U.S. shale drives rig count recovery in 2017

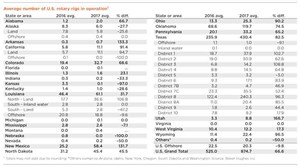

With oil prices on the rise in 2017, operators added drilling rigs back to many areas of the U.S. The grand total of the U.S. rig count exhibited an average 67% gain from 525 working rigs in 2016 to 875 rigs during 2017.

Much of the growth in drilling that took place during 2017 was concentrated in major shale plays, like the Permian basin and SCOOP/STACK plays. Texas experienced an annual average 82.5% increase in working rigs, from 236 units in 2016 to 430 units in 2017. The biggest increase in the Lone Star State can be attributed to District 8, in the heart of the Permian, where the count of working rigs almost doubled, from about 122 units in 2016 to 240 in 2017. Oklahoma was the state with the second biggest volume increase, where the count advanced 74.5%, from an average 69 rigs in 2016 to 120 rigs in 2017.

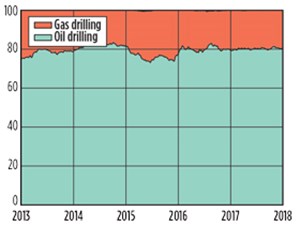

Other states with shale development activity also encountered significant percentage growth, including Colorado (69%), North Dakota (45%), Ohio (74.5%), and Pennsylvania (82.5%). Though states with large gas plays, like the Marcellus and Utica, also are experiencing growth, the overall ratio of rigs targeting gas plays versus rigs targeting oil plays has remained fairly consistent, with an estimated 80% of rigs still targeting oil and 20% targeting gas.

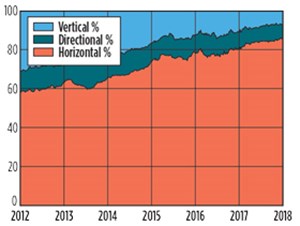

States with slight annual declines include Alaska, Indiana, Kansas, Kentucky, Mississippi, Nebraska and Nevada, as well as Texas District 5. Another indicator of the preference for unconventional activity is how the number of horizontal rigs has grown, garnering 86% of market share. Directional and vertical rigs split the remaining 13% of drilling activity.

Operators lately are resisting large-scale deepwater developments because of volatility in oil prices, preferring short-cycle onshore developments that can turn a profit in a matter of months. As such, the U.S. offshore rig count was down about 10% in 2017, from an estimated 22.5 rigs in 2016 to about 20 rigs in 2017. ![]()

Related Articles

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- The last barrel (February 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)