Regional Report: Brazil

Oil and gas production in Brazil was gaining late last year, even as Petrobras reported a modest decline. The third-quarter production improvement was attributed to regulatory and economic changes, and technical advances that, together, track a return to pre-Covid production levels and support an optimistic forecast of continued growth. Beyond its transient Q3 dip, Petrobras is also optimistic; its 2022-2026 CAPEX plan is expected to add 20 Bboe to the company’s production over the next decade.

RECOVERY TIME

A small year-to-year increase in September 2022 pushed production to 4.048 MMboed, only the second time Brazil’s production has exceeded 4 MMboed, according to Brazil’s National Agency for Petroleum, Natural Gas, and Biofuels (ANP). The first was in January 2020, on the cusp of the pandemic.

That total compares to August 2021 production of 3.956 MMboed that was 2.9% less than August 2020, when Covid-19 had shut down many fields and FPSO operations.

Pre-salt production in September continued to dominate national output at 3 MMboed. Tupi field ranked first, with over 887,000 bopd produced. In August 2020, pre-salt production was 2.7 MMboed.

LONG-TERM GROWTH

Oil production in 2022 was expected to increase about 10% over 2021, based on regulatory advances, modernization of the Brazilian energy market and investments made in the pre-salt, predicted the Ministry of Mines and Energy in March 2022.

Growth is also forecast by Brazil’s Energy Research Office (Empresa de Pesquisa Energética or EPE), which expects production to reach 5.2 MMbopd and 1.6 MMboed of natural gas by 2030. That’s a significant bump from 2019’s average of 2.8 MMbopd. Natural gas is forecast to increase from 122 million m3/d to 276 million m3/d.

The outlook is largely driven by greater exploration and development of key assets by Petrobras and other international oil companies. At the same time, midsize assets are being sold to smaller companies that have a reputation for getting better production from mature and marginal fields. Underlying the EPE’s optimism is record investment in pre-salt fields, improvements in the bidding process, competitive assets, resilient projects, world-class resources and legal security that allowed Brazil to consider new licensing rounds.

The natural gas market is also expected to increase in size and efficiency. More competition, players and investment have resulted in more companies using Petrobras infrastructure, which in turn stimulates more supply, promoting more demand, said EPE. In addition, LNG imports are becoming more relevant, and pre-salt pipelines moving more natural gas to Brazil’s markets.

The U.S. Energy Information Administration’s (EIA) June 2022 Short-Term Energy Outlook said that after the United States, it expected liquid fuels production to increase the most in Brazil and Canada. By the end of 2023, EIA expects Brazil's liquid fuels production to increase 400,000 bpd, and grow from 3.7 MMbpd in 2021 to 3.9 MMbpd in 2022 and to 4.1 MMbpd in 2023.

The forecast assumes that production from six FPSO units will ramp up through 2023 and continue to drive growth, notably at Sepia, Mero and Buzios fields. Once they reach full capacity, these FPSOs will each produce between 70,000 bpd and 180,000 bpd.

BIDDING ROUNDS

Two auctions were held in 2022—first Permanent Production Sharing Offer (OPP) and the third Permanent Concession Offer (OPC). Both are forms of the Open Acreage Permanent Offer system that is the main model for bidding areas for E&P in Brazil.

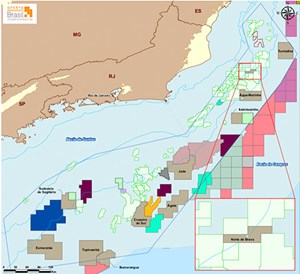

Production sharing. The first cycle of the OPP model was held on Dec. 16, 2022. Four blocks were acquired out of the 11 blocks offered (four in the Campos basin and seven in the Santos basin). The sale generated about 72% of the maximum potential signature bonus—about $170 million—with another $270 million estimated in the exploration phase, said ANP, Fig. 1.

The OPP consortium/company winners and blocks were:

- Petrobras/TotalEnergies/Petronas/Qatar Energy (Água Marinha Block)

- Petrobras (Norte de Brava Block)

- BP Energy (Boomerang Block)

- Petrobras (Southwest of Sagittarius Block).

The seven blocks that did not receive bids were Itaimbezinho, Tourmaline, Agate, Southern Cross, Emerald, Jade and Tupinamba.

Two of the areas, Água Marinha and Norte de Brava, had competition, said ANP Director-General Rodolfo Saboia. “In Água Marinha, the minimum percentage of profit-oil was exceeded by 220% and, in the case of Norte de Brava, the percentage offered had a premium of almost 171.73% in relation to the minimum.”

The Southwest of Sagittarius exploratory block in the Santos basin was won by Petrobras in partnership with Shell Brasil Petróleo Ltda (Shell). Shell said it will have a 40% stake in the block and will pay R$132 million as a signing bonus for its participation in the project.

“We are very excited about this newest addition to our exploration portfolio in Brazil,” said the president of Shell Brasil, Cristiano Pinto da Costa. “This permanent offer auction in the sharing modality further increases our presence in the country, which already accounts for around 13% of Shell's global production in oil and gas,”

With this new block, Shell Brasil now holds more than 30 oil and gas contracts in the country.

TotalEnergies, along with Qatar Energy and Petronas Petróleo Brasil Ltda (PPBL), won the Agua Marinha Block in the pre-salt Campos basin. Petrobras exercised its right to take 30% participating interest and operatorship. The move expands TotalEnergies’ presence in the Campos basin, following its entry into two blocks, S-M-1815 and S-M-1711, in the south Santos basin during the third OPC sale.

Permanent concessions. The third OPC was held in April 2022, when 59 exploratory blocks in the Espírito Santo, Potiguar, Recôncavo, Santos, Sergipe-Alagoas and Tucano basins were purchased for a total bonus of about $90 million and estimated exploration investment of roughly $87 million.

Shell (70%) partnered with Ecopetrol (30%) to win competitive bidding for six blocks in the Santos basin, consolidating holdings that it won in 2021. TotalEnergies won 100% of two blocks.

Onshore bidding by 11 companies accounted for the remaining 51 blocks. Active companies included Origem Energia in the Sergipe-Alagoas and Tuscano Sull basins, Petro-Victory Energy in the Potiguar basin, and 3R Petroleum, also in the Potiguar basin.

PETROBRAS STRATEGY

Petrobras said its crude oil production during the third quarter of 2022 fell 6.8%, compared to the same period last year. The company pumped 2.115 MMbpd in the July-to-September period. With natural gas, production averaged 2.644 MMboed, down 6.6% from the same quarter last year.

The company attributes the decline to lower production from Atapu and Sepia fields, an operation halt at the FPSO Capixaba unit, and declining production from mature fields. Still, pre-salt production was relatively stable. It made up about 73% of the company’s production, compared to roughly 71% in the same quarter last year.

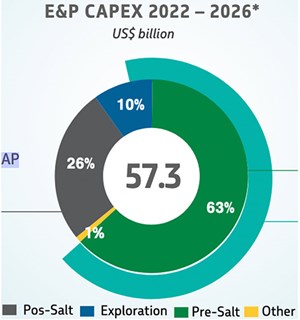

Under its current strategy, Petrobras intends to add 20 Bboe to its production over the next decade, just short of the 23 Bboe produced over the past 68 years. To get there, Petrobras has laid out a $68 billion 2022-2026 CAPEX plan that commits $57.3 billion to a continued focus on deep and ultra-deep waters.

In the plan, pre-salt expenditures make up 67% of spending, with about 26% going to post salt, Fig. 2. Those dollars target 10 pre-salt fields and five post-salt fields, Table 1. The $5.5 billion exploratory portion is directed largely to the Southeast basins (58%) over the Equatorial Margin (38%) on the northeast coast, Fig. 3.

The strategy relies on several key initiatives, starting with portfolio management and value generation intended to reach production targets faster. Its emphasis is on Búzios field, home to eight of the company’s 10 most productive wells, and where Petrobras expects to get 33% of its oil production by 2026.

Also key is maximizing long-term production, particularly in Tupi field. Its position as the biggest field in ultra-deep waters will be reinforced by efforts to enhance deployed systems, as well as build new production projects. The field has produced 2.6 Bboe since 2009 and is currently at about 800,000 boed.

The Campos basin is also a strategic focus. Petrobras plans to deploy three new FPSOs, drill more than 100 new wells, and revamp pipeline/fiber optics logistics. Of an expected production of 900,000 boed by 2026, 600,000 boed will come from new projects.

In addition, plans call for 15 new FPSOs in six fields between 2023 and 2026. Six vessels will go to Buzios and four to Mero, with others deployed in Itapu, Marlim, IPB 1, and SEAP 1.

Petrobras describes “value generation” in a typical pre-salt project as a process of introducing more complex FPSOs while reducing the cost of subsea systems and well construction. Consequently, about 59% of the 2022-2026 budget goes to increasing FPSO production capacity, CO2 separation and reinjection, and operational efficiency. In the other column, the average cost per well for subsea systems is projected to fall 9%, while average construction costs per well are being reduced 5% from the 2021-2025 strategic plan.

This plays out in Buzios, where the 2021 installed capacity of 600,000 bpd will grow to 1.7 MMbpd in 2026. Plans call for a new-generation FPSO with processing capacity of 180,000 to 225,000 bpd. Additions also include 8-in. ridged lines for greater production and injection, and a new riser system configuration. Improved productivity is also expected from alternating water and gas injection, and intensive use of openhole intelligent completions.

The value generation process is also seen in Mero field, which will be the first field to install subsea high-pressure separation system (HISEP) technology. And it is seen in the ultra-deepwater Sergipe development, where first oil from SEAP 1 in 2026 will be followed by a common pipeline to join it with SEAP II.

PETROBRAS SNAPSHOT

Petrobras E&P activities include a broad scope of operations, as well as partnering and divestments. What follows is a snapshot of a few points of interest.

Petrobras sold its 100% stake in the post-salt deep waters of the Espírito Santo basin, to BW Energy Maromba do Brasil Ltda (BWE). The $75 million deal involved the Golfinho Cluster and Camarupim Cluster concession groups.

The Mero-1 project last April began production through the FPSO Guanabar, the pre-salt Mero field’s first definitive production system. Its deployment was delayed from 2021, due to the COVID pandemic.

The FPSO Guanabara (known as Mero-1 while under construction) has an installed capacity of 12 MMcmgd and 180,000 bopd. It initially has six producing wells and seven injector wells connected to the field.

Mero field is part of the Libra Production Sharing Contract (PSC), signed in December 2013. It was discovered in 2017 and unitized in 2018. The PSC consists of Petrobras (38.6%) Shell (19.3%), Total (19.3%), Chinese companies CNPC (9.65%) and CNOOC (9.65%), and Pré-Sal Petróleo S.A-PPSA (3.5%), representing the Federal Union in the non-contracted area.

Mero field is divided into four development areas, with Mero-2 start-up planned for 2023, followed by Mero-3 in 2024, and Mero-4 in 2025. Plans call for the field to receive three more FPSOs between 2023 and 2025.

A Petrobras pre-salt oil discovery in the southern portion of the Campos basin (1-BRSA-1383A-RJS) is credited in part to new real-time data processing technology and enhanced decision-making.

Petrobras sold China National Offshore Oil Corporation (CNOCC) an additional 5% stake in a production-sharing contract for Buzios field. The November agreement cost $1.9 billion and leaves Petrobras with an 85% interest, CNOCC Petroleum Brazil Ltda (CPBL) with 10%, and Brasil Petróleo e Gás Ltda (CNODC) with 5%. Petrobras has 90% of Buzios’ exploration and production rights. Petrobras also sold its interest in the Campos basin’s Albacora Leste field to a subsidiary of Petro Rio.

In August, Petrobras signed a contract with Keppel Shipyard for construction of its P80 platform, which will be the ninth unit installed in Buzios field. The FPSO has the capacity for 225,000 bopd and 12 million m3/d of gas. It can store more than 1.6 MMbbl. The project plans 14 wells—seven oil producers and seven injectors.

The new-generation FPSO is characterized by high production capacity and technologies to reduce CO2 emissions, such as closed flare technology and a methane gas detection system. The platform will also be equipped with the CO2 Capture, Use, and Geological Storage (CCUS) technology.

Onshore, Petrobras sold its 100% interest in the Potiguar basin’s Fazenda Belém and Icapuí fields (the Fazenda Belém Cluster) to 3R Fazenda Belém S.A. The assets in the state of Ceara averaged about 575 bopd from January to July 2022. The buyer specializes in redevelopment of mature and producing fields.

Petrobras awarded Diamond Offshore’s Ocean Courage semi-submersible a four-year project with an option for four more, Fig. 4. The $429 million contract is expected to begin late in fourth-quarter 2023 after conclusion of the rig’s current contract and new contract preparation, said Diamond Offshore.

OPERATOR NOTES

Shell. In Atapu field, Shell increased its holding with the acquisition of a 25% stake from Petrobras. The $ 1.1 billion production sharing contract announced April 27 adds to interests acquired in a December 2021 Transfer of Rights auction, along with partners Petrobras (52.5%, operator) and TotalEnergies (22.5%).

The Atapu pre-salt oil field in the Santos basin sits in water depths of about 2,000 m. Production started in 2020 through the P-70 Floating, Production, Storage and Offloading unit (FPSO), which has the capacity to produce 150,000 boed.

Equinor. The Phase 2 Peregrino C platform produced first oil in October. Expected to increase field production to 110,000 bopd, the project consists of a new platform with drilling facilities and living quarters tied into the existing Peregrino FPSO.

A new pipeline importing gas to the platform will support a change from diesel to gas power generation, a move expected to halve CO2 emissions.

Located in the Campos basin, Peregrino field started production in 2011. Equinor is the operator (60%), with Sinochem (40%) as partner in the field. Peregrino Phase 1 consists of an FPSO supported by two wellhead platforms: Peregrino A and Peregrino B.

In the pre-salt Balcalhau, Santos Basin, Equinor awarded the Valaris DS-17 drillship a 540-day drilling contract, scheduled to start in 2023. It will be tasked with drilling an appraisal well, plugging an old exploration well and conducting additional drilling scope. Drilling services and other additional services, such as remotely operated vehicles (ROVs), managed pressure drilling (MPD), casing running, slop treatment and cuttings handling are included in the contract. A fuel reduction incentive has also been agreed on.

“The second rig in Bacalhau will expand our drilling capacity in Brazil and will further enhance our understanding of Bacalhau North through an ADR (Reservoir Data Acquisition) well. The decision to bring in DS-17 demonstrates our commitment to create value in Brazil, where we have a long-term presence perspective,” said Equinor country manager in Brazil, Veronica Rezende Coelho.

Lead photo: The Valaris DS-17 drillship will work for Equinor in the Santos basin. Source Equinor.

- What's new in production (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- Dallas Fed: E&P activity essentially unchanged; optimism wanes as uncertainty jumps (January 2024)

- Enhancing preparedness: The critical role of well control system surveys (December 2023)