Better days ahead, as industry sits on brink of recovery

The past year has been marked by rising rig counts, rising oil prices, and rising oil and gas production. The worst of the downturn that struck the E&P sector in 2014 is over, and the recovery is now progressing. Operators are producing hydrocarbons more efficiently than ever before, primed to capitalize on favorable crude prices in 2018, with OPEC’s cooperation.

As upstream activities continue to expand in North America, demand for oilfield services is also increasing, which will help service companies begin to garner more pricing power during 2018. In fact, onshore activity picked up so much in 2017 that the oilfield services sector is still struggling to keep up. A build-up of drilled-but-uncompleted (DUC) wells has inhibited the U.S. rig count’s growth rate in the last six months, and a shortage of pressure pumping crews has caused a bottleneck in hydraulic fracturing activity. Though drilling and production activity is increasing throughout much of the U.S., the country’s top focus will remain the Permian basin, and any meaningful recovery in the offshore sector still seems to be on hold.

These market factors have been confirmed through World Oil’s surveys of U.S. operators and state agencies. Thus, World Oil forecasts the following for 2018:

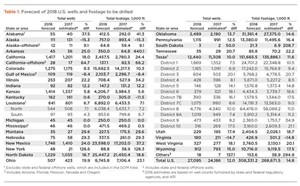

- U.S. drilling will increase 12%, to 27,095 wells, Table 1

- U.S. footage will jump 14.8% higher, to a total of 308.3 million ft of hole

- Offshore drilling in the U.S. Gulf of Mexico will slip 8.4%, to 109 wells

- While some areas, like the Permian basin of Texas, the SCOOP/STACK plays of Oklahoma, and the Marcellus/Utica shales of the Appalachian states will thrive, the states with larger shares of conventional activity—such as Alabama, Arkansas, Kansas and Mississippi—will continue to struggle.

U.S. MARKET FACTORS

Upstream activity in the U.S. has been stimulated by growing oil prices, as operators increased capex in 2017 and are expected to continue expanding budgets during 2018. Natural gas demand also will play a part, as the U.S. became a net exporter of the resource in January. Operationally, companies are becoming better at extracting unconventional oil and gas. They are leveraging lessons learned during the recent downturn to drill for, and produce, hydrocarbons more economically—drilling shale wells with increased depths and lateral lengths, and completing wells with greater proppant volumes.

Oil and gas prices. Brent and WTI prices have risen substantially since January 2017, from around $50 to $55/bbl in the early part of last year, up to around $60 to $70/bbl in the last two months. A major driver for this is the sustained effort by OPEC and Russia to continue with oil supply cuts into the foreseeable future, although shale oil production has trended upward along with prices. With a vast array of acreage that operators can choose from in the U.S. Lower 48—each with a different break-even oil price level—shale activity has insulated price growth in the past year. The limits of shale geology are sure to be tested in 2018, as service costs rise along with increased activity, which could make greater investment in these unconventional regions less attractive.

Though natural gas pricing has been more volatile in the past year, the Henry Hub spot price spiked from a low of about $2.600/MMBtu in December 2017, to a high of about $3.200/MMBtu in January 2018. Demand for natural gas should remain substantial, as the U.S. prepares to increase its LNG export capacity. The U.S. has one export facility, the Sabine Pass terminal in Louisiana, but at least two new LNG export facilities are planned to launch during 2018. As long as free trade of energy between the North American countries remains intact, the U.S. is looking to increase its supply of natural gas via pipeline to Mexico. Net exports of U.S. gas are estimated at 0.4 Bcfd in 2017, up from net imports of 1.8 Bcfd in 2016, according to the EIA.

Capex. Not surprisingly, U.S. E&P spending is projected to continue increasing during 2018, following the recent gains in commodity prices. Investment banking firm Evercore ISI forecasts U.S. capex to increase an estimated 15% in 2018, according to the company’s December 2017 outlook. The report says that while 2018 will be a year of consecutive improvement when it comes to upstream spending, capex levels are still expected to sit below 50% of peak-2014 spending levels. Turn to page 33 for more details.

Oilfield service companies look to keep pace with demand. With capex increasing in 2018, a meaningful uptick in business for oilfield service companies is inevitably on the way, as well. However, the growth is expected to look different than oilfield service activity trends have traditionally appeared. Though the average monthly U.S. rig count increased nearly 67% year-over-year from 2016 to 2017, the rise in drilling rigs began to stagnate in late 2017, and rig count levels could remain steady for the first half of 2018, barring any sudden spikes in oil prices.

Operators learned to squeeze more production out of each well—by high-grading acreage, drilling longer laterals and pumping higher proppant volumes. These tactics have lessened the need for a large volume of wells to substantially increase production. For example, while the U.S. rig count is nowhere close to its level in summer 2014, production is soaring, and has surpassed 10 MMbopd. In fact, U.S. crude production could even average 11.2 MMbpd during 2019.

Yet, operators also need to address a rising DUC count before planning any vast drilling project expansions. Austin-based research firm DrillingInfo defines DUCs as wells that have been drilled and remain uncompleted for more than six months. For instance, as of December, the firm had a count of about 539 Permian DUC wells, and the company tracked an average of about 30 new DUC wells per month in the region during 2017. While a big buildup in DUC wells may not be great news for drilling contractors, it does mean that the services of hydraulic fracturing providers will be in high demand during 2018. Rates for fracing crews grew 30% in 2017, and could grow by as much as 10% in 2018, according to IHS Markit.

Infrastructure. There has been a push recently to add pipeline capacity, to deal with increased supplies of hydrocarbon energy to Mexico. In December 2017, Texas Railroad Commissioner Ryan Sitton told World Oil that he expects about 600,000 boed of added transport capacity in Texas by 2019. This is added infrastructure that will be necessary to help the Permian reach its production potential, and also as support in case of pipeline interruption, such as what occurred during Hurricane Harvey last August.

U.S. FORECAST

Drilling rigs may not be added as rapidly in 2018 as was observed in early 2017, but as long as oil prices continue higher, operators will drill more wells. With more operators turning to multi-well pads in shale plays, companies are also drilling more wells with less rigs. The Permian is expected to continue to drive drilling growth, but the number of wells drilled will also climb in other major plays, such as the Bakken, Utica, Marcellus and Haynesville. Offshore activity remains depressed, with more operators steering capital toward shale development in lieu of deepwater megaprojects. Therefore, World Oil forecasts a 12% increase in overall U.S. drilling activity in 2018, up to 27,095 wells drilled. Total footage in the U.S. is also expected to increase 14.8% to 308.3 million ft, indicative of the long laterals that operators are drilling.

Gulf of Mexico. One other problem in an otherwise bright forecast is the Gulf of Mexico (Fig. 1), where activity remains stuck at historically low levels. Last year, activity was down 17%, with just 119 wells drilled. Given the higher oil prices—and assuming they stay above $60—there is certainly the potential for activity to begin trending upward in the Gulf. But even as operators look at sanctioning new development projects, it is going to take a while for these long-term efforts to get underway. So, in the short run, we are calling for an 8.4% decline.

Operator surveys. World Oil surveyed 15 major U.S. drillers (integrated companies and independents with large drilling programs) and 105 independent operators (a cross-section of small- and medium-sized firms) working in various states. Together, these two groups represent 16.6% of all U.S. drilling in 2017 and 16.2% of all activity forecast for 2018, Table 2.

Among the companies surveyed, 4,019 wells were drilled nationwide last year, of which just 2.9% were exploratory. This year, these firms will increase their drilling 9.1%, to 4,385 wells, including 155 for exploration (+33.6%). Last year, 2,821 (70.2%) of the total wells were horizontal completions. This year, that share will actually shrink slightly, to 68.9%.

In addition, 83.4% of all wells drilled by the survey group last year were oil-directed. This year, that figure will be one point less, at 82.4%. Average footage drilled per well among surveyed firms was 12,197 ft, and this figure is expected to rise slightly this year to 12,233 ft.

STATE-BY-STATE ACTIVITY

Texas. Drilling activity in the Lone Star State is projected to grow 10%, and each district should exhibit improvement. By far, District 8, in the heart of the Permian basin (Fig. 2), will garner the largest volume gain, from 4,340 wells drilled in 2017 to a forecast 4,776 wells in 2018, a 10% increase. Other districts that encompass the Permian are also expected to experience growth, with activity in District 7C projected to increase 8.6%, to 1,075 wells drilled, and District 8A will post a 7.4% gain, to 1,019 wells.

A notable uptick is also expected for the Eagle Ford shale’s oil and gas plays, and for conventional drilling. Districts 1, 2, 3, 4, 5 and 6 are forecast to experience a combined 10% growth over 2017, up to 4,391 wells drilled this year. Drilling in District 7B, which holds the Barnett shale, is forecast to grow 16.1%. A 17.5% increase is expected for District 10, to 316 wells.

Oklahoma. The SCOOP and STACK plays may be the most interesting areas for shale development outside of the Permian basin in the entire U.S. So far, the region is still dominated by large and mid-sized independent oil companies. Though these plays haven’t gained the notoriety of the Permian, wells in the SCOOP/STACK can achieve prolific production rates—some of the best in all of North America. As such, World Oil predicts an annual 13.7% gain in drilling activity for Oklahoma during 2018, up to 2,489 wells drilled.

Louisiana. The Haynesville gas play in the northern part of the state could ramp up, as the U.S. increases efforts to export LNG around the world. Consequently, we expect northern Louisiana to be up 7% this year. On the other hand, the southern half is still struggling, where there is a higher proportion of conventional oil activity. Overall, we expect Louisiana to increase a little under 7%, to 641 wells, with footage rising proportionately.

New Mexico. Though the Land of Enchantment holds much of the western portions of the Permian basin, it has not yet seen the same activity boosts that have taken place in West Texas. However, that started to change in 2017, and it should continue to improve during 2018. Due to its Bone Spring acreage, within the southeastern part of the state, New Mexico is expected to reap an annual 24% gain in drilling activity during 2018, up to 1,748 wells drilled. Nationally, this forecast would put New Mexico in third place for wells drilled, behind World Oil’s predictions for Texas and Oklahoma.

North Dakota. The Bakken is still a steady basin with the richest production on America’s Great Plains. Accordingly, North Dakota’s drilling activity is expected to grow from 1,035 wells in 2017 to 1,229 in 2018, an 18.7% increase. While we don’t see it posting any major performance gains in the near future, North Dakota remains a consistent crude producer, led by such Bakken operators as Continental, Hess and WPX. And the average lateral length is now pushing beyond 10,000 ft, hence the average footage drilled per well is now up above 20,000 ft.

Northeastern states. Drilling in the Marcellus and Utica plays remains strong, and operators have continued to drill longer laterals to generate increased gas production. As a group, these states will be up nearly 17%. Individually, Pennsylvania drilling will be almost exclusively for shale, and the state will be up about 13%. In Ohio, activity will jump about 20% higher, as activity continues to be a mix of Utica shale wells and conventional, shallow oil drilling. And in neighboring West Virginia, gas-targeted activity dominates, with an 18% gain expected.

Rocky Mountain states. In the Rocky Mountain region, the main states are all in various modes of recovery. Overall, they will be up nearly 12% this year. In Colorado, activity will be driven upward by the Niobrara shale and DJ basin, along with a share of drilling in the San Juan basin, in the southwestern part of the state. We see drilling rising more than 8%, to nearly 1,300 wells. Westward in Utah, operators are bringing back activity to such plays as the Uinta basin. Drilling in the state will be up 17.4%. And Wyoming continues to recover from historically low levels, driven by a mix of oil- and gas-directed activity. We expect the state’s drilling to gain 15%, to more than 900 wells.

California. Drilling activity in the Golden State has improved considerably after suffering an 80% reduction during the 2014–2016 period. This year, onshore operators are expected to expand drilling 18%, to more than 1,400 wells. And offshore California, we expect a 65% increase in activity, from 17 wells last year to 28 this year. As has been the case for some time now, the vast bulk of Californian drilling is accounted for by just several firms, drilling primarily in the state’s heavy oil fields.

Alaska. Up in Alaska (Fig. 3), onshore activity on the North Slope will slow down a bit, while offshore work in the Cook Inlet remains fairly steady. We expect a 13% decline in drilling, overall, down to 123 wells. One notable project is Eni’s construction and use of an artificial island just off the northern Alaskan coast in the Beaufort Sea. Late in December, the company spudded its first exploration well from the island, and it will be an extended-reach effort that could total up to 30,000 ft of hole.

U.S. POLITICAL ISSUES/PRIORITIES

With a new administration in place, along with a changed attitude regarding the oil and gas industry, the U.S. government has begun to change course, when it comes to its direction on hydrocarbon energy. Friendly policy decisions could help bolster increased activity in 2018, as the Trump administration continues its quest to promote American “energy dominance.” However, questions remain regarding how the administration will treat its trade agreements, namely the North American Free Trade Agreement, which many believe is vital to the U.S. energy industry. ![]()

- The last barrel (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- Executive viewpoint: TRRC opinion: Special interest groups are killing jobs to save their own (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)