Industry at a Glance

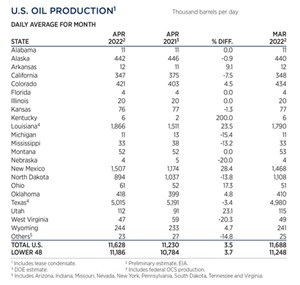

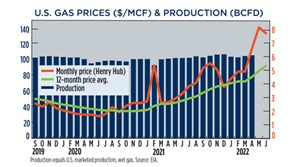

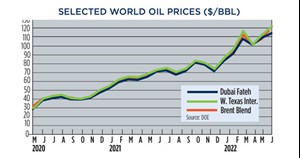

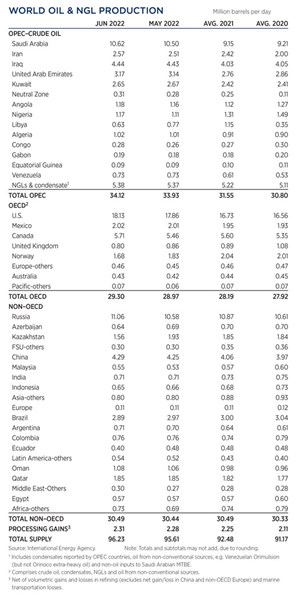

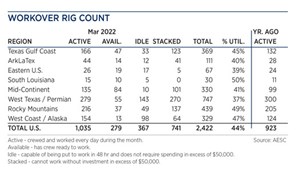

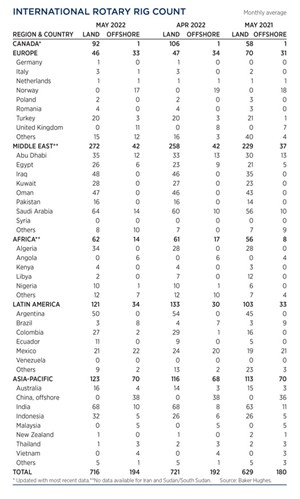

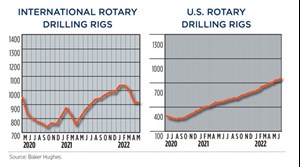

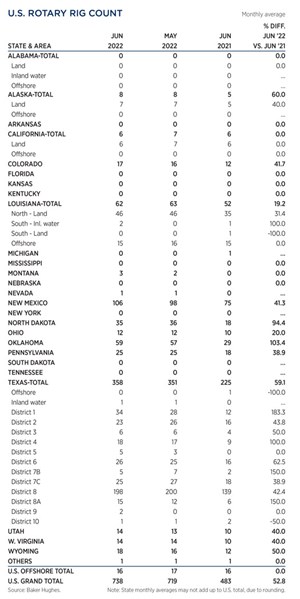

Despite rising interest rates and fear of economic recession, crude prices climbed in July, as the war in Ukraine continued to restrict Russian supply. WTI surged 4.8%, hitting $114.84/bbl, with Brent trading at $122.71/bbl, up 8.3% compared to May. Higher commodity prices have caused U.S. operators to cautiously increase drilling activity, but high debt and a lack of bank financing have slowed a more vigorous upturn. However, the U.S. rig count continued its upward trajectory, averaging 738 units in July, up 2.6% from the 719 tallied in May. New Mexico gained eight rigs to average 106, with Texas adding seven rigs, up to 358. International activity averaged 910 rigs in May, just three fewer than in April, as additions in the Middle East (+14) and Asia (+9) offset a 14-unit decline in Canada due to spring thaw.

- From impossible to inevitable: Superhot rock geothermal to unlock gigawatts of energy (January)

- Halliburton’s ZEUS IQ™ powers the first fully autonomous fracturing platform with closed-loop automation (January)

- Making shale competitive (December 2025)

- Energy services: The relentless backbone of global energy security (December 2025)

- How space tech can help autonomous oil rigs become a reality (December 2025)

- Coiled tubing drilling: A strategic enabler for mature field redevelopment (December 2025)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)