2022 Forecast: U.S. operators respond cautiously to higher crude prices

Despite oil hitting multi-year highs, many of the large, publicly traded companies remained cautious in 2021, electing to pay off debt and return cash to shareholders rather than ramping up drilling activity. According to IHS Markit, the larger companies held back in 2021, increasing spending by about 5%. The majority of the drilling activity was by smaller, private producers that kept oil production growing in the major U.S shale plays.

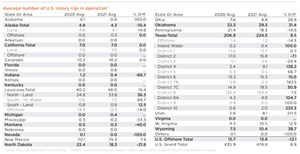

The average U.S. rig count for 2021 was 474.8 units, an 8.9% increase compared to the previous year’s average of 435.9 During January 2021, the rig count averaged 374, and then it gained for 11 consecutive months, finishing with a monthly average of 579 in December.

Four major oil-producing states enjoyed sizeable gains in activity, with Utah shooting up over 200%. Wyoming (+39%), Oklahoma (+31%), and Louisiana all experienced significant percentage gains. Continued interest in the Haynesville drove activity up 36%, as operators sought to take advantage of higher gas prices.

In Texas, nine of the 12 RRC districts experienced an increase in activity, with a statewide average gain of 18 rigs in 2021, an upturn of about 9%. In the Permian, RRC District 8 (+1.5%) and RRC District 7C (+31%) experienced gains in activity. In the Eagle Ford, District 1 broke even, averaging 14 rigs in 2020 and 2021. But gas-rich District 4 saw a 138% increase y-o-y. On the New Mexico side of the Permian, activity increased 7.4%. North Dakota suffered a major decline, losing 22% of its active rigs and dropping to an average 18 units in 2021.

Despite escalating prices for natural gas in the second half of 2021, Pennsylvanian was down 15%, to average 18 rigs in 2021. However, West Virginia and Ohio increased rig utilization 13% and 29% respectively, in 2021.

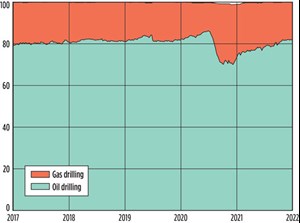

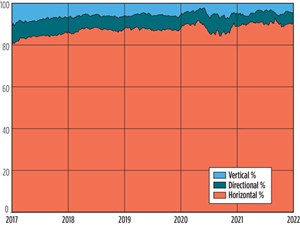

Target/trajectory split. The spot price for natural gas averaged $3.91/MMBtu in 2021. However, the ratio of rigs targeting gas versus those drilling for crude declined steadily in 2021. In January, approximately 76% of rigs were targeting oil, with 23% drilling for gas. In 2021, the split between trajectories remained relatively stable. Similar to previous years, horizontal drilling accounted for the vast majority of wells drilled.

- Coiled tubing drilling’s role in the energy transition (March 2024)

- The last barrel (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)