Shaletech: Permian Basin Shales

Amid the global oil price contagion, the late February abandonment of a once-ballyhooed resource play in far West Texas is but an unfortunate sidebar to the grinding headaches pounding the Permian basin.

The $3-billion write down of Alpine High is a stark reversal from the late-2016 christening of what Apache Corp. described as one of the largest onshore discoveries in the U.S. Located in a relatively undeveloped swath of the Permian’s southern Delaware sub-basin, Alpine High was estimated to contain 75 Tcf of rich gas and 3 Bbbl of oil.

“Our most significant challenges were associated with Alpine High,” said President and CEO John Christmann on Feb. 27, upon pulling the plug on the Reeves County, Texas, play and telling analysts that it would “receive minimal to no funding” this year.

Apache’s decision came days before the abrupt dismantling of a Saudi Arabia and Russia alliance to prop up prices, which quickly flooded an already saturated market. By March 18, the West Texas Intermediate (WTI) futures oil price had cratered to $20.37/bbl, with the double whammy of inflated production and deflated demand, aggravated by the worldwide Covid-19 pandemic, threatening to further deepen the price rout and, for many, made survival the chief corporate priority.

With ExxonMobil setting the tone, investor-pressured Permian players, for the most part, had already braced for a challenging year by reducing spending and slowing production growth. As evidence, the Texas Railroad Commission (RRC), the state’s chief regulator, had issued 1,703 horizontal drilling permits for Permian-applicable Districts 08, 8A and 7C, as of March 12, down from 1,752 authorizations between Jan. 1 and March 12, 2018. However, the last pie chart had barely been dissected in the latest earnings season before the spat on the other side of the world sent prices plunging. The response was swift.

After previously cutting 2020 expenditures, Occidental Petroleum Corp. and Marathon Oil Corp. stepped up quickly on March 11, re-slicing their already reduced capital expenditures by more than $1 billion and $500 million, respectively. Soon afterward, nearly every Permian operator followed suit, rendering earlier guidance on 2020 activity irrelevant.

In short order, the spending cuts were reflected in drilling activity, with operators laying down 64 rigs in March closing with a three-year low of 351active rigs on April 3, according to Baker Hughes.

RESTRICTIVE GROWTH

Just as the nearly 50-year-old proration law to limit production/lease, the U.S. Energy Information Administration (EIA) estimated that oil production from the Permian region would hit 4.792 MMbpd in April (Fig. 1), compared to 4.177 MMbpd in March 2019. Owing to an expanding in-basin processing and take-away infrastructure, associated gas production is predicted to increase year-over-year to 17,171 MMcfd, from 14,075 MMcfd. This comes as operators face intense pressure to reduce flaring, even as gas prices show no sign of reaching tolerable levels anytime soon. “I think it’s important to remove that black eye on the Permian basin going forward,” Pioneer Natural Resources Co. President and CEO Scott Sheffield said of the widely excoriated flaring rates.

Entering 2020, Parsley Energy Inc. President and CEO Matt Gallagher had high hopes that this would be the year shale operators would finally begin to appease disgruntled investors. “I think 2019 was the inflection year. We saw these glimmers of hope that the shale leaders can print free cash flow. And 2020 is going to see free cash flow in spades,” he told Bloomberg on Jan. 10, upon closing the $2.7-billion all-stock acquisition of Jagged Peak Energy.

Toward that end, some operators are re-directing activity from the higher-cost and more restrictive Delaware basin of New Mexico, much of which lays

beneath publicly owned land, to the Texas portion of the Delaware and low-cost Midland basins. While saying his company remains “very, very high” on its New Mexico asset, Cimarex Energy Co. President and CEO Thomas Jorden conceded, “New Mexico has some unique issues that Texas doesn’t. We’re generally on state and federal leases. Our permit time can be long. We have environmental constraints with some species protection.”

Among the majors, ExxonMobil stood out by reining-in production growth, while insisting it remains on track to produce more than 1 MMboed from the Permian by 2024. After increasing 2019 production to 272,000 boed—an 80% jump over 2018—the company said in March that production could drop by about 10% over the next two years.

ExxonMobil’s onshore subsidiary, XTO Energy Inc., operated up to 58 rigs in 2019, but will lay down more than 20% of Permian-directed rigs this year. According to RRC data, XTO was issued 138 horizontal drilling permits between Jan. 1 and March 9, compared to the 183 authorizations for the same 2019 timeframe.

ExxonMobil went on a multi-billion-dollar spending spree three years ago, snatching up 227,000 net acres in New Mexico and doubling its two-state Permian leasehold. “We are still in the relatively early days of this development, particularly in the Delaware basin,” Chairman and CEO Darren W. Woods said in a Jan. 31 earnings call.

Chevron Corp., likewise, intends to produce more than 1 MMboed from the Permian within the next four years, and was holding firm on ramping up production to reportedly around 600,000 boed. Chevron controls a legacy leasehold of 2.2 million net acres, including 1.7 million unconventional net acres in the Midland and Delaware basins. As of March 9, RRC statistics show the company being issued only 43 horizontal drilling permits this year.

The infrastructure improvements over the past year apparently were enough to convince BP plc to begin developing its 83,000-net-acre position in the Delaware basin acquired two years ago in the $10.5-billion deal for BHP Billiton’s three U.S. shale plays. “We’ve ramped up in the Eagle Ford and Permian as more takeaway capacity comes through,” CFO Brian Gilvary said in a Feb. 4 conference call.

No specifics were made available, but BP’s onshore entity, BPX Energy, was issued 36 horizontal drilling permits between Jan. 1 and March 9, after receiving no authorizations last year, according to RRC data.

After lifting oil production to around 250,000 bpd to close out 2019, Shell, so far, has given no indication of a pullback in the Permian, despite the economic challenges of shale. “If I look at shales, we did not achieve the level of cash flows that we expected for 2019,” CEO Ben van Beurden said on Jan. 30. “However, despite the weaker gas macro, which of course hit the business quite severely, we are progressing with our organic free cash flow delivery, as we continue to ramp up production in the Permian.”

While emphasizing Shell is “still growing in the Permian,” van Beurden quashed reports the company is presently on the hunt for acquisitions to expand its estimated 260,000-net-acre footprint. “I think at this point in time, of course, with the framework where it is, I think anything inorganic would not be the right thing to do,” he said. According to RRC data, Shell was awarded only 16 horizontal permits up to March 9, compared to 147 for all of 2019.

Among the independents, Occidental had expected to operate 15 gross (9-10 net) rigs and hook 270 to 295 wells to the sales line in its commanding 3.1-million-acre unconventional and conventional leasehold. First-quarter production is projected at 457,000 to 465,000 boed, closing out the year at guided production between 465,000 and 475,000 boed.

Along with the Texas Delaware basin acreage acquired in the Anadarko deal last year, Oxy also is integrating the recently closed joint venture with Colombia’s Ecopetrol S.A. that covers 97,000 net acres in the Midland basin. It marks Ecopetrol’s first U.S. shale venture. The partnership had set a 50-well production well target this year.

HANGING IT UP

Apache, meanwhile, cited a host of circumstances that combined in its decision to walk away from Alpine High, not the least of which were the unanticipated low natural gas liquids (NGL) prices and discouraging well performance. “In the second half of 2019, extended flow data from key spacing and landing zone tests indicated disappointing performance of our multi-well development pads. While these tests are not fully conclusive for the entirety of Alpine High, given the prevailing price environment, further testing is not warranted at this time,” CEO Christmann said.

After putting 24 Alpine High wells online in the fourth quarter, Apache laid down the one remaining rig at year end (Fig. 3), later saying all rigs in the Permian would be laid down.

Outside of the now-shuttled play, Apache had averaged seven rigs and two frac crews in the Midland and Delaware basins in the fourth quarter. Apache drilled and completed 54 net (56 gross) wells in the fourth quarter, with some 60% of the company’s 2020 gross completions planned for the Southern Midland basin.

WOLFCAMP GETS LOVE

As the operators still working look to recover more with less, activity is intensifying on the multi-bench and high-margin Wolfcamp formation. The Wolfcamp underlies the Upper and Lower Sprayberry in the weathered Midland basin, where it has been assessed as holding roughly 30 Bboe of recoverable reserves. In the Delaware basin, the Wolcamp underlies the three-bench Bone Springs, which, according to the U.S. Geological Survey (USGS), together contain at least 46.3 Bbbl of oil and an estimated 281 Tcf of dry gas and 20 Bbbl of NGLs.

Devon Energy Corp. said nearly 65% of the projected 130 new drills in the Delaware basin this year will target the Wolfcamp, said Executive V.P. of E&P David Harris.

Fourth-quarter net production averaged 154,000 boed, up a staggering 82% over the same year-ago quarter. The growth was driven largely by 36 new wells exploiting the Wolfcamp, Bone Springs and overlying Leonard shales, with initial 30-day production (IP30) rates averaging 2,800 boed, at a mean completed cost of $7.5 million/well.

Devon controls more than 250,000 net acres of stacked pay in the Delaware basin where, as of Feb. 19, the company was running eight active rigs and two frac spreads.

Five months removed from christening the Wolfcamp M bench and the Third Bone Spring its latest premium plays, EOG earlier established an aggressive 2020 program that called for 18 active rigs and seven completion crews with around 350 net completions. The company’s uncompromising premium drilling strategy mandates every well must earn at least a 30% return at a $40/bbl oil price. EOG controls 389,000 net acres in the Delaware basin, which produced 174,000 bopd last year.

As the second quarter unfolded, Centennial Resource Development Inc. went from five to four rigs, with all but one targeting the Upper Wolfcamp A and overlying Third Bone Spring Sand pay zones in the Reeves County, Texas, portion of the company’s 80,100-net-acre Delaware basin leasehold.

Centennial V.P. and COO Sean R. Smith pointed to a two-well pad to justify joint development of the two diverse intervals. Completed with 6,200-ft laterals in a stacked-staggered pattern, the pad averaged IP30 rates of 1,800 boed. Centennial completed 10 Bone Spring wells last year, most of which were paired with the Wolfcamp Upper A horizon.

Centennial reduced its FY 2020 capital budget by 28%, but plans to grow production around 3% this year.

Mimicking 2019, Noble Energy Inc. expects to drill and complete 50 to 60 Delaware basin wells in 2020, focusing primarily on Wolfcamp A development in the northern and central portions of a 94,000-net-acre position. The company planned to run two rigs and an equal number of frac crews in the first quarter. In the final three months of 2019, 13 wells were turned-in-line, all but one producing from the Wolfcamp A.

Despite a planned 20% year-over-year spending reduction, SM Energy Co. expects to increase Permian production by 10% this year, over the average 72,000 boed produced in 2019. As of Feb. 19, the company was operating five rigs and two completion crews on an 82,000-net-acre position in the Midland basin with activity largely centered on co-developing the Lower Spraberry and the Wolfcamp A and B benches.

Elsewhere in the Midland basin, the newly re-branded Ovintiv Inc. (formerly Encana Corp.) expects oil and condensate volumes to grow by 10% or more this year, after a 14% year-over-year production jump in 2019 to an average of 104,800 boed. Ovintiv was running five rigs in February on its 115,000-net-acre leasehold.

Last year, Marathon focused primarily on delineating the Red Hills asset in its 91,000-net-acre Northern Delaware leasehold in southeast New Mexico, where fourth quarter production averaged 28,000 boed, up 40% from the year prior. The company had planned to put 55 to 65 wells on line this year with up to 90% of activity concentrated on the Upper Wolfcamp and Bone Springs intervals.

DARKER SKIES AHEAD

Meanwhile, this time next year the night skies over West Texas promises to be a bit darker, as new pipeline networks and beefed up gas processing replace the flare stacks that have drawn intense scrutiny. Among those, the Kinder Morgan-led Permian Highway pipeline remains on track to begin service by the first quarter of 2021, transporting up to 2.1 Bcfd of associated gas from Pecos County east to the Gulf Coast.

“By looking at the rate of new flaring, the development of new wells, and the future completion of infrastructure, our projections are that flaring will drop by 50,000 to 150,000 Mcfd over the next 18 months as new infrastructure is completed,” outgoing RRC Commissioner Ryan Sitton concluded on Feb. 18 upon releasing the results of the first comprehensive analysis of flaring in Texas. The report followed an Environmental Defense Fund claim on Jan. 24, 2019, that satellite data showed Permian basin operators burning off 104 Bcf of gas in 2017, while reporting flared gas volume of 55 Bcf to the state regulator.

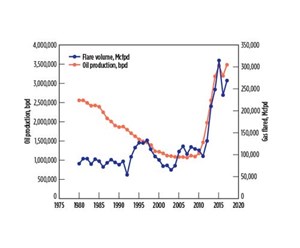

In his analysis, Sitton calculated the relationship between oil production and flaring up to 2017, and identified a “flaring intensity” metric (Fig. 4) to develop an effective benchmark to compare performance.

Pioneer ranked near the top of operators Sitton recognized as voluntarily reporting flaring below a suggested 0.10 Mcf/bbl benchmark volume. Pioneer pointed to gas processing and takeaway commitments as helping maintain a 2% maximum flaring intensity. “We think it’s important to set a percent target. Pioneer would like to be able to continue to produce below 2%,” says President and CEO Scott Sheffield.

Pioneer holds 680,000 net acres in the Midland basin, where it expects to place 345 to 375 wells on production, up from 306 new producers hooked up in 2019. Of those, 80% will produce from the Wolfcamp A and B benches, with first-quarter production forecasted to average between 361,000 to 376,000 boed.

Parsley Energy, the company Sheffield founded and formerly headed, faces a tall order in maintaining flared volumes to less than 3%, given that the newly acquired Jagged Peak Delaware basin assets averaged 2019 flaring rates of 20%. “This [flaring rate] has been front and center for our integration team, and prior to close and throughout our review of the Jagged Peak assets, we were able to identify several tactical and actionable paths to reducing their flared volumes,” said Senior V.P. of Corporate Development, Land and Midstream Stephanie Reed.

Parsley planned to place 180-190 wells on production, up from the 145 new producing wells in 2019. During the fourth quarter, the company drilled 38 and put 37 gross operated wells on production, all but four of which in the Midland basin.

Concho Resources Inc., for one, lays claim to only a 1.6% flaring rate, with pre-production takeaway planning and consistent surveillance of fugitive emissions credited for a 35% reduction since 2017.

The 2020 program includes the drilling and completion of around 300 to 320 gross wells, compared to 294 gross completions in 2019. Activity will be equally split between the Midland and Delaware positions in the nearly 860,000-gross-acre leasehold, even though Concho says well costs in the latter are around $100/ft higher on average, given the comparably deep depths and higher pressures.

Diamondback, like Parsley, ties employee compensation to flaring reduction, one of the quantitative and “not subject to discretion” metrics in the company’s Environmental, Social and Governance (ES&G) initiatives. “Flaring in the Permian basin is an issue that we as an industry have to address,” says CEO Travis Stice.

No flared values were made available for 2019, which saw total production climb to 283,000 boed from 222,000 boed in the year prior. Diamondback ran eight completion crews throughout the second half of 2019, and planned to complete 340 wells this year in a multi-zone development strategy encompassing seven core areas within a roughly 350,000-net-acre position traversing the Delaware and Midland basins.

- From impossible to inevitable: Superhot rock geothermal to unlock gigawatts of energy (January)

- Halliburton’s ZEUS IQ™ powers the first fully autonomous fracturing platform with closed-loop automation (January)

- Flexibility and modularity enable tailored solutions for challenging shale plays (December 2025)

- Making shale competitive (December 2025)

- Energy services: The relentless backbone of global energy security (December 2025)

- How space tech can help autonomous oil rigs become a reality (December 2025)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)