Drilling

News

February 09, 2026

Perenco has installed the $200-million Kombi 2 platform on Congo’s Kombi-Likalala-Libondo II field, supporting a six-well drilling campaign beginning in 2026 aimed at boosting production and extending field life.

News

February 06, 2026

Brazil’s ANP has authorized Petrobras to resume drilling in the Foz do Amazonas offshore frontier following a temporary suspension, reopening one of Brazil’s most closely watched exploration campaigns.

News

February 05, 2026

ConocoPhillips says recovering billions from past Venezuela expropriations will take priority over new drilling, highlighting ongoing financial and political hurdles facing foreign investment in the country’s oil sector.

News

February 02, 2026

World Oil marked a milestone in its annual Forecast Breakfast series on Friday, celebrating 100 years of forecasting and its 58th Forecast Breakfast event, with industry leaders offering a clear-eyed view of global energy demand, U.S. shale productivity, regulatory challenges and the year ahead for drilling activity.

Article

January

U.S. natural gas demand is on track to surge by roughly 30 Bcfd by 2030, driven largely by LNG exports—but can drilling keep up? In this month’s Drilling Advances column, Ford Brett breaks down what isn’t holding the industry back anymore—and the bottlenecks that could determine whether drillers can deliver the next wave of gas supply.

News

January 29, 2026

Condor Energies Inc. reported progress on its multi-well drilling campaign in Uzbekistan, including a record-length horizontal well with strong gas shows, while announcing the sale of its Turkish gas assets to sharpen its strategic focus in Central Asia.

News

January 27, 2026

India is targeting up to $100 billion in upstream investment by opening new acreage and accelerating drilling, as it seeks to curb oil imports and strengthen long-term energy security.

News

January 23, 2026

SLB closed 2025 with signs of stabilizing upstream activity across global markets. The company is leaning into production optimization, digital growth and offshore developments as it looks toward 2026.

Article

December 2025

Unconventional drilling demands uncompromising rig performance, and new rig designs are delivering value by reducing flat time, increasing efficiency and improving safety

News

January 16, 2026

Low oil prices are forcing a rare pause in Bakken drilling, as Continental Resources founder Harold Hamm says margins have largely disappeared.

Article

December 2025

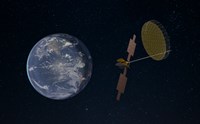

This article explores how advanced space technology and resilient satellite connectivity can support the development of autonomous oil rigs by addressing connectivity challenges in remote, hazardous environments. Improved remote monitoring, control and autonomous tools have the potential to enhance safety, increase operational efficiency and strengthen resilience across the energy sector.

Article

December 2025

In the Middle East, operators are leveraging underbalanced coiled tubing drilling (UBCTD) to reduce formation damage, improve reservoir connectivity, and deliver higher production with lower completion complexity.

News

January 06, 2026

Halliburton has launched the Hypersteer MX matrix-body directional drill bit, addressing erosion and abrasion challenges in high-flow shale wells to enable longer runs and reduced well construction time.

Article

December 2025

H&P’s FlexRobotics™ system has reached its first commercial use in the Permian, where robotic arms are handling pipe-movement tasks typically performed manually. Following lab and field testing, the company is now evaluating the technology’s impact on crew workflow, rig-move times and operational consistency.

News

December 11, 2025

Dana Gas has confirmed a significant 15–25 Bcf gas discovery at the North El-Basant 1 exploratory well in Egypt’s onshore Nile Delta. The find supports the company’s $100 million drilling program, with production expected to exceed 8 MMscf/d once tied into the national gas network.

News

December 11, 2025

DNO has restarted drilling in the Kurdistan region after surpassing 500 MMbbl of cumulative production at the Tawke license. Two rigs will drill eight wells through 2026 as the operator targets increasing gross output to 100,000 bopd across the Tawke and Peshkabir fields.

News

December 08, 2025

Block Energy has received a non-binding farm-in offer from a major energy company for its Project III appraisal and early development program in Georgia. The proposal includes a full carry for well re-tests, sidetracks, and a 20 MMcf/d early-production facility.

Article

November 2025

Eavor Technologies Inc.’s Geretsried project in Bavaria, Germany, is the first commercial deployment of its closed-loop (Eavor-LoopTM) advanced geothermal system. This article outlines the technical achievements in multilateral drilling performance, including a 90% improvement in rate of penetration, 3x increase in bit run lengths, and the integration of enabling technologies, such as insulated drill pipe and active magnetic ranging.

Article

November 2025

As LNG export capacity surges and AI-driven power demand skyrockets, U.S. natural gas is poised for its biggest growth cycle yet. In this month’s Drilling Advances, columnist Ford Brett breaks down why “trash gas” may soon turn to gold—and what a 25% jump in gas production by 2030 means for rigs, crews and drilling technology.

News

December 03, 2025

Black Stone Minerals and Caturus Energy have entered a 220,000-acre Haynesville development agreement, establishing a multi-year drilling program to expand Gulf Coast natural gas output.