Digital transformation for oil & gas investors

The ongoing digital transformation of the oil and gas industry involves the combination of emerging technologies, such as artificial intelligence (AI), the Internet of Things (IoT), augmented reality (AR), mobile connectivity and the cloud, to gather, analyze and react in real time to production-related information gathered in the field. This transformation is being driven by the rapidly growing demand for digital oilfield technologies (DOF) from companies seeking to increase efficiencies, reduce operating costs and accelerate decision-making.

While the adoption of digital oilfield practices has increased steadily over the last several years, the Covid-19 pandemic significantly accelerated the demand for these products in 2020, as companies sought ways to enable staff to monitor and operate fields remotely, and allow others to work in the safety of their homes. To support this growing demand, an emerging market of independent providers is affording our industry with DOF solutions associated with big data management, data analytics, and smart remote operations.

One such provider is PetroAi LLC, an international collaboration formed in January 2020 between U.S. energy lender PetroAlpha Energy, and Korean Technology Companies, Energy Holdings Group, and iSciLab, to bring AI and big data analytics into the decision-making process associated with value determination in oil and gas investments.

As noted by Dr. Hyeong In Choi, founder of IsciLabs, “making informed investment decisions requires more than just access to big data and smart sensors, as the real value lies not in the volume of information available or gathered, but in the way it is strategically analyzed.” This fundamental understanding provides the vision that is incorporated into PetroAi’s applications. Therefore, while most DOF providers focus on applications and equipment to help operators optimize production and reservoir performance, PetroAi uniquely develops applications that support investors’ decisions concerning asset valuation throughout the life of an investment.

INVESTMENT LIFECYCLE

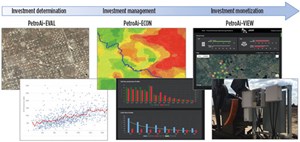

The lifecycle of an oil and gas investment can be grouped generally into three phases: Investment Determination, Investment Management, and Investment Monetization. While forecasted production volumes, and the costs required to optimize this production, are the critical valuation parameters in each phase, the data available for analysis to determine an investment’s value varies in each. As such, PetroAi has developed a family of DOF solutions that will support investor decisions through each investment phase.

Investment Determination Phase includes the due diligence that investors perform on an asset or portfolio of assets, to confirm key technical, economic and legal assumptions, and to also confirm operator competence. All tasks performed during this phase have the purpose of achieving a final investment decision (FID).

Investment Management Phase involves the active oversight of an asset, once an investment has been made. This includes the monitoring of an asset’s performance and making subsequent investments necessary to sustain and optimize performance. Investors also will monitor the performance of their operator partner, along with the field procedures utilized, and make the necessary changes to increase efficiencies and reduce costs.

Investment Monetization Phase is the exit strategy used to end an investment. For lenders, it may be reaching the full term of a loan, and for working interest owners, it may mean the divesting of an asset to others. For those seeking to divest, the primary goal during the Monetization Phase is to maximize the achievable upside value remaining in an asset.

COMPLETE SOLUTIONS

PetroAi’s family of DOF applications includes PetroAi-EVAL, PetroAi-ECON and PetroAi-VIEW. They provide investors with a seamless source of DOF solutions to support decision- making throughout the investment lifecycle, Fig. 1. Together, these applications support the digital transformation of an investor’s ability to evaluate (EVAL), justify (ECON) and validate (VIEW) a successful oil and gas investment.

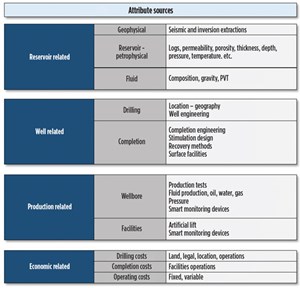

PetroAi-EVAL utilizes proprietary deep machine learning and artificial intelligence to mine large datasets, to identify trends and anomalies reflecting changes in reservoir conditions or field operations. The information included in these “big data” volumes is sourced primarily from regional databases consisting of historical data associated with drilling, completion and production operations that may be augmented with various technical studies. A list of potential sources for the digital data that can be incorporated into the machine learning process is shown in Fig. 2.

Predictive AI production forecasting utilizes the machine learning database to derive the most complete determination of hydrocarbon volumes, for wells that are currently producing and uniquely, for wells that have yet to be drilled. Conventional forecasting methods typically determine future production volumes, based on a few fixed engineering parameters and production trends derived from a limited number of “close-by” analog wells. PetroAi-EVAL’s analytics, however, can incorporate an unlimited number of reservoir and production attributes to reliably recognize and forecast subtle and abrupt changes in production patterns, owing to variations in subsurface conditions, completion methods, and production techniques at any location across a trend or basin.

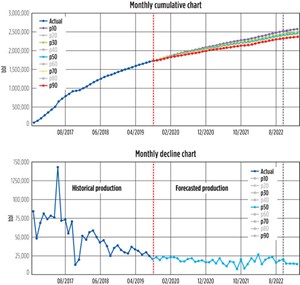

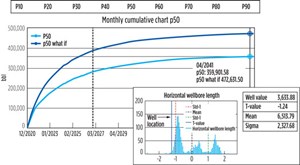

Descriptive AI analytics determine the correlation between each attribute and the historical production for every well in the machine learning database. Based on these correlations, production forecasts are derived, using time-dependent, conditional quantile regression and predictive dynamic zonation of individual attributes, along with a non-parametric decline curve analysis. Production decline curves and cumulate production curves (Fig. 3) are derived for any drilled or undrilled location. The P10 through P90 probability distributions for these curves are provided and exported for use in financial modeling and investment decisions associated with economic viability.

Dynamic “what-if” analysis allows for the adjusting of individual attribute values to evaluate their impact on production volumes. These modifications can be made on attributes associated with producing wells or the AI-forecasted attribute values associated with undrilled locations.

Specifically, the “what-if” analysis function is a powerful, versatile tool in helping investors determine the value of incremental production resulting from changes in operations or reservoir conditions. The revised production forecasts can be downloaded automatically into the economic modeling application or exported for incorporation into external cash flow analysis, to determine whether the operations required to increase production can be justified.

When combined with the descriptive AI analytic evaluations of attribute importance and attribute distribution, the Dynamic Analysis can help explain variations in well performance within each Investment Phase. It also can demonstrate remaining upside potential that may exist by incorporating the attribute values associated with optimized performance. As an example, Figure 4 shows the cumulative production impact of increasing the horizontal completion length of a planned well to match the calculated mean for all horizontal completion lengths in the basin.

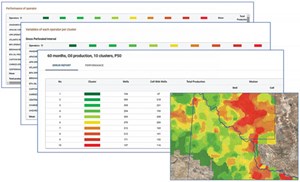

Cluster Analysis utilizes descriptive AI analytics to determine the distribution of production volumes and other key attributes across an entire basin or trend. This allows investors to quickly determine remaining production volumes and key attribute values at any location. In addition to the number of wells and production volumes remaining in each cluster, the AI analytics also allow for evaluating the production performance of individual operators, along with the engineering attributes they use, Fig. 5. This provides investors with insight into the historical performance of a potential future operator and how existing operating partners are performing within their peer group. It also ensures that these operating partners utilize best practices to optimize production.

PetroAi-ECON incorporates the forecasted production for any well or groups of wells into a cash flow model to support real-time investment decisionsin any of the investment phases. This product is particularly useful in evaluating the economic justification for undertaking operational changes that the Dynamic “what-if” Analysis shows will better optimize production. After providing fundamental inputs associated with ownership, commodity pricing and costs, the cash flow analysis is automictically updated, when production forecasts are adjusted in PetroAi’s other applications.

PetroAi-VIEW utilizes smart monitoring devices located directly in the field, to enable investors to actively monitor and respond to the real-time daily performance of an asset after an investment is made. The data available for monitoring are obtained by wireless IoT sensors and meters that monitor surface facilities, wellhead functions, production rates and reservoir performance. Individual wells may use ultrasonic, magnetic and vibration sensors to monitor the performance of surface equipment, and to provide automatic notification of failures, excessive corrosion, and leakages. Monitoring of reservoir and wellbore conditions can be performed with smart meters that measure tubing and casing pressures, temperature and flowrates. Storage tanks use fill level sensors to measure individual oil and water volumes being produced. Devices can also provide notification and monitoring of when a change in custody occurs with the sale of product.

Dashboard Monitoring enables investors to track the real-time performance of an investment on a smart device or computer, Fig. 6. Key performance and cost indices are tracked against target levels established by approved plans and budgets or obligations required by the investor. Warnings are delivered automatically to the investor’s desktop and smart devices, when actual performance is outside user-set alarm limits. Wells with such warnings are placed on a daily “sick well” list. Receiving warnings about sick wells allows investors to be proactive in discussions with the operator on the performance of wells that are critical to the economic viability of an investment. In combination with predictive analytics, these warnings can help mitigate unexpected incremental investments by detecting patterns and anomalies that may be precursors to equipment or component failures.

Investors are provided a daily snapshot valuation for every well by incorporating the tracking of operating and analytics included within PetroAI-VIEW. Alarm limits can be set on this evaluation, as well, to provide notification when an asset is under- or overperforming expectations.

Predictive analytics, utilizing the constant stream of data derived from the monitoring sensors, can help to mitigate unexpected incremental investments by detecting patterns and anomalies that are precursors to equipment or component failures.

DELIVERING ANSWERS

Simply put, PetroAi helps investors determine with confidence, answers to the age-old questions of “What is currently happening with my investment?”, “What happened to my investment? “and “Why are the assets in my investment performing differently than those in the property next door?”

“The solutions provided by the PetroAi products allow us to not only make more informed investment decisions, the high level of confidence in the answers provided by their technology allows us to better attract and retain participants in our funds” says Paul Hudson, CEO of PetroAlpha. “As a result, we are incorporating the PetroAi technology exclusively in our underwriting process and will require it for each of our deals in the future”.

As an international collaboration already relying on remote video conferencing to coordinate daily activities, the Covid-19 pandemic had a limited impact on the company’s software development efforts in 2020. By year-end, PetroAi was therefore able to release its current family of applications on schedule.

During development of PetroAi-EVAL, the Company performed analytics on Machine Learning datasets, including over 24,000 wells. In addition, the company is actively installing smart devices on wells, and PetroAi-VIEW is being used to monitor real time field performance for investments.

An aggressive development program is planned for 2021 that will address additional analytical, monitoring, and financial modeling applications. With an ongoing economic recovery supported by the release of multiple Covid-19 vaccines and oil prices above $60 per barrel, the company sees a strong recovery for the industry and a growing demand for its digital oilfield solutions.

SUMMARY

PetroAi came into existence, owing much to the visionary and timely partnership between U.S. oil and gas expertise and Korea’s leadership in digital technologies and abundant manpower. With strong encouragement and support of this partnership from the Korean government, PetroAi was able to quickly establish itself as a market leader in AI solutions. Dr. Howard Park, Founder of Energy Holdings Group, anticipates rapid growth for PetroAi and continued support from the Korean government as part of its efforts to face the transformation that is ongoing in the oil & gas industry.

Dr. Park provides an appropriate summary in his statement, “our ultimate goal is helping investors and operators communicate by sharing field level data in real time to create true partnerships for mutual prosperity and the maximizing of an asset’s value through an agile reporting and feedback process”.

- Rugged, explosion-proof computers safeguard offshore rigs (January)

- The evolution of remote-controlled FPSOs (January)

- What's new in production: Welcome diversion? (December 2025)

- How AI-driven asset management is channeling the sea of data into actionable insights for companies (December 2025)

- Upstream benefits: Oil and gas networks for the digital era (December 2025)

- Comprehensive cybersecurity approach protects the heart of the rig (December 2025)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)