Executive viewpoint

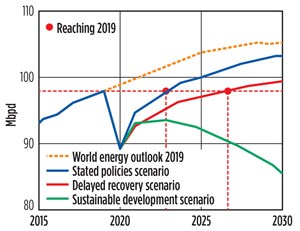

Will we look back on Covid-19 in 10 years’ time as the key catalyst that accelerated the “Energy Transition?” Probably. Between the various IEA scenarios (Fig. 1) at best, it will take at least two to three years for oil demand to recover to 2019 levels. Or, per the sustainable development scenario, only recover slightly to 2015 levels and then taper off permanently. Each scenario’s ramifications are huge.

What is certain is that oil demand has shifted significantly in a short timeframe, leaving the energy industry in substantial uncertainty. The World Economic Forum’s Global Risks Report 2020 paints an alarming picture of the perceived challenges ahead, with the environment and decarbonization topping the list.

As a result, the energy industry must determine the most effective method to transition away from carbon-intensive, fossil fuel-based generation to cleaner, lower-emission-based generation, transportation, storage and usage. However, the transition is being hampered by shortages in alternative energy sources, at scale, to replace more carbon-intensive ones. Therefore, investment is set to continue in some upstream areas, with natural field decline occurring faster than decline in oil demand.

That said, a lot of upstream production is uneconomic at current and forecast oil prices. The industry, overall, needs to digitalize deeper and faster to boost its resilience and competitiveness. It’s no longer about individual assets’ competitiveness, but rather competitive of the oil industry as a whole.

So, do you have time to grow your top line? Probably not in this business environment. Survival hinges on three things:

- Short-term productivity and efficiency optimization, to remove cost and buy time;

- Digitalization, to help short-term gains “stick” as long-term cost-savings;

- Portfolio management, to position for longer-term Energy Transition success.

Asset owners exhibit a range of responses, relating to potential disruption of the Energy Transition. This range is bounded by the two ends of the spectrum, both entailing value destruction:

- Do nothing / status quo, leading to irrelevance and disruption. The Energy Transition will hit companies that do nothing in multiple ways. Regulatory compliance, shareholder and competitor pressures, and financial challenges will converge. A traditional response would be to make investments in physical assets/infrastructure. But left too late, the planning, execution and capital intensity required for these investments is likely to undermine their efficacy, leading to value destruction.

- Investing heavily, but arbitrarily, resulting in profit erosion. Too much upfront investment is as risky as too little. Over-investment will result in stranded assets in the short-to-medium-term that are surplus to requirements, and which will deliver low returns on capital and carbon reduction. Poor cash flows in the earlier years of these project investments will impact their viability. For example, some companies are moving aggressively toward electrification and installation of renewables infrastructure without doing a systematic analysis on how to reduce heat demand across the portfolio. Such large capital outlays are potentially unnecessary in the short/medium term.

In any business, short-run marginal costs and short-run average variable costs per unit of output determine viability and going concern. These are critically important, as the oil industry has suffered demand destruction and weakened prices. To steer a path between the two value-destroying extremes, the pursuit of energy efficiency remains the easiest, lowest-risk source of energy cost and decarbonization.

Through energy efficiency, operators can reduce carbon significantly and save money, while impacting production minimally. However, they often lack structured and automated digital technologies to identify and sustain energy efficiency improvements. The situation is exacerbated by inconsistent data and inaccurate tools.

The best digital energy management solutions provide the information and analytical tools that assets need at each organizational level, allowing everyone to achieve and sustain decarbonization goals in a focused manner. This involves combining real-time data, asset-wide digital twins, and proprietary analytics, to identify and break down performance gaps in all of the utilities system and processing equipment together. Accordingly, improvement areas are highlighted in real time and daily facility energy improvement opportunity lists, provided to operators to make meaningful changes. Furthermore, capital project efficacy can be tracked holistically with accurate projections, so faster-informed decisions can be made for capital allocation.

Energy efficiency is a quick win in all scenarios. Beyond that, carbon mitigation will require significant planning, capex and attention.

- State of digitalization in the oil and gas industry (February)

- Rugged, explosion-proof computers safeguard offshore rigs (January)

- From impossible to inevitable: Superhot rock geothermal to unlock gigawatts of energy (January)

- The evolution of remote-controlled FPSOs (January)

- Halliburton’s ZEUS IQ™ powers the first fully autonomous fracturing platform with closed-loop automation (January)

- How AI-driven asset management is channeling the sea of data into actionable insights for companies (December 2025)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)