaware and Haynesville shale areas. Compared to earlier versions, the latest-generation electric frac fleets are installed through a specialized rapid deployment system that has eliminated some 96 cables and integrated the transformer onto the pump trailer, all while boosting pumping capabilities by 67%.

Conjointly, the inherent capacity of an e-frac spread to automatically adjust pump rates down to 0.1 bpm and eliminate the constant transmission shifts characteristic of diesel frac fleets, enables more precise control, thus helping elevate the quality of the frac job.

The steady advancement of e-frac technology, however, came with the formidable issue of accessing sufficient electrical capacity. While relying on utility-generated electricity under power purchase agreements (PPA) would appear an ideal solution, as substations are designed to minimize wasted heat and emissions, that option is either unavailable to generate sufficient horsepower or unable to handle the intermittent load profile associated with electric frac fleets, particularly in more remote operating areas.6 Installing a permanent utility substation is largely cost-prohibitive, but it also restricts the operational reach from the set point, which likewise would prohibit the use of stranded gas and the subsequent elimination of flaring that may be occurring outside the prescribed coverage area.

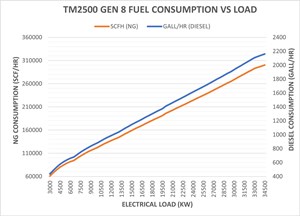

New generation turbines. Meeting at the intersection of higher-intensity frac programs and the growth of electric frac spreads, turbine technology likewise has advanced significantly from cumbersome, crane-mounted machines with lower power capacity to portable packages with up to seven times higher nameplate capacity. Over the past two years especially, development has focused on mobility and power density, resulting in trailer-mounted turbines capable of mobilizing and demobilizing in a matter of hours while generating up to 35 MW of power, Fig. 4. The actual fuel consumed, however, is appreciably less, as the gas used is dictated by the electrical load at a given time, Fig.5. Furthermore, along with a smaller footprint, portable turbines require fewer connections and field personnel, making teardowns and installations safer and faster.

These new-generation turbines are engineered to run on untreated field gas and can accept a wide range of gas qualities compared to other natural gas-burning technologies. In an unlikely disruption of well gas supply, the latest turbines are also engineered to utilize other hydrocarbons, such as compressed and liquefied natural gas (CNG/LNG) and even CNG-hydrogen blends. While in operation, these leading-edge packages have near-zero methane slip, with NOx emission rates as low as 0.15g/bhp-hr (grams per brake-horsepower hour).

The mobility and lower footprint of high-power turbines have also proved to be a decided advantage with the more recent emergence of simul-fracs, whereas two wells are stimulated simultaneously, requiring a single frac spread to deliver up to 60,000 hhp. To generate the 40 MW needed to pump at 10,500 psi and 160 bpm in a typical simul-frac job, dual 35-MW turbine packages can be placed side-by-side in an efficient and power-dense onsite footprint.

The advancements in mobile turbine technology further advanced the PowerPath microgrid and associated technologies, effectively enabling remote electric fracing with field gas without having to depend on local utilities. Moreover, once the portable turbines and e-frac spreads are moved to the next location, the power lines can remain in place and the cables repurposed to transmit power to production and associated equipment.

Addressing power loads, site noise. The modular, multi-patented microgrid system meets the high and undisrupted power demand by way of an electrical generation and distribution network capable of remotely executing high-intensity fracing through fit-for-purpose power lines. The microgrid layout comprises a number of associated technologies that range from on-site noise dampening to addressing the unique challenges of electric fracing, with particular attention directed to intrinsic pressure and rate variations that lead to oft-changing power loads.

It is common knowledge that turbines operate most efficiently under unwavering high loads, as illustrated in industrial and power plants, where they typically run at a constant 98% to 99% of maximum capacity—a load rate impossible to sustain in ever-fluctuating fracing conditions. Over the course of pumping frac fluid, wellhead pressures can spike or drop precipitously without warning, requiring constant modification of the torque applied from VFD motors, thus drawing ever changing power loads from the turbines. Pumping rates, likewise, can constantly increase or decrease.

A specially engineered switchgear—a core technology in any electrical network—acts as a single electrical hub designed to synchronize power supply generated from one or more sources and distribute that power to the various pieces of electric equipment on the pad, including any properly installed ancillary third-party gear.7 Capable of accepting up to 60 MW of electricity through the power lines, the proprietary switchgear is configured to enable turbine load sharing and optimization, depending on the power loads required at any given time. This power is then fed to the electric blenders and 3,000-hhp VFD-controlled electrical motors driving the 10 frac double pumpers on a typical new-generation Clean Fleet spread.

Apart from executing the pressure pumping exercise with more control over the horsepower output, electric-driven frac fleets are intrinsically much quieter than diesel-powered spreads, even more so with the similarly quiet turbines located remotely from the site. Field monitoring has shown a 69% reduction in average sound pressure at a Clean Fleet location and a 95% reduction in low-frequency noise (dBc). Along with crew safety and comfort, noise reduction is critical when operating within city limits and residential areas, even more so in areas like the populous Marcellus-Utica shale play in Pennsylvania, West Virginia and Ohio.

Microgrid mob, demob procedure. Pre-frac planning ensures the overhead power lines are properly sized to meet the significantly higher power demand, while electrical engineers optimize routing for the 2-3 mi of power lines that will run from the producing well, where the turbines will be connected to the separated gas off-take line, to the targeted pad(s).

Riser drops on the power poles enable the cables to be lowered to the ground and easily connected to the switchgear. From there, installation and rig-up is rather straightforward, requiring few connections and normally taking less than 48 hr to complete. The remote positioning of the turbine and associated equipment enables the frac spreads to be mobilized independently of the microgrid installation. When the frac spread is mobilizing within the same microgrid project area, the fleet deployment time to the next pad is often reduced to less than 24 hr.

During the pressure pumping operation, turbine output is monitored 24/7, with data on the power supplied forwarded directly to the frac crew. The operation can include multiple contingency options, including provisional CNG or LNG supplies in the event of any fuel disruptions, which typically do not pose a significant concern. Owing to economic considerations, the fuel contingencies are seldom used.

Once the completions program is completed for the active microgrid region, the electric spreads and turbines are quickly disconnected and trucked to the next location. Especially in grid-challenged areas like West Texas, where electric production boosting equipment is required, the power poles remain post-frac and available to transfer power generated from the gas source to drive ESPs and other lower-power oilfield equipment. With the poles in place, it is a simple matter to string properly sized cables and bring in smaller generators capable of delivering sufficient megawatts of power for non-fracing activities.

Costs, emissions field recaps. At the onset of a PowerPath project, each client receives specially designed calculators. enabling them to model fuel consumption and costs, and emissions outputs, with direct comparisons to Tier IV diesel fleets operating under the same conditions as the electric-driven frac spreads. While fuel consumption varies with completion efficiency and horsepower requirements, calculated estimates show annual net savings of up to $17 million in the Permian basin, after e-fleet adders to cover power generation, gas conditioning and the like. These numbers assume diesel costs of $4.00/gal and field gas costs of $2.50/Mcf.

In the Permian's more mature Midland sub-basin, where pumping pressures average 7,500 to 8,500 psi, Clean Fleet frac spreads can shave more than $11 million/yr off of completions costs, compared to their diesel counterparts. The savings are even greater in the Delaware sub-basin of southeastern New Mexico and far West Texas, which typically requires higher pumping pressures of 10,500 to 11,500 psi, where potential net savings can exceed $17 million/yr. Assuming 300 pumping days/yr, the Midland and Delaware savings break down to $35,000/day and $51,700/day, respectively.

In one microgrid, multi-pad frac program within the city limits of Midland, an operator saved a net $2.070 million in a 30-day period, translating to $69,000/day savings. The project entailed a cumulative 532 fraced stages, averaging 19.4 daily pumping hours at 365,000 hp-hr/day, pulling 20 MW of maximum turbine power. Running the electric fleet on natural gas, likewise, cut 2,073 metric tons of CO2e emissions. Owing to the location being within city limits, the operator also normally struggled with noise concerns. However, with the quiet nature of the electric fleet, the operator was able to reduce noise abatement rentals and neighbor complaints.

Elsewhere, in the tightly regulated Marcellus shale play, another operator saved $3.9 million in fuel costs, while removing 3,184 metric tons of CO2e from the atmosphere. That project encompassed a total of 574 stages over 60 days, averaging 18.4 pumping hours/day at an average 407,000 hp/hr/day and maximum turbine power of 19 MW. Moreover, completed e-frac projects in both the Permian and Marcellus regions documented averaged metric ton reductions in atmospheric CO2 , ranging from 20% to 26%.

REFERENCES

- Jacobs, T., "Electric frac fleets rise from 3% to 30% of U.S. shale market amid diesel drop," Journal of Petroleum Technology, May 11, 2020.

- Cookson, C., "Pressure pumpers develop new ways to run on natural gas," American Oil & Gas Reporter, March 2023.

- Tong, Z., Y. Kuang, C. Fan, T. Li, J. Wang, Y. Li, J. Qian, "Eco-friendly, electric-powered hydraulic fracturing towards shale-gas recovery: Efficiency, economics and field application,” presented at the SPE International Hydraulic Fracturing Technology Conference & Exhibition, Muscat, Oman, January 2022.

- S&P Global, "The potential of electric fracking," S&P blog, Sept. 11,2019.

- Cookson, C., "Modern frac fleets deliver wells faster and consume less fuel," American Oil and Gas Reporter, January 2023.

- Rassenfoss, S., "ATCE: Electric power charges the future of oilfield operations," Journal of Petroleum Technology, Sept. 21, 2021.

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- When electric meets intelligence: Powering a new era in hydraulic fracturing (January 2024)

- Next-generation electric fracturing system improves efficiency, ESG performance (January 2024)

- Going global with unconventionals (December 2023)

- Singlet oxygen-generating treatment technology achieves sustainable operations, helps operators meet production goals (November 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)