2022 Forecast: U.S. activity to jump as oil prices surge, companies adjust to energy transition

The U.S. oil and gas industry is recovering and adjusting its business models, as companies pursue net-zero goals. Approximately 50% of the world’s population has received at least one dose of the Covid-19 vaccine, and many companies are finalizing their return-to-office plans. Oil demand is back to 95% of pre–Covid levels, and prices are remaining well above $80/bbl and beyond $90/bbl at times.

Despite higher oil prices, U.S. shale operators have resisted (until just recently) ramping-up drilling activity and remained disciplined with capital expenditures. The speed at which new rigs have been deployed to the field has mostly been less than in previous up-price cycles, although recent weeks have shown greater movement. Most U.S. shale companies have been conservative, as priorities remain focused on protecting balance sheets and generating free cash flow.

Capital investments in U.S. drilling projects should increase 15% to 20% in 2022 (Fig. 1), according to The Wall Street Journal. Investors have pressured oil companies to live within their means, pushing them to pay off debts and return cash to shareholders. Many of the larger companies are likely to increase spending less than 5%, according to IHS Markit. Meanwhile, the companies set to increase spending the most are the smaller, private producers that kept oil production growing in the major U.S shale plays.

Higher prices funding energy transition. The escalation in oil prices above the $40-to-$60/bbl range is significant. In the past, high oil prices encouraged companies to increase capital expenditures and focus on their core business, rather than on new sustainability opportunities. Accordingly, it is assumed that high oil prices could slow the energy transition.

However, a year-end survey by Deloitte shows that 76% of executives state that oil prices above $60/bbl will boost their energy transition in the near term. The current cycle of higher oil prices reveals two new trends, which will likely continue throughout 2022 and challenge conventional wisdom:

- Oil companies are more disciplined with production and capital guidance, despite high oil prices. A significant reduction in the DUC inventory (37% decrease between December 2020 and December 2021), flat production levels (increase of 2.5% in 2021) and debt reduction (decrease of 4.5% in 2021) suggest that the industry is no longer just managing the cycle.

- High oil prices are enabling companies to fund their net-zero commitments. Many U.S. companies joined the net-zero group in 2021.

Strong oil prices enable investment in riskier and expensive green energy projects, including carbon capture, utilization and storage (CCUS). Given that no single stakeholder can provide the necessary investment and absorb all commercial risks associated with building a CCUS industry, all participants in the oil and gas value chain (upstream, midstream and downstream) become important players, as they are involved in 50% of planned CCUS projects.

OFS transitioning. The OFS sector had slashed costs and optimized operations to remain profitable before the pandemic. Being traditionally dependent on upstream cycles, the sector is likely to see a permanent structural shift, as rapid energy transition alters the scales of oil and gas revenues and spending. Not surprisingly, spending in OFS, which declined during the pandemic, is expected to remain about 25% below 2019 levels until 2025. With margins at the mercy of another price cycle and reduced spending, many OFS companies are crafting new strategies for the future of energy.

With a broadening decarbonization mandate across industries, companies have an opportunity to lead the way by fully re-engineering OFS business models and solutions outside traditional oilfield services. Several companies have already diversified beyond core services. One company has restructured its business by making big bets on cloud and edge computing, whose rate of growth is expected to outpace that of their oil and gas business in a few years.

Similarly, Halliburton and Baker Hughes are partnering with start-ups and academic institutions, through Halliburton Labs and Baker Hughes Energy Innovation Center, to accelerate technology development for diverse energy and industrial applications. However, digitalization will only help to a certain extent. Providing integrated solutions for decarbonizing upstream projects, implementing subscription-based revenue models or diversifying into the low-carbon space could be key enablers of the future OFS strategy.

Schlumberger bets on traditional demand growth. Despite the green push, Schlumberger is gearing up for growth around the world, as the company expects recovering economies to ignite several years of crude demand expansion. Schlumberger will boost spending 18% to $2 billion, serving North American oil explorers that should dominate activity in the first half of the year, followed by international growth in the final six months. “Oil demand is expected to exceed pre-pandemic levels before the end of the year and to further strengthen in 2023,” said CEO Olivier Le Peuch. “Resurgent global demand-led capital spending will result in an exceptional multi-year growth cycle.”

Many OFS companies are experiencing a resurgence in profitability, as crude demand rebounds, due to underinvestment. The company expects North American clients, drilling on land and offshore, to increase spending 20% this year, while international customers should expand their budgets 12% to 16%.

OPEC struggling to meet demand. Although the cartel pledged to add 400,000 bopd each month to reduce oil prices, actual production increases have fallen short, due to internal unrest and insufficient long-term investment. In December, OPEC increased output by just 90,000 bopd. UAE Energy Minister Suhail Al-Mazrouei said OPEC is increasing output, but he warned the cartel could not solve the global oil supply issues alone. “The industry needs investment, through the involvement of international oil companies, to provide adequate supplies. Failure to infuse sufficient capital may lead to future price hikes,” Al-Mazrouei warned.

Inflationary pressure. If OPEC+ continues to fall short of production targets, there may be wider economic consequences. The recovery in oil demand has remained robust, as the Omicron variant has had a milder effect on the global economy than anticipated. Brent has jumped considerably since the start of the year and has gone as high as $95 recently.

Surging energy prices are a significant contributor to rising inflation, and the U.S. White House, led by President Joe Biden, has consistently applied pressure on OPEC+ to boost supply and help curb costs, rather than call on U.S. producers to increase output. Through most of 2021, Russia maintained fairly consistent monthly production increases, as it restored capacity idled in the initial stages of the pandemic. By November, the revival floundered; most idle and shut-down Russian wells were returned to production, indicating that the industry had essentially deployed its spare capacity.

The abovementioned factors, along with World Oil’s surveys of operators and state agencies, have all shaped this cycle’s U.S. forecasting process. Accordingly, World Oil’s editorial staff presents its 2022 E&P forecast, as follows:

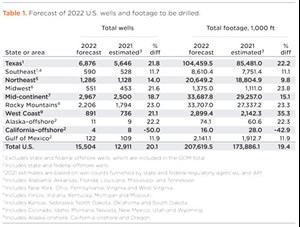

- U.S. drilling will increase 20.1%, to 15,504 wells, Table 1

- U.S. footage will increase 19.4%, to 207.6 MMft of hole

- U.S. Gulf of Mexico activity should improve 11.9%, to 122 wells.

U.S. MARKET FACTORS

Although positive trends in commodity prices slowed in late December/early January, due to Omicron, Evercore ISI expected that this latest variant would have a limited impact on mobility and global demand. Companies have been using $70/bbl WTI and $3.90/MMbtu Henry Hub decks for 2022 budgets.

Commodity price expectations have improved noticeably since our mid-year 2021 forecast update and remained resilient despite the emergence of the Omicron variant. Oil prices have now gone above the sweet spot between where budgets will reset higher at $75 WTI and lower at $65 WTI, while gas budgets are unlikely to be materially revised unless prices fall below $3 or increase above $5.50. Cash flow remains the key determinant of spending, although y-o-y changes in oil and gas prices as determinants for spending plans suggest a subtle shift is underway in operators’ hydrocarbon targets.

However, there is a sense that fundamental transformation is required, as the industry moves into 2022. Simply managing or riding oil price cycles is not an option anymore, and many companies are taking action to reinvent themselves by:

- Practicing capital discipline (global upstream capex increased only 4% in 2021)

- Focusing on financial health (debt reduction of 4% in 2021)

- Stronger financial commitment to addressing climate change

- Transforming business models. About 66% of industry executives said they are positive about the strategic changes made by their organizations.

Capex. NAM spending is expected to increase 20.6% in 2022, reversing the 1.7% decline in 2021 and part of the 44.1% collapse in 2020, says James West, senior managing director at the Evercore ISI investment firm (see page 19). At about $73 billion in 2021, NAM capex fell to its lowest level since 2003 and is about 72% below the 2014 peak and 49% below the 2018 level. With spending growing 20.6% in 2022, led by the U.S. at 23.5%, total NAM capex should recover slightly north of 2004 and 2016 levels. However, Capex remains 66.6% below the 2014 high point and 38% below the 2018 level.

Crude production. Despite the sharp three-year consecutive decline in spending, U.S. crude production averaged 11.2 MMbopd in 2021, down only about 130,000 bopd year-over-year and just 1.7 MMbopd from the annual record of 12.9 MMbopd averaged in 2019.

Analysts believe U.S. shale production has peaked, with declining well productivity and increasingly challenging geological conditions limiting growth. And with operators prioritizing capital discipline and limiting capex spend, it appears U.S. shale is structurally impaired.

Evercore ISI analyst Steve Richardson forecasts U.S. crude output to increase by 1.1 MMbopd in 2022, with a significant boost coming from new GOM projects. Although the U.S. land rig count has increased steadily from the August 2020 record low, Evercore believes the U.S. rig count and frac activity continue to operate at levels below that required to stave off broad production declines. The firm also believes it is materially below levels required to grow production, as forecasted by EIA, which foresees 12.0 MMbopd in 2022 and 12.6 MMbopd in 2023.

Natural gas production. The EIA estimates that the U.S. produced 93.5 Bcfd in 2021, up 2.0 Bcfd (2%) from 2020. Natural gas production fell in 2020 as a result of low prices that reduced drilling activity. Production grew in 2021, as drilling activity came back online, especially in the Permian basin, where associated gas production in that region contributed to the overall growth.

We forecast dry natural gas production will increase by 2.5 to 3.0 Bcfd (2.7% to 3.2%) in 2022. Recent increases in oil and domestic natural gas prices will contribute to an overall increase in drilling activity in 2022, which will, in turn, lead to production growth from second-quarter 2022 onward.

LNG outlook. The EIA forecasts that U.S. natural gas exports will reach record highs in 2022 and continue to grow in 2023. Net gas exports averaged 10.7 Bcfd in 2021 and are forecast to increase to 13.4 Bcfd in 2022 and 14.3 Bcfd in 2023. A combination of rising LNG exports and increases in pipeline exports to Mexico will drive this increase. The U.S. exported 11.2 Bcfd of LNG in December 2021, an increase of 0.7 Bcfd over the previous record set in November. LNG export growth in 2021 was driven by rising natural gas demand and high LNG prices in Europe and Asia; reductions in global supply because of several unplanned outages at LNG export facilities worldwide; and cold weather in key LNG consumption markets, particularly in Asia.

Crude prices. Oil prices rose during much of 2021, with Brent spot prices averaging $71/bbl for the year, compared with $42/bbl in 2020. Rising prices reflected growth in global oil demand that outpaced near-term growth in oil production, resulting in falling global oil inventories. During 2021, Brent prices reached their highest monthly average of $84/bbl during October. Brent prices fell to an average of $74/bbl in December, which reflected concerns about how the Omicron variant and potential mitigation efforts might affect near-term oil demand. EIA expects Brent will average $82.87/bbl in 2022.

Natural gas prices. Henry Hub spot prices averaged $3.91/MMBtu in 2021. Natural gas prices were volatile throughout 2021. Early in 2021, volatility resulted from near record-high spot prices during the extreme winter weather in February. During the rest of the year, Henry Hub prices rose from $2.62/MMBtu in March to $5.51/MMBtu in October, before falling back to $3.76/MMBtu in December, amid a warmer-than-normal start to the heating season across most of the country. EIA forecasts HH spot price will average $4.07/MMBtu in 2022.

Drilled-but-uncompleted. In a surprising turn of events, U.S. operators have made considerable progress working down the DUC backlog over the last year. Clearly, the increase in oil prices has made these temporarily abandoned wells more attractive, as operators know the break-even price from completing other wells on the lease (spoked or wine-racked). As of December 2021, the DUC total stood at 4,657, 36% less than reported by the EIA a year earlier. DUCs in the Permian dropped dramatically, with 1,444 tallied in December, 59% fewer than the year-ago figure of 3,524. The Bakken (-41%) , Eagle Ford (-27%) and Niobrara (-21%) round out the top four regions with inventory declines. And in January 2022, the U.S. DUC total fell another 191 wells, to 4,466.

U.S. FORECAST

In 2021, global oil and gas discoveries hit their lowest level in 75 years, with total volumes found calculated at 4.7 Bboe. This also represents a considerable decline from the 12.5 Bboe added in 2020 (Rystad Energy). Liquids continue to dominate the hydrocarbon mix, accounting for 66% of discoveries. The monthly average of discovered reserves in 2021 was 424 MMboe. The reduction in volume accentuates the absence of large individual finds.

Part of the reason that oil prices are reaching multi-year highs is an unexpected supply gap, caused by robust demand despite Omicron, outages and geopolitical unrest. A major contributor to the lack of surplus production capacity was caused by excessive pressure applied by short-sighted politicians, who caved into demands from environmental groups without considering the far-reaching consequences. This created an unprecedented reduction in investment in hydrocarbon-based energy, in favor of developing unreliable green resources. However, the price spike has been a boon for the U.S. shale industry.

Gulf of Mexico. As the Biden administration’s move to scrap new oil and gas leases remains in unsettled legal territory, Democrats and Republicans on a U.S. House panel sharply disagreed about the merits of new energy development in the GOM. Democrats argue that reducing energy development off the Gulf Coast is one way to drive down emissions from fossil fuels. Republicans respond that reducing domestic production would not meaningfully lower global emissions, because the demand would be filled by other sources.

The situation was complicated further, when a federal judge in late January invalidated the results of BOEM lease sale 257, comprising 1.7 million acres, which was conducted last November, Fig. 2. The judge said that the Biden administration violated federal law by tying the sale to flawed analysis of the climate change impact of drilling in the Gulf. Now, a new analysis will have to be conducted before another sale can

take place.

Despite the political wrangling, operators plan to increase drilling activity in the Gulf of Mexico. World Oil predicts an 11.9% increase in drilling (122 wells) and total footage in 2022.

U.S. REGIONAL ACTIVITY

World Oil projects nationwide drilling was up 12.7% in 2021, due to a sustained increase in commodity prices, caused by an unexpected supply gap, which was triggered by stout demand, outages and geopolitical uncertainty. With demand expected to exceed pre-Covid levels in 2022, coupled with a lack of surplus production capacity due to underinvestment, we forecast a 20.1% increase in 2022, Table 1.

Although 52% of U.S. drilling will be in the Texas and New Mexico oil-rich shale plays, operators also plan to increase their search for natural gas in 2022. We predict 46% and 5% increases in Texas Districts 10 and 6, respectively, and a 35% increase in District 4. The Texas District 8 portion of the Permian will remain the major target for companies seeking to add oil reserves, with 3,409 wells forecast for 2022, an increase of 21%. We also expect operators working other oil-rich shale plays in Oklahoma and New Mexico, to boost drilling by 24% and 19%, respectively. Kansas and Wyoming will be leading a rebound in gas-focused activity.

Texas. Shale drilling will continue to dominate the Lone Star State, but natural gas-producing regions will get more attention in 2022 than in previous years. In spite of the modest increase in drilling activity in 2021, operators still managed to increase production to 4.9 MMbopd in October 2021, 5.6% more than the year-ago figure of 4.64 MMbopd.

However, this significant amount of crude output in a remote area forces operators to flare vast quantities of casinghead gas to capture the liquids. To combat the wasteful practice, RRC Commissioner Jim Wright announced he will deny most requests for exceptions to Statewide Rule 32, governing flaring permits to gather more details on the need to flare, and to inquire about the timeline for sufficient infrastructure to take gas to market.

In spite of the state’s stricter stance on flaring, Permian basin operators working in RRC District 8 plan to increase drilling activity 21.4%, with an accompanying boost in footage of 22.1% in 2022, Fig. 3. In District 7C, World Oil forecasts an 18% increase in well spuds and a 19% jump in total footage. In the heart of the Eagle Ford, in District 1, operators plan to ramp-up drilling 23% and total footage 24%.

With the demand for natural gas reaching all-time highs, and improvements in LNG production and transport capabilities, we predict Districts 10, 4 and 8A will enjoy 46%, 35% and 30% increases in drilling activity, respectively. Similarly, gassy Districts 5 and 9 also will increase, with gains of 20% and 20.7%, respectively. World Oil forecasts total combined activity in Texas will increase 21.8% during 2022, with footage up 22.2%.

Southeast. In northern Louisiana, a 19% y-o-y increase in the area’s DUC inventory, coupled with an abundant supply of natural gas from other shale plays, will result in just a 10% increase in the Haynesville gas play during 2022. Activity by smaller companies will also increase in the state’s mature shallow oil fields. In southern Louisiana, footage and total well spuds are forecast to increase 6.7%. Combined, Louisiana will enjoy a 9.5% increase in wells and a 9.7% jump in total footage during 2022. In Alabama and Mississippi, the volume of activity will remain relatively low compared to pre-2016 levels, but percentage gains will be noticeable in 2022 at 38.5% and 26.7%, respectively.

Northeast. After demand fell precipitously, due to Covid-19, LNG buyers around the world cancelled more than 100 U.S. cargoes, as prices for the fuel collapsed to record lows in Europe and Asia. However, the demand for U.S. LNG has recovered. It is estimated that the short-run marginal cost of U.S. LNG exports to the Asian market rose to $5.60/MMBtu, as of June 2021, up 65% from $3.4/MMBtu in mid-2020 and 30% higher than last year’s average of $4.30 per MMBtu.

Although liquefaction and transportation costs have increased slightly, the EIA forecasts U.S. natural gas exports will reach record highs in 2022 and continue to grow in 2023. It is likely that demand for Marcellus-Utica gas and LNG export from the Cove Point LNG facility in Maryland will improve during 2022. Accordingly, gas-dominated activity in the Northeast will be up 14%, Fig. 4.

After impressive development during the shale boom, drilling activity in Pennsylvania has slowed and is forecast to improve just 8.5% with a footage increase of 7.7%. In West Virginia, World Oil forecasts a strong increase in activity, with spuds improving 18% and total footage projected to jump 18.2% in 2022. The average well should TD around 17,100 ft in the Mountain State. Apparently, relatively high drilling costs associated with wells in excess of 20,500 ft is suppressing activity in Ohio. We forecast the state’s well activity will improve just 5%, but total footage is projected to climb 8.6% in 2022 as operators increase horizontal well lengths to improve ROI.

Midwest. World Oil predicts activity levels will experience a noticeable surge in this region. In Illinois, state officials project a 9.2% increase in spuds, with an 8% improvement in total footage in 2022. The increase is due to higher commodity prices and an increase in rig availability. In Indiana, where gas activity will improve, we are predicting an increase of 19% in drilling activity and a similar jump in footage. Michigan continues to lag in overall volume, compared to its sister states, but recovering demand as Covid vaccines take hold is a factor driving new drilling projects. Because of this optimism, we forecast a 21% increase in spuds and 26% jump in total footage during 2022 in the Wolverine State.

Mid-continent. Although disappointing results in the SCOOP and STACK plays of Oklahoma continue, operators are expected to increase drilling operations in the state, to take advantage of updated technologies and completion practices. During 2022, we predict that Oklahoma’s activity will increase 24% overall, with a 24.1% boost in total footage. Activity in the Sooner State continues to be dominated by Continental and Devon.

In the oil-rich Bakken shale of North Dakota, activity is forecast to remain relatively consistent in 2022. World Oil forecasts that drilling and footage will increase 5.6% and 6.7%, respectively, Fig. 5. We predict the trend to laterals approximately two miles long will continue through 2022, with some wells reaching a total MD in excess of 21,300 ft. Although the DUC count in the region has declined 41% y-o-y, there are still 458 wells waiting on completion. Oil transport from the remote location is still an issue, but the region’s entrenched operators will continue to support their large drilling and completion investments.

In conventionally oriented Kansas, operators continue to drill relatively shallow oil and gas wells to maintain production. But with other shale plays waning, and gas prices surging, investors are starting to shift attention back to traditional prospects that don’t require high-cost horizontal drilling and staged fracing techniques. Similar to last year’s gains, we predict a 24.4% increase in total wells and a 24.9% jump in footage during 2022.

Rocky Mountain states. The pro-green political climate in Colorado is starting to fade, and the state’s oil and gas industry is starting to recover. It’s clear the established operators working the state are not willing to abandon their producing properties in search of more favorable drilling conditions in neighboring states. As such, we project 20% more wells and footage in 2022, Fig. 6. And despite the hostile environment, Colorado’s crude production has remained stable. In October 2021, the Centennial State produced 411,000 bopd, up 4.1% from a year earlier.

On the Wyoming side of the Niobrara shale, operators plan a 30.1% uptick in drilling activity, while making 32.2% more hole in 2022. The state is benefiting from the negative political climate in neighboring Colorado and a push is underway to drill on federal lands before leases expire. In spite of a 24% increase in drilling activity in 2021, production remained unchanged at 235,000 bopd last October, the same as the year-ago figure. In January, Canadian Overseas Petroleum announced it confirmed a conventional light oil discovery in Converse and Natrona Counties, Wyoming. COPL estimates total reservoir volume of 1.5 Bbbl of oil. Production has commenced from the Dakota sand at the BFU 14-30VF discovery well, with an output of 100-120 bopd.

In northeastern Utah’s multi-horizon Uinta basin, a boom scenario is predicted, as operators expedite activity to lock in held-by-production rights on federal lands as leases expire. Approximately 67% of the state’s mineral acreage is controlled by the U.S. BLM. Drilling activity is forecast to increase 41%, and footage should improve 45.5% in 2022. The 74% jump in drilling activity during 2021 increased oil output 28% (y-o-y) to 104,000 bopd in October 2021.

Although New Mexico was late to the Permian shale boom, the southeastern part of the state is now a full-fledged member of the exclusive Permian basin club. Operators will focus more attention on the prolific Bone Spring formation, with an 18.9% increase in drilling activity during 2022, as operators rush to drill federal lands before lease terms expire. We also forecast that operators will increase footage drilled 20.4% in 2022.

On the West Coast, California’s production has been remarkably resilient over the past several years, especially considering there was practically no exploratory drilling for the past decade, Fig 7. However, this might change in 2022, with onshore operators expected to increase drilling 19.8%, with total footage up 35.0%. But compared to last year, we predict that 2022 will be a bust scenario for offshore drilling in the Golden State, with only four new wells projected for 2022, compared to eight drilled in 2021. As in previous years, most onshore drilling is conducted by just four companies. The erratic drilling activity is starting to take a toll on the state’s production. In October 2021, operators managed to pump 365,000 bopd, 5.2% less than produced in October 2020.

Several factors have hampered the development of Alaska’s offshore drilling industry, with no meaningful recovery in sight. However, offshore work in the Cook Inlet will increase 22.2% for 2022, with footage set to rise 22.3%. Furthermore, onshore drilling activity and total footage on the North Slope are both projected to boom, with a 36% increase forecast in 2022.

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- The last barrel (February 2024)

- What's new in production (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)