Mexico enters an uncertain period of regulation and activity

These have been unsettled times for Mexico’s upstream sector, since new President Andrés Manuel López Obrador (AMLO, Fig. 1) won office last July in a major electoral victory. The great oil reform and opening of the previous five years has hit a roadblock and may never resume its march forward. After 75 years of a Pemex monopoly in Mexico’s E&P activity, former President Enrique Peña Nieto in 2013 took the risky step of opening the Mexican upstream sector to other operators and private investment. But now, since taking office Dec. 1, 2018, AMLO has, at least temporarily, gutted the heart of the reform/opening by cancelling two “bidding procedures” and instituting a three-year ban on any new auctioning of onshore and offshore tracts. It seems that Mexico’s E&P sector may be returning to where it came from.

THE GREAT MEXICAN OIL REFORM

Since the Great Mexico Oil Reform was promulgated in 2013/2014, its cornerstone has been the licensing rounds that have given operators other than Pemex an opportunity to explore and/or develop onshore and offshore tracts. While the process often has been confusing and inconsistent, the National Hydrocarbons Commission (CNH, which handles licensing) has been able to award 106 contracts for blocks/tracts/fields out of 166 offered. This has been done in nine “bidding processes,” in three rounds, over three years’ time.

The administration of former President Peña Nieto actually had scheduled two additional bidding processes in Round 3. However, these were postponed until AMLO’s administration took over last December, and shortly thereafter, they were cancelled. What follows is a summation of the results of the nine bidding processes that were completed.

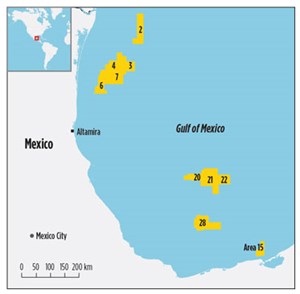

Round 1, Bidding Processes 1 through 4. The first bidding process, CNH-R01-L01, offered 14 contract areas in shallow waters offshore. Only two of these were awarded, both to a group headed by Talos Energy. However, one of the tracts, Block 7, hosted the first offshore exploration well drilled (spudded in May 2017) by the private sector in Mexico’s history. That first well, Zama 1, resulted in a world-class oil discovery (in July 2017) that Talos continues to appraise and intends to develop, with a goal of first oil by second-half 2022. Current estimated reserves are 1.4 Bboe to 2.0 Bboe.

In the second bidding process, CNH-R01-L02, exploration and extraction PSCs were again offered for five shallow-water areas. Of these, three were awarded in September 2015, one, each, to Eni, Pan American Energy and Fieldwood Energy. The winners have proceeded to further appraise and develop these blocks, containing finds already made by Pemex. And all three operators have announced or are proceeding with field development plans.

The third bidding process, CNH-R01-L03, was the first offering of onshore tracts. These were for extraction licenses, covering development and production of already-discovered areas. All 25 areas offered were awarded in December 2015.

The first deepwater bidding process, CNH-R01-L04, offered 10 areas in the Gulf of Mexico (GOM). Of these, eight were awarded in December 2016, including four in the Perdido Fold Belt and four in the Saline basin. In all, two contracts were awarded to Equinor, CNOOC picked up two areas, and one contract, each, went to Total, Chevron, PC Carigali and Murphy Oil.

Round 2, Bidding Processes 1 through 4. Several series of bids were fired off very quickly during 2017. In June 2017, bidding process CNH-R02-L01 repeated the format of the first two offerings in Round 1, with a focus on the shallow-water GOM. Of 15 areas offered over three regions, 10 were awarded.

Also in June 2017, bidding process CNH-R02-L02 awarded 7 of 10 onshore areas offered. Six were in the Burgos basin, and one was in the Southeast basins. These were followed rapidly by bidding process CNH-R02-L03, which offered another 14 onshore areas. In July 2017, all 14 were awarded, spread over the Burgos basin, the Tampico-Misantla region, the Veracruz area, and the Southeast basins.

The final portion of Round 2, bidding process CNH-R02-L04, was the second deepwater offering under the Reform process. In January 2018, 18 of 28 areas offered were awarded, including eight to Shell, three to PC Carigali, three to Repsol, two to Pemex, and one, each, to Chevron and Eni.

Round 3, Bidding Process 1. In the first bidding process of Round 3, CHN-R03-L01, the format returned once again to the shallow-water GOM. In all, 35 areas were offered from three regions. Of that number, just 16 were awarded in March 2018, reflecting a slowdown in bidding that perhaps was due to uncertainty about the upcoming election and what changes it might bring to the E&P regime.

Meanwhile, as alluded to earlier, AMLO’s new regime has cancelled the two other bid offerings in Round 3, scheduled for 2018/2019.

REFORM ROLLBACK: THE AMLO ERA

AMLO’s inauguration on Dec. 1, 2018, may have started yet another chapter in Mexico’s E&P sector, albeit a rollback to pre-2013 times. On Dec. 5, AMLO said that he will offer a three-year “truce” to operators and their partners that won E&P contracts through bidding rounds under his predecessor, former President Enrique Peña Nieto.

Based on the levels of investment and production that these firms are able to achieve during the three-year period, the government will decide whether to continue with new bidding rounds, said AMLO. He said that his administration would honor the 100-plus contracts that have been awarded through the three rounds and nine bidding processes, provided, he added, that the projects “show results.”

AMLO inherits state-owned Pemex, whose oil and gas output has continued to plummet. Over the past decade alone, crude oil production has declined between 4% and 5% per year, dragging Mexico’s share of global output down from 5% to 2%. Despite the 2013/2014 energy reforms, output as of January, is about 30% below the 3.0-MMbopd level that was promised by the then-President Peña Nieto back in 2015. In addition, given that Mexico’s natural gas production is mostly associated, the country’s gas output has dropped 40% since 2012.

In addition, revenues to the government are dwindling, according to data studied by Forbes. Although down from 40% a decade ago, oil sales still account for 20% to 25% of federal revenues. This over-dependence on Pemex’s revenues has siphoned money and not allowed the company an opportunity to re-invest more in E&P. Accordingly, various financial institutions now consider Pemex to be the world’s most indebted oil company.

AMLO disputes investor concerns that his new government will worsen Pemex’s fiscal situation. “We are going to invest, where we know there’s oil, and where it costs less to extract it,” he said. “We are going to reduce costs.” Accordingly, a new six-year business plan calls for Pemex’s oil production to rise 52% by the end of 2024, which is the end of AMLO’s term as president.

That means a jump from 1.730 MMbopd to 2.624 MMbopd over six years, noted the company’s new CEO, Octavio Romero, Fig. 2. The new plan focuses on onshore and shallow-water areas in the southeastern basins, as well as conventional areas in the north, explained Romero, and exploration investment will be increased 10% annually. In February 2019, AMLO officially suspended future Pemex farm-out bids. However, “what is already agreed will continue on course,” said Romero.

COMPANIES

While the new regime in Mexico City blusters about the future path of E&P, the operators in place are trying to make the best of the situation. What follows is a look at the more significant players’ activities.

Pemex. Up until late 2018, the state company seemed to fully support the Reform effort. But now it adheres to AMLO. As of last year, Pemex was continuing the oil reform process, to gain new partnership opportunities. In January 2018, the company was awarded four deepwater blocks; two as part of a consortium, and two individually. As the momentum continued in 2018, Pemex and Lewis Energy signed their first Integrated Exploration and Extraction Contract for Olmos field, in the state of Coahuila. The $617-million investment will be used to assess and develop resources on Mexico’s side of the Eagle Ford shale.

There was some hopeful news on the exploration side. Last October, Pemex confirmed the discovery of seven reservoirs in two new wells in Mexico’s Southeast basin, which will incorporate more than 180 MMboe of 3P reserves. The Manik-101A and Mulach-1 shallow-water discoveries will become part of Pemex’s portfolio of field developments. Combined peak production of the six fields that Pemex is evaluating and developing could be up to 210,000 bopd. and 350 MMcfgd.

Last December, Pemex confirmed that Ixachi field, 45 mi from the Port of Veracruz, is much larger than estimated upon its discovery in November 2017. Its 3P reserves now exceed 1.0 Bboe. At peak production in 2022, Ixachi should yield around 80,000 bcpd and over 700 MMcfgd. This was validated by assessments made when the Ixachi-1DEL and Ixachi-1001 wells were completed. This discovery is the biggest onshore find made in the last 25 years, and the fourth-largest, worldwide, in the last decade.

Last September, Pemex and Talos Energy, as operator of the Block 7 Consortium (with Sierra Oil and Gas, and Premier Oil), announced that the two groups signed a pre-unitization agreement related to tracts within the Amoca-Yaxche-03 allocation, and the contiguous Block 7 PSC. Both areas are in the offshore Southeast basin.

Administratively, during last summer, Jorge Lemelin was named corporate director of Pemex, and Ruiz Alarcon was named E&P chief. AMLO made clear that there will be “zero tolerance” for corruption in the energy sector and clear rules. He has proposed that Pemex invest $10.4 billion in E&P during 2019. That’s a 26% increase, compared to 2018’s level, when Pemex planned to invest $8.76 billion, according to the finance ministry. Oil production is expected to stabilize at 1.847 MMbpd during 2019, assuming an average $55/bbl price level.

Talos Energy. In April 2018, Talos submitted an appraisal plan for the Zama discovery in Block 7 to CNH, for up to three wells, beginning in fourth-quarter 2018. In addition, Talos said it was focusing on executing its first exploration project on Block 2, in about 100 ft of water. The first well would test the Bacab prospect, and was expected to be drilled in second-quarter 2019.

In July 2018, Talos formally requested approval from the Mexico Ministry of Energy (“SENER”) to enter into a Preliminary Unitization Agreement (PUA) with Pemex for a potential unit involving Zama field in Block 7 and the Pemex grant to the east of Block 7. Last September, Pemex and Talos (and its partners) signed the PUA.

In November, CNH approved the Zama appraisal plan, and the first well, Zama 2, was spudded late that month. Then, in January 2019, Talos reported that the Zama-2 had been drilled 1.3 mi north of the Zama-1 discovery. This initial appraisal was completed on Jan. 20, 2019, about 28 days ahead of schedule and 25% below initially projected costs. The well reached the top of the Zama reservoir at 10,759 ft, TVD.

It encountered a contiguous Zama sandstone interval of 1,676 ft of gross TVD sand. The Zama-2 penetration logged approximately 581 ft of gross TVD oil pay before reaching the oil-water contact, preliminarily estimated at 11,254 ft. The Zama-2 also tested a deeper exploration prospect, Marte, but it was not hydrocarbon-bearing.

Shell. In January 2018, in the second deepwater offering, Shell was awarded nine blocks (Fig. 3), with an estimated price tag of $324 million. Shell won four exploration blocks on its own, one with its partner, Pemex, and four with partner Qatar Petroleum. Shell will operate all nine blocks. “For Shell, [this] win marks a competitive, deep-water entry in Mexico,” said Upstream Director Andy Brown at the time. “The proximity and technical similarity of this opportunity to our leading position in the U.S. Gulf of Mexico will allow us to benefit from, and build upon, decades of experience, complementing our position in the region.”

Eni is working offshore Mexico. In 2017, the company completed drilling in Area 1, 125 mi west of Ciudad del Carmen in a 33-m water depth, and increased the estimate of available hydrocarbons to 2.1 Bboe, in-place. Eni also won Block 24 in the deepwater Cuenca Salina basin. In August 2018, Eni announced approval of the development plan for Area 1 discoveries. The development will be phased, initially with early production, and startup is planned for first-half 2019, through a wellhead platform on Miztón field. Full field production should start in late 2020, utilizing an FPSO that can process 90,000 bopd.

DEA. In 2017, DEA was awarded one shallow-water license in Round 2, bidding process 1. This was followed later in the same year by the award of operatorship of Ogarrio producing oil field, onshore, Fig. 4. The 50% license share that DEA acquired was offered in a farm-out auction held by CNH in October 2017. Pemex holds the remaining 50%. DEA plans to improve the field’s recovery rate. The mature field was discovered in 1957, and more than 100 wells are active and produce about 10,000 boed.

In March 2018, DEA was awarded three offshore exploration blocks as operator in the shallow-water 3.1 bidding process. These include Blocks 16 and 17 with partners Pemex and Cepsa, and Block 30 jointly with partners Sapura E&P and Premier Oil. Blocks 16 and 17 are in the Tampico-Misantla basin and Block 30 is in the Sureste basin of the GOM. In addition, DEA holds a 30% share of Block 2, and Pemex has the remaining 70% as operator. In December 2018, DEA announced the acquisition of Sierra Oil & Gas, which holds interests in six blocks in Mexico, including the Zama discovery.

Petronas. The PC Carigali subsidiary of Malaysia’s national oil company won operatorship of two blocks during Mexico’s 2.4 bidding round in late January 2018. That firm also is an interest-holder in other consortia that won control of four additional areas, offshore the state of Tamaulipas. In early February 2019, CNH approved PC Carigali’s acquisition of a 30% stake in CNOOC’s Block 4, in the Perdido Fold Belt deepwater region. This reinforces PC Carigali’s position as one of the larger private offshore acreage holders in Mexico.

- ESG perspective: The great regulatory rollback (February)

- Regional Report: Focus on Arctic oil and gas sharpened during 2025 (January)

- Orphaned wells remain a problem (December 2025)

- Keeping the Gulf of America as our energy anchor (December 2025)

- Energy services: The relentless backbone of global energy security (December 2025)

- “Drill, Baby, Drill”— Hmmm…? (December 2025)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)