North America

News

February 27, 2026

Venezuela has canceled the auction of assets seized from Halliburton after pressure from the U.S. government, a move seen as clearing the way for the oilfield services giant’s return amid efforts to revive the country’s oil sector under U.S. engagement.

News

February 26, 2026

Diversified Energy has agreed to acquire East Texas natural gas assets from Sheridan Production for $245 million, adding approximately 62 MMcfed of low-decline production and 397 Bcfe of reserves to its portfolio.

News

February 26, 2026

bp is expanding U.S. shale drilling through its bpX Energy unit, targeting 8% production growth in 2026 and up to 650,000 boed by 2030 as the company seeks to reverse declining output and strengthen its upstream portfolio.

News

February 26, 2026

The Energy Workforce & Technology Council has appointed Kyle Chapman of Levare and Daniel Watson of Steel Alloys & Services to its advisory board, strengthening industry leadership and strategic guidance for the oilfield services and technology sector.

News

February 25, 2026

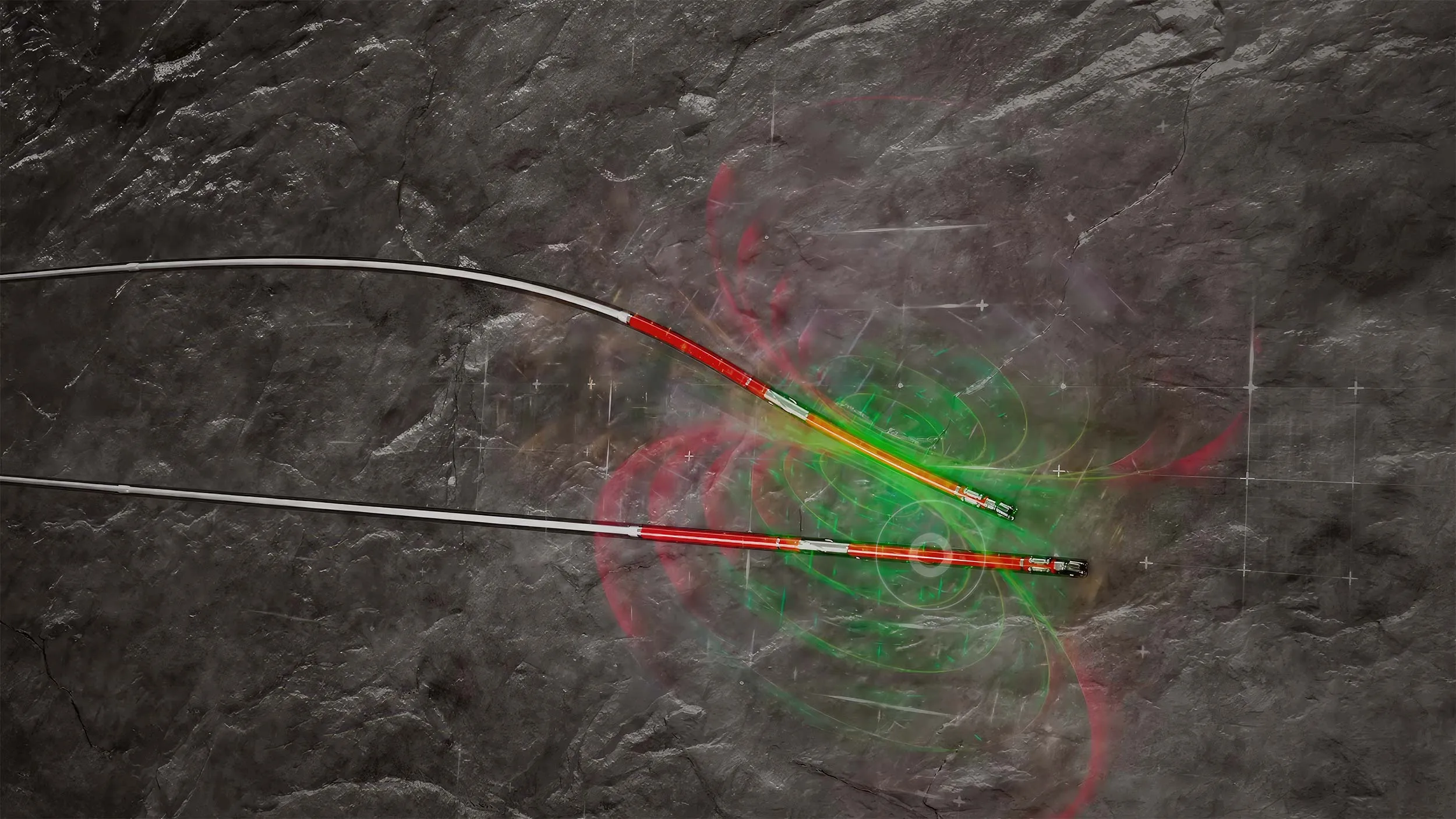

Halliburton has launched the RangeStar geothermal well spacing and intercept service, a magnetic ranging solution designed to improve well placement accuracy, reduce decision time and support automation in complex geothermal drilling environments.

News

February 25, 2026

Hephae Energy Technology has appointed industry veteran Andy Bruce as president to support commercial deployment of its ultra-high-temperature geothermal drilling and robotics technology, designed to enable next-generation superhot rock geothermal development worldwide.

News

February 25, 2026

Breakwall Capital and Vitol have closed Valor Upstream Credit Partners II, a new energy-focused credit fund targeting structured financing for North American upstream oil and gas companies, including refinancing, acquisitions and development capital.

Article

February

U.S. drilling enters 2026 with fewer rigs but resilient production, as operators prioritize capital discipline, consolidation and LNG-driven gas demand. Regional trends across shale and offshore basins point to steady output, measured investment and a continued shift toward efficiency over expansion.

News

February 24, 2026

Ovintiv is directing nearly $2.3 billion in 2026 capital toward its Permian and Montney assets, targeting up to 275 net wells and increased oil output from its core North American basins.

News

February 23, 2026

After $37.8 billion in 2025 oil patch deals, analysts say Canada’s oil sands sector could be next in line for a transformational mega merger as pipeline pressure and pricing volatility reshape strategy.

Article

February

The Canadian oilpatch always seems to be in flux—if the fundamentals are strong, then there’s political uncertainty or intervention. And when the political support lines up, they are at the mercy of global commodity prices. Still, 2026 is lining up to be a decent year—for now.

News

February 18, 2026

Occidental reported strong fourth-quarter 2025 production and cash flow, exceeded output guidance and reduced debt following its OxyChem sale, reinforcing its Permian-focused portfolio and balance sheet strength.

News

February 18, 2026

SM Energy has agreed to sell 61,000 net acres and 260 producing wells in South Texas to Caturus Energy for $950 million, with proceeds expected to reduce debt and strengthen its balance sheet.

News

February 17, 2026

The offshore industry is marking the anniversary of the Ocean Ranger disaster, remembering the 84 crew members lost in 1982 and the lasting impact on offshore safety standards worldwide.

News

February 16, 2026

Buccaneer Energy has completed an organic oil recovery pilot at its Pine Mills field in East Texas, reporting increased production and reduced water cut as it evaluates expansion of the enhanced recovery program.

News

February 14, 2026

Canada’s energy minister says carbon capture investments and the Pathways Alliance project will help secure the long-term future and global competitiveness of the country’s oil sands industry.

News

February 12, 2026

The Independent Petroleum Association of America expressed support for EPA’s repeal of the 2009 endangerment finding and called for clear, durable greenhouse gas regulations affecting U.S. upstream oil and gas producers.

News

February 11, 2026

The U.S. has issued a general license allowing oilfield service companies to resume limited operations in Venezuela, signaling a further easing of sanctions aimed at restoring crude production and rebuilding the country’s oil infrastructure.

News

February 11, 2026

Harbour Energy has completed its $3.2-billion acquisition of LLOG Exploration, establishing a major deepwater position in the U.S. Gulf of America and adding oil-weighted production with growth to 70 MMbpd expected by 2028.

News

February 10, 2026

Expand Energy will relocate its corporate headquarters to Houston in 2026 and appoint Chairman Michael Wichterich as interim CEO, positioning the company closer to global natural gas markets while reaffirming its capital, synergy and operating outlook.

News

February 09, 2026

Oilfield service and technology executives are heading to Washington in record numbers this week, urging lawmakers to accelerate permitting reform, stabilize trade policy and ensure regulatory certainty as operators weigh new drilling and infrastructure investments.