Forecast

News

November 30, 2022

Offshore Energies UK, the leading trade body for the UK’s offshore energy industry, has launched a report pinpointing key skills shortages that could put the transition to cleaner energies at risk.

News

November 30, 2022

Government and industry gathered on Nov. 30 to discuss energy security, the energy transition to net zero and challenges to maintaining investment in the North Sea during a forum hosted by industry regulator the North Sea Transition Authority (NSTA).

News

November 29, 2022

Exxon Mobil’s recent discovery in Block 15 off Angola in the Bavuca South prospect adds further credence to the notion that Africa is a significant contender in future energy markets, according to the African Energy Chamber.

Article

October 2022

Since day one, the Biden administration has set the U.S. on a path toward more reliance on foreign energy from countries with lower environmental standards. Caving to green activists, President Biden launched an overly aggressive environmental campaign designed to phase out the U.S. hydrocarbon industry and the immense value it provides our country in terms of energy independence and employment opportunities.

News

November 08, 2022

The United States cut its forecast for the nation’s oil production growth next year, predicting that output will fall short of an all-time high.

News

November 07, 2022

Global oil demand in 2023 will grow a million barrels per day lower than organizations such as the International Energy Agency and OPEC have forecast, according to a new report from Enverus Intelligence Research.

News

November 03, 2022

Republicans in Congress plan to increase domestic fossil fuel production by expanding federal oil and gas leasing and banning energy development moratoriums on federal lands.

News

November 01, 2022

A new analysis of the American Petroleum Institute's (API) "10 in 2022" policy plan found that it could spur nearly $200 billion in direct investment, 225,000 jobs and production growth in natural gas, oil, carbon capture and hydrogen.

News

October 31, 2022

An excess of supply in the oil market was the main reason for OPEC+ opting to cut production in October, according to the group’s secretary-general.

News

May 09, 2022

Oil booms typically spark a chase for higher production -- but not this time. All five supermajors have kept their capital expenditure budgets firmly in check and pledged that this discipline will hold in future years.

Article

March 2022

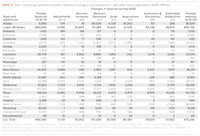

World Oil has analyzed data to create 2022 drilling forecasts for the U.S., offshore and international.

Article

March 2022

World Oil has analyzed data to create 2022 drilling forecasts for the U.S., offshore and international.

Article

February 2022

Operators revised their proved reserves downward in 2020 and postponed development drilling.

Article

February 2022

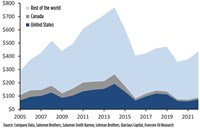

Every region will post an increase, led by the Middle East, the Americas, Africa and the FSU. Offshore activity will grow at about the same pace as onshore drilling.

Article

February 2022

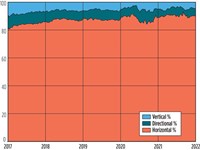

Despite higher oil prices, U.S. shale operators have (until recently) resisted ramping-up drilling activity and remained disciplined with capital expenditures.

Article

February 2022

Worldwide E&P spending is set to increase 16% in 2022, extending the 5.5% growth experienced in 2021. The first coordinated global upturn since 2018 will be led by North America, but ambitious capacity growth targets in the Middle East, Latin America and Africa will drive international capex gains.

Article

February 2022

The upstream industry must play a defensive holding action until the U.S. mid-term elections.

Article

February 2022

As the global economy recovers from the pandemic, indicators have shifted to a positive outlook for the first time in many years. But politics, especially in Canada, have cast a pall over any potential turnaround for the Canadian industry.

Article

February 2022

The average U.S. rig count for 2021 increased almost 9% from the previous year, though companies remained cautious with ramping up drilling activity.

Article

February 2022

U.S. oil production decreased mildly during 2021. A surge in gas prices during 2021 was influenced by increased demand despite Omicron and geopolitical unrest in Europe.

News

April 26, 2021

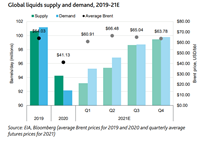

A sustained uptick in commodity prices on the back of a recovering global economy is set to bolster a turnaround in industry fundamentals over the coming 12 to 18 months.