RAJ KANWAR, Contributing Editor, and PRAMOD KULKARNI, Editor

|

| Vantage Drilling’s Platinum Explorer drillship is in the fourth year of a five-year contract with ONGC (left). Cairn India plans to drill 30 E&A wells annually for three years in its Rajasthan desert fields (center). Reliance Industries control room for the KG D6 field on India’s east coast, where a BP-Reliance team is developing strategies to reverse production decline due to sand and water ingress. |

India’s oil and gas scenario can be characterized as being good, bad and ugly. The country’s Directorate General of Hydrocarbons (DGH), the government agency charged with leasing and regulatory activities, as well as both public sector and private oil and gas companies, are making a good effort to pursue E&P opportunities, despite the lack of world-class discoveries for more than a decade. The bad part could be that the potential for major fields is limited due to geological conditions. The ugly consequence is that India has a significant import bill, due to stagnant supply and ever increasing demand caused by a growing population and steady economic growth. India’s domestic consumption of petroleum products increased by 965 MMbbl in 2009–10, to 1.03 Bbbl in 2011–12. To support this growing consumption, India had net imports of 125.9 MMt, a debilitating 85% import rate.

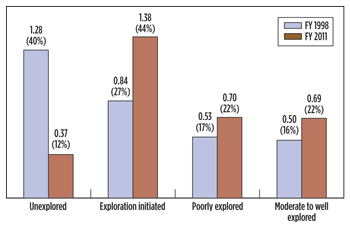

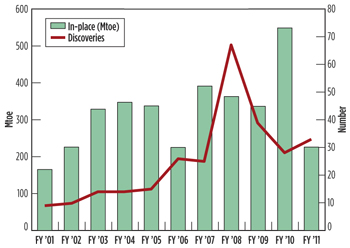

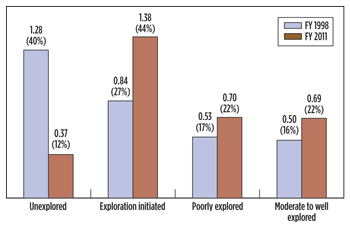

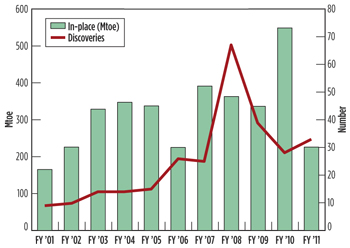

India has 4% of the world’s sedimentary basins. Through nine rounds of New Exploration Licensing Policy (NELP), exploration has increased during the past two decades. There are, however, substantial areas that need to be evaluated via seismic surveys, much less drilled, Fig. 1. The exploration that has taken place during the last 12 years has yielded discoveries that peaked in 2008. After a precipitous drop, there is an encouraging pick-up since 2011, Fig. 2.

|

| Fig. 1. India has initiated exploration on 1.38 million sq km, but a 1.28-million sq km area is unexplored. |

|

|

| Fig. 2. India has made 380 discoveries, with an in-place volume of 3.5 Btoe in the newly licensed areas over the last 11 years. |

|

Presented below is a report on E&P activity by three of the leading oil and gas operators in India.

ONGC

India’s Oil and Natural Gas Commission (ONGC) is a multinational corporation with nearly 70% of its equity shares held by the government. Formed in 1956, ONGC has onshore producing properties in the northeastern states of Assam and Tripura, the western state of Gujarat and the southeastern state of Andhra Pradesh. ONGC discovered the landmark Bombay High oil field in 1974, in the western Arabian Sea, 174 mi offshore. Since then, ONGC has participated in the discovery of oil and gas fields on India’s east coast, including the Krishna Godavari (KG) and Mahanadi basins.

Discoveries. ONGC notified DGH of six discoveries during FY2013, the result of both onshore and offshore drilling programs. Among these is a new pool of reserves discovered during development drilling in the D1 field, which has been under development since the first strike in 1976. The field is located 200 km west of Mumbai at a water depth of 85–90 m. Peak production occurred in 2009 at 17,500 bopd, with production declining by 2012 to 12,500 bopd. Earlier, D1 had an initial oil in place (IOIP) estimate of 600 MMbbl. After the discovery of the new reservoir, the total IOIP is expected to be 1 Bbbl. The reservoir consists of about 242 m of oil-bearing sand at a 2,640-m depth. On complete development of D1 field, production is expected to go up to 60,000 bopd from January 2014.

Monetization projects. During the 2012–13 fiscal year, ONGC has undertaken 13 field development projects to monetize 37 fields. The production volume from these projects is estimated at 280 MMbbl of oil and 64 Bcm of gas. Among the projects included are the KG-DWN-98/2 discoveries in ultra-deep waters off the east coast in KG basin. Appraisal drilling began in 2012 through eight wells. Initial gas in place is 4.85 Tcf, and peak production is expected at 22 MMcmd by 2016–17. Further north in the offshore Mahanadi basin, ONGC plans to drill five wells by December 2013. On the west coast, ONGC announced in January 2012 a new gas discovery in the Daman cluster of an estimated 4 Tcf of in-place reserves. The operator plans to fast-track the development, which consists of B-12 North; B-12 South, C-26 and SD fields. The project plan includes an onshore gas receipt and processing plant about 150 km south of Mumbai.

International operations. Through its ONGC Videsh Ltd. (OVL) subsidiary, ONGC is conducting 33 E&P projects in 15 countries around the world. Ten of OVL’s properties are in the production stage, yielding 65 million boe during 2011–12. To date, it has made cumulative investment amounting to $14 billion in its foreign assets and, with a war chest of $8.8 billion at its disposal, is now poised for a quantum jump over the next five years. Today, OVL contributes 15% of India’s oil and gas supply. OVL’s objective is to raise that contribution 45% to 259 million boe by 2030. OVL’s noteworthy achievement is a 30% participating interest (PI) in Russia’s Sakhalin 1 field. Operated by ExxonMobil, the project includes three offshore fields: Chayvo, Odoptu and Arkutun Dagi. The first phase of Sakhalin-1 of Chayvo field has been producing since 2005. Odoptu first-stage production started in September 2010.

In January 2013, Kazakhstan’s Kashagan oil field partners have given their approval for OVL to acquire ConocoPhillips’ 84% stake for approximately $5 billion, its largest overseas acquisition after it paid around $2.1 billion in 2009 for acquiring UK-based Imperial Energy that is active in Siberia.

Also in January, OVL announced oil discoveries in Colombia’s CPO-5 Block in the onshore Llanos basin. As operator with a 70% PI, OVL has a commitment to drill two exploratory wells.

|

| Fig. 3. USGS estimates shale gas potential of 63 Tcf in India’s seven prospects. |

|

Shale prospects. USGS has made an estimate of 63 Tcf for seven potential shale plays in India, Fig. 3. ONGC plans to explore the Cambay, KG, Cauvery and Bengal basins in alliance with ConocoPhillips. ONGC has also signed a shale research agreement with the Energy & Geoscience Institute at University of Utah and the Indian School of Mines. For practical understanding of shale potential, ONGC has undertaken a pilot study in the Damodar Valley in central India, where four wells have been drilled and completed with a full set of logs and extensive coring. Well RNSG#1 flowed shale gas at surface in January 2010. Based on core data, ONGC has estimated potential shale reserves in the area at 48 Tcf.

CAIRN ENERGY

Cairn Energy’s success story in India continues, after the Scottish independent sold off 60% of the Indian enterprise in 2012 to Vedanta Group, a UK-listed minerals company, while retaining a 10.3% share. During the third-quarter of FY 2012–13, Cairn India produced 200,000 boed, which represents 25% of India’s total oil production. While Cairn’s first lease was offshore the east coast of India at Ravva, the first exploration success was in the desert Barmer basin of Rajasthan. As the parent company changed direction to explore opportunities in Greenland and the North Sea, Cairn India is continuing development at Rajasthan, drilling exploration and appraisal (E&A) wells at its other onshore and offshore prospects in India, and has started new exploration ventures in deepwater Sri Lanka and offshore South Africa. ONGC is a minority partner in many of Cairn’s ventures in India.

Rajasthan. Working leases that were relinquished by Shell, Cairn discovered Mangala field in 1999. With the subsequent discoveries of adjacent Aishwariya, Bhagyam, Rageshwari and Saraswati fields, Rajasthan has become a world-class development. Mangala field had sustained production at peak rates over the last two years and is producing nearly 150,000 bopd. Bhagyam field is producing 20,000–25,000 bopd, and production at Aishwariya is expected to commence in 2013. Cairn India has built gathering and processing infrastructure in the area and is transporting the crude via the world’s longest heated pipeline to Bhogat port, where it is loaded onto crude oil tankers for India’s refineries in the south. The pipeline has to be heated because of the waxy nature of the crude. Cairn India has completed an EOR polymer pilot at Mangala field and will conduct a full-field implementation by early 2014, to help ensure peak production. Cairn has identified 100 prospects in the area and is planning to drill 30 E&A wells each year, for three years, in an effort to increase production to 300,000 bopd.

Onshore KG basin. Cairn India drilled two wildcat wells (Nagayalanka I and II) in the onshore Krishna-Godavari (KG) basin to discover a gross oil column of 300 m in a deep Cretaceous play. To exploit potential reserves of 500 MMboe, Cairn is drilling six E&A wells in two phases.

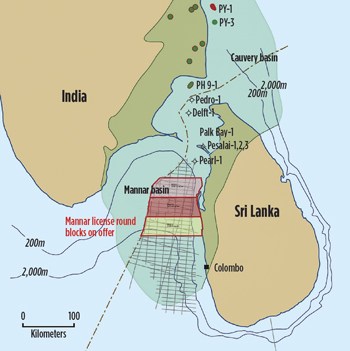

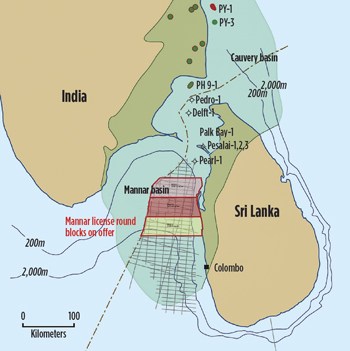

Deepwater Sri Lanka. Cairn India has drilled two gas discovery wells (Barracuda and Dorado) to establish a working hydrocarbon system in the deepwater Mannar basin. The company has acquired 600 sq km of 3D seismic and was planning to spud an exploration well in February 2013 as part of Phase II of its E&A program, Fig. 4.

|

| Fig. 4. Cairn India has started the second phase of its exploration campaign in Sri Lanka’s Mannar basin. |

|

Offshore South Africa. Cairn India has been granted 60% interest and operatorship by South African regulatory Authorities for Block 1. Tendering for a 3D seismic survey over the lease area is underway.

RELIANCE INDUSTRIES

India had high expectations when Reliance Industries, a major conglomerate but a novice in upstream oil and gas, discovered the KG D6 field offshore India’s east coast—the world’s largest discovery in 2002. By 2011, KG D6 and its associated fields were expected to achieve peak production at 140,000 bopd and 2.82 Bcfd. However, due to excessive sand and water production, a decline has set in. KG-D6 production declined to 275 Bcf of gas and 2.6 MMbbl of crude oil/condensate in the first nine months of FY13, a drop of 37% and 42%, respectively, on a year-on-year basis. Morgan Stanley analysts have said the D6 production could be exhausted within five years.

KG basin. Reliance has brought in BP as a technical partner to help revive the fields. BP has paid $7.2 billion to invest in 23 oil and gas blocks. Reliance and BP submitted a revised field development plan to DGH in September 2012, cutting the gas reserves in the D6 block by about two-thirds to 3.4 Tcf. In December 2012, the Reliance-BP team shut the seventh well in the D6 block, bringing down the number of producing wells to 11.

Projects designed to revive production include drilling of new wells in the G2 development and targeting deeper formations in the D1-D3 ML area. Decline in reservoir pressure is being addressed through a booster compressor and MEG upgradation.

Panna-Mukta & Tapti. Reliance-ONGC’s smaller fields on the west coast are seeing either marginal gains or production declines of as much as 37% during the first nine months of FY13. For Tapti field (0.4 MMbbl, 36.2 Bcf), the company has placed two extended-reach wells into production in mid-Tapti, and a third well is expected to completed by mid-2013. Subsequently, infill drilling will commence in the south Tapti area. Reliance has received approval to drill five infill wells in Panna-Mukta field (6.4 MMbbl and 54.6 Bcf).

U.S. shale participation. Reliance Industries is participating in the U.S. shale plays as a minority partner with Pioneer Natural Resources in the Eagle Ford shale, and Carrizo and Chevron in the Marcellus shale. The JVs achieved record gas production in the third quarter of 2012, resulting in Reliance’s share of production jumping from 3.7 Bcfe in March 2011 to 27.8 Bcfe in October 2012. The expectation is that Reliance will apply lessons learned from its U.S. partners to shale opportunities in India.

LEADING IMPORTER

It is clear that while India is doing what it can to increase oil and gas production, in both domestic and international arenas, its role in the global oil and gas arena is that of a major importer. Geopolitics and economic uncertainties have made even that role increasingly complex and difficult. Sanctions against Iran have forced India to begin the process of diverting imports from Iran to other countries, such as Saudi Arabia. While Qatar is a major supplier of LNG for India, two other sources appear to be Australia and the U.S.

With the prospects of Australian LNG to be priced in the double digits, India was one of the first countries to sign up to receive LNG from the Cheniere terminal in Louisiana. In late 2011, Gas Authority of India Ltd. (GAIL) signed a 20-year agreement to purchase 3.5 mtpa of LNG from Train 4 at Henry Hub prices, plus a fixed component. Deliveries from Train 4 are expected to occur in 2017. India’s ability to import from the U.S. is limited by the absence of a free trade agreement between the two countries. The hope is that just as the U.S. energy role changed from that of an importer to an exporter with the shale revolution, a similar unforeseen surge in domestic production will benefit India.

|