Guyana to become a major oil producer

A flurry of deepwater discoveries in the Atlantic off Guyana’s coast has changed the future for the small South American nation, which has yet to produce a barrel of oil. Since the Liza-1 discovery in May 2015, ExxonMobil and its partners have identified reservoirs containing at least 5.5 Bboe of recoverable reserves. The operator has fast-tracked the Stabroek Block development with the first of at least three FPSOs expected on location in September 2019 and first oil anticipated in early 2020. The rapid approach of oil revenue and the likely transformation of the nation’s economy have given the government and civil society a tight schedule to prepare for the opportunities and problems that will result from becoming a major oil producer.

Underdeveloped economy. Settled by the Dutch West India Company in 1620 to establish sugar plantations, Guyana became a British colony in 1834, and gained its independence in 1966. Today, with a GDP of just $3.6 billion, Guyana is the third-poorest nation in South America, just ahead of Bolivia and Paraguay. One third of the country’s roughly 750,000 people live below the poverty line. Only 10% of Guyana’s roads are paved. Its electricity grid has frequent blackouts. Guyana has been disappointed by foreign investors in the past, as Chinese companies harvested timber from its forests, mined gold and bauxite, and entered the sugar industry, but left the country without providing any lasting benefits. If projections prove to be accurate, oil income could triple the country’s GDP by the end of the next decade. This could be a tremendous opportunity for Guyana’s citizens, if the country can avoid the “resource curse” experienced by other poor countries with sudden major oil discoveries. However, at the 2019 AAPG Annual Convention in San Antonio, Maria Guedez, manager of Guyana for Exxon Mobil said, “new discoveries will make Guyana one of the wealthiest countries per capita in the Western Hemisphere, bringing infrastructure and prosperity to the region.”

Guyana-Suriname basin resource assessment. From 1975 to 2014, about 40 exploratory wells were drilled in Guyana and Suriname–both on and offshore–without finding commercial results. The oil and gas industry’s interest in the Guyana-Suriname offshore basin was piqued by a 2000 USGS assessment of South American undiscovered resource potential. Updated in 2012, the report identified the basin as the second-largest prospect on or near the continent, behind Brazil’s pre-salt Santos basin. The assessment’s mean values for the basin were 13.6 Bbo, 21.2 Tcf of natural gas, and 574 MMbbl of natural gas liquids. In 2012, CGX and Repsol drilled exploratory wells that encountered high pressures, but both were plugged without commercial finds.

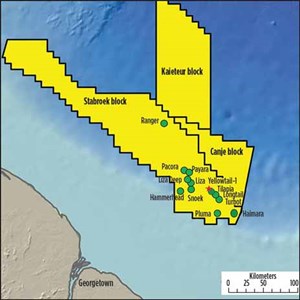

Flurry of discoveries. In 1999, before the USGS assessment, Exxon Mobil and Shell signed an agreement with the Guyanese government for offshore exploration. Shell pulled out of the arrangement in 2012, and Exxon Mobil (45%) brought in Hess (30%) and CNOOC’s Nexen (25%) as partners in the 6.6-million-acre Stabroek Block, 90 mi off the Guyana coast. In May 2015, the Liza-1 exploration well, drilling in 5,719 ft of water, encountered 295 ft of high-quality oil-bearing sandstone upon reaching 17,825 ft, TVD. Exxon Mobil estimated that the reservoir contained recoverable reserves between 800 MMboe and 1.4 Bboe. Based on these results, Exxon Mobil contracted Petroleum Geo-Services (PGS) to conduct the largest 3D seismic survey in the operator’s history, to provide a more detailed assessment of the Stabroek Block’s geology. By March 2017, Exxon Mobil had confirmed the Liza discovery with three appraisal wells, and had made new discoveries with the Payara-1 and Snoek-1 wells, confirming the promise of the USGS assessment, Fig. 1.

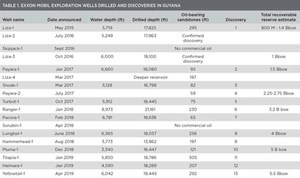

Over the next four years, Exxon Mobil conducted an impressive and very successful deepwater exploration campaign, as summarized in Table 1.

Exxon Mobil’s program achieved a remarkable 87% success rate on its first 15 Stabroek exploratory wells. Except for the Skipjack-1 well in September 2016, and the Sorubin well in April 2018, every exploratory well that the company drilled found substantial reserves. The campaign also identified a variety of distinct reservoirs at depths from 13,862 ft on Hammerhead-1 to 21,161 on Ranger-1. As Exxon Mobil reservoir teams evaluated this series of finds, they gradually increased their estimates of recoverable reserves from around 1.0 Bboe to 5.5 Bboe for the Stabroek Block.

Through July 2019, Exxon Mobil’s drilling campaign has been conducted by three drillships, Fig. 2. The Noble Bob Douglas drillship drilled the Liza-1 discovery well and subsequent development wells for that field. The Noble Tom Madden and the Stena Carron drillships have drilled the wells for the other 12 discoveries. Exxon Mobil is bringing in a fourth drillship, the Noble Don Taylor, in the fourth quarter of 2019 to expand the exploration program, with new wells to be drilled at the Hammerhead and Ranger prospects.

In 2016, Exxon Mobil also took over operatorship of two additional blocks adjacent to Stabroek. The company acquired a 50% interest in the 3.3-million-acre Kaeitur Block from the Guyanese company Mid-Atlantic Oil & Gas, and a 35% interest in the 1.5-million-acre Cadje Block from Israeli company Patio Petroleum and Canadian firm Cataleya Energy. Exxon Mobil conducted new seismic surveys in Kaietur in 2017 and was considering exploratory wells in Cadje, but had to relinquish 20% of the acreage in the block in 2019, due to inactivity.

In July 2016, ExxonMobil added acreage in Suriname’s waters just east of the Straboek Block. Along with Hess and Equinor, Exxon Mobil Exploration and Production Suriname B.V. signed a production sharing contract for Block 59 with Staatsolie Maatschappij Suriname, the national oil company of Suriname, Fig. 3. Deepwater Block 59, with water depths ranging from nearly 6,600 ft to 11,800 ft, has 2.8 million acres, or 4,430 mi2, and shares a maritime border with Guyana. While continuing its exploration program, Exxon Mobil has sanctioned investment for the Liza-1 and Liza-2 development projects.

Liza Phase 1 development. Liza Phase 1 development is approximately 120 mi offshore, in water depths of 4,900–6,200 ft, and is expected to develop approximately 450 MMboe. The project will produce from two drilling centers with a total of 17 subsea wells, including eight producing, six water injection, and three gas injection wells.

Phase 1 wells will produce to the Lisa Destiny floating production, storage and offloading (FPSO) vessel, which has the capacity to handle 120,000 bopd. When operating at full capacity, production will be offloaded to conventional tankers every five to 10 days. The Lisa Destiny FPSO was constructed and will be operated by SBM Offshore. The Lisa Destiny’s hull was originally the Tina very large crude carrier, and work began on its conversion in November 2017. More than 12,000 tons of topside equipment were installed onto the hull at the Keppel shipyard in Singapore.

Launched in July 2019, the Lisa Destiny FPSO was expected on location in the Stabroek Block in September, and first oil should be produced in early 2020, just five years after the Liza-1 discovery. This compares to the ten-year timeline typically required for deepwater developments.

Liza Phase 2 development. The Liza Phase 2 development plan received government and regulatory approvals in April 2019. Liza Phase 2 will produce up to 220,000 bopd while developing 600 MMboe.

Exxon Mobil plans six drilling centers on Phase 2 with approximately 30 wells, including 15 production, nine water injection and six gas injection wells. Phase 2 wells will produce to the Liza Unity FPSO that is being constructed by SBM Offshore and will be leased to Exxon Mobil. The Liza Unity topsides will be installed on an SBM-standardized Fast4Ward design hull, which was constructed in Shanghai and launched from dry dock in August 2019. The Liza Phase-2 development is on schedule to come online in mid-2022.

Third Phase at Payara. A final investment decision is expected before the end of 2019 for a third phase of development, Payara, pending government approval. The Payara development is designed to produce between 180,000 and 220,000 bopd, with startup as early as 2023. ExxonMobil is evaluating additional development potential in other areas of the Stabroek Block, including at the Turbot and Hammerhead areas, and expects combined production from the block to reach 750,000 boe from as many as five FSPOs.

Repsol in Guyana. Repsol has been present in Guyana since 1997 with a variety of upstream projects. The company currently operates the 479,000-acre Kanuku Block in 230 to 330 ft of water south of the Stabroek Block. Repsol holds a 37.5% stake along with Tullow (25%), Total (27.5%) and Qatar Petroleum (10%). Repsol has acquired 333 mi2 of 2D and 2,300 km2 of 3D seismic on the block to support the exploration program. In March 2019, Repsol contracted the Super 116E-class jackup EXL II from Valaris (formerly EnscoRowan) to drill Carapa-1, the first exploration well in Kanuku. The rig will be serviced from bases in Guyana and Trinidad and Tobago.

Tullow leases and a discovery. Tullow holds a 50% operated interest in the Orinduik license, a 439,000-acre block in 4,430 ft of water, just 7 mi from the Stabroek Block. Partners include Total (25%), Canada’s Eco Atlantic Oil & Gas (15%), and Qatar Petroleum (10%).

Following acquisition of new 3D seismic on the license in 2017, Tullow evaluated potential prospects across the Orinduik and Kanuku licenses, and planned to drill two consecutive exploration wells in the second half of 2019 on the Orinduik Block with the Stena Forth drillship. The Jethro-1 well targeted the Lower Tertiary Jethro-Lobe prospect, drilled to 14,436 ft, and encountered 180 ft of quality oil-bearing reservoirs with estimated recoverable oil resource beyond Tullow’s expectations. The drillship will next move to drill the Upper Tertiary Joe prospect. Apart from the Jethro-Lobe and Joe targets, Tullow has identified 10 other potential prospects in the Orinduik block.

Border dispute with Venezuela. Guyana’s oil development plans have been challenged by its neighbor, Venezuela, which claims 40% of Guyana’s territory in a border dispute that dates back to at least 1889. Several tribunals have since settled the argument in Guyana’s favor. However, Venezuela, with its economic collapse and Guyana’s oil discoveries, has renewed its claims, which extend into the Atlantic Ocean. Most recently, in December 2018, Venezuelan Navy ships intercepted two PGS seismic vessels and halted their survey in the far northwestern portion of the Stabroek Block, 90 mi from the closest discovery well, Ranger-1.

Boosting the local economy. While no oil revenue has yet to reach the Guyanese treasury, the offshore activity has already helped the local economy. More than 1,000 Guyanese are employed with Exxon Mobil and its contractors. Also, the company is taking a three-pronged approach to help Guyana achieve lasting value from its petroleum resources. The effort includes developing a Guyanese workforce, working with local companies to supply in-country goods and services, and investing to support health, education and infrastructure programs. The company’s foundation has invested $13 million to support these efforts, and its operations have spent more than $60 million with local firms. The Guyanese Business Development Centre was opened to promote the establishment of small- and medium-size businesses in the country.

Politics block progress. The potential windfall of oil wealth has introduced instability to the politics of Guyana. The country’s president, David Granger, won a surprise victory in May 2015, just weeks before the Liza-1 discovery. Once it was clear that the country would become a major oil producer, opposing politicians and other citizens began to question the terms of Exxon Mobil’s production sharing agreement, which allows the oil company to recover its expenses before splitting profits 50/50 with the Guyanese government. In December 2018, President Granger lost a no-confidence vote in the legislature, paralyzing the government, and a date for new elections has not been set.

Meanwhile, like many underdeveloped countries where oil is found, Guyana has no experience and few resources to handle taxation, regulation and environmental control related to large-scale energy production. The government has proposed establishing a sovereign wealth fund like Norway’s for “transformational projects that will benefit generations to come.” Major infrastructure investment also is needed to support the offshore activity, including processing facilities, an oil services base, and a possible deepwater port. A power plant also has been proposed, along with a pipeline to carry gas from Liza field to fuel it. All these initiatives are on hold, however, until the gridlock in the nation’s executive branch and legislature is resolved. WO

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Driving MPD adoption with performance-enhancing technologies (January 2024)

- Digital transformation: A breakthrough year for digitalization in the offshore sector (January 2024)

- Offshore technology: Platform design: Is the next generation of offshore platforms changing offshore energy? (December 2023)

- 2024: A policy crossroads for American offshore energy (December 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)