ShaleTech: Marcellus/Utica Shales

While the deep freeze that ushered in 2018 across much of the U.S. spiked record gas prices in the Northeast, operators targeting the low-cost Marcellus and Utica shales are more emboldened with the prospect that additional takeaway capacity will help sustain the momentum when the weather warms and demand cools.

As producers await the start-up of two gas pipelines in the once coal-dominated Appalachia basin—and their nearly 5 Bcfd of collective capacity—January’s Arctic blast triggered unprecedented withdrawals and prices. At a trading hub in pipeline-allergic New York state, spot gas prices hit a record $140.52/MMBtu on Jan.5, according to the U.S. Energy Information Administration (EIA). By comparison, EIA data had spot prices on Louisiana’s Henry Hub benchmark peaking at $6.24/MMBtu on Jan. 3, before retreating.

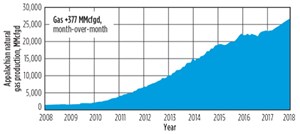

Appalachian operators are responding in kind, with the EIA estimating that February shale gas production from the Pennsylvania, Ohio and West Virginia fairways will reach 26.778 Bcfd (Fig. 1), up from the estimated 22.547 Bcfd delivered in February 2017. In the latest earnings report, Houston’s Southwestern Energy Co., for one, delivered company-record production of nearly 2.4 Bcfed during third-quarter 2017, a 42% increase for the like period of 2016. Southwestern controls 567,368 net acres in northeastern Pennsylvania and northwestern West Virginia. The firm initiated production on 17 Marcellus and one Utica well in West Virginia, joining 15 Marcellus wells put online in Pennsylvania during the quarter, with average total cost of $7.2 million/well, normalized for 8,093-ft laterals.

Drilling activity and associated lateral lengths, likewise, increased appreciably, holding at a relatively steady 76 active rigs throughout January, according to Baker Hughes, which tallied 60 active rigs last year. The principal Marcellus fairways of Pennsylvania and West Virginia led the way, with a 50-rig average. The remaining 26 rigs were drilling the underlying Utica, often co-developed with the Ohio-centered Point Pleasant limestone-shale. Utica-focused Gulfport Energy Corp. was running four of the 28 rigs on its 213,000-net-acre Ohio leasehold. After drilling 23 wells in the third quarter, with production averaging 987.2 MMcfed per well—a 38% year-over-year jump—the Oklahoma operator expected to exit 2017 with the drilling of 99 Utica wells.

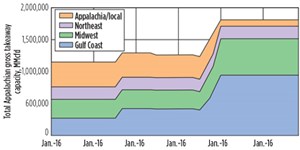

With a measure of takeaway relief on the horizon (Fig. 2), the new wells and production come at an opportune time. The second phase of Energy Transfer Partners’ Rover and Williams’ Atlantic Sunrise pipeline networks, designed to move 3.25 Bcfd and 1.7 Bcfd, respectively, are scheduled to begin accepting gas in the first half of 2018. The duo is among multiple pipeline projects in various stages of development, which operators are counting on to eventually eliminate differentials that have partly offset wellhead break-even prices as low as $2/Mcf.

“I think that analyst investors, and people as a whole, expect those differentials to narrow quite a bit with all the new pipe coming on,” says Glen Warren, Jr., president and CFO of Antero Resources Corp, which expects to operate six to seven rigs and three completion crews in 2018, across a 485,000-net-acre Marcellus leasehold in northern West Virginia and southwestern Pennsylvania. Antero also is running a single rig and completion crew on the 151,000 net acres under its control in the eastern Ohio Utica play, where four horizontal wells drilled in the third quarter averaged 17,000-ft laterals.

More than half the new pipeline capacity coming online this year, “will be immediately used by simply redirecting volumes out of the current local sales to better markets,” says Jeff Ventura, CEO of Marcellus first mover Range Resources Corp.

Sidestepping the takeaway issues and the rhetorical truce on the so-called “war on coal,” electrical generation companies are rushing to build new gas-fired power plants directly at the fuel source. A major beneficiary is Cabot Oil & Gas Corp., the supplier for two power plants expected to go online this summer near its tightly-concentrated 179,000-net-acre position in Susquehanna County, Pa. Together with dedicated volumes as part of its equity stake in Atlantic Sunrise, Cabot is on track for Marcellus production growth of 27% to 33% by 2019.

Production averaged 1.706 Bcfd in the third quarter, during which Cabot drilled 13.2 net Marcellus wells. Cabot expects to drill between 85 to 90 wells in 2018, with plans calling for a third rig and second frac crew to join the fleet in the first quarter, a spokesman said. The company had forecast the drilling of 60 wells in 2017.

“INFLECTION POINT”

Meanwhile, Range Resources has entered what Ventura describes as “clearly an inflection point in what has, in essence, been a decade-long commissioning of the largest gas field in the country.” With some 900,000 net acres across Pennsylvania, covering the Marcellus’ wet and dry gas windows, Range plans to run no less than five rigs this year. The Fort Worth, Texas, independent drilled an estimated 113 wells in 2017, a third of which were on its more than 200 multi-well pads in Appalachia.

Range singled out nine pads completed last year in its southwest Marcellus position, which averaged 4.5 wells/pad, producing on average approximately 34.3 MMcfed/well. With lateral lengths ranging from 9,247 to 11,634 ft, the new pads reflect the planned 2018 drilling strategy that calls for horizontal reaches averaging at least 10,000 ft. Lateral lengths in the third quarter averaged more than 11,700 ft, compared to the less-than-6,171-ft average in third-quarter 2016, the company said.

“Importantly, drilling costs per lateral foot in the third quarter of 2016 were $302 and in 2017 are $202/ft, which is a 33% decrease. This means we drilled 90% longer laterals at 33% less cost per foot than a year ago,” COO Ray Walker told analysts on Oct. 25.

CNX Resources Corp., the spun-off gas business of coal miner CONSOL Energy Inc., likewise, is going full-bore in its first year as a stand-alone company, with 75 new Marcellus and Utica wells set for 2018. CNX enters the year with three rigs and forecasted drilling of 55 Marcellus wells within its legacy Morris field in southwestern Pennsylvania. Along with five new wells on tap in West Virginia, CNX plans to drill seven Utica wells in Ohio and eight in Pennsylvania, where it continues to delineate the Keystone State’s deep Utica dry gas potential. A pair of offsets to the pacesetting Gault well in Westmoreland County were completed late last year, each delivering 35-day production rates of 25 MMcfd under restricted choke. “Given the continuation of extraordinary results of these dry Utica wells, at substantially lower capital costs, compared to our initial (Gault) well, we have successfully proven the commercial viability of developing the deep dry Utica shale in Pennsylvania,” says COO Timothy Dugan.

CNX closed out 2017 expecting to drill 35 Marcellus and Utica wells across a 584,000-net-acre position. Year-end production estimated at 1.4 Bcfed puts the company on pace to reach its cumulative 2018 production guidance of 520–550 Bcfe.

Following its Nov. 29 spin-off from CONSOL, CNX’s midstream entity acquired Noble Energy, Inc.’s 50% stake in CONE Gathering LLC. and promptly dedicated 63,000 Utica acres to help exploit stacked pay opportunities in southwestern Pennsylvania’s deep dry gas core.

In a related development, just as Noble removed the last vestige of its Appalachia basin footprint and PDC Energy Inc. on Sept. 25 put its 67,000-net-acre Utica leasehold up for sale, the U.S. investment arm of Thailand’s Banpu Pcl, a major coal and power generation company, continued to gobble up Marcellus assets. Kalnin Ventures LLC in December acquired 35 producing wells and 60,000 net acres in Wyoming County, Pa., from Warren Resources, Inc., for $105 million, marking the fund’s sixth Marcellus acquisition at a total investment of $522 million.

LONG IS IN

Drilling chart-busting horizontal wells has become habitual for Pennsylvania’s Eclipse Resources Corp., which last year broke its own world record for the longest shale laterals, three times no less. On Nov. 12, Eclipse referred investors to its Mercury B 5H Utica well in southeastern Ohio, “recently drilled” with a record 20,800-ft lateral. The well, uncompleted as of mid-January, was drilled in 13 days at a measured depth (MD) of 28,775 ft, said Executive V.P. and COO Oleg Tolmachev.

The new record-setter eclipsed the Outlaw C 11H well drilled last June to 27,750 ft, MD, with a 19,500-ft lateral, surpassing Eclipse’s 19,300-ft-lateral Great Scott 3H well, drilled a month earlier, also in the Utica condensate fairway of Guernsey County, Ohio. Completed with Eclipse’s Gen 3 slickwater, high-proppant-loading completion strategy, the long-reach duo averaged combined initial production (IP) rates of 6,600 boed in the fourth quarter. Total well cost was estimated at $750/lateral ft.

Eclipse plans to continue a two-rig program, at least in the early going of 2018, and drill 139 wells in Pennsylvania. The firm says most of its new drills will average laterals of just over 16,000 ft, making “super lateral” an outmoded designation. Of the 10 gross wells drilled in the third quarter, four averaged lateral lengths exceeding 17,500 ft. “We probably will stop using the term ‘super lateral’ at some point, and just use the term ‘lateral,’ because we’ve gotten to the point where, whenever possible from a land perspective, every single well will be in that ballpark range, if not longer,” says Co-Founder, President and CEO Benjamin Hulburt.

The company expanded its aerial reach in Ohio and Pennsylvania to 159,920 net acres with December’s $93.7-million acquisition of 44,500 net acres and associated production from Travis Peak Resources, LLC.

Production averaged 310.409 MMcfed for the first nine months of 2017, compared to 219.605 MMcfed for the like 2016 period. Eclipse was expected to begin production in January on its stacked pay Stalder pad, designed to further validate the condensate-rich Marcellus footprint in eastern Ohio. The pad includes two Marcellus condensate and three Utica dry gas wells.

Elsewhere, EQT Corp., fresh off the $6.7-billion acquisition of Rice Energy Inc. in November, hopes to partly replicate Eclipse’s Utica strategy in the Marcellus. As its Haywood H18 well went onstream in Washington County, Pa., in December, purportedly as the longest lateral well completed in the Marcellus at 17,400 ft, EQT said 27 of the estimated 139 Marcellus wells to be drilled this year will have lateral reaches of at least 17,000 ft. Operating a 10-rig (Fig. 3) and 10-frac crew program, EQT expects to drill 111 wells in Pennsylvania and 28 in West Virginia in 2018, at average lateral lengths of 11,800 ft. EQT also plans to drill 38 gross (25 net) Utica wells on its 65,000-net-acre Ohio leasehold.

Largely contiguous to EQT’s pre-acquisition leasehold, the Rice deal comprised 421,000 acres in Pennsylvania, West Virginia and Ohio, along with associated production and midstream assets. EQT now holds just over 1.2 million net acres, with all but around 214,000 net acres within the Marcellus. The operator has earmarked 2018 Marcellus-Utica drilling and completion expenditures of $2.4 billion, up 60% over last year.

Correspondingly, in what is a boilerplate company-wide strategy, Utica pioneer Chesapeake Energy Co. credits its enhanced completions, featuring frac sand loadings of more than 3,000 lb/lateral ft, as driving up-to-50% increases in peak production rates. Chesapeake pointed specifically to two Upper Marcellus wells, put on production in September on its Maris pad in Susquehanna County, which delivered peak rates of just under 30.0 MMcfd/well, slashing the 18.7 MMcfd produced in its previous Upper Marcellus record well. Chesapeake says super-sized Utica completions also have yielded a nearly 25% increase in 120-day cumulative production. As of November, Chesapeake was running two rigs and two frac crews in the more-than-1.8 million acres that it has under lease in Ohio and Pennsylvania.

Concurrent with now-ubiquitous elongated laterals and juiced-up, multi-stage completions, IHS Markit predicts 2018 will go down as a record for frac sand consumption in the Appalachia basin, increasing to 22.3 billion lb from the estimated 17.3 billion lb pumped in 2017. Spiraling sand demand notwithstanding, recent well results suggest the markedly higher conductivity of ceramic proppant is a more sustainable option for coping with the tremendous downhole stresses that these wells generate, says Don Conkle, CARBO vice president of marketing and sales. “The most recent long-term deep Utica data we have continue to show about a 30% production and recovery uplift by using ceramic proppant as opposed to sand,” he said. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- The last barrel (February 2024)

- What's new in production (February 2024)

- Using data to create new completion efficiencies (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)