KURT ABRAHAM, Executive Editor

|

| Good exploratory results continue to generate development projects throughout the region. |

|

Although E&P work has slowed overall, deepwater projects remain the heartbeat of Southeast Asia. A number of new fields will go onstream in the next several years, and additional projects are under evaluation. Deepwater development in this region can be relatively expensive and technically challenging.

INDONESIA

Indonesia in recent years has been a net importer of oil after a long history of being net exporter. The country’s oil production has declined since 1998, due to maturation of the largest oil fields and a failure to sufficiently develop new resources.

Production sharing contracts. During November 2011, Calgary-based Niko Resources Ltd. was awarded two new deepwater PSCs. The North Banal PSC in deepwater East Kalimantan totals 939 sq mi and was awarded to a consortium of Niko, Eni (operator), Statoil, GDF SUEZ and Black Platinum Energy. The Obi PSC covers 3,111 sq mi offshore eastern Indonesia, south of Halmahera Island. That consortium includes Niko (operator), Statoil and Manley N.V. In March 2011, Lundin Petroleum (100%) was awarded a new PSC for the Gurita Block by MIGAS. The block is in the Natuna Sea and covers an area of about 8,018 sq km.

Exploration. In third-quarter 2011, TGS began a 2D, multi-client seismic survey offshore eastern Indonesia, just north of the Sunrise-Troubadour gas fields and west of Abadi gas field. This year, Statoil will drill three wells in the Karama deepwater PSC. On the Kuma PSC, Statoil drilled one exploratory well at the end of 2011.

Last October, Canada’s Talisman Energy spudded the Lempuk 1 deepwater well in the South Sageri PSC, in the South Makassar Basin. As of December, the firm was awaiting preliminary drilling results.

Projects. A year ago, when this report was last published (World Oil, January 2011, p. 73), a major agreement had just been signed by state firm Pertamina in December 2010 to form a consortium with ExxonMobil, Total and Petronas for joint development of the deepwater Natuna Sea Alpha D Block. A previous JV between Pertamina and ExxonMobil to develop the potential, 46-Tcf gas reserves had failed to achieve commercial production, due to high CO2 content in the gas stream.

The next step was to negotiate a PSC with regulator BPMIGAS during first-half 2011. Unfortunately, that process has proved to be a much more difficult hurdle than anyone imagined. After several days, came further word on Dec. 20, 2011, that the PSC signing would be delayed yet again. The PSC may finally be signed in 2012.

The Indonesian Deepwater Development (IDD) Project, operated by Chevron, continues to move forward. IDD is developing five natural gas fields in Makassar’s deep water (between 975 m and 1785 m) in four working areas—Ganal, Rapak, Makassar Strait and Bakau Estuary. Fields under development include Gendalo, Maha, Gandang, Gehem and Bangka. These fields’ development has been done in an integrated manner to meet domestic and export needs for gas. The project scope consists of drilling wells and constructing production facilities. BPMIGAS now says that in 2015, delivery of 120 MMcfgd and 2,880 bcpd to consumers will begin from Bangka field. Output from Gendalo will begin in fourth-quarter 2016, while production from Gehem will commence in second-quarter 2017.

As operator of the Muara Bakau PSC, Eni has presented a Plan of Development for Jangkrik field to the Indonesian Authorities. According to the company, Jangkrik should go onstream in 2015, due to a fast-track development plan.

Production. As of mid-2011, Indonesia had about 3.6 billion bbl of proven oil reserves. In 2010, total oil supply averaged just over 1.0 million bpd. According to BPMIGAS, crude and condensate production dropped from 945,000 bpd in 2010, to just 905,000 bpd in 2011. Production had declined at an annual average rate of 4.1% between 2000 and 2010. Last year’s decline rate was 4.2%. On the other hand, natural gas output has exceeded regulators’ goals. Through the first three quarters of 2011, gas production averaged 8.46 Bcfd, or 8.9% higher than the target.

Premier Oil’s development of Gajah Baru field in Natuna Sea Block A achieved first gas production last October. Premier achieved first gas after receiving ministerial consent to complete commissioning at an expected rate of up to 50 billion btu per day.

As envisioned a year ago, BP confirmed last August that it has discovered enough reserves, to enable it to build a third LNG train at Tangguh gas field. This was also confirmed by BPMIGAS. BP said that no firm decision had yet been made.

MALAYSIA

The Malaysian government is focused on exploration in deepwater areas, while enhancing production from existing fields. New tax and investment incentives, which were proposed in late 2010 to promote oil and gas exploration and development, became official in mid-2011.

Production sharing contracts. State firm Petronas said that despite maturing acreage, there is still good interest shown by companies to bid on, and operate, blocks in Malaysia. Eleven new PSCs were awarded during the 2011 fiscal year. There are 19 active deepwater PSCs, held by seven operators. An additional eight deepwater blocks are open and available.

Exploration. Murphy Oil continues to explore and appraise. The firm shot additional 3D seismic in 2011, and plans to drill up to three exploration wells in 2012. BHP Billiton began drilling its second well last year, in the deepest water for any well in the country. Newfield Exploration has an existing oil and gas discovery in deepwater Block 2C offshore Malaysia. Additional drilling is required to determine commerciality.

Projects. Deepwater fields under active development or development planning include Gumusut/Kakap (Shell), Malikai (Shell), Jangas (Murphy Oil), Ubah Crest (Shell), Pisangan (Shell), Kamunsu (KPOC) and Kebabangan (KPOC). Gumusut field has commenced development, with production now expected in 2013.

KPOC made a final investment decision last May to develop Kebabangan gas field, offshore Sabah. The company will develop the gas field in water depths of 100 m to 400 m. The project will include a 12-well, two-phase drilling campaign, and the fabrication and installation of an integrated drilling/production platform with living quarters.

The Malikai discovery was appraised in 2005 and 2006, and development planning and front-end engineering are under way. The field is slated to go onstream in 2014. Successful appraisal wells were completed on Ubah in 2008 and 2010. Murphy Oil’s Jangas field is scheduled to go into production in 2014.

Production. Total oil output during 2011 was 630,000 bpd, compared with 665,000 bpd in 2010. Of this amount, about 17% was condensate. More than half of all Malaysian production comes from Tapis field in the Malay basin. Malaysian oil output has decreased gradually since peaking at 862,000 bpd in 2004.

|

| Southeast Asian offshore drilling is shifting away from traditional shallow waters, as drilled by jackups like Seadrill’s Calisto, and toward greater activity in deepwater tracts. |

|

VIETNAM

State firm Petrovietnam is eager to increase oil and gas production to feed the country’s fast-growing economy. Indeed, the state company stepped up exploration efforts on Vietnam’s continental shelf during second-half 2011. The firm wants to raise its proven crude oil reserves by at least 150 million bbl. Petrovietnam’s efforts to expand its control of the sector and generate results also extends to re-acquiring PSC shares in some of the country’s offshore acreage.

Exploration. Fugro GEOS signed a contract in December 2011 and began work on the provision of a year-long program of deepwater current measurements at two blocks off the southern coast of Vietnam. The data will be used for future exploration drilling operations.

Last May, Salamander Energy farmed out a 20% interest in Block 101-100/04, offshore northern Vietnam, to JX Nippon. Block 101-100/04 is operated by Salamander and contains the Cat Ba oil prospect. Subsequently, Salamander drilled the Cat Ba–1X well on that block to a TD of 1,724 m (5,656 ft). The well encountered 38 m of hydrocarbon pay in Tertiary clastics, the well’s secondary objective. No oil shows were observed, and only low levels of gas were recorded. The Cat Ba-1X well was subsequently P&A’d as a sub-commercial discovery.

Projects. At Premier Oil’s Chim Sao and Dua fields in Block 12 W, development drilling was completed in mid 2011. The project’s FPSO was moved to its offshore anchorage, where deepwater commissioning and trials were completed in July 2011. In October, Premier confirmed the start of oil production from Chim Sáo field. Output should plateau at around 25,000 bopd.

In second-half 2011, Soco International said that it had begun Te Giac Trang (TGT) Phase II development drilling offshore Vietnam. The first well was spudded at the H4 platform by the PVD-1 jackup rig. Surface casing was set on all five wells, and drilling continued ahead of schedule. Production from the first phase began, on schedule, during third-quarter 2011, at 35,000 bopd and 20 MMcfgd.

Production. Vietnam expects to boost its oil production nearly 7%, to 16 million tons. “A crude oil output decline in major oil fields is, in fact, taking place, but to offset the fall there are smaller fields,” said Petrovietnam Chairman Phung Dinh Thuc, who was quoted by the official Dau Tu newspaper.

PHILIPPINES

The Philippine energy sector faces challenges in the oil, gas and power segments. An emphasis on gas-fired power plants is creating a need for LNG imports. Meanwhile, domestic oil production is nowhere near keeping pace with increasing demand. The country’s future gas production will be shaped not only by field development success, but also by the available market to utilize gas.

Production sharing contracts. Nido Petroleum Ltd. and Total have agreed to jointly bid for oil and gas exploration contracts in the Philippines. Nido and Total signed an agreement to look over exploration areas that will be auctioned by the Philippines next year. Nido said it would do technical and commercial evaluations of all 15 blocks in the latest bidding round. The government will auction several exploration blocks between April and July 2012. Contracts will be awarded by the second half of 2012.

Exploration. In November 2011, Searcher Seismic began acquisition of the Pala Sulu non-exclusive, 2D seismic survey in the Philippines, with its project partner, Seabird Exploration, and in cooperation with the Philippines Department of Energy. During mid-2011, Nido drilled its Gindara 1 well, off Palawan. However, the well was found to be “water-bearing,” and it was abandoned. Separate from Gindara, the company also planned to drill in two sites within SC 63, in the Aboabo discovery and the Kalapato tract. Otto Energy Ltd. will begin drilling a natural gas prospect offshore the Philippines with partner BHP Billiton in April 2012.

Projects. Shell’s next-phase development of the Malampaya deepwater gas-to-power project was ceremonially kicked off on Aug. 9, 2011. During that event, the first contract awarded was signed by the Service Contract 38 consortium.

Malampaya’s next phase will maintain production levels and maximize gas recovery from the Malampaya and Camago reservoirs. Malampaya Phase 2 will include drilling of two additional wells by 2014. Malampaya Phase 3 involves installation of a new platform, to house additional facilities by 2015. Shell has one semi/dedicated to the effort, Table 1.

Production. Oil output last year averaged 20,500 bopd from 10 offshore wells. Government officials have said that Filipino oil output should reach almost 50,000 bpd by 2013, due to Malampaya liquids and current field development work. Gas output last year averaged 389.8 MMcfd from four offshore wells, as well as associated production.

| TABLE 1. DEEPWATER RIGS IN SOUTHEAST ASIA |

|

THAILAND

During November 2011, Thai state company, PTT Exploration and Production, said that it was in talks with Royal Dutch Shell about potential, new cooperative efforts on deepwater E&P. No specific projects or ideas were mentioned, but PTT E&P said that it welcomed the opportunity to learn about deepwater operations from Shell.

Last May, Coastal Energy made a new discovery in the Bua Ban North B-02 well, in the Gulf of Thailand. The well, drilled to a TD of 6,513 ft, encountered 62 ft of net pay in the Miocene. It also tested the Eocene, hitting 150 ft of net sand.

In October 2011, Australia-based Tap Oil said it had more than tripled its proven and probable reserves from the Manora field in concession G1/48, offshore Thailand. Operator Pearl Energy has defined the Manora field development concept and is finalizing plans for development. Peak production should hit about 15,000 bpd in early 2014.

OTHERS

On Aug. 31, 2011, Cambodia’s National Petroleum Authority (CNPA) made a Declaration on Overlapping Maritime Claims with the government of Thailand. In this declaration, CNPA decried allegations that previous, secret negotiations between the two governments, about the Overlapping Claims Area (OCA) of offshore oil and gas tracts, indicate that some former Thai officials have secret individual interests with Cambodia. CNPA also noted that the newly formed Thai government of Prime Minister Yingluck had not tried to hold any meetings with Cambodia to resolve either the OCA issue, itself, or the matter of potential personal interests. Pledging to do all that it could to resolve these matters, CNPA called on Thai officials to resume open and official negotiations as soon as possible.

The OCA includes an estimated 27,000 sq km (10,425 sq mi) offshore. The governments of Cambodia and Thailand signed a Memorandum of Understanding (MOU) in 2001, in relation to the joint management of petroleum resources located in the OCA. However, this MOU was put on hold by Thailand in November 2009. What makes this offshore area crucial and disputable is that geological assessments have shown significant natural gas potential, similar to the undisputed Pattani basin offshore Thailand. Chevron holds operated interests in the OCA, ranging from 30% to 80%, in six blocks.

In Myanmar, during a December 2011 industry conference, U Htin Aung, director general of the Energy Planning Department under the Ministry of Energy, said there are eight offshore blocks available for exploration in the Gulf of Mottama. As reported by The Myanmar Times, these tracts include four in shallow water (less than 60 m or 200 ft) and four in deep water. Meanwhile, U Phone Kyaw Moe Myint, operations and chief health, safety and environmental policy officer for Asia Drilling, an affiliate of Myanmar Petroleum Resources Ltd (MPRL), also spoke to the conference, during which he spoke of the untapped potential in the nation’s oil and gas sector. “Our deepwater blocks haven’t been properly explored yet, and the onshore blocks have only just opened up for exploration, so we are going to see a big change in the country’s oil and gas industry,” he said.

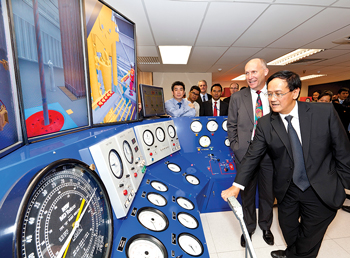

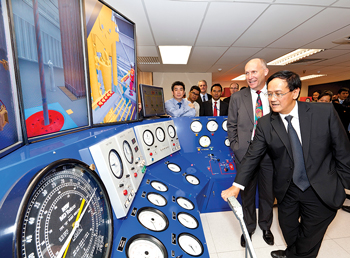

|

| Transocean’s new training center in Kuala Lumpur opened in October 2011 and will include a focus on deepwater drilling challenges. |

|

TECHNOLOGY CHALLENGES

Southeast Asia’s deepwater market is still relatively young, so E&P professionals are still learning about the area’s operating challenges. Here are several widely diverse challenges.

Flow assurance. Representative fluid samples are necessary to achieve high-quality PVT and flow assurance lab analyses. This is especially important, when downhole samples are acquired in an oil base mud (OBM) environment. High-quality samples are also needed to better understand reservoir and fluid behavior throughout the field life. As presented in a recent SPE paper by Schlumberger and Carigali Operating Co. authors, an offshore field in the Malaysia/Thailand Joint Development Area required high-quality reservoir oil fluid samples for detailed PVT and flow assurance analyses. An oil-bearing sand was discovered during the development drilling phase of a predominantly gas-bearing reservoir environment. Low contamination samples from this zone had to be taken during the development drilling phase without compromising the primary well objective of completion as a gas producer. As such, samples had to be taken on wireline in an oil based mud (OBM) environment. Accordingly, a carefully planned methodology and technology were planned and used to achieve the goal of obtaining reservoir fluid samples.

Samples acquired from a previous well in the field using traditional open-hole wireline formation testing technology and methods resulted in relatively high contamination levels. High levels of OBM filtrate contamination typically have detrimental effects on the PVT analyses quality for both gas and oil samples. Rig time, cost and sticking risk also limited the time allowed for the wireline formation tester to stay stationary at a sampling depth. As a result, a decision was made to utilize a new sampling technology that is specifically designed to obtain low-level contamination samples while minimizing sampling station and hence rig time.

Managed pressure. Deepwater exploration wells in Southeast Asia frequently spawn well control issues associated with kicks and losses in carbonate formations, something that managed pressure techniques may be able to overcome. More than 200 wells have been drilled to date in Southeast Asia using managed pressure drilling (MPD) techniques. As detailed in an SPE paper by a Weatherford author, while MPD technologies are now routinely used on floating rigs to solve the loss kick scenarios encountered in the fractured carbonates, the use of MPD equipment in deepwater (+400 m) operations provides a number of additional technical challenges that are now also being addressed.

For instance, using underbalanced drilling techniques could be a potential solution for these fractured carbonate reservoirs. However, underbalanced drilling is complex at best, and production rates from a fractured carbonate reservoir can be significant. Handling large hydrocarbon volumes on an offshore rig while drilling results in high safety risks and equipment complexities. Crew size and equipment requirements for an offshore, underbalanced drilling operation are often a further limiting factor in application of offshore underbalanced drilling. Using MPD techniques, especially pressurized mud cap drilling, to drill these fractured reservoirs has been proven highly successful. The cost of implementing MPD operations is only a fraction of the rig spread cost and on floating rigs with the higher day rates. Even minor savings can rapidly result in significant cost savings.

Misinterpretation of seismic data. In an SPE paper, authors from Indonesia’s regulatory agency, BPMIGAS, analyzed why there were six, notable, very expensive but ultimately unsuccessful exploration wells drilled in the deepwater Makassar Strait within a short timeframe. They concluded that the common geological factor leading to these unsuccessful results was in the interpretation of the presence of reservoir and source rock. In particular, they laid blame on misinterpretation of age of the carbonate reservoirs in the seismic correlation, and they also found less attention focused on the detail of the seismic character’s differentiation of the carbonate developed on the host structures. They discussed the cause of the failure in a review study of the regional geology, based on a sequence stratigraphy concept, carbonate facies model, and re-identification of seismic character of the carbonate reservoir target, based on drilled wells data. Their evaluation led to a new overview of the petroleum system model that is different from previous interpretation. Thus, they have now advised each operator in the contract areas to re-evaluate the regional petroleum system in more detail, based on the new model, before drilling.

|