Guyana-Suriname basin: Rise from obscurity to super potential

Recent discoveries in the Guyana-Suriname basin attest to estimates of 10+ Bbbl of oil resources and more than 30 Tcf of gas.1 Like many oil & gas successes, this is a story that begins with early exploration success onshore, followed by a long period of exploration disappointment in coastal to shelf regions offshore, eventually culminating in deepwater success.

Ultimate success is a testament to the Guyana and Suriname governments and their oil agencies’ perseverance and usage of international oil companies’ exploration success in the African Transform Margin to the conjugate South American Transform Margin. Successful wells in the Guyana-Suriname basin are due to a combination of factors, most of which are technology-related.

In the following five years, this area will be at the top of oil and gas, while current discoveries became appraisal/development areas; and several exploration crews are still looking to hit a discovery.

THE EARLY EXPLORATION

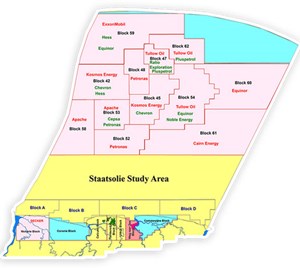

Onshore exploration. In both Suriname and Guyana, oil seeps were known from the 1800s, into the 1900s. Exploration in Suriname discovered oil at a 160 m depth while drilling for water in a schoolyard in Calcutta Village.2 The onshore Tambaredjo oil field (15-17 oAPI oil) was discovered in 1968. First oil began in 1982. Satellite oil fields to Calcutta and Tambaredjo were added. These fields had an original STOOIP of 1 Bbbl of oil. Currently, these fields are producing around 16,000 bopd.2 Staatsolie’s crude is processed at Tout Lui Faut refinery, at 15,000 bpd, to produce diesel, gasoline, fuel oil, and bitumen.

Guyana did not have the same onshore success; since 1916, 13 wells have been drilled, but only two wells have shown oil.3 Onshore oil exploration in the 1940s produced geological studies in Takatu basin. Three wells were drilled between 1981 and 1993, all either dry or non-commercial. These wells confirmed the presence of thick black shale, Cenomanian-Turonian age (known as Canje Fm), equivalent to the La Luna formation in Venezuela.

Venezuela has a thriving oil exploration and production history.4 Drilling success dates back to 1908, first in the western part of the country with the Zumbaque 1 well,5 with production in Lake Maracaibo rising during WWI and into the 1920s and 1930s. Of course, the tar sands in the Orinoco Belt, discovered in 1936,6 have significantly impacted the oil reserves and resources, contributing to the 78 Bbbl of oil reserves; this reservoir gives Venezuela the current first position on reserves. La Luna formation (Cenomanian-Turonian) is a world-class source rock for much of this oil. La Luna7 is responsible for most of the oil found and produced from the Maracaibo basin and several others in Colombia, Ecuador and Peru. The source rock found offshore Guyana and Suriname has similar characteristics to those found in La Luna, and is the same age.

Offshore Guyana oil exploration: Shelf region. Exploration on the continental shelf began in earnest in 1967,7 with the Guyana Offshore-1 and -2 wells. A 15-year gap ensued until the Arapaima-1 was drilled, followed by Horseshoe-1 in 2000 and the 2012 wells, Eagle-1 and Jaguar-1. Six of these nine wells had either oil or gas shows; only the Abary-1, drilled in 1975, flowed oil (37 oAPI). Although the lack of any economic discovery was disappointing, these wells were very important, because they confirmed a functioning petroleum system was generating oil.

Offshore Suriname oil exploration: Shelf region. The story of exploration on the continental shelf in Suriname mirrors that of Guyana. Nine wells were drilled through 2011, three of which had oil shows; the others were dry. Again, the lack of economic discoveries was disappointing, but these wells confirmed a functioning petroleum system was generating oil.

ODP Leg 207 drilled five sites in 2003 on the Demerara Rise, which separates the Guyana-Suriname basin from offshore French Guiana. Very importantly, all five wells encountered the same Cenomanian-Turonian Canje Fm source rock found in Guyana and Suriname wells, which was a confirmation of the presence of a source rock as La Luna.

APPLYING AFRICAN DEEPWATER PLAY CONCEPTS

Successful exploration of the African Transform Margin began with the 2007 Tullow Oil discovery of Jubilee field in Ghana. Success was followed in 2009 by the discovery of the TEN complex, west of Jubilee. These successes spurred equatorial African countries to offer deepwater licenses, which oil companies gobbled up, prompting exploration from Cote d’Ivoire to Liberia to Sierra Leone. Unfortunately, drilling for these same types of plays was woefully unsuccessful in finding economic accumulations. In general, the further west one went from Ghana along the African Transform Margin, the more that the success rate declined.

Like much of the West African success offshore Angola, Cabinda and northward, these deepwater Ghanaian successes confirmed a similar play concept. That play concept had a foundation based on a world-class mature source rock with an associated migration pathway system. Reservoirs were predominantly slope-channel sands, known as turbidites. Trapping style is referred to as stratigraphic traps, relying on solid top and lateral seals (shales). Structural traps are rare. Oil companies discovered early on, by drilling dry holes, that they needed to discriminate the seismic response of hydrocarbon-bearing sands from wet sands. Each oil company keeps its technological expertise concerning how they apply this technology as confidential. Each subsequent well is used to tweak this methodology. Once proven, this methodology significantly reduces the risk associated with drilling appraisal and development wells and new prospects.

Geologists often refer to the term “trendology.” It is a simple concept that allows geologists to transport their exploration thinking from one basin to another. In this case, many of the same international oil companies that had proved successful in West Africa and along the African Transform Margin were determined to apply those concepts to the South American Equatorial Margin (SAEM). As a result, companies licensed deepwater offshore blocks in Guyana, Suriname and French Guiana by early 2010.

Tullow Oil was the first company to find significant hydrocarbons in the SAEM by drilling the Zaedyus-1 discovery in a 2,000 m water depth, offshore French Guiana in September 2011. Tullow Oil announced that the well found 72 m of net oil pay in two turbidite fans. Three appraisal wells would encounter thick sands but no commercial hydrocarbons.

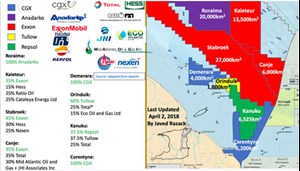

Guyana success. ExxonMobil/Hess et al. announced in May 2015 the now-famous Liza-1 discovery well in Stabroek license, offshore Guyana (Liza-1 well12). Upper Cretaceous turbidite sands are the reservoir. The follow-up Skipjack-1 well, drilled in 2016, found no commercial hydrocarbons. Through 2020, the Stabroek partners have announced a total of 18 discoveries, amounting to a gross recoverable resource over 8 Bbbl of oil (corporate ExxonMobil)! The Stabroek partners solved the concerns about the seismic response to hydrocarbon-bearing versus water-bearing reservoirs (Hess Investor, 2018 Investor Day8). A deeper Albian age source rock has been confirmed in some wells.

Interestingly, ExxonMobil and partners found oil in a carbonate reservoir in the Ranger-1 well, announced in 2018. Evidence suggests that this is a carbonate bank that accumulated atop a subsiding volcano.

The Haimara-18 discovery, announced in February 2019 as a gas condensate discovery in 63 m of high-quality reservoir. Haimara-1 sits adjacent to the border between Stabroek, Guyana, and Block 58, Suriname.

Tullow and partners (Orinduik license) found two discoveries inboard of the slope channel discoveries in Stabroek:

- Jethro-1 found 55 m of net oil in Lower Tertiary high-quality sands (August 2019)

- Joe-1 found 14 m of high-quality oil pay in Upper Tertiary sands (September 2019).

Both discoveries reported having found heavy oil (10-15oAPI) with high sulfur content.

ExxonMobil and partners (Kaieteur Block) announced on Nov. 17, 2020, that the Tanager-1 well was a discovery, but it was deemed non-commercial. This well found 16 m of net oil pay in high-quality Maastrichtian sands, but a fluid analysis indicated heavier oils than in the Liza development. High-quality reservoirs are found at deeper Santonian and Turonian levels. Data are still in evaluation.

Offshore Suriname, three deepwater exploration wells drilled during 2015 through 2017 were dry holes. Apache drilled two dry holes in Block 53 (Popokai-1 and Kolibrie-1), and Petronas drilled the Roselle-1 dry hole in Block 52, Fig. 2.

Offshore Suriname, Tullow announced in October 2017 that the Araku-1 well encountered no significant reservoir rocks but proved presence of gas condensate.11 The well was drilled on a prominent seismic amplitude anomaly. This well result clearly indicates the risk/uncertainties surrounding amplitude anomalies and illustrates the need for data from wells, including core data, to solve the seismic resolution issue.

Kosmos in 201816 drilled two dry holes in Block 45 (Anapai-1 and Anapai-1A), plus the Pontoenoe-1 dry hole in Block 42.

Obviously, by early 2019, the outlook in deepwater Suriname was bleak. But that was about to change significantly for the better!

Early January 2020, in Suriname Block 58, Apache/Total17 announced an oil discovery on the Maka-1 exploration well, which spudded in late 2019. Maka-1 was the first of four consecutive discoveries that Apache/Total would announce in 2020 (Apache Investor). Each well encountered stacked Campanian and Santonian reservoirs, with separate oil and gas condensate reservoirs. Reservoir quality, according to the reports, is very good. Total became operator in Block 58 in 2021. An appraisal well is being drilled.

Petronas18 announced an oil discovery with Sloanea-1 well on Dec. 11, 2020. Oil was encountered in several Campanian sands. Block 52 is on-trend and east of Apache’s discoveries in Block 58.

TRANSITIONING FROM DISCOVERY TO APPRAISAL AND DEVELOPMENT

There will be a number of prospects to watch in the region, as exploration and appraisal continue in 2021.

Guyana wells to watch in 2021. ExxonMobil and partners (Canje Block)19 just announced on March 3, 2021, that the Bulletwood-1 well was a dry hole, but results indicated a functioning petroleum system in the block. Followup-wells in the Canje Block were tentatively scheduled for first-quarter 2021 (Jabillo-1) and second-quarter 2021 (Sapote-1).20

ExxonMobil and partners in the Stabroek Block are scheduled to spud the Krobia-1 well, 16 mi northeast of Liza field. Later, the Redtail-1 well will spud 12 mi east of Liza field.

In the Corentyne Block (CGX et al.), a well may be spudded to test the Santonian Kawa prospect in 2021. This is Santonian amplitude play on-trend with similar age discoveries in Stabroek and Suriname Block 58. The deadline to drill this well was extended to Nov. 21, 2021.

Suriname wells to watch in 2021. Tullow Oil spudded the GVN-1 well in Block 47 on Jan. 24, 2021. This well is targeting dual targets in Upper Cretaceous turbidites. Tullow updated the situation on March 18, saying the well reached TD and encountered a good-quality reservoir, but minor oil shows. It will be interesting to see how this good result impacts future wells NNE from the Apache and Petronas discoveries into Blocks 42, 53, 48 and 59.

In early February, Total/Apache spudded an appraisal well in Block 58, apparently up-dip from one of the discoveries in that block. Subsequently, the Bonboni-1 exploration well may spud this year, located in the far north of Block 58. It will be interesting to see in the future if the Walker carbonate play in Block 42, similar to Ranger-1 discovery in Stabroek, will be tested.

ExxonMobil and partners may drill a well in Block 59 during 2021.

Suriname licensing round. Staatsolie announced a 2020-2021 licensing round for eight licenses stretching from the shoreline toward the Apache/Total Block 58. Virtual Data rooms opened on Nov. 30, 2020. Bids were due April 30, 2021.

Stabroek development plans. ExxonMobil and Hess have published details of their field development plans, which can be found in various locations, but the Hess Dec. 2018 Investor Day8 is a good place to start. Liza is being developed in three phases, with first oil occurring in 2020, five years from discovery, Fig. 3. An FPSO tied to subsea development is one example of their attempt to reduce costs, to obtain early production at a low Brent break-even price.

ExxonMobil announced that it plans to submit plans for the fourth significant development in Stabroek by the end of 2021.

Challenges. Just over a year after the historical negative oil price, the industry has recovered with a WTI price above $65, and the Guyana-Suriname basin has become the most exciting development in the 2020s. The area is already on record with discovery wells. It represents more than 75% of the last decade’s discovered oil and at least 50% of the discovered gas in clastic stratigraphic traps, according to Westwood.21

The biggest challenges are not on reservoir properties, as both rock and fluids seem to have the desired quality. It’s not the technology, because deepwater technology has been developed since the 1980s. It would most likely be to take the opportunity to implement industry best practices, from the start, on offshore production. This would allow government agencies and the private sector to develop regulations and policies to enable an environmentally-friendly framework, and make possible both countries’ economic and social growth.

One way or another, the industry will keep an eye on Guyana-Suriname this year and in the next five years, at least. There will be plenty of opportunities to engage in activities and events, where government, investors, and E&P companies can meet, Covid permitting in some cases. These include:

- Guyana Basin Summit 2021 (GBS2021)- it happened last month virtually, and is set for 27-29 Oct. 27-29, 2021, in person

- Suriname International Petroleum & Gas Summit and Exhibition 2021 (SIPEX 2021), set for June 1-3, 2021

- 3rd Annual Guyana International Petroleum Business Summit & Exhibition (GIPEX 2021), set for June 28-30, 2021. The meeting will be held virtually

- 2nd Guyana Oil & Gas Summit and Exhibition, partnering with the Guyana Oil & Gas Energy Chamber (GOGEC) – set for Oct. 6-7, 2021, the meeting will be in person

- Caribbean Oil & Gas Summit. Set for Nov. 17-19, 2021, in Georgetown, Guyana, this will be a virtual summit.

ABOUT ENDEAVOR

Endeavor Management is a management consulting firm that collaborates with clients to achieve real value from their strategic transformational initiatives. Endeavor serves as a catalyst by providing the energy to maintain the dual perspective of running the business while changing the business through the application of key leadership principles and business strategy.

The firm’s 50-year heritage has produced a substantial portfolio of proven methodologies, enabling Endeavor advisors to deliver top-tier Transformational Strategies, Operational Excellence, Leadership Development, Advisory Technical Support, and Decision Support. Endeavor advisors have deep operational insight and broad industry experience which enable our team to understand client companies and markets’ dynamics quickly.

REFERENCES

- OilNow, “Guyana-Suriname basin stratigraphic traps delivering multi-billion barrel pay,” Westwood, April 28,2020: https://oilnow.gy/featured/guyana-suriname-basin-stratigraphic-traps-delivering multi-billion-barrel-pay-westwood/

- Staatsolie website: https://www.staatsolie.com/

- Website, Guyana Geology and Mines Commission: https://ggmc.gov.gy/services/all/petroleum

- La Nacion Petrolera – Tomas Straka: https://www.unimet.edu.ve/unimetsite/wp-content/uploads/2013/02/La-Nacion-Petrolera-Venezuela-1914-2014.pdf

- Website: https://es.wikipedia.org/wiki/Zumaque_I

- Article: https://globovision.com/article/especiales-descubrimiento-de-la-faja-petrolifera-del-orinoco

- Article: http://petroleumag.com/pues-si-senor-el-petroleo-viene-de-la-luna/

- Hess Investor Day: https://investors.hess.com/events/event-details/hess-investor-day-2018

- Staatsolie licensing round: https://www.staatsolie.com/media/svcnl01y/staatsolie-sho-license-round-synopsis.pdf#

- Moonan, X., and J. Razack, “From deep horizon to deep water, a northeastern Latin America success story, for some,” AAPG Search and Discovery, Article #30669, 2020.

- Tullow, 2019:. https://www.tullowoil.com/media/press-releases/araku-1-well-update/

- Liza-1 well: https://www.ogj.com/general-interest/companies/article/17246698/exxonmobils-liza1-well-encounters-oil-offshore-guyana

- Corporate ExxonMobil: https://corporate.exxonmobil.com/Locations/Guyana/Guyana-project-overview#DiscoveriesintheStabroekBlock

- Apache: https://investor.apacorp.com/static-files/44b70d2e-d8fa-4275-a249-ae18d629a673

- Wong, T. and L. Geuns, “The discovery of a major hydrocarbon occurrence in the Guiana Basin, offshore Suriname: a blessing or a curse?” 1-6, 2019: https://www.researchgate.net/publication/341029358_The_discovery_of_a_major_hydrocarbon_occurrence_in_the_Guiana_Basin_offshore_Suriname_a_blessing_or_a_curse

- Kosmos, 2018: https://investors.kosmosenergy.com/news-releases/news-release-details/kosmos-energy-provides-suriname-activity-update

- Total: https://www.total.com/media/news/press-releases/suriname-total-and-apache make-significant-discovery-block-58

- Petronas: https://www.petronas.com/media/press-release/petronas makes-hydrocarbon-discovery-block-52-offshore-suriname

- Article: https://www.msn.com/en-us/money/markets/exxon-xom-finds-no-oil-at-bulletwood-1-well-in-offshore-guyana/ar-BB1epzdq

- Article: https://www.oedigital.com/news/485863-exxonmobil-set-to-spud-another-well-at-guyana-s-canje-block

- Article: https://oilnow.gy/featured/guyana-suriname-basin-stratigraphic-traps-delivering multi-billion-barrel-pay-westwood/

- Rugged, explosion-proof computers safeguard offshore rigs (January)

- Drilling advances: Bottlenecks? What bottlenecks? (January)

- The evolution of remote-controlled FPSOs (January)

- What's new in production: Welcome diversion? (December 2025)

- Flexibility and modularity enable tailored solutions for challenging shale plays (December 2025)

- Keeping the Gulf of America as our energy anchor (December 2025)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)