Regional Report: Permian Basin

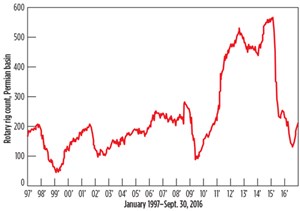

How many times has the Permian basin gone bust? In June 1985, we were pretty sure it was finished, when the rig count for Railroad Districts 7C, 8, and 8A bounced off a very hard bottom of 226 rotaries. There were 1,821 active U.S. rigs; the basin accounted for about 12.5% of them. Down from $39/bbl in 1981, we were starving on $11 in 1986. The bumper sticker, “Stay alive ‘til ’85,” had let us down.

As 2016 unfolded, there was a déjà vu feel in the air. Like 1986, the prior year made a lousy starting point. Oil prices that had started downward in 2014 dipped below $40 by December 2015. Revenue fell 50% in less than a year.

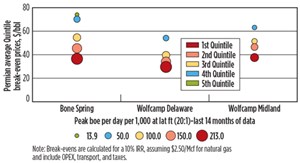

Nevertheless, the Permian basin exhibited remarkable resiliency in the midst of an industry Armageddon. To that, it owes geology and infrastructure. Much of the geological impetus is found in the familiar tight oil sands and limestones of the Spraberry, Bone Spring and Wolfcamp. Drilled laterally, wells in these formations can yield a break-even price that may be in the mid-to-upper $40s (Fig. 1), says IHS Markit. While that price point varies, it’s enough to make the Permian basin a relatively attractive investment for many.

In a late-September interview with Bloomberg, Pioneer Natural Resources’ CEO Scott Sheffield predicted that 100 oil-directed rigs will be added in the Permian basin over the next year.

As good as that sounds, not everyone agrees. In mid-September, BP CEO Bob Dudley told Bloomberg that he would rather invest in Argentina’s shale oil fields than in the Permian basin. The report quoted Brewin Dolphin analyst Iain Armstrong, who said, “I’m not surprised, because valuations in the Permian have become expensive.”

THE NUMBERS GAME

The U.S. Energy Information Administration’s (EIA) Annual Energy Outlook 2016, projected that U.S. oil production would decline from 9.4 MMbpd in 2015, to 8.6 MMbpd in 2017. After 2017, EIA projects total production growing to 11.3 MMbpd in 2040, as crude oil prices recover from an annual average of about $50/bbl in 2017, to more than $130/bbl in 2040.

The Permian basin, which produces about one in every four barrels of U.S. oil, was the only unconventional liquids resource with significant year-to-year, per-well productivity gains in 2015. IHS Markit in January reported that peak productivity in the Permian had improved by more than 40% since third-quarter 2014, led primarily by the Bone Spring play.

In mid-October 2016, the EIA said production from the Permian basin would rise 30,000 bopd this month, to reach 2.012 MMbopd for November.

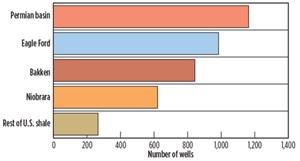

Consulting firm Rystad Energy believes that drilled-but-uncompleted (DUC) wells in the Permian basin (which has the largest inventory), from September and October 2016, will be sufficient to balance the declines from the Bakken and Eagle Ford plays. Thus, this will restore U.S. production growth in the last months of the year. Rystad’s analysis identified 1,200 DUCs in the Permian basin, about 1,000 in the Eagle Ford, and 850 in the Bakken, Fig. 2.

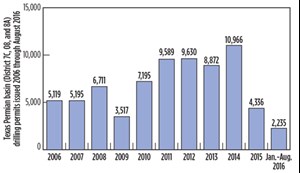

At the end of October, Baker Hughes tallied 212 Permian rigs (Fig. 3), down 17 from last year’s level. The U.S. land rig count was 535 versus 742 last year. Drilling permits, as of August, had reached 2,235, according to the Railroad Commission of Texas (RRC), and were half of last year’s total of 4,336. In 2014, 10,966 permits were issued, Fig. 4.

RRC said Permian basin oil production continued to rise and, as of the end of August, the figure was well ahead of 2015’s production rate. Output was 1,471,838 bopd, up 45,189 bopd from 2015. From 2014 to 2015, production increased

161,933 bopd.

Natural gas production is now declining. By July, production was at 21.108 Bcfgd, down from 24.021 Bcfgd in 2015, and 23.811 Bcfgd in 2014.

ART OF THE DEAL

Private equity and debt are major players in the Permian basin as properties change hands, assets are examined and re-examined, and wells are drilled. More than 35% of 2015 market deals were focused on the Permian basin, and were expected to increase into second-half 2016, said IHS Markit in January. The firm observed that “the Permian is single-handedly helping sustain activity, and has caused the region to become a hotbed of consolidation.”

Reed Olmstead, a senior manager at IHS, said, “Operators are looking to focus their money on areas that can generate economic returns at depressed oil prices, and the Permian keeps rising to the top, when you look at cost and performance. Permian deals skyrocketed in 2015, passing all other plays.”

In February, Bloomberg reported that Permian basin producers were “defying expectations they would fall victim to OPEC’s price war” in raising at least $2 billion over an eight-week period on the basis that they could profit with prices below $35/bbl.

The Permian really is “a diamond in the rough,” Gianna Bern—founder of Brookshire Advisory & Research in Chicago, and a former BP crude trader—told Bloomberg. “With the supply glut in the global market, these are challenging times for the entire industry, but the Permian is one place with the resources, ingenuity and engineering expertise to continue improving the cost structures.”

In August, Rystad Energy observed that nearly 70 rigs had returned to work in the Permian basin since early May, comparable to activity between second- and fourth-quarter 2015. Completions of DUCs were adding to the production. The company expected that Permian output would balance the declines in other plays, and restore growth in U.S. onshore oil production in November and December 2016. In contrast, said Rystad, Bakken and Eagle Ford operators had not increased fracing activity, with some waiting for a WTI price level of $55/bbl to $60/bbl.

By September, $27 billion had been spent on oil E&P mergers and acquisitions in the Lower 48, said Wood Mackenzie. Of that, $12 billion—or almost half—had gone to acquiring Permian land and assets.

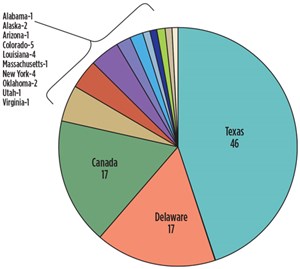

Debt load in this market is often not sustainable, helping fuel consolidation. From 2015 through Sept. 7, 2016, there was a total of 80 E&P bankruptcy filings; 46 occurred in Texas, where debt was about $30 billion, said Haynes & Boone, Fig. 5. The law firm has tracked 102 North American oil and gas producers that have filed for bankruptcy since the beginning of 2015. Including Chapter 7, Chapter 11, Chapter 15 and Canadian cases, they involve approximately $67.8 billion in cumulative and unsecured debt. This year, through Sept. 7, 58 producers have filed bankruptcy, representing about $50.4 billion in debt. Despite the recent spike in oil prices, said the firm, all indications suggest more producer bankruptcy filing will occur in 2016.

THE OPERATOR OUTLOOK

There is not much doubt about what operators are after. The old “stay alive ‘til ‘85” meme still rings true. The key to staying alive is driving down cost, optimizing processes, picking the right prospects, and finding a way to fund it. Multi-well pad drilling, long laterals and frac optimization are a few of the answers, along with buying and selling assets.

Occidental Petroleum (Oxy) said it would operate four to five rigs in the last half of 2016. The strategy of the Permian basin’s largest producer includes computer modeling to enhance recovery, productivity and field economics; minimizing decline; and growing its Permian Resources and EOR segments. It is emphasizing new technologies and applications, as well as improvements in execution and cost.

Oxy had 2015 net production in excess of 300,000 boed. About half of that comes out of EOR (145,000 boed) and 110,000 boed from unconventional assets. The company also has 12 processing plants and 1,900 mi of pipeline.

In reports to analysts, Oxy said it is shifting more capital to longer-cycle EOR, to take advantage of lower-cost materials and services. The inventory includes projects with F&D costs of $3/boe to $12/boe. Oxy said its Permian EOR projects operate at cash costs as low as $22/boe. They plan to increase CO2 injection capacity by 25% over the next five years.

Oxy’s Permian Resources business, with a 1.5-million-acre net position, planned this year to run two to four drilling rigs in development programs in Howard and Regan counties, in the Midland basin, and Reeves and Eddy (N.M.) counties in the Delaware basin. The company is integrating seismic and data analytics from producing wells to further evaluate its drilling inventory.

Permian Resources’ production grew 31% year-to-year, to 128,000 boed. Its drilling focuses on lowering economic requirements through reservoir characterization and optimization, improved productivity, reduced well costs and faster time to market. The company has a horizontal inventory of approximately 8,500 locations, with 3,400 locations that are economic at less than $60/bbl, and 350 that are economic at below $40/bbl.

A shift to manufacturing mode has significantly reduced well costs, said Oxy. Cost per 1,000 ft of perforated lateral decreased about 30%, from $1.72 million in 2014, to $1.06 million in second-quarter 2016. Average lateral length during the same period increased from about 5,100 ft to 6,800 ft.

Chevron reports its U.S. shale and tight production increased 50,000 bopd, due primarily to growth in the Permian’s Midland and Delaware basins. Continued growth is expected, Fig. 6. Permian production in the second quarter was 21%, or 24,000 boed higher than during the second quarter of 2015.

Its capital priority is to fund high-return, short-cycle base, shale and tight investments. The key emphasis is Permian operations, where Chevron said it has a large royalty-advantaged acreage position (85% with no or low royalties). The company added an additional rig in August, and expected to add four more, for a total of 10 rigs by the end of the year.

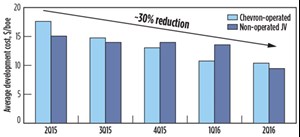

Since the second quarter of last year, Chevron said it has reduced Permian unit development costs per barrel by approximately 30%, Fig. 7. Recent pad drilling programs have improved drilling and completion costs. For 7,500-ft laterals in the Midland basin, Chevron said it is averaging $5.6 million per well, for a 25% reduction from March 2016 figures.

Recovery per well is improving, due to optimization of lateral lengths, well completions and drawdown strategies. Earlier this year, Chevron exceeded 2,000 boed in a 24-hr well test, on a 7,500-ft lateral well in the Greater Bryant G area. The company put its 100th operated horizontal well on production, and the experience further benefits acreage characterization and performance.

The company’s 2 million acres in the Permian include 1 million in the Delaware basin, and 500,000 acres in the Midland basin. The two basins had combined, 2015 net production of about 125,000 boed.

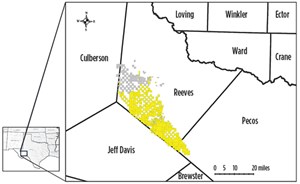

Apache Corporation announced its Alpine High discovery in early September. Located in the southern portion of the Delaware basin, primarily in Reeves County, Texas, the company estimates the find has 75 Tcf of rich gas, and 3 Bbbl of oil-in-place in the Barnett and Woodford formations, with significant oil potential in the shallower Pennsylvanian, Bone Spring and Wolfcamp formations.

Apache reports 4,000 ft to 5,000 ft of stacked pay in up to five distinct formations, and has identified 2,000 to 3,000 future drilling locations in the Woodford and Barnett.

Over the last 18 months, the company has accumulated 307,000 contiguous net acres—about 20% of Reeves County. The chronology starts with the 2014 acquisition of 55,000 acres, and the first phase of a 3D seismic survey. Two test wells were drilled in 2015, along with the acquisition of another 182,000 acres (Fig. 8), as well as a second round of seismic. This year, delineation wells 1-12 were drilled, Phase Three of the surveys was completed, and the company acquired 70,000 more acres, and finished stratigraphic delineation.

The latest count was 19 wells drilled and nine producing. Apache estimates there may be 3,000 locations, and that the Woodford and Barnett can support a six-rig program for over 20 years. Production is currently limited by infrastructure constraints. This includes six wells in the Woodford, one well in the Barnett, and one well, each, in the shallower Wolfcamp and Bone Spring oil formations.

Development well costs for a 4,100-ft lateral are estimated to be approximately $4 million per well in normally pressured settings, and $6 million per well in over-pressured settings.

In the greater Permian basin, Apache has about 1.75 million net acres, excluding the new Alpine High acreage. Mid-2016 production was 165,000 boed, with about 40% from unconventional resources. The company had a low decline in conventional assets in the Central basin platform, and unconventional growth in the Midland and Delaware basins. Apache has 193,000 net acres in the core of the Midland basin. Its Spraberry/Wolfcamp inventory has 700 locations at $50/bbl, and as many as 3,200 locations at $60/bbl. In the Delaware basin, Apache has about 420,000 net acres. A 12,000-acre plan has 200-plus locations being drilled in an ongoing five-year, two-rig program.

Pioneer Natural Resources plans to spend $1.9 billion of its $2.1-billion 2016 capital expenditure budget in the Permian basin, where it claims the largest acreage position in the Spraberry/Wolfcamp and leading production of 216,000 boed. Its operational strategy includes focusing each rig on a single interval, increasing multi-well pad drilling, casing design modifications, and optimized completions. Pioneer plans to increase its horizontal rig count from 12 to 17 rigs in the northern Spraberry/Wolfcamp in the second half of 2016.

In August, it acquired 28,000 net acres from Devon for $435 million, building on its 785,000-acre position in the Spraberry. Most of the acreage is in the core of the Midland basin. About 15,000 acres are located in the Sale Ranch area, where Pioneer drilled its most productive Wolfcamp B wells.

The company raised its production growth forecast for 2016 from 12% to 13%, based on Spraberry/Wolfcamp activity. The additional rigs will contribute to planned 2017 growth of 13% to 17%.

Completion optimization efforts are focused on contacting more rock closer to the reservoir. Pioneer said it has tested three design versions in this program. The third uses up to 1,700 lb/ft of proppant and 50 bbl/ft of fluid in a 15-ft cluster spacing, and 100-ft stage spacing.

Cost is increased by $500,000 to $1 million per well, versus the base design that uses 1,000 lb/ft of proppant and 30 bbl/ft of fluid, with 60-ft cluster spacing and 240-ft stage spacing. Despite the increase, Pioneer said its drilling and completion costs per perforated lateral foot in the northern Wolfcamp wells have decreased 35% since 2014. Their 100-well program planned to have 37 wells online by the end of second-quarter 2016.

Concho Resources has 1.1 million gross (690,000 net) acres in core areas of the Delaware basin, Midland basin and New Mexico Shelf, with 623.5 MMboe of estimated reserves. In September, it had 17 rigs running, calling it the largest rig program in the Permian. Concho is targeting upwards of 20% growth in 2017.

The company is focused on improving well performance through drilling completion optimization, multi-zone delineation, and transition to development mode, with more multi-well pads and long laterals. Multi-well pads were used for about 55% of the drilling program in second-quarter 2016.

In a 2016 report to analysts, Concho noted that it had reduced average well cost per lateral foot by 40% since first-quarter 2015, and achieved a 20% improvement, year-to-year, in feet drilled per day in the Midland basin.

QEP Energy Company expected to close in September on its June acquisition of approximately $600 million in Permian basin properties in Martin County, in the northern Midland basin. QEP said the purchase adds significant drilling inventory.

Memorial Production Partners (MEMP) sold some of its Permian basin assets for approximately $37.4 million, and had an agreement to sell properties in the Rockies. The Permian basin properties consisted of 285 gross (238 net) wells, which produced approximately 1,200 boed in the first quarter of the year. The assets have estimated proved reserves of 3.1 MMboe, or approximately 1% of the partnership’s total estimated proved reserves of 1,268 Bcfe. “Driving down costs, generating positive free cash flow and managing MEMP’s balance sheet is our key focus this year,” said John A. Weinzierl, MEMP board member.

Guidon Energy was formed in early 2016 to create an independent shale company focused on the liquids-rich Midland basin. In April of this year, the company acquired approximately 22,000 gross acres (16,000 net acres) in the core of Martin County, Texas. The company joins former Pioneer Natural Resources executive Jay Sills and Blackstone Energy Partners, a private equity firm. Investors have committed approximately $500 million of capital with more in the wings. Guidon said it will develop the leases through manufacturing-styled horizontal well development.

PDC Energy bought 57,000 acres from New York-based private equity asset manager Kimmeridge Energy for $1.5 billion, or about $21,000 per undeveloped acre.

Diamondback Energy, in July, bought 19,000 acres from Austin’s Luxe Energy for $560 million, or $27,000 per undeveloped acre.

Silver Run Acquisition, run by former EOG CEO Mark Papa, bought 38,000 acres from Centennial Resource Development for $1.38 billion, or $29,000 an acre.

Charger Shale Oil Company, and Oaktree Capital Management, said their JV had $600 million focused on the Permian basin, with an additional $300 million in the wings. Charger had previously secured 40,000-plus acres and has since closed on the initial acreage. They have plans to expand development to over 85,000 acres, and will ultimately have over 100 horizontal well locations across multiple horizons. ![]()

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)