ShaleTech: Australia-China shales

For at least one component, the monumental Australia-China free trade agreement got off to a less than auspicious start. The sweeping initiative went into force on Dec. 20, 2015, and as a new year unfolded, Australia’s LNG exports to its premier trading partner were facing stiff headwinds.

Just as the oft-delayed Gorgon LNG colossus is set to resume deliveries this summer, exporters must confront a rare drop in China’s demand for imported gas, which by year-end had declined 2%, reversing a decade of double-digit growth, according to a Jan. 14 article in the Australian Financial Review. “The economics of LNG at the moment are not very good,” Deloitte’s Brisbane-based National Oil and Gas Director Geoffrey Cann said in June.

The same also can be said of the near-term prospects for their respective shale sectors. While China has made inroads in developing its world-leading shale reserves, a cooling economy and the typical go-it-alone strategy of state-owned operators has the nation once more missing its once-ambitious production targets. To the south, operators in high-cost Australia show little indication of delivering any consequential shale production over the foreseeable horizon, even as LNG exports, ironically, raise fears of domestic gas shortages in its eastern states.

However, with respect to LNG, Cann believes China’s reduced gas demand is temporary, even as it shifts from an industrial-dominated to a more service-centric economy. “The story with China, as I would describe it, is driven by a commitment to clean up their air quality,” he said in an interview. “It’s a locally driven phenomenon, as the population is really unhappy with dirty air, and then there’s also China’s commitment to the Paris climate accord. Natural gas is really a small part of the China energy mix. Relatively speaking, it’s around 7% to 8%, but the Chinese have a commitment to get it to 10% by 2020. That’s a very big growth curve.”

To be sure, China has long proclaimed its intention to wean itself off coal and by 2014, annual domestic gas consumption had reached 193 Bcm, “making a significant contribution to reshaping the energy mix and facilitating a low-carbon economy in the country,” said Dr. Jin Zhijun, president of the Sinopec Exploration and Production Research Institute. Sinopec joins China National Petroleum Corp. (CNPC), the parent of PetroChina, and China National Offshore Oil Corp. (CNOOC) as the country’s Big Three producers.

Cann said the outlook for LNG exports to China also could get a major boost as Beijing looks to deregulate the natural gas utility market, and allow imports from companies other than the NOCs. Citing a Wood Mackenzie report, Cann said more than 20 parties in mainland China are eyeing LNG imports.

“China has announced a desire to deregulate its domestic natural gas utility business, which is dominated by state-owned enterprises that are slow and have a difficult time reacting quickly to government policy. Another element they’ve announced is opening up natural gas imports. This is a big deal as all (LNG) imports and the necessary infrastructure are now dominated by the Big Three, which makes it challenging to get access and permits,” he said.

“The direction of travel is pretty clear: A desire to get coal out of the mix and deregulation of their environment to open it up. This certainly appears to underscore there will be a growing demand for gas in China.”

However, despite the commitments of the Canberra and Beijing seats of power, it is doubtful that shale gas anytime soon will provide major contributions to Australia and China’s respective energy mixes.

AUSTRALIA REALITY CHECK

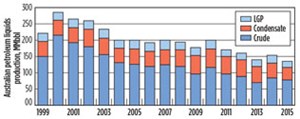

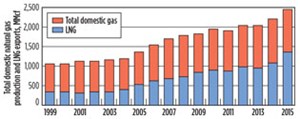

With oil on a persistently downward trend, gas will continue its domination of Australian production (Fig. 1), but it is unlikely that shale will play a significant role, as operators focus on conventional offshore and onshore assets.

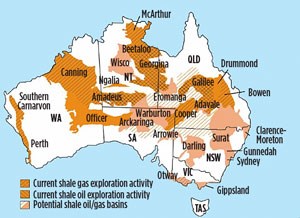

The U.S. Energy Information Administration (EIA) estimates prospective basins throughout Australia (Fig. 2) hold 437 Tcf and 17.6 Bbbl of unproved, technically recoverable shale gas and tight oil reserves, respectively. Yet, any suggestion that Australian operators will come even close to replicating the unconventional success of North America is wishful thinking, at best. “The shales here in Australia are not identical to those in the U.S., and the techniques that work really well, and have been perfected in North America, do not translate perfectly here,” says Deloitte’s Cann. “The shales here are considerably deeper, hotter and have higher pressures and different geological characteristics.”

Moreover, if the low commodity price environment was not sufficient deterrent, Cann said the dearth of unconventional-related services and enormously high operational costs put Australian shales at a huge disadvantage. “For example, there are very few frac spreads in Australia, so you don’t have the competitive dynamic. The shale resources also are very distant from the existing infrastructure, so mobilization and demobilization costs are enormous. If you wanted to frac a well in the Cooper basin, the costs to move your equipment there can be double, and sometimes triple, the actual costs of the spread itself. Some of the explorers also have told me that finding the right proppant characteristics is a challenge, as the weights (of deeper wells) tend to crush the readily available and proven proppant from other basins. So, you also would need to establish a proppant industry here,” he said.

“As there is very little infrastructure where the shales are located, to build the economies to go after the shales, you would need a very, very large resource that can sustain the construction of all the associated infrastructure. In Australia, for instance, we’re not talking about 20- to 30-km (12- to 18-mi) pipelines, but more like 2,000- to 3,000-km (1,243- to 1,864-mi) pipelines.”

There also is the matter of lease accessibility, which differs remarkably from the U.S., where drilling rights are negotiated between the operator and the typically private holder of the mineral rights. “Australia does not have the same land and tenure rules of the U.S., in that all land is crown-owned and subject to auctions and availability. That means only the larger players can participate,” he said.

Compounding the glaring economic drawbacks, operators also face a growing anti-frac movement, even as Canberra promoted shale as a key component of its 2015 national gas strategy. Despite growing concerns over impending gas shortages in eastern Australia, frac prohibitions have been enacted in New South Wales, Tasmania and Victoria, which in August is expected to rule on the continuation of its earlier imposed fracing ban. Surprisingly, the Northern Territory opposition Labor Party, likewise, has proposed a frac moratorium, despite the results of the independent “Inquiry into Hydraulic Fracturing in the Northern Territory” study, released last year, which found “no justification for imposing a moratorium on hydraulic fracturing in the Northern Territory.”

NT IN PLAY

The threatened frac moratorium notwithstanding, much of Australia’s nascent shale activity is being played out in the Northern Territories’ Beetaloo basin, which Deloitte’s Cann describes as “one of the most prospective basins around.” According to the Northern Territory Department of Mines and Energy (DME), six wells were drilled last year in the largely unexplored Beetaloo, a subset of the uber-remote MacArthur basin.

Commercial production is a long way from getting off the starting blocks, as a handful of players, for the most part, concentrate on evaluating the highly prospective Middle Velkerri and overlying Kaylla shales.

“It is too early to form expectations on whether or not commercial gas will flow from the Beetaloo; however, there is increasing confidence that the gas in place within the entire sub-basin is in the order of hundreds of Tcf, and future work will need to focus on determining how much of that gas is commercially recoverable,” Ian Scrimgeour, executive director of the DME’s Geological Survey, told the Sydney Morning Herald on Jan. 10.

When and if production flows from Beetaloo wells, operators may find ready market access, between the recently sanctioned North East Gas Interconnector pipeline and LNG export facilities in Darwin. With a planned 2018 commissioning, the 386-mi transcontinental pipeline is envisioned to connect the Northern Territories with the growing Queensland gas market. Furthermore, the Conoco-Phillips-operated Darwin LNG plant (Fig. 3), is expected to be joined, in September 2017, by the Ichthys LNG export facility now under construction near Darwin. “Darwin LNG is looking for fresh gas supply, but Ichthys has a 40-yr supply. So, any demand for Beetaloo gas might come from Darwin LNG,” says Cann.

Half of the 2015 Beetaloo wells DME identified were constructed by a three-company alliance, led by Ireland’s Falcon Oil & Gas, which has announced a similar three-well program for 2016. As part of its drilling and evaluation strategy, a multi-stage frac program is set to begin this summer on the Amungee NW-1H, the first horizontal well drilled in its ongoing campaign to test the organic-rich Middle Velkerri “B” shale, Fig. 4. According to Falcon, the 2016 campaign also includes the vertical Beetaloo W-1 well some 53 mi south of the Amungee and Kalala S-1 wells, both drilled in 2015, and a second vertical well to test the shallower and more condensate-rich Middle Velkerri. The Beetaloo W-1 well is expected to spud in the third quarter and, pending regulatory approval, will be followed by the second vertical well within the EP-98 license area.

After teaming up in May 2014, Falcon and partners Origin Energy and Sasol Petroleum Australia kicked off the 2015 three-well drilling and evaluation program with the Kalala well in July. The partnership has outlined plans for a nine-well program between 2015 and 2018 on the 4.6 million gross acres it controls in the Beetaloo. The overall objective of this year’s program is to further delineate the areal extent of the Velkerri shale, Falcon says.

The Amungee NW-1H well was drilled in November 2015 to a measured depth (MD) of 12,493 ft, including a nearly 4,000-ft lateral in the “B” shale bench. In a statement, Falcon said the well encountered “excellent gas shows and represents a highly prospective candidate for multi-stage hydraulic fracture stimulation.”

Falcon says it has identified and characterized three prospective intervals within the Middle Velkerri formation, with the “B” and “C” benches each more than 131-ft thick.

The infrequency of Australia shale drilling is reflected in the 6.4-million-acre Beetaloo/McArthur acreage controlled by privately held Tamboran Resources, which operates under a farm-in arrangement with Santos, but drilled its latest documented well in the permit in 2014. The Tanumbirini-1 exploration well targeted the Middle Velkerri at just under 13,000 ft TD, making it one of Australia’s deepest onshore wells to date, according to Tamboran. After encountering “elevated gas readings” over a total gross interval of more than 1,600 ft, the well was cased and scheduled for re-entry and further evaluation last year. No update has been made available.

Meanwhile, an aggregate $175 million in drilling participation funds has apparently gone to the wayside as U.S.-based American Energy Partners ceases operations following the March death of its founder, Audrey McClendon.

SHARING THE LOAD

Adelaide-based Beach Energy in March acquired Sydney’s Drillsearch Energy, which included prospective unconventional acreage along the Cooper basin’s Patchawarra and Nappamerri Troughs. Beach and Santos had earlier teamed up with Drillsearch in two separate Western Patchawarra JVs that identified unconventional pay in a number of conventional gas exploration wells.

Last October, Drillsearch and partners Santos and Sundance drilled the unconventional Washington-1 exploration well in the Northern Patchawarra, which was completed and shut-in for additional testing. According to its half-year FY16 report, released on Feb. 24, Drillsearch also was evaluating the results of the nearly 258-mi2 Delaware 3D seismic survey covering the southern section of the permit. The survey reportedly was the largest ever conducted onshore Australia.

Norwest Energy, likewise, completed a seismic survey last year on its EP413 Arrowsmith shale-gas permit in the Perth basin. According to the Perth-based operator, the 3D shoot revealed additional tight gas targets in the Kockatea, Beekeeper, Carynginia, IRCM and HCSS formations. The newly uncovered prospective zones were found some 4-mi south of the Arrowsmith-2 unconventional well, which Norwest and majority-partner AWE drilled in 2011 and tested in 2014. Norwest offered up the Arrowsmith permit as a farm-in opportunity during the June PESA Deal Day in Brisbane. Another well is not on the drilling schedule until late 2017.

As part of its unconventional gas program with partner Origin, targeting the thick and mature Roseneath and Murteree shales in the Cooper-Eromanga basin, Senex Energy of Brisbane recently drilled two “successful” wells and completed a seismic survey on the northern portion of its permit. In late June or early July, the partners plan to frac and test the Efficient-1 well, drilled last October, according to a spokesperson. The Ethereal-1 horizontal well was drilled in January, also in the southern portion of the permit.

To the north, Senex and Origin have agreed to an initial two-well drilling campaign in the first half of FY17, targeting “large-scale prospective gas resources” in the Patchawarra Trough.

In the Canning basin, Perth-based Buru Energy says preliminary results of its tight gas pilot exploration program, targeting the Laurel formation, have been “very encouraging.” Buru and partner Mitsubishi Corp. based its prognosis on two recently fraced wells and the previously drilled Valhall-2 well. Buru said the wells delivered initial peak gas rates on blowdown of up to 44 MMcfd. No guidance on 2016 plans has been made available.

CHINA MISSES AGAIN

As with Australia, China has put a priority tag on exploiting its world-leading shale gas reserves, but once again state-owned operators fell short of Beijing’s targets. Sinopec and CNPC, which are responsible for nearly all of the nation’s shale gas production, in 2015 were expected to deliver a combined 5.1 Bcm, well off the production target of 6.5 Bcm, according to Bloomberg.

A slowing economy, low commodity prices and the NOCs’ general lack of shale expertise have been blamed for the inability to fully develop China’s prodigious resources. In its last international assessment, the EIA estimated China holds a world leading 1,115.2 Tcf of unproved, technically recoverable shale gas, as well as 32.2 Bbbl of tight oil (Fig. 5), though other estimates have the potential resources significantly higher.

Most activity is centered in the 301,000 mi2 Sichuan province, specifically the Jiaoshiba shale play in the Sinopec-operated Fuling Block. As 2015 drew to a close, Sinopec said that over the next two years it intended to double annual production to 10 Bcm from China’s first commercial shale field. In its first-quarter 2016 earnings release, Sinopec said much of its E&P expenditures in the first three months was earmarked for the continued Phase II Fuling development. Sinopec closed the first quarter with gas production of 211.36 Bcm, up just under 17% year-over-year, while its domestic oil production dropped more than 10% to 66.35 MMbbl, compared to 74.01 MMbbl in first-quarter 2015.

As reflected in Fuling field, Sinopec is recognized as far and away the most advanced of the home-grown shale players. “Comparing with North America, shale gas reservoirs in China differs greatly in field, geological and surface conditions. Technological and theoretic innovations based on previous studies helped to achieve an exploration breakthrough and green exploitation of Fuling shale gas,” Sinopec’s Jin said last September at the 15th U.S.-China Oil and Gas Industry Forum in Chongqing.

To illustrate, he pointed to factory-style drilling technology customized for mountainous areas, centered around the company’s “step-style-sliding rail drill rigs,” which, he says, has helped reduce drilling time and costs by 53% and 35%, respectively. He also cited optimizations in well spacing and multi-stage frac jobs.

Jin said at the time that annual unconventional gas production would grow to 10–13 Bcm by 2020, and increase to a yearly output of 30–40 Bcm by 2030.

BP TAKES A STAB

On March 31, BP signed a production sharing contract (PSC) with CNPC. The PSC covers approximately 932 mi2 across the Neijiang-Dazu shale gas block in the greater Sichuan basin, home of the CNPC-operated Weiyuan-Changning field, which joins Fuling as China’s predominate shale gas producers.

Unlike its previous agreements with international companies, CNPC will serve as operator. During questioning in the first-quarter earnings call, BP Group CFO Brian Gilvary said little, other than the PSC represents “a great step forward in terms of our corporation and working with CNPC, who will be the operator.”

At the same time BP was signing its PSC, Shell decided to abandon a similar agreement it had held with CNPC since 2012, saying “no follow up investment can be justified.” In April 2014, Shell and CNPC announced a strengthening of their E&P JV, which was concentrated on a heavily faulted block in the Sichuan province. ![]()

- Flexibility and modularity enable tailored solutions for challenging shale plays (December 2025)

- Making shale competitive (December 2025)

- Shale: Sorry Monte Python, I’m not dead yet (December 2025)

- Below-grade well cellar enables simultaneous operations in shale plays (November 2025)

- Cleaner separation, safer future: AutoSep’s automated approach to flowback (September 2025)

- Oil and gas in the capitals: The Philippines increases E&P and stands up to China’s “Grey Zone warfare” (July 2025)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)