Disruption and digital: Business transformation should drive technology adoption, not the other way around

It is not news that the energy landscape is in a state of disruption, driven by decarbonization, electrification, decentralization, developing markets, digitalization and the need to design for efficiency.

Companies can and will speculate about the future energy mix and the role of oil and gas. They will adjust their portfolios accordingly. Over time though, in our view, supply and demand will tend to even out and returns will be fairly robust all along the value chain. If you’re in an asset for the longer-term, it’s probably okay to say that you can do so without regret and as long as you’re prepared to do business in what will undoubtedly be a more complex and competitive energy landscape. Complexity can be an opportunity and digitalization is the most important enabler of complexity.

Energy businesses will increasingly rely on technology to gather higher volume data, perform more sophisticated analyses and create more precise process control. Digitalization will drive down exploration, drilling, completion, production and refining costs, and the competition between fossil fuels and renewables will be complicated.

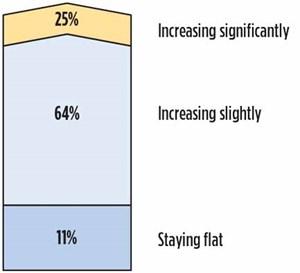

Consider: Nearly nine in 10 respondents to a recent EY industry survey said their company’s investment in digital tools will increase over the next two years, with a quarter foreseeing a significant increase in spending. Accordingly, not a single respondent said their company would spend less on digital technology over the near term, Fig. 1.

The nearly universal embrace of new and emerging digital technologies is, in many ways, the industry’s response to dramatic disruption. There is massive uncertainty in the marketplace, as the world transitions to a new energy future, one marked by decarbonization—including growth in renewables and a diversion to electric power, especially in transportation—and a corresponding decline in worldwide oil and gas demand.

There are other factors at play, too—the growing importance of developing markets, which are highly sensitive to energy costs and where a lack of infrastructure makes oil and gas exploration, production and transportation more complex. Distributed generation is also an issue. Increasingly, energy doesn’t need to be supplied by large, highly integrated companies; any facility or individual can install renewable assets that will generate all the energy needed, especially as storage becomes more efficient and affordable.

Of course, even in the near future, when oil and gas demand has peaked and begins to decline, traditional hydrocarbons will have a critical role to play in meeting energy needs. The industry will still be important; but producing the oil and natural gas the world needs—and doing so profitably, in a way that reduces carbon emissions—will be a major challenge. Oil and gas companies will need to be far more efficient and productive than they are today, all while executing complex, expensive, multi-decade projects in perhaps the most uncertain investment environment ever.

That’s where digital technologies can make a difference, by revolutionizing the entire value chain. Digital tools, deployed across the enterprise, can unleash the technical and creative skills of oil and gas companies and enable them to do more with less while enhancing profitability, reducing their environmental footprint and improving safety and operational performance.

Still, we are seeing many companies struggle with their digital strategy. Determining where to start, or what the next step should be, is a challenge for many organizations. Our survey found that confusion or uncertainty about which technologies and solutions to champion is a major challenge for 32% of respondents; determining how much to invest was the major stumbling block for 20%.

It’s clear that even though companies can envision the benefits of a robust digital platform, the effort to roll out digital tools is still seen as risky, with an uncertain return on investment. Yet companies feel pressure to test the waters with a patchwork of solutions, trying to determine the best path forward.

CREATING A DIGITAL CULTURE

The sticking point may be in how senior leaders think about digital. Too often, these tools are viewed as a bolt-on to existing functions and structures rather than as a platform for deep organizational and cultural change. In other words, there is a significant difference between simply implementing digital technology and actually “being” digital.

In EY’s experience, oil and gas companies that focus merely on the technology itself tend to struggle. Digital becomes a procurement decision; IT recommends the flavor-of-the-month tool and the company finds the best vendor with the right price.

In those cases, the technology is not embedded into the organization in a way that helps make business transformation possible. The tools may be used, and can even be helpful, but they are not anchored together in a coherent fashion across the enterprise. Over time, these tools may even be abandoned because of a lack of connectivity with legacy systems.

Viewing digital as an IT issue, rather than an operating business issue, can lead to disappointment. When a transformation is technology driven, there is often a large disconnect between the tools implemented and the real day-to-day issues and needs that impact the business.

Being digital, on the other hand, is about creating a culture where technology provides a roadmap to continuous improvement, efficiency and new opportunities. Technology itself isn’t a strategy driver; it’s just a tool that is used by the workforce to achieve critical business gains.

Being digital also means that the organization’s culture is comfortable with technology integration. The workforce continuously looks for ways that emerging technologies can provide value and makes recommendations for new processes that utilize technology to speed decision-making or reduce manual steps.

A digital culture makes it possible for employees to operate at their most productive—with a laser focus on high-value tasks—while technology handles everything else, from the most mundane, repetitive jobs to the most dangerous.

In short, being digital is about the journey. It’s about business needs—and business ideas—pushing the demand for technology, rather than technology being inserted into the workspace because a committee recommends it. Changing the culture—from one in which technology is solely IT’s purview to one in which business operations are digitally savvy—is critical.

In addition, being digital requires a leadership team that is comfortable with technology and recognizes the industry’s need to advance in order to overcome the challenges of disruption. Without that recognition, buy-in and support, digital initiatives are destined to wither away without much impact.

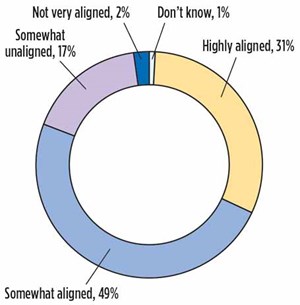

Leadership teams must be aligned on a vision for digital investments, too, Fig. 2. Nearly 20% of respondents to EY’s survey said senior management at their company was either not very aligned or somewhat not aligned. Just 31% said their senior leadership was highly aligned around a digital strategy. Resolving those internal conflicts must be an early priority.

Even at companies where there is complete agreement, the necessary shift in perspective, organizational structure and employee mindset won’t happen overnight. Being digital requires a long-term commitment.

THINKING RIGHT TO LEFT

Acquiring new technology is easy. The challenge is understanding where and how technology can help, and successfully integrating it into business operations. Asking the right questions at the start of the journey is vital; your company’s digital strategy must support a business transformation that will enable you to compete in a transitioning world. The best way to do that is to begin with the end in mind, and then find the technology that can make it possible.

First, what does the future look like, for your company, as well as for the industry? Given that, what should your company look like? How should it be organized? How should its core functions work? What strengths should be nurtured? What weaknesses should be shored up? Do you have the internal resources and talent necessary to succeed in a vastly different market environment, one where digital technology is ubiquitous?

Envision your company operating at its peak potential. What does that look like? Be specific. How long should it take to design a new well? Develop alternative drilling strategies? Process accounts payable? Implement safety best practices?

This “best case scenario” is important because it helps senior leaders see the end in mind. These objectives are what should be driving your company’s digital strategy, not the technologies themselves.

The next step is determining, function-by-function, where your organization’s pain points are, and the obstacles they create for achieving short- and long-term business objectives. What mission-critical processes require the most staff time? Where are the major project design and development bottlenecks? Where are the systemic breakdowns that cost the most in time and resources? What’s standing in the way of achieving peak performance?

These types of insights are typically found best on the front lines of the function—the field staff, engineers, accountants, and countless other employees who understand where the day-to-day challenges of the business reside.

Together, leadership’s vision for the future—and the real-world opportunities that your employees identify—give you a roadmap for understanding where your digital strategy needs to take you, and the hurdles you’ll encounter along the way.

CUSTOMIZATION WILL WIN

Our survey found that most oil and gas companies are seeking value from five major digital technologies: advanced analytics; robotics process automation (RPA); cloud-based computing; industrial internet of things (IIoT); and artificial intelligence (AI) and machine learning.

Each of those digital tools is powerful by itself. But the companies that have the most success in the digital revolution will recognize that each individual business problem will likely require a holistic approach; that is, stitching together unique technologies for each challenge will deliver more value than trying to make one tool work in every application. In most cases, the right answer is likely to be a combination of tools. Integration of the full spectrum of technology—in a manner that enables both the business process and the full capabilities of employees—will make the biggest impact.

EY’s extensive oil and gas digital survey shows that the industry is beginning to comprehend the truly world-changing possibilities this new wave of technologies offers.

But our research also suggests that executives may be limiting the scope of their strategies too narrowly.

There’s temptation for members of technology teams to focus exclusively on one tool at a time. As the complexity of the digital space grows, integrated solutions—designed specifically to help companies overcome the obstacles to a complete business transformation—will win the day. And the companies that use technology to achieve their vision will be the most successful.

The views reflected in this article are the views of the author and do not necessarily reflect the views of the global EY organization or its member firms.

- Digital transformation/Late-life optimization: Harnessing data-driven strategies for late-life optimization (March 2024)

- The reserves replacement dilemma: Can intelligent digital technologies fill the supply gap? (March 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- Digital transformation: Digital twins help to make the invisible, visible in Indonesia’s energy industry (January 2024)

- Digital transformation: A breakthrough year for digitalization in the offshore sector (January 2024)

- Quantum computing and subsurface prediction (January 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)