Washington outlook: Federal oil and gas policy shifts noticeably toward the industry

GORDON FELLER, Contributing Editor

Since returning to the Oval Office on Jan. 20, 2025, President Trump has unleashed what industry leaders are calling a “seismic shift” in U.S. oil and gas policy, Fig. 1. The administration’s “Drill, Baby, Drill” mantra has translated into concrete federal actions across multiple agencies, rolling back Biden-era restrictions, fast-tracking permits, and opening vast tracts of public land—including the Arctic National Wildlife Refuge—to fossil fuel development.

Although the administration says it was not following the Heritage Foundation’s Project 2025, officials do seem to have accomplished most of its agenda, Table 1. Furthermore, if one examines a list of Trump campaign promises on energy, you will find that most of them have been fulfilled, Table 2. As the administration enters its second year, the question facing industry executives, policymakers, and environmental advocates alike is simple: what comes next?

Based on the aggressive regulatory rollbacks and legislative victories secured in 2025, the trajectory for 2026 points toward even more dramatic expansion of domestic oil and gas production. The industry’s leading organizations have hailed this "energy dominance" agenda as a breakthrough, although the path forward is increasingly contentious.

What follows is a summary of key moves—emanating from Washington, D.C.—during the past 14 months.

DEPARTMENT OF THE INTERIOR: OPENING THE FLOODGATES

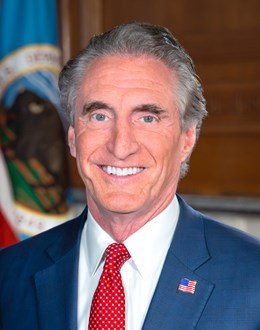

Under Secretary Doug Burgum’s (Fig. 2) leadership, the Department of the Interior has become the administration’s most aggressive vehicle for expanding fossil fuel extraction on federal lands. The numbers tell a striking story: between Jan. 20, 2025, and early January 2026, the Bureau of Land Management approved 5,742 permits to drill—a 55% increase, compared to the same period under former President Joe Biden. The BLM held 22 lease sales in 2025, offering 328,000 new acres across 10 states and generating over $356 million in revenue.

The crown jewel of Interior’s 2025 actions was the finalization of plans to open the entire 1.5-million-acre coastal plain of the Arctic National Wildlife Refuge to oil and gas drilling. “For too long, many politicians and policymakers in D.C. treated Alaska like it was some kind of zoo or reserve,” Secretary Burgum declared at an October announcement event. “This land should, and will be, supporting responsible oil and gas leasing.”

Interior also implemented emergency procedures in April 2025 to accelerate permit approvals, cutting the typical one-to-two-year timeline down to just 28 days. “The United States cannot afford to wait,” Burgum stated, invoking President Trump’s declaration of a national energy emergency to justify the expedited process.

The administration also reversed Biden-era restrictions on the National Petroleum Reserve in Alaska, opening nearly a third of the 23-million-acre reserve to drilling. Offshore, the One Big Beautiful Bill Act mandated 36 oil and gas lease sales—30 in the Gulf of America/Mexico between 2025 and 2040, plus six in Alaska’s Cook Inlet between 2026 and 2032. Interior followed up with a draft 11th National Outer Continental Shelf Leasing Program that proposes 34 offshore lease sales through 2031, in three of the four OCS Regions and in 21 of the 27 OCS Planning Areas. This schedule includes seven sales in the Gulf of America/Mexico, six along the Pacific Coast and 21 off Alaska.

Looking ahead to 2026, Interior is expected to continue its acceleration of Arctic development, including advancing the controversial Ambler Road—a 211-mi highway through Gates of the Arctic National Park that would open remote mining opportunities. The department may also target additional restrictions on renewable energy projects on federal lands while prioritizing fossil fuel development.

DEPARTMENT OF ENERGY: THE LNG EXPORT BOOM

Secretary Chris Wright (Fig. 3) wasted no time reversing President Biden’s January 2024 pause on new LNG export permits. On his first day, President Trump signed an executive order ending the freeze, and DOE has since approved export authorizations for five major LNG facilities: Commonwealth LNG in Cameron Parish, La.; Port Arthur LNG Phase II in Jefferson County, Texas; Venture Global’s massive CP2 facility in Cameron Parish, La.; Golden Pass LNG in Jefferson County, Texas; and Delfin LNG, to be located about 50 mi offshore Cameron Parish, La.

“President Trump has outlined a bold agenda for unleashing American energy dominance, and restoring regular order on U.S. LNG export permits is critical for meeting this commitment to the American people,” stated Secretary Wright in February 2025 when approving Commonwealth LNG. “Exporting American LNG strengthens the U.S. economy and supports American jobs while bolstering energy security around the world.”

The CP2 project alone, once constructed, will export up to 3.96 Bcfd of LNG to non-free trade agreement countries. In October 2025, DOE finalized CP2’s export authorization.

DOE has also taken steps to expedite data center connections to the power grid and fast-track approvals of new chemicals for data center use—a recognition that artificial intelligence’s energy demands will require massive increases in natural gas-fired generation. In 2026, the administration expects to export 4 Bcfd more natural gas than in 2024—a 33% increase.

Future DOE actions will likely include additional LNG export approvals, further streamlining of grid connection processes for gas-fired generation, and potential support for gas infrastructure serving energy-intensive industries like cryptocurrency mining and artificial intelligence computing.

ENVIRONMENTAL PROTECTION AGENCY: ROLLING BACK CLIMATE RULES

The EPA has pursued an aggressive deregulatory agenda targeting methane emission standards, vehicle pollution limits, and climate change determinations. The agency has delayed limits on methane from oil and gas operations, with an eye toward eliminating them entirely. The administration also has proposed repealing the landmark 2009 “endangerment finding”—the EPA’s determination that climate change poses a threat to public health—as part of an effort to roll back vehicle emission standards.

At the Department of Transportation, EPA has supported proposals to roll back vehicle fuel efficiency standards and zero-out penalties for violating efficiency requirements. The agency has also sought to phase out Biden-era subsidies for renewable energy at the agency level, attempting to claw back billions of dollars allocated for green projects.

In 2026, EPA is expected to finalize the repeal of methane regulations, continue efforts to weaken the endangerment finding, and potentially target additional air quality standards that industry argues place undue burdens on fossil fuel operations. The agency may also attempt to revoke California’s waiver, allowing the state to set stricter vehicle emission standards.

SECURITIES AND EXCHANGE COMMISSION: ABANDONING CLIMATE DISCLOSURE

In a dramatic reversal, the SEC voted on March 27, 2025, to end its defense of climate disclosure rules, requiring public companies to report greenhouse gas emissions and climate-related risks. Acting Chairman Mark Uyeda called the requirements “costly and unnecessarily intrusive,” signaling the commission would allow legal challenges to proceed without opposition.

“The goal of today’s Commission action and notification to the court is to cease the Commission’s involvement in the defense of the costly and unnecessarily intrusive climate change disclosure rules,” said Uyeda. By withdrawing its defense, the SEC effectively invited the Eighth Circuit Court of Appeals to vacate the rules without requiring formal APA rulemaking to rescind them.

In 2026, the SEC may formally rescind the climate disclosure rules through notice-and-comment rulemaking, though the commission’s July 2025 statement indicated it has no plans to “review or reconsider the Rules at this time.”

DEPARTMENT OF JUSTICE: CHALLENGING STATE CLIMATE POLICIES

In April 2025, President Trump signed an executive order directing the Department of Justice to protect American energy companies from state-level “climate superfund” laws. API enthusiastically welcomed the move, with Senior Vice President and General Counsel Ryan Meyers stating, “We welcome President Trump’s action to hold states like New York and California accountable for pursuing unconstitutional efforts that illegally penalize U.S. oil and natural gas producers.”

The directive positions DOJ as a defender of fossil fuel interests against state attorneys general pursuing climate-related litigation. While specific enforcement actions have not yet been publicized, the order signals the administration’s intent to preempt state-level climate policies that could impose liability on oil and gas companies for historical emissions.

In 2026, DOJ may file amicus briefs or intervene directly in state climate litigation, challenge California’s climate disclosure laws on constitutional grounds, and potentially pursue actions against states restricting fossil fuel development.

THE MEGA-MERGER WAVE

January 2025 saw the Federal Trade Commission grant final approval to two very large oil and gas mergers: ExxonMobil’s $64.5 billion acquisition of Pioneer Natural Resources and Chevron’s $53 billion purchase of Hess Corporation, Table 3. The approvals came with significant conditions—FTC Chair Lina Khan barred Pioneer CEO Scott Sheffield from serving on ExxonMobil’s board after uncovering “troubling evidence” of communications with OPEC representatives, aimed at cutting oil production to raise prices.

“This relief will help ensure that these companies seek to respond to their rivals by competing, rather than subordinating their independent decision-making to the goals set by a cartel,” Khan said. Similarly, Hess CEO John Hess was initially barred from Chevron’s board, though the FTC later granted limited exceptions allowing him to consult on Guyana operations and carbon reduction initiatives. It should be noted that Khan was a Biden appointee, who, after leaving the FTC in January 2025, became chairman of New York City Mayor Zhoran Mamdani’s mayoral transition team after his November 2025 election win.

ExxonMobil completed its Pioneer acquisition in May 2024, more than doubling its Permian basin production to 1.3 MMboed. The merger created an unconventional business with an estimated 16 Bboe resource and 1.4 million net acres in the Delaware and Midland basins. Chevron finalized its Hess acquisition in July 2025 after prevailing in an arbitration dispute with ExxonMobil over Hess’s Guyana assets.

The consolidation wave (Table 4) also included ConocoPhillips’ $23 billion acquisition of Marathon Oil and Diamondback Energy’s $26 billion purchase of Endeavor Energy. Industry observers note that Trump appointees now control the FTC.

INDUSTRY CELEBRATES “GENERATIONAL OPPORTUNITY”

API has been effusive in its praise of the administration’s actions. “Americans sent a clear message at the ballot box, and President Trump is answering the call on Day One—U.S. energy leadership is delivering,” API President and CEO Mike Sommers (Fig. 4) declared on Inauguration Day. In November 2024, Sommers wrote to President-elect Trump that “our country has a generational opportunity to fully leverage U.S. energy leadership to improve the lives of all Americans and bring stability to a volatile world.”

API’s five-point policy roadmap calls for repealing EPA tailpipe rules and vehicle efficiency standards, issuing a robust offshore leasing program, ending the methane fee, reforming the National Environmental Policy Act, and advancing tax policies favorable to the industry. Sommers emphasized in January 2025 that API seeks “durable action that lasts the test of time,” noting that “oftentimes, that means that it takes an act of Congress to get durable action enacted.”

ANTITRUST AND MARKET CONCENTRATION WORRIES

Former FTC Chair Lina Khan’s dissenting statement on the ExxonMobil-Pioneer merger highlighted concerns about industry consolidation leading to higher prices for consumers. Environmental advocates including Greenpeace USA, the League of Conservation Voters, and Sierra Club argued that the approved mergers were anticompetitive and would allow ExxonMobil and Chevron to “dominate the market and inflate oil and gas prices for consumers.”

Some conservative economists have also expressed unease about the concentration of market power. While generally supportive of deregulation, they worry that mega-mergers reduce competition and could lead to price-fixing behavior.

LIBERTARIAN AND FISCAL CONSERVATIVE CRITIQUES

Interestingly, some criticism has emerged from libertarian and fiscal conservative quarters. The One Big Beautiful Bill Act’s reduction of federal royalty rates from 16.67% to 12.5%—a 25% cut—has been characterized by the Center for Western Priorities as “giving the oil and gas industry a giant tax break” while “hurting Western states and communities.” The Center’s deputy director, Aaron Weiss, noted that “Oil CEOs have made it clear in public statements that they have no intention of passing these savings on to Americans at the pump. Instead, they plan to pocket the billions in lost federal revenue for themselves and their shareholders.”

Some fiscal conservatives argue that federal lands should generate maximum revenue for taxpayers and not provide subsidies to profitable corporations. The reduction in bonding requirements for drillers—which makes it easier for companies to abandon wells and leave cleanup costs to taxpayers—has also drawn criticism from deficit hawks.

MARKET REALITIES: THE MISSING BIDDERS

Perhaps the most telling criticism of current administration policies comes from the market itself. Despite the administration’s enthusiasm for Arctic drilling, the January 2025 ANWR lease sale attracted zero bidders. Major oil companies have largely declined to pursue Arctic development, citing high costs, lack of infrastructure, and mounting pressure from banks and insurers who have ruled out financing such projects on environmental grounds. This market resistance suggests that even with regulatory barriers removed, the economic case for some forms of expanded drilling remains weak.

WHAT TO EXPECT IN 2026

As the Trump administration enters its second year, the trajectory is clear: more drilling permits, more LNG export approvals, more public land lease sales, and more regulatory rollbacks. The administration has signaled its intention to finalize the repeal of methane regulations, potentially eliminate the EPA endangerment finding, and continue challenging state climate policies through the Justice Department.

Interior will likely push forward with additional Arctic development, including the Ambler Road and expanded drilling in the National Petroleum Reserve. DOE may approve several more LNG export facilities, further cementing America’s position as the world’s leading gas exporter. The SEC appears unlikely to revive climate disclosure requirements, and with Trump appointees now controlling the FTC, additional mega-mergers may face less antitrust scrutiny.

However, the administration’s agenda faces significant headwinds. Legal challenges to Arctic drilling, offshore leasing, and the rescission of environmental protections are already winding through federal courts. The industry got much of what it wanted in 2025. Whether that translates to actual increased production, lower consumer prices, or enhanced energy security will become clearer as 2026 unfolds.

Related Articles- First Oil: Celebrating our 100th year of forecasting (February)

- This time….it will still be the same (December 2025)

- International drilling & production: Upstream work outside the U.S. will be up slightly (February 2025)

- First Oil: Forecast calls for a near-repeat in 2025 (February 2025)

- Industry continues to prove itself despite regulatory interference (September 2024)

- U.S. drilling decreases on shale consolidation, technical advancements following record production (September 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)