Newfoundland works to stay on track with projects

What a time to be an operator anywhere in the world, including those working offshore Newfoundland and Labrador (NL), Canada. The global Coronavirus pandemic has teamed up with extremely low oil prices to put a double- hit on oil-and-gas companies worldwide, including those firms operating out of St. John’s. Yet, the long-term nature of most of NL’s projects is helping to cushion the blow.

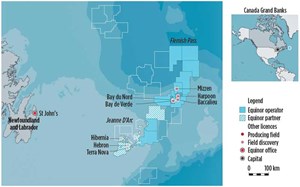

“The global pandemic, COVID-19, is changing the way we do business all around the world, including our province,” said the Hon. Siobhan Coady, Minister of Natural Resources in the NL government, Fig. 1. “Operations in the Newfoundland and Labrador offshore continue, including drilling by Seadrill’s West Aquarius. As well, Equinor is expected to begin their exploration drilling program this spring. The Department of Natural Resources is proceeding with its plan, Advance 2030 – The Way Forward on Oil and Gas, which was developed to position the province as a globally preferred location for oil and gas development. Work is continuing towards enhancing the development, competitiveness and sustainability of the province’s oil and gas industry.”

“Over the past several weeks,” continued Minister Coady, “there have been a number of developments in our offshore, due to the rapidly changing COVID-19 environment,” including:

- West White Rose work sites in Argentia and Marystown, as well as the Come by Chance refinery, have moved to care and maintenance mode;

- Suncor is evaluating options for the Terra Nova Asset Life Extension;

- Equinor is delaying—not cancelling—development of the Bay du Nord Project;

- CNOOC International is delaying its exploration program in the Flemish Pass, as the drilling rig is still in Europe; and,

- All operators have reduced the number of personnel offshore and are focused on keeping it virus-free.

“We have had many conversations with the province’s energy and oil and gas companies during this time, to determine their needs and to assist with continuing operations,” added the minister.

“Our members are resilient, and we all must look at this economic situation with a long-term view,” said Charlene Johnson, CEO of the Newfoundland and Labrador Oil & Gas Industries Association (Noia). “We have experienced lows before, most recently the oil price decline in 2014 and the financial crisis of 2008–2009. The Newfoundland and Labrador offshore industry rebounded then, due to our excellent resource and the capabilities of our members. While this situation will be challenging, I am confident we will once again rebound, though we will need significant help from our governments to help stimulate the Canadian oil and gas industry.”

“Operations are continuing as usual, as Hibernia, Hebron and White Rose fields continue in production,” said Geoff Cunningham, vice president of Operations at A. Harvey Group, which services the vast majority of supply vessels in St. John’s Harbor. “As long as they stay operational, we will be there to support.”

OPERATOR UPDATE: HUSKY ENERGY

Since our last article on Newfoundland’s offshore (August 2019 issue), construction has progressed on Husky’s West White Rose (WWR) platform and related facilities for the ongoing field development. Construction has been underway at three facilities: Argentia (concrete gravity structure, or CGS); Marystown (living quarters); and Ingleside Yard, Texas (topsides). What follows are updates on all three platform portions. The Coronavirus in March interfered with this work, as detailed farther below.

WWR concrete gravity structure (CGS). Argentia was a hub of activity last summer in the third quarter, said Husky, with three slipforms taking place over the summer months, and two decks installed in the shaft of the CGS. The southeast quadrant began slip forming on June 8, finishing on July 6. One month later, the southwest quadrant began pouring, finishing in early September. While the slip-forming was occurring on the CGS exterior, interior work also was underway. Two of the seven interior decks were installed, plus components of the ballast and J-tube systems.

The fourth CGS quadrant was poured in the last part of 2019, Fig. 2. While concrete work ensued, interior work was ongoing. The CGS interior contains guides for drillstrings, flowlines, mechanical decks and staircases. All these items are lifted into place by the large cranes on site. In fourthquarter 2019, decks three and four were stacked in the CGS. Only three quadrants were scheduled for 2019, but “thanks to a productive and engaged workforce,” said Husky, four were accomplished. And it was all done safely, finishing a strong year of safe work at the Argentia site.

WWR living quarters. Construction on the living quarters continued at the Kiewit yard in Marystown, NL, during thirdquarter 2019, with the work just over 70% complete. A major milestone was accomplished on Sept. 17, when the first cabin was rolled into location in the living quarters.

Work continued in Marystown during the fourth quarter on the living quarters and other in-province topsides components. At the end of 2019, the living quarters were 80% complete, with more than 50% of the cabins installed. Fabrication also began on the other in-province topsides components, the contract for which was awarded to Kiewit Marystown in mid-2019. The helideck, lifeboat stations and flare boom are all being fabricated in Marystown, and this work began in the fourth quarter. When complete, they will be shipped to the Ingleside yard for installation on the final topsides.

WWR topsides. At the Ingleside yard during third-quarter 2019, the load-out support frame (LSF) was substantially completed, said Husky. Each of the three major decks of topsides (cellar, middle and drill) were constructed in three sections. Construction continued on a variety of components, including the middle deck, drill deck, and the drilling equipment set.

During the fourth quarter, the LSF was completed and is ready for use. The LSF is a support structure that will act as a base for topsides transportation: the topsides will be assembled on top of the LSF, which will then be loaded onto a barge for transport to NL waters, said Husky. The individual levels of the topsides are large enough that they have to be divided into three separate zones for painting. These zones are then “floated over” and installed on the LSF, using cranes. Two of these float-over operations for the cellar deck were completed during fourth-quarter 2019.

Coronavirus-related delay. One thing that no one could anticipate is the incredible disruption caused by the rampant spread of the Coronavirus worldwide. Accordingly, on March 22, Husky took “immediate action” to ensure the safety of its workforce, construction sites and communities. Husky announced that it would begin a systematic, orderly suspension of major construction activities related to the WWR Project.

“The decision reinforces Husky’s objective to prevent the transmission of the COVID-19 virus among its employees, contractors and the community,” said the firm. The company said it carefully assessed the risks and determined that they could not be adequately mitigated for such a large construction workforce.

Husky worked with its contractors to safely suspend all activities, and to demobilize and secure its construction sites. Meanwhile, production from White Rose field and its satellite extensions, 350 km (217 mi) off the NL coast, was continuing with enhanced workforce control measures introduced to ensure ongoing, safe operations on the SeaRose FPSO. The firm said that it would provide a business and capital spending plan update “in due course.”

OPERATOR UPDATE: EQUINOR

When it comes to taking an FID to implement its proposed Bay du Nord development project (Fig. 3), Equinor, for now, has decided not to decide. On March 18, the operator and its partner, Husky Energy, announced that they were deferring the project, with a decision on whether to proceed pushed back from 2020 into at least 2021.

In a statement to local media, Equinor said, “The energy industry has been impacted by the deep fall in the price of oil and the sharp economic downturn, as countries scale down their activities to limit the spread of the virus. Bay du Nord remains an important part of our international project portfolio, and Equinor will now take the time to further improve the project business case and assess the duration of this deferral.” The company said that the project will continue its planning for an FPSO concept, as well as moving forward evaluations of existing tenders. The firm expects to develop an adjusted work program and timing.

Project specs. The Bay du Nord project consists of three light oil discoveries in the Flemish Pass basin: Bay du Nord (2013), Bay de Verde (2015), and Baccalieu (2016). The project area is 500 km (311 mi) east of St. John’s, in water depths of about 1,200 m (3,937 ft), with recoverable reserves estimated at 300 MMbbl of oil. As Newfoundland’s first deepwater project, the overall development concept (Fig. 4) comprises subsea installations tied back to an FPSO for storage and offshore offloading to shuttle tankers. If an investment decision is finally made in 2021, first oil could be produced in 2025.

Reaction. “The drastic drop in commodity prices, and the global economic slowdown, are causing oil and natural gas companies around the world to revisit their capital plans,” noted CAPP’s Barnes. “The Bay du Nord project has the potential to significantly contribute to the economic recovery of (NL), and provide a lift to Canada’s offshore industry. CAPP is hopeful the project proponents will be able to improve the business case for the project and reach a positive final investment decision.”

“The price of oil is certainly concerning for all of us, who hope to expand our industry,” said A. Harvey’s Cunningham. “I hope Equinor continues to see Bay du Nord as a future project, but I certainly understand them being cautious.”

“The proposed Bay du Nord development project is an exciting opportunity for the (NL) offshore,” said Noia’s Johnson. “While the deferral announcement by Equinor and Husky Energy is unfortunate, it is not surprising, given global economic circumstances. Noia is pleased that Equinor stated the project remains an important part of the company’s international project portfolio, and that planning for the project and the evaluation of existing tenders will continue.”

Exploration drilling. Equinor continues to explore, to enable the firm to develop its licenses offshore Newfoundland to full potential. The company has plans to drill locations in EL 1156 during 2020 to achieve this goal. “My understanding is that Equinor mobilized the Transocean Barents during the week of April 6,” said Cunningham.

OTHER OPERATORS

Besides the work being done by Husky and Equinor, several other operators either have activity underway or are trying to initiate operations for this year. Of course, the double-hit of Coronavirus and crashed oil prices is not helping. “Discussions are ongoing between the regulator (CNLOPB) and the operators that have pending exploration programs,” explained CAPP’s Barnes. “The situation is fluid, and the primary focus is ensuring the safety of all their offshore workers that would be on the drilling rigs.”

“Exploration projects have been making their way through environmental approval processes, and there are more drilling programs than ever scheduled for the Newfoundland and Labrador offshore in the next few years” said Noia’s Johnson.

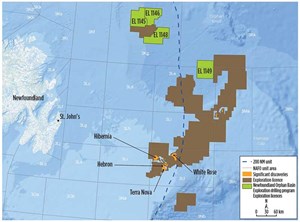

Suncor Energy operates Terra Nova offshore oil field, about 350 km (217 mi) southeast of NL. Production from the field began in 2002, using the Terra Nova FPSO, Fig. 5. In May 2019, Suncor and the Terra Nova J.V. owners sanctioned plans to proceed with a project to extend the FPSO’s life to approximately 2031.

The asset life extension project should allow the facility to capture approximately 80 MMbbl of additional oil. No update has been provided, as of yet, with regard to the impact of current market conditions or COVID-19 implications on the project’s timeline. The vessel is supposed to go offline for six to seven months, sailing to a drydock facility, where work will be executed.

ExxonMobil. Operated by Hibernia Management Development Company (HMDC), with ExxonMobil as the largest shareholder, the 22-year-old Hibernia field platform experienced two small oil spills last summer. These spills occurred on July 17 and Aug. 17, due to a leak from a storage cell and an overflow from a drain tank, respectively. Output was restored for good on Sept. 27, said HMDC. Production was expected to rebuild close to last June’s 125,000-bopd average.

HMDC said in early April that it will shut down the drilling rig on the platform. This will be done after the firm completes a well in May.

ExxonMobil has been drilling one “bluewater” exploration well in recent months. It is a step-out in the Flemish Pass, in the Central Ridge. No report yet, of any results.

BP. The company holds interests in nine exploration licenses (ELs) in the Eastern Newfoundland region offshore NL. Of these nine licenses, BP Canada proposes to conduct exploration drilling within the four ELs (Fig. 6) that the company operates in the Orphan basin, 343 to 496 km (213 to 308 mi) northeast of St. John’s. The Newfoundland Orphan Basin Exploration Drilling Program was intended to drill exploration wells between 2022 and 2026, with an initial well currently planned for 2022, pending regulatory approval. BP has submitted an Environmental Impact Statement (EIS) and EIS Summary document to the Impact Assessment Agency of Canada for review by regulatory agencies, Indigenous peoples, and public stakeholders.

CNOOC. In late March 2020, CNOOC announced a delay in its Flemish Pass exploration drilling campaign for this year. The operator said the delay is tied to the COVID-19 pandemic and involves the Stena IceMax drillship, which is under contract to CNOOC to carry out the drilling. In a statement to the local CBC outlet, the firm said that it was delaying the Pelles A-71 well, because it had concluded that it “cannot safely execute offshore in Atlantic Canada in the near term, due to the COVID-19 pandemic.”

The decision is tied to the Coronavirus spreading in Europe, because the Stena IceMax drillship has been in Spain, and it cannot sail to NL. And the reason for that, is that Spain has been battling a severe Coronavirus outbreak. It would not be permissible to bring the vessel across the Atlantic to NL waters, given the situation. The drillship recently underwent an overhaul in a Spanish shipyard, and had been scheduled to start drilling the location in early April.

SEISMIC/EXPLORATION EFFORT

Provincial company Nalcor Energy-Oil and Gas (Nalcor) continues to pursue an ambitious seismic and resource assessment effort. What follows is an update of the last eight months’ activity.

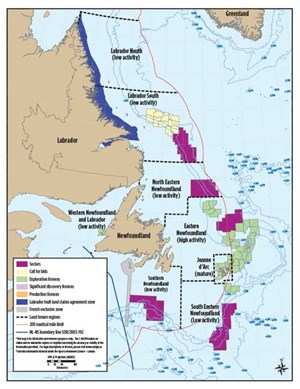

General background/seismic update. NL currently produces from one basin, the well-known Jeanne d’Arc, “but we have over 20 basins identified throughout our offshore,” noted Nalcor. Should Bay du Nord proceed, that development will open a new basin—the Flemish Pass—and there’s been significant oil and gas potential identified throughout NL’s more-than-20 basins.

Nalcor’s seismic program is a critical piece in creating new opportunity throughout NL’s offshore. During the summer of 2019, in partnership with TGS and PGS, Nalcor conducted a 2D survey south of the Carson basin, as well as in the Laurentian basin, south of the island of Newfoundland, to better understand the area in advance of the 2021 and 2022 license rounds.

For the first time, a 3D survey, targeting a key part of the Churchill River Delta, offshore Labrador, also took place during 2019. The data collected will help define the nature and extent of existing structures, as well as hydrocarbon indications in the area. To build a deeper knowledge of the area, which is the focus of the 2021 bidding round (Fig. 7, yellow areas), Nalcor invested in extending the 3D survey to the north of the basin. This year (2020), Nalcor has 3D seismic surveys planned to cover areas identified within upcoming license rounds.

This year (2020), Nalcor has three, 3D surveys planned. They will cover areas identified within upcoming license rounds.

License round results. Prior to Nalcor’s exploration strategy, average annual bid levels for the offshore were $100 million annually. Over the past five years, the province has seen the early results of the strategy, and is averaging approximately $800 million in bids for frontier license rounds. For example, from 1988 to 2013, all bids totaled $2.6 billion, while from 2014 to 2019, bid totals have been $3.9 billion.

Historically, there have been five major E&P companies operating offshore, but over recent years, eight new companies have entered the area.

Latest resource assessments. Nalcor and Beicip-Franlab, in partnership with the NL government, release Oil and Gas Resource Assessments in advance of frontier license rounds. The 2019 results identified an additional 3 Bbbl of oil and 5.8 Tcf of gas potential offshore Newfoundland. Thus, given these results, the combined resource potential is 52.2 Bbbl of oil and 199.6 Tcf of gas, in just 9% of NL’s offshore.

Last year’s independent resource assessment was based on new data, covering nine parcels on offer in the Carson-Bonnition and Salar basins (NL19-CFB01). This area was within the Canada-Newfoundland and Labrador Offshore Petroleum Board’s (C-NLOPB) 2019 South Eastern Newfoundland Call for Bids.

The resource assessment was based on multiple scenarios of geological models. All scenarios were calibrated to well and seismic data, which provided a robust range of outcomes. Detailed technical work defined the nature and extent of the findings. The 2019 activity was the province’s fourth scheduled license round. Future license rounds, scheduled through 2024, will follow the same process, with detailed resource assessments being conducted and released prior to bid closing.

SERVICE/SUPPLY: SPECIALTY VESSEL

Horizon Maritime has operations across Canada and Norway, making its mark by answering unique challenges with maritime solutions. Horizon has a fleet of versatile, state-of-the-art vessels equipped for a broad range of tasks in the offshore and marine industries, as well as offering fleet management, crewing, and supply base and logistics.

One of the more interesting challenges/ projects has been Horizon Maritime’s recent partnering with HB Rentals, Ampelmann, Allswater Marine Consultants and Nycum & Associates, to develop a solution for an Isolation/Emergency Care vessel. The result is the Horizon Enabler, a large, multi-functional supply and support vessel enabling mobile, safe and adaptable marine and offshore personnel care.

Outfitted with an Ampelmann Walk-2-Work offshore passenger transfer system (Fig. 8), the vessel has accommodations for 172 persons and segregated living quarters for 90 people, which can be increased to a total of 220. The vessel also can be adapted for isolation and quarantine functions, health care and medical support, and offshore transportation, all of which can be useful in this time of Coronavirus pandemic.

Among its functional characteristics, the Horizon Enabler is designed for quick adaptability for evolving facility needs. It can stay at sea or remote locations for extended periods. An environmentally friendly vessel, it has unlimited water generation and storage, as well as specific washdown and shower areas for staff entering ship’s accommodation. There also are dedicated laundry services, medical and laboratory services, administrative facilities, and medical supply storage.

There is a helicopter landing deck for emergency patient transfer and staff changes at sea. Plus, there is additional space on deck for evolving care needs. The vessel also has an ability to transfer personnel offshore in up to 5-m seas.

REGULATORY MATTERS

Last year, the Canadian parliament passed two controversial bills—C-69 (changing “environmental assessments” to broader “impact assessments”) and C-48 (Oil Tanker Moratorium Act). And yet, the uncertainty and concerns regarding their implementation remain.

“We still believe that the legislation that was created, when these bills passed the Canadian Parliament, creates regulatory uncertainty and adds unnecessary delay to projects,” said CAPP’s Barnes. “It is now more important than ever for governments to streamline regulatory processes and improve their competitive position, to ensure they are properly able to capitalize on investment when oil prices begin to rebound. We are looking to the Government of Canada to send a message to investors that this country is open for business.”

Noia’s Johnson sounds a similar tone. “It is Noia’s hope that by providing a regional assessment of the offshore, which provides program exemptions from the Impact Assessment Act, as created by Bill C-69, our industry will have a clearly defined process,” she said. “This allows these projects to be approved in an expeditious manner.”

- Oil and gas in the capitals: Norway sustains the industry (December 2025)

- Overcoming extreme challenges: Advanced chemical solutions for offshore oil production integrity (September 2025)

- Canadian operators search for market stability (September 2025)

- Powering Mero-3: A look inside one of the world’s largest deepwater FPSOs (August 2025)

- First cargo puts Canada on the map of LNG exporting nations (July 2025)

- Energy NL’s CEO says Newfoundland & Labrador’s offshore work is steady, as province awaits next major project (June 2025)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)