Bakken shale remains North Dakota’s growth engine

North Dakota continues to benefit mightily from the continued exploitation and expansion of the Bakken shale. Now about 10 years into the process, the play’s surging output has catapulted North Dakota to the position of No. 2 oil producing state behind only Texas.

As head of North Dakota’s Department of Mineral Resources for nearly two decades, and its chief oil and natural gas regulator, Lynn Helms has kept a close watch on the sector. He fully expected output to recover and surge further as the industry recovers, following the oil price collapse in late 2014.

OIL PRODUCTION STATUS

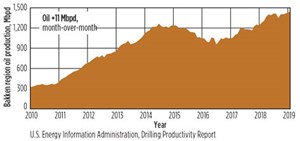

In his June 14, 2019, “Director’s Cut” comments, Helms reported the latest full monthly statistics covering April, and in that period, producers’ oil output averaged 1.391 MMbpd. However, this figure was about 12,700 bpd less than the all-time high for North Dakota oil output, set in January at 1.404 MMbpd. Meanwhile, the U.S. Energy Information Administration (EIA) is estimating that Bakken oil output will rise to 1.407 MMbpd in June, which would be a new record. EIA projects that Bakken production will increase another 11,000 bopd in July, to average 1.418 MMbopd, Fig 1.

Helms added that gas production was up another 25.7 MMcfd, or 0.9% in April, averaging 2.863 Bcfd, a new all-time high for the state. Active producing wells were up 0.8% in April, at 15,490. This number exceeds the previous all-time high, which was set in January at 15,409. The composition of that total is now 90% from the Bakken and Three Forks plays, while 10% are producing from “legacy conventional pools.”

DRILLING STATUS

“The drilling rig count has become very stable in the mid-60s,” noted Helms. “Operators have shifted from running the minimum number of rigs to incremental increases and decreases, based on gas capture, completion crew availability, and oil price.” Operator plan to hold the rig count steady or perhaps run two to five fewer rigs during second-half 2019, depending on oil price, workforce, and infrastructure.

In addition, explained Helms, “the number of well completions has become variable again, due to oil price, gas capture, workforce, and weather.” Thus, completions totaled 66 in February (final), 62 in March (revised) and 78 in April (preliminary). Over 99% of drilling now targets the Bakken and Three Forks formations. From the end of March to the end of April, estimated wells waiting on completion fell 6, to 962, and the estimated inactive well count declined by 72, to 1,625.

“Lower crude oil price, gas capture, workforce, and competition with the Permian and Anadarko shale oil plays for capital continue to limit drilling rig count,” continued Helms. “Utilization rate for rigs capable of 20,000+ ft is 55% to 65%, and for shallow-well rigs (7,000 ft, TD, or less) 40 % to 50%.

His department’s data indicate that drilling permit activity is normal, and operators continue to maintain a permit inventory that will accommodate varying oil prices for the next 12 months. Finally, rigs actively drilling on federal tracts in the Dakota Prairie Grasslands was down one unit, to one.

PIPELINE OUTLOOK

Justin Kringstad, the engineer who heads the North Dakota Pipeline Authority (NDPA), has spoken optimistically about the production prospects for oil and gas in the Bakken. This includes pointing out that the relatively small volumes from the Bakken in eastern Montana have been inching upward. This should result in more requirements for pipelines.

In addition to steady rig counts in the core of the Bakken, drilling activity has increased somewhat in the far western portions of North Dakota, near the Montana border. Across the border, Montana had seen the number of rigs working in its portion of the Bakken increase from zero in mid-2018 to as high as four in November and December. However, that bubble of activity soon waned, and the rig count has been back to zero for that area in the last several months.

Nevertheless, Kringstad remains upbeat on the E&P outlook, which translates into an optimistic pipeline view. “If you look across all fronts—oil, natural gas, natural gas liquids—every single area is going to have new pipeline investment, in order to keep up with production,” said Kringstad. “There is not one segment of the industry right now that is prepared for long-term growth. The companies working these areas are busy in the boardrooms, trying to figure out how many expanding, existing systems are needed, and how many are designed for open markets. So, for natural gas and all the fuels, there will be more infrastructure built.”

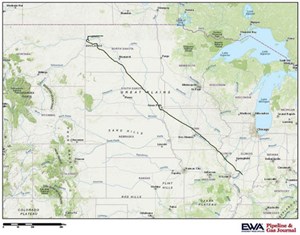

Dakota Access Pipeline. Accordingly, among the pipelines likely to be built is an expansion of the Dakota Access Pipeline (Fig. 2), the 1,172-mi, 30-in. backbone of the Bakken, which is now transporting 570,000 bpd of light crude, according to Energy Transfer LP. That expansion took a step forward last October, when ETP began an open season for additional volumes of Bakken crude to the Gulf Coast.

The success of the open season highlighted the continued market demand and need for additional capacity out of the Bakken. To meet these needs, Energy Transfer is proposing a plan to optimize the existing Dakota Access Pipeline by late 2020 to accommodate additional volumes of crude oil.

Optimizing the Dakota Access Pipeline to accommodate increased volumes can be done easily, said Energy Transfer, by adding horsepower along with a few modifications and upgrades along the existing line. No mainline construction or additional pipe will be needed. The maximum operating pressure will not change. The additional horsepower will be created by adding pumps at new and existing pump stations.

Energy Transfer said that it will purchase property outright for three new mid-point pump stations; one each in North Dakota, South Dakota and Illinois. Pumping equipment at each new station will be isolated within closed structures for additional environmental protection and sound mitigation. Specific to North Dakota, this work will require between $30 million and $40 million in upgrades.

Keystone XL Pipeline. Additionally, state officials and oil producers are keeping an eye on the Keystone XL pipeline project for additional takeaway possibilities, which could reduce the need for oil trains in the region. However, construction by operator TC Energy will not happen anytime soon. Although a federal appeals court on June 6 ruled in favor of the Keystone XL pipeline moving forward by overturning a lower court injunction, U.S. construction is still delayed. Yes, a 9th U.S. Circuit Court of Appeals panel ruled in favor of the Trump administration and TransCanada’s Corp.’s argument against the injunction. However, this is not the only hurdle remaining for construction to take place.

In March, TC Energy said that it had lost the construction season this year because of uncertainty created by various lawsuits. One case still pending before Nebraska’s state Supreme Court contests the pipeline’s latest planned route through that state. There also is a lawsuit by tribal groups in Montana. The project also still needs some permits from the Army Corps of Engineers and the Interior Department.

Liberty Pipeline. On a potentially bigger scale, Phillips 66 and Bridger Pipeline LLC announced on June 10 that they have formed a 50/50 joint venture, Liberty Pipeline LLC, and are proceeding with construction of the Liberty Pipeline, Fig. 3. The 24-in. pipeline will provide crude oil transportation service from the Rockies and Bakken production areas to Cushing, Okla. From Cushing, shippers can access multiple Gulf Coast destinations, including Corpus Christi, Ingleside, and Houston, Texas. Liberty is underpinned with long-term shipper volume commitments. Initial service on the pipeline is targeted to commence as early as first-quarter 2021, subject to receipt of applicable permits and regulatory approvals.

“The Liberty Pipeline presents us with a great opportunity to serve producers in the growing Bakken and Rockies production areas,” said Greg Garland, chairman and CEO of Phillips 66. “The pipeline adds to our integrated infrastructure network that serves the key shale oil producing regions with connectivity to major Gulf Coast market centers. Our pipeline network has strategic alignment with our Central Corridor and Gulf Coast refineries, further enhancing value across our assets.”

Phillips 66 will lead project construction on behalf of the JV and will operate the pipeline. Where feasible, Liberty will utilize existing pipeline and utility corridors and advanced construction techniques to limit environmental impact. The project is expected to cost approximately $1.6 billion.

Double H expansion. Crude production has also prompted Kinder Morgan to consider an expansion of its 84,000 bpd Double H Pipeline to increase takeaway capacity from the Rockies and provide shippers with crude oil transportation service to downstream markets.

The 511-mi Double H Pipeline originates in the Bakken near Dore, N.D., and Sidney, Mont., and terminates near Guernsey, Wyo. The pipeline transports oil from the Dore Terminal in North Dakota and Albin Terminal in Montana to Guernsey, Wyo., where Double H interconnects with the Pony Express Pipeline for transportation to the Phillips 66 Refinery in Ponca City, Okla., or the Deeprock Terminal in Cushing, Okla. Double H went into service in February 2015 and is expandable. WO

Editor’s note: The Energy Web Atlas is a product of Gulf Energy Information, the parent company of World Oil.

- Coiled tubing drilling’s role in the energy transition (March 2024)

- What's new in production (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)