Rebalancing of markets and a new U.S. administration will speed recovery

The two-year oil price decline, and resulting plunge in activity and downsizing of assets and personnel by industry companies, appears to be over. Now, the industry is preparing to get back to work. A combination of OPEC’s quota deal in late 2016, along with lower North American oil production, service/supply cost reductions, high-grading of prospects by operators, and operational efficiencies, has done much to prop up oil prices and encourage a rebound in activity.

Data indicate that U.S. production has hit bottom and is slowly increasing again, averaging 8.9 MMbopd in fourth-quarter 2016, up from 8.7 MMbopd in the third quarter. However, North America may have to continue in its new role as swing producer, and thus may be required to remain flexible. For instance, in West Texas, various analysts believe that Permian basin production is about 2.1 MMbopd, yet the region has the potential to double output. Nevertheless, based on the closing gap between supply and demand, the price of oil should continue to move upward.

Accordingly, given current economic realities, and the analysis of our surveys of U.S. operators, U.S. state agencies and international petroleum ministries/departments, World Oil forecasts the following:

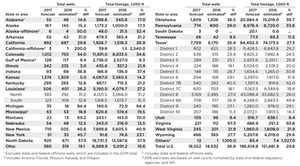

- U.S. drilling will jump 26.8% higher, to 18,552 wells, Table 1.

- U.S. footage will increase 29.8%, to 196.6 MMft of hole, Table 1.

- U.S. Gulf of Mexico E&P activity, focused on deepwater projects, will go up approximately 9.4%, with increasing well depths and footage.

- Among the largest U.S. operators, some that had minimal drilling programs during 2016 will double and triple their activity this year.

U.S. MARKET FACTORS

The U.S. upstream market is a complex combination of technical, financial, political and logistical factors. What follows is a short discussion of some major factors affecting activity.

Cycles. During a recent presentation to IPAA’s Supply & Demand Committee, IHS Energy’s chief upstream strategist, Bob Fryklund, noted that the global upstream industry has alternated between bull and bear cycles over the last 57 years. Since 1960, there have been five discernable bull/bear runs, and we are in a third bear cycle. Fryklund said there have been two bulls, but the duration of the bear cycles has been longer, as follows:

1960–1972, bear cycle

1973–1980, bull cycle

1981–1998, bear cycle

1999–2012, bull cycle

2013–????, bear cycle

There is considerable debate as to whether the current bear cycle is already ending or will drag on for a while longer, and what the criteria are for declaring an end to the cycle.

Market drivers. The combination of OPEC’s recent quota deal and a modest global oil production deficit should result in a slowly rising oil price during 2017–2018. Yet, it is likely that the industry will not see a sustained price above $60/bbl through fourth-quarter 2018, unless an unforeseen event (like a war) occurs. While the U.S. EIA predicts average prices of $52.50/bbl for WTI and $53.50/bbl for Brent during 2017, we at World Oil think that the range may be somewhat higher, at $53.95 for WTI and $55.00 for Brent.

In natural gas markets, the U.S. landscape is dominated by Appalachian region supplies, not to mention associated gas produced from greater oil production across the country. According to EIA, the northeastern U.S. is expected to continue to add to reserves, which should result in strong output growth, all the way through 2030. Last year, marketed production, wet gas, averaged about 76.2 Bcfd. The problem is that the U.S. may have too much gas, and now the question is whether this commodity can crack the $4/Mcf barrier during the next several years. The introduction and growth of LNG exports is helping to soak up some of the supply. Accordingly, EIA is calling for an average 2017 gas price of $3.55/Mcf at the Henry Hub, while World Oil forecasts a rate of $3.47/Mcf.

Service sector recovery. The service/supply sector has been hit hard over the last two years, with more than 200 companies going out of business. Profits have been meager or non-existent, and oil price weakness right before OPEC’s quota deal in late 2016 probably delayed the sector’s recovery by another couple of months.

Meanwhile, operators have been squeezing equipment manufacturers and service firms for lower costs and greater value. According to IHS, this has resulted over the last two years in an average $30/bbl reduction in break-even prices for most plays. In the next 18-24 months, IHS predicts the $30/bbl cost reductions will shrink to $24.90, as follows, because service companies will not be able to maintain the recent cost-cutting pace.

Rigs. As of Jan. 20, 2017, the U.S. rig count was up 72% from its record low last May, said Baker Hughes. Given the outlook for U.S. well count, the number of active rigs should rise another 25% to 30% this year. Something to keep an eye on will be the trend among drilling contractors to retire older units and replace them with higher-spec rigs that operators are insisting on increasingly.

U.S. FORECAST

With the benchmark price of crude oil holding above $50/bbl, and natural gas trading in the $2.90–3.30/Mcf range, U.S. operators are putting rigs back to work in the Lower 48 at a fairly brisk pace. Much of the recovery will be in the shale plays, but improvement also will occur in shallow oil wells and conventional gas wells. Accordingly, World Oil forecasts a 26.8% jump in drilling, to 18,552 wells, Table 1. This will make 2017 only the third year since the mid-1930s to see drilling fail to exceed 20,000 wells, but activity is definitely heading in the right direction. Spurred by the Permian basin, Texas will account for 42% of all drilling.

OPERATOR SURVEYS

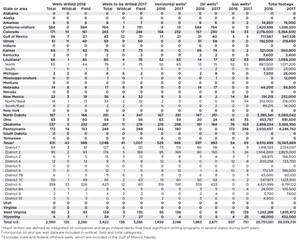

World Oil surveyed 12 major U.S. drillers (integrated companies and independents with large drilling programs) and 103 independent operators (a cross-section of small and medium-sized firms) working in various states. Together, these two groups represent roughly 16.5% of all U.S. drilling in 2016, and about 18.5% of all activity forecast for 2017, Table 2.

Among the companies surveyed, 2,390 wells were drilled nationwide, of which just 125, or 5.2%, were exploratory. This year, these companies will boost their drilling 43.2%, to 3,422 wells, including 136 for exploration (+8.8%). Last year, 1,459 (61.0%) of the total wells were horizontal completions. This year, that share will increase to 64.2%. In addition, 78.8% of all wells last year were oil-directed. This year, 78.1% of this group’s wells will be oil-directed. Average footage drilled per well in this group was 10,769 ft last year, and this figure is expected to rise during 2017, to 11,553 ft/well.

Last year, many of the smaller operators (and a few large ones) responding to World Oil’s survey gave up on drilling entirely. We are happy to report that many of these companies, given the improvement in oil prices (and in some cases, the lure of the Permian basin), have reversed course and are planning renewed drilling this year. In some cases, the increases are substantial.

GULF OF MEXICO

Activity has been at historically low levels in the Gulf over the last several years, and 2016 was the lowest yet, with just 117 wells tallied. Given low oil prices and still relatively high costs to operate in the province, exploration is suffering. And many potential development projects have been postponed. Yet, a core of deepwater development activity has continued, and it will again form the bulk of work in the Gulf. We project that drilling will increase about 9%, to 128 wells.

SHALE PLAY CONTRIBUTIONS

Among unconventional plays, the Permian basin will lead U.S. supply growth. The Bakken should retain a steady pace, but other smaller plays may seem some shrinkage in the short term. Meanwhile, a key piece of the supply situation is the need for additional infrastructure, particularly in the Marcellus shale and Permian basin. However, several transportation projects in the Marcellus region are moving slowly through the Federal Energy Regulatory Commission, stymied by a combination of permit delays, lower drilling activity, lawsuits, timelines stretched out by operators and opposition from environmental groups.

The major shale plays continue to generate most of the new onshore liquids production. EIA reports that in January 2017, new-well oil production per rig has risen to 1,395 bpd in the Eagle Ford, 1,251 bpd in the Niobrara, 968 bpd in the Bakken and 652 bpd in the Permian. In addition, EIA said that new-well gas production per rig has risen to 12.7 MMcfd in the Marcellus and 8.7 MMcfd in the Utica. It’s not a surprise then, that U.S. shale production has remained resilient and not declined at the rate of the rig count during the last two years.

STATE-BY-STATE ACTIVITY

Texas. Drilling in the Lone Star State will rise 26.4%, with double-digit increases expected for all 12 of the Railroad Commission districts. While the gains are being led by the Permian, with some additional recovery in the Eagle Ford, there is also significant improvement underway in conventional activity (Districts 3, 4, 6, 7B, 9 and 10). In addition, gas-targeted drilling is making a moderate comeback.

The Texas side of the Permian basin (Fig. 1) continues to be a hotbed of activity spurred by reductions in break-even economics. In 2016, operators drilled 3,198 wells in Railroad Commission Districts 8 and 7C, more than originally anticipated. For 2017, we expect to see 3,999 wells drilled in these districts, an increase of 25%. Average lateral length in the Permian has increased from about 4,000 ft in 2011 to more than 6,800 ft in second-quarter 2016. For 2017, the industry projects a 10% increase in average lateral length.

Now that oil prices have risen past the break-even figure of $48/bbl and gone above $50, drilling activity in the Eagle Ford shale of South Texas is showing signs of recovery. In the play’s predominantly oil portion, concentrated in District 1, activity should increase 28.3%. We predict that operators will drill 802 wells with an average TD of 14,250 ft. In the gas-heavy Railroad Commission District 2, operators have said they plan to drill 638 wells to an average TD of 15,400 ft, a gain of 23.9%.

Oklahoma. The developing SCOOP and STACK plays in western and south-central Oklahoma continue to draw attention from large and mid-level independents. During 2017, we predict that drilling in the state will increase 38.5% overall, with 1,809 wells scheduled. As Continental Resources noted in its recently released capital spending plan, new wells in its Oklahoma plays are able to generate rates of return, ranging from 55% to more than 100%, at prices of $55/bbl for WTI crude and $3.50/Mcf for natural gas. That’s good, because these wells are not cheap to drill. Continental said that in the STACK, its average, budgeted, completed well cost is approximately $9.0 million. Wells in the SCOOP window have an average, budgeted, completed well cost of $10.3 million.

North Dakota. The Bakken shale remains the driving force in North Dakota’s activity. Based on figures from state officials and our own survey of operators, World Oil forecasts that drilling will total 925 wells in 2017, accounting for 18.7 MMft of hole. Average well depth, including lateral sections, will be approximately 20,250 ft. Reflecting the industry’s concerted effort to get more bang for its buck, EIA reports that the average new-well oil production per rig in the Bakken has risen a remarkable 40%, from 690 bpd in January 2016 to 968 bpd in January 2017.

Louisiana. In the northern half of the state, several operators plan to increase activity in the Haynesville shale, to boost their natural gas reserves. Additionally, some small operators are drilling shallow oil wells. When it’s all put together, activity in the northern half will be up a stout 31.2%. In the state’s southern half, featuring conventional oil and deep gas wells, activity is recovering at a more measured pace. Wells drilled are forecast to increase 12.8%, to 123.

Northeastern states. Activity continues to remain resilient in this region dominated by the Marcellus and Utica shales. In Pennsylvania, operators plan to drill 774 wells for a 29% increase. Footage will total approximately 9 MMft, or 11,600 ft/well, which is 3.6% more footage per well than in 2016. In Ohio, drilling should increase 19.1%, to 380 wells, Fig. 2. Activity will be a mix of Utica shale wells and conventional, shallow oil drilling. And in neighboring West Virginia, gas-targeted activity is on the rebound, with about half of the wells targeting the Marcellus. Total wells should reach 245, up 21.9%.

Rocky Mountain states. With oil prices improving, regional activity is beginning to revive. As operators boost drilling in the prolific Niobrara shale, particularly in the DJ basin, Colorado’s wells drilled will rise 34.0%, to 1,012 wells. In addition, the state’s southwestern portion is benefitting from a rebound underway in the San Juan basin, where both oil and gas are showing new life, Fig. 3. That trend is spilling over into northwestern New Mexico, a state that is already on the mend in its southeastern counties, thanks to surging work in its portion of the Permian basin. New Mexico should see its wells drilled total 710, for an impressive 40.6% increase. And Wyoming is beginning to come back from extremely low activity, with both oil and gas improving, and a 27.7% gain to 466 wells forecast.

California/Alaska. It’s been a rough time in California, with activity last year plummeting to roughly one-fifth of 2014’s level. Yet, improving oil prices are spurring a drilling rebound in the state’s heavy oil fields. The vast bulk of California’s drilling is accounted for by just four firms. Overall, the state will improve about 30%, to 892 wells. In Alaska, field projects are on a more long-term basis, so activity fluctuations have not been as great as those experienced by other states. Steady oil development work continues on the North Slope and in the Cook Inlet, helping to push drilling up 15.2%, to 167 wells.

U.S. POLITICAL ISSUES/PRIORITIES

As the last eight years have shown, the U.S. regulatory climate can have a major impact on the upstream industry’s operations and activity levels. The new Trump administration has stated that it intends to support American energy production while reconsidering and/or altering many recent federal regulatory and permitting actions extensively. Several key areas have been identified to help guide energy policy.

Federal drilling/production regulations. Additional federalizing of oil and gas production remains an ongoing challenge. State programs already in place have demonstrated that cost-effective, environmentally protective regulation can manage oil and gas production without more federal intervention. Nevertheless, we expect fossil fuel opponents to continue to lobby to federalize regulations through petitions and litigation.

Air emissions. The Clean Air Act provides some of the most widespread regulatory authority that affects the industry. In recent years, revisions to the Ozone National Ambient Air Quality Standard, EPA methane regulations, and BLM venting/flaring regulations, have openly targeted oil and gas production. Industry is pursuing efforts to address the excesses of these regulatory programs.

Endangered Species Act (ESA). This act continues to be a persistent problem. Its scope, and its potential to cause litigation forcing listing decisions, remains a key issue. Some of these challenges should be more manageable with a Trump administration that is concerned with growth and a strong economy.

Tax reform. The newly installed Trump administration and Republican leadership have prioritized tax reform in the 115th Congress. Bolstering tax provisions for intangible drilling costs and depletion allowances has, historically, successfully encouraged capital investment by U.S. operators. ![]()

- The last barrel (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- Executive viewpoint: TRRC opinion: Special interest groups are killing jobs to save their own (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)