Electrifying offshore oil and gas facilities with floating wind turbines

Floating offshore wind is widely acknowledged as the answer to exploit deepwater sites with abundant wind resources. For example, in 2017, the Hywind floating wind farm off the northeast coast of Scotland was the first in the world to be brought into operation.

As the fossil fuel industry grapples with its net zero target ambitions, switching gas turbine generation to 100% green power from neighboring wind turbines could be an efficient and sustainable step in the right direction. Dan Jackson and Mark Dixon, co-founders of Cerulean Winds, discuss the needs and challenges associated with wind-powered electrification and asset conversion.

World Oil (WO): The oil and gas industry is contending with increased pressure to fulfil its net zero ambitions. Having worked on large-scale offshore infrastructure developments in the UK sector for more than 25 years, how do you feel this drive to decarbonize is fairing?

Dan Jackson (DJ): The UK has set world-leading targets to progress energy transition, but to achieve them there must be a greater sense of urgency and joined-up thinking. If assets don’t reduce their CO2 emissions by the mid-2020s, increased emissions penalties through carbon taxes will see many North Sea fields become uneconomical, moving them towards decommissioning by the end of the decade, at the cost of thousands of jobs. That would seriously compromise the sector’s role in homegrown energy security. It must remain a vital element in the transition journey for decades to come, but emissions must be cut significantly to make production greener, thereby providing the social license to operate through the transition.

WO: Research has suggested that installed capacity of floating wind (Fig. 1.) is expected to double nine times in the next 30 years, opening up deepwater sites in many more countries and unlocking the second phase of the energy transition.1 How do you see its potential compared to fixed structures?

Mark Dixon (MD): While there are many similarities between fixed and floating offshore wind turbines, the opportunities come from the differences. Fixed asset maintenance is carried out offshore, with little of the value coming to the economies. Floating units are assembled onshore before being towed to location and connected to mooring lines, Fig. 2.

They can then be disconnected and towed back to shore for maintenance, servicing or technical upgrades. Floating wind farms also can be developed faster with standardized floating turbine units and higher energy yield. Compared with fixed-bottom designs, they offer economic and environmental benefits, due to less-invasive activity on the seabed during installation.

Already, floating wind technology is swiftly progressing from pilot projects to more commercial-scale deployments. A report by DNV predicts that by 2050, the installed floating wind capacity will have grown from 100MW today to over 250GW—more than 20% of the offshore wind market and around 2% of the world’s power. That represents a highly attractive investment opportunity if the energy and maritime sectors work together to reduce risk and cost.

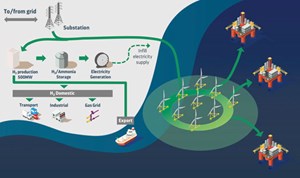

WO: To accelerate the decarbonization of oil and gas assets in the North Sea, Cerulean Winds is proposing using electricity generated from 200 floating wind turbines to power offshore operations (Fig. 3). What impact can this make on reducing carbon emissions?

DJ: Currently, offshore platforms in the UKCS produce 18 million tonnes of CO2 emissions per year. It is estimated that 75% of this figure is associated with power generation emissions (13.5 million tonnes). As a green infrastructure developer, we want to turn off traditional gas turbine generation and instead use an integrated 200-turbine floating wind and hydrogen development to power facilities located at sites West of Shetland (WoS) and in the Central North Sea (CNS). Excess green power would be used to generate green hydrogen providing opportunities for export and to decarbonize other industrial sectors.

The aim of the single strategic infrastructure project, worth $13 billionUSD, is to support the UK’s goal to halve greenhouse gas emissions by 2035. The scheme could effectively remove nine million tonnes of the industry’s power generation emissions from 2025, well ahead of abatement targets, while sustainably securing the supply of oil and gas required in the energy mix to mid-century. This would ultimately stall costly decommissioning activity and bring new life and jobs into the sector. We estimate that 160,000 oil and gas jobs can be safeguarded, and 200,000 new roles created within the floating wind and hydrogen sectors within the next five years.

MD: The risk of not moving quickly on basin wide decarbonization would wholly undermine the objectives set out in the recent North Sea Transition Deal. This calls for a 25% reduction in oil and gas emissions by 2027 and 50% by 2030. Our proposal would exceed these targets. This would see the assembly of all the large components of the floating structures carried out in Scotland and the UK, thereby feeding multi-million-dollar contracts to local dock, quayside, and shipyard facilities within the next few years. This then sets the supply chain foundation for UK delivery of future wind farm projects awarded through ScotWind and Round 4. No other project currently in the pipeline can deliver to that timescale, so a bolder approach is needed to secure existing jobs and create a boom akin to that stimulated by the Forties oil and gas field in the 1970s.

Crucially though, the green power would be used to generate green hydrogen which can be used to decarbonize other industrial sectors. This puts the UK on a par with other countries such as Germany, which has taken the decision to decarbonize its heavy industries and is actively looking at how to use green energy from windfarms to do that.

WO: The initiative was announced in May 2021 and already has Tier 1 contractors in place to deliver the UKCS backbone development and has engaged the financial markets for a fully funded infrastructure construct. With energization expected to begin in 2024, what stage is this transformational and fast-paced proposition at?

DJ: Having undertaken the necessary infrastructure planning to ensure the required level of project readiness for the scheme, we have submitted a formal request to Marine Scotland for seabed leases at selected unused, unallocated and in uneconomic seabed areas. This must be granted by Q3 in 2021 to target financial close in Q1 2022. Construction is scheduled to begin soon after so that the infrastructure is in place by 2024-2026. An Infrastructure Project Finance model, commonly used for major capital projects is being adopted. The initiative requires no Government subsidies but does require a more flexible and urgent approach to enabling projects of this scale to be in with any chance of meeting targets laid out in the recent North Sea Transition Deal.

Société Générale, one of the leading European financial services groups, is advising the business alongside Piper Sandler, corporate finance advisors to the energy industry in the UK and in the US, who have partnered with us over the past year to develop the UKCS decarbonization model.

MD: As seabed leases are allocated for 60 years, this will create a long-term sustainable industry that provides security in jobs ranging from assembly and maintenance to high-tech employment associated with green energy hubs. The timing involved in gaining approvals for the project is critical. The decision to proceed will ultimately rest with the Scottish Government and Marine Scotland and their enthusiasm for a streamlined regulatory approach. Our ask is simple. We want an exceptional decision made for an extraordinary outcome. We are ready to deliver a self-sustained development that will decarbonize the UKCS and be the single biggest emissions abatement project to date.

WO: NOV was recently named as the exclusive provider of floating and mooring systems for the initiative, while px Group will support onshore green hydrogen plants and associated industrial infrastructure. What does this involvement mean for this groundbreaking venture?

MD: As the largest and most qualified provider of marine equipment and wind vessel designs working in this space, NOV’s experience and knowledge of a project of this magnitude is second to none. Having them on board brings the scheme a step closer to reality. They will leverage their core competencies as well as their UK and European infrastructure and personnel to drive major progress.

px Group will be responsible for lease and ownership arrangements for the hydrogen generation facilities and the associated onshore infrastructure, including the onshore substations and grid interfaces. They will also be responsible for obtaining planning permissions and permitting prior to more detailed engagement with local government, regulatory and environmental stakeholders.

We also have several other Tier 1 delivery stakeholders signed up. Though we can’t disclose who they are at this stage, they are some of the largest providers in the world, with the scale and capacity to deliver and we look forward to making further announcements over the coming months.

WO: As floating wind can be deployed in any depth of water; this opens new sites and markets and brings wind power within reach of more of the world’s population. How will the turbines planned for the North Sea development differ from conventional designs?

MD: For the technical and economic aspects of the scheme to work, wind power needs to be generated close to the oil and gas facilities. So, we’ve had to forecast where the technology is going to be, not in a futuristic sense but in a near future sense. Getting the turbine size spot on has been an important part of achieving the economics that we ultimately have. The triangular template of each turbine foundation is based on a steel semi-submersible structure, though the benefits of a concrete or hybrid foundation have been considered. The semi-submersible has several features which make it really suited to large-scale buoyancy requirements for flotation and stability. Steel fabrication is prolific around the world, and therefore, these structures will have the widest opportunity for local content.

The design parameter and the need for rapid scale development and deployment by 2025 dictates the size, or capacity, of each turbine. Whilst today’s installed turbines deliver in the range of seven to ten megawatts (MW), we are confident that twice that capacity can be achieved. The proposed coupled dynamic system incorporates wind loading on the huge, composite rotor blades, wave loading on the floating foundation itself, as well as their interaction with the mooring system.

WO: Currently, WoS and CNS require around 250MWh and 600MWh respectively for base load, increasing with peak requirements. How will an integrated network of floating wind turbines feed sufficient power to the assets to meet demand?

MD: Clearly, despite many studies, it is not economically or technically feasible to run cables from shore to power individual platforms or groups of platforms in the UKCS, and the grid cannot guarantee continuous green power for this purpose. Therefore, we have essentially worked on the principle that an oil and gas facility wants a cable that is provided to them, that supplies them with 100% of the electricity needs that they have. It is 100% green, and it has 100% availability. Additionally, the delivery certainty for the scheme means the facilities can electrify as soon as they are read, thereby mitigating the commercial exposure to future emissions penalties. This base load and peak power demands will reflect the operating activities of larger/older and far less efficient facilities.

The plan is to have more than 200 of the largest floating turbines at sites WoS and in the CNS with up to 3GW of capacity to feed power to the platforms via an interconnected fixed jacket substation which will transmit that electricity via HVAC cable network running hundreds of kilometers to the offshore facilities. Depending on the location the platform, demand is between 40% and 60% with the balance of electricity going to hydrogen production, which is located onshore. For example, WoS demand is 250MW excluding BP’s Clair South development which, if it goes ahead as a fixed platform, would require up to 100MW more. The Moray Firth area has a demand of around 250MW and the Central Graben area is 350MW. The average production is around 600MW per site on a year-round basis (i.e. capacity factor of about 60% which is typical for floating wind farms).

Each cable will be pulled up a J tube on the facility, routed through the facility and connected into the power system. For existing facilities, this requires an element of brownfield work to swap offshore gas turbines and associated systems to green power. For new developments, the use of green electricity supports a simpler architecture while potentially saving hundreds of millions of CAPEX and attaining net zero emissions. The cables will be configured in daisy-chains or loops to cost-effectively connect a series of platforms together, for optimum resilience and contingency.

WO: Robust and reliable electrification is key if oil and gas operators are to make the switch from gas-fired turbines to green power generation within a short period of time (Fig. 4). How will this transmission system actually work?

DJ: What we’ve done, through the technical structuring and the commercial arrangement, is allow 100% availability of green power to offshore platforms at a price below current gas turbine generation through a self-sustained scheme with no upfront cost to operators. Depending on the type of equipment used and whether gas-fired generation is available from production at site or is imported, as well the CO2 tax, this can range between $100 and $180 per MW to generate electricity on the platforms: we are targeting $100 per MW. So, we are offering a standard, robust electrical transmission system designed to build in resilience. There will also be interconnection between sites for redundancy.

For periods when the wind does not blow sufficiently, three onshore substations and hydrogen generation plants located in the North of England, Northeast Scotland and on Shetland will buffer the system and guarantee 100% availability of green electricity to the platforms. A HVDC cable from the substation to shore at bases in Peterhead and Blythe, will also use an expected excess of 1.5GW per hour to generate hydrogen at a commercial scale, with an expected sales potential of around $0.5 billion. This will ultimately realize the ability to electrify the majority of current UKCS offshore assets as well as future production potential from 2024. As platforms have varying production and emission levels, power demands, and complex ownership structures, a single, strategic infrastructure approach will ensure decarbonization is basin wide and economically sound for the facilities.

WO: In a recent report, the European Technology and Innovation Platform on Wind (ETIPWind) and WindEurope said that electrification is the most cost-effective way to decarbonize Europe’s economy. How will cost and logistics dictate that decision?

DJ: As more sites open in deeper waters, floating wind will become increasingly competitive. Although not expected to become cheaper than bottom-fixed wind, the price difference will narrow as both fall due to the introduction of larger turbines, larger wind farms, significant technology developments and the creation of a highly cost-competitive supply chain. We faced two options to solve the issue of electrification of the offshore facilities. The first was to place turbines within the local proximity of several, small developments. However, this meant additional systems were needed to ensure back-up supply. The alternative was to select sites that could hold enough turbines to service the widest possible collection of platforms to the maximum capacity that they require, thus improving the economics.

To extract maximum energy from a single 150m tall, 14 or 15MW turbine, each unit will be separated by at least 1.5 km. Therefore, a network could potentially cover an area of between 250 and 400sq km grabbing, and never wasting, every gust and gale. The technical and logistical aspects of developing floating wind technology benefits from the ‘last mover advantage’ or the lessons learned from fixed offshore wind. However, ensuring stability is as close to that of a fixed jacket as possible is key, given the challenging marine environment and wind conditions of the North Sea and WoS. Cerulean draws on decades of experience in oil and gas floating facilities, specific to this region as well as worldwide, and has applied this deep understanding to this scheme.

WO: When excess electricity is produced, Cerulean’s plan is to use this for the development of green hydrogen at scale, which you have projected as having around $0.5 billion hydrogen revenue potential. How will this be further developed beyond the inevitable need for decommissioning?

MD: Hydrogen generation provides several benefits. It adds value to the excess ‘primal’ green energy (over and above powering oil and gas facilities) and provides a green product that is high in demand in fast growing domestic and export markets. This essentially ensures that every gust of wind is turned into a useful and useable megawatt of power for maximum decarbonization across offshore oil and gas facilities as well as for onshore users as part of the hydrogen economy. It also offers the UK a valuable export to replace the oil and gas industry in time, as facilities will inevitably be decommissioned.

WO: How far can this proposed UK scheme be retrofitted for other oil and gas regions and what are the wider societal benefits?

DJ: We have a transformative development that will give the UK the opportunity to rapidly decarbonize oil and gas assets, safeguard many thousands of jobs and support a new green hydrogen supply chain. This is the only project currently in the pipeline that can deliver these results within the timescale. It we don’t get the go-ahead, then there’s nothing else out there that can work across the whole of the UKCS in time to get even close to those targets, let alone meet and exceed them. Cerulean is considering the application of this approach for other oil and gas regions which will bring the same benefits to the local and regional economies as well as the societal and environmental benefits of clean oil and gas production during the energy transition.

REFERENCE

https://www.dnv.com/focus-areas/floating-offshore-wind/commercialize-floating-wind-report.html#:~:text=DNV%20predicts%20that%20the%20installed,of%2040%20EUR%20per%20MWh.

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- What's new in production (February 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)