Regional Report: North Sea

Despite an area of approximately 220,000 mi2, which contains Western Europe’s largest oil and natural gas reserves, the North Sea region has endured a considerable amount of setbacks, due to the oil slump. Back in June of last year, it was reported that two-thirds of operators had been forced to cancel or postpone drilling projects in this marginal sea.

More than anything else, North Sea exploration has fallen casualty to the industry downturn. According to the Norwegian Petroleum Directorate, just 30 exploration wells have been planned off Norway this year, compared to last year’s 56 wells.

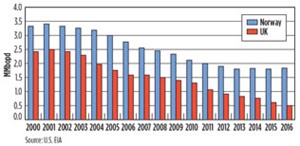

The International Energy Agency (IEA) forecasts crude output will fall to an average 2.5 MMbpd this year, down from last year’s 2.6 MMbpd. This waning production rate is expected to result in increased UK oil imports, as the declining supply is overtaken by wearying demand, Fig. 1.

CUTTING COSTS

Statoil, alone—which operates more than 70% of Norway’s oil and gas production—reportedly has cancelled the equivalent of four years of drilling in the past year-and-a-half. Statoil’s cuts have impacted drilling companies in Norway and the UK significantly, including Transocean and Seadrill’s North Atlantic Drilling Ltd. With so many idling rigs, offshore drillers will likely be forced to abandon more units in the region by the time the market returns to better health.

Statoil has delayed projects to boost reserves at Snorre field, in the Tampen area of the Norwegian North Sea, by as much as 300 MMbbl of oil. Additionally, in August 2015, Maersk Oil was preparing to shut down production from its Janice platform, about 172 mi southeast of Aberdeen, UK. The physical shutdown was set to occur during either second-quarter or third-quarter 2016. The decision to cease production resulted in the elimination of 220 jobs in the UK. According to UK lobbyists, those 220 jobs are just some of the 120,000 positions that are expected to be lost this year in the UK, due to the price collapse.

Because North Sea explorers contend with some of the highest operating costs in the world, investment budgets have been slashed pointedly to shield cash flow and maintain dividends. According to Norway’s Finance Ministry, overall investment by oil companies is expected to fall at least another 11%.

Operators throughout the region are responding to the price climate, not only with contract cancellations, but with cost-saving strategies like JV partnerships and the use of innovative technologies with potential to improve operational efficiency. Petrofac, Faroe Petroleum and Eni Hewett, for example, entered into an agreement in November 2015, in an effort to drive down costs, as well as improve efficiencies and commercial partnerships across their UK operations in the southern North Sea.

The agreement sees cooperation, between Petrofac and the respective equity owners of the Hewett, Schooner and Ketch gas fields, to share logistics and accommodation services. Under the terms of the agreement, Faroe Petroleum is operator and 60% equity holder in Schooner and Ketch fields, and Eni Hewett is operator and 89% equity holder in Hewett. “Reducing the cost of operations in the UKCS [UK Continental Shelf] is a collective industry responsibility, and we are absolutely committed to playing our part,” said Walter Thain, managing director, Petrofac Offshore Projects and Operations.

In June, BP and Det norske oljeselskap announced the combination of their Norwegian (Det norske) businesses to form Aker BP ASA, which will be the largest Norwegian independent oil and gas producer. The new company will be owned jointly by Det norske shareholder Aker (40%), other Det norske shareholders (30%) and BP (30%). The companies are confident that the new Norwegian super-independent could bring production up to more than 250,000 boed in the next five years.

The UK has attempted to ease the strain put on North Sea drillers by cutting taxes. In March, Chancellor of the Exchequer George Osborne announced that the Petroleum Revenue Tax, which stood at 35%, would be discarded altogether. The supplementary charge for the industry has fallen by half, from 20% to 10%. This brought the overall corporate tax rate down to 40% from the previous 50%.

While Britain proffered billions in tax cuts, Norway has taken another approach to surviving the downturn. Companies were warned that abandoning projects could ultimately hurt their chances of getting new Arctic licenses. The differing strategies can be explained by disparate circumstances. Norway’s larger reserves mean that it can afford to be uncompromising, while the UK is continually fighting to extend the life of aging and more expensive fields. According to Rystad Energy, Norwegian fields produce double the oil, and their operational costs are one-third of those in the UK.

Rystad Managing Partner Jarand Rystad said, “The UK shelf is in a far more desperate situation than the Norwegian one. On the Norwegian shelf, there’s still a significant positive cash flow, and the state is still getting large tax earnings, despite the downturn.”

ADJUSTING TO A NEW ENERGY CLIMATE

As UK North Sea decommissioning costs are set to rise over the next decade, it is one of the few areas of the industry that is flourishing. As more and more fields halt production, decommissioning costs are rising. According to Oil & Gas UK, costs are set to increase to $25.7 billion by 2024. That can be compared to the $20.9 billion spent last year. Plugging and abandoning wells make up the bulk of these costs.

About 17% of the region’s 470 installations will need decommissioning over the next several decades. Oil & Gas UK cited that over the next decade, 79 platforms are forecast for removal on the UKCS. Wood Mackenzie consultants addressed the topic in September, saying that as many as 140 fields in the UK North Sea could close over the next five years, alone. And that will happen, even if oil recoups to around $85/bbl.

Another area of the industry that continues to thrive, despite the obstacles resulting from the price slump, is the technology and innovation that have been driving the North Sea energy industry forward. For instance, in November 2015, Centrica Energy was the first firm to charter a well intervention vessel and use coiled tubing drilling to drill a pilot hole for shallow gas, instead of using a rig. This was done in an effort to remove the risk of shallow gas at the planned drilling location in Butch field, about 155 mi off Norway’s coast.

According to Centrica, this is likely the first time that this technology has been used this way in the oil and gas industry. It had been employed only to take core samples in work on undersea tunnels in the Rogfast road project in Rogaland County, Norway. Centrica Energy’s Norway Manager Espen Kopperud said, “We have to work smarter and cheaper, while maintaining safety levels. I believe strongly in following what happens outside our own sector, and also daring to test new technology. Many industries have exciting solutions that we can also use.”

OFFSHORE THE NETHERLANDS

Wintershall has been particularly active in the North Sea region during the last year. In June 2015, the company announced that it was expanding its natural gas production in the Netherlands. Its unmanned mini-platform, L6-B, began production off the Dutch North Sea coast, after being brought to its offshore location just one year prior.

The platform is situated in a restricted military zone, making Wintershall Noordzee the first company to secure permission to operate in the area. Because of the facility’s location, the installation was required to be as small as possible, Fig 2. It is anchored to the seabed through suction piles, rises about 59 ft above the sea and has three decks, but no helideck. It only can accommodate a maximum of two producing wells.

NORWEGIAN NORTH SEA

In December, Wintershall Norge was drilling wildcat well 35/11-18 and appraisal well 35/11-18 A in production license (PL) 248. The wells, drilled approximately 2.5 mi west of Vega Sør field, were aimed at proving petroleum in the Middle and Upper Jurassic reservoir rocks.

The wildcat encountered moderate-to-good reservoir quality in the Brent group, at a thickness of about 902 ft. It proved light oil in the Tarbert and Oseberg formations, with columns of about 36 ft and 10 ft, respectively. The well had been drilled to an MD of about 12,332 ft below the sea’s surface.

Additionally, the appraisal well encountered a column of about 26 ft, and proved gas and oil in two Upper Jurassic sandstones with net thicknesses of about 108 ft and 78 ft, respectively. It encountered oil throughout the Brent group, with moderate-to-good reservoir quality. A 150-ft column of light oil in the Lower Jurassic was encountered, as well. The well was drilled to an MD of more than 13,000 ft below the sea’s surface.

Preliminary estimates placed the size of the discovery between 6.3 MMbbl and 19 MMbbl of recoverable oil. Collected data and sampling, including formation tests in the Cook and Oseberg formations, have shown good flow properties with stable flow pressure and low pressure drop, as well as good permeability.

Also in December, Statoil and its partners submitted a Plan for Development and Operation (PDO) for Oseberg Vestflanken 2, a new project containing an unmanned wellhead facility with ten well slots. The facility will recover both oil and gas from new deposits, as well as improve the recovery rate from deposits already producing. The $940-million PDO is expected to recover approximately 110 MMboe. Production start-up is scheduled to begin in 2018.

Earlier this year, Wintershall Norge AS completed the drilling of wildcat wells 35/8-6 S and 35/8-6 A, also in PL248. They were drilled approximately 3 mi northwest of Vega field, and about 93 mi northwest of Bergen, Norway. The wells were drilled to an MD of approximately 13,264 ft and 12,467 ft, respectively, below sea level. Both were terminated in the Heather formation.

Well 35/8-6 S encountered a poorly developed reservoir, and was reportedly dry. Well 35/8-6 A, however, encountered an almost 10-ft column. Preliminary estimates of the discovery range between 1.26 MMbbl and 6.30 MMbbl of recoverable oil. Extensive data collection and sampling were undertaken, as well.

Statoil, too, has made multiple discoveries over the last year. In July 2015, Statoil and Total E&P Norge struck a gas and condensate find in the Julius prospect, in the King Lear area of the North Sea. The discovery well proved gas and condensate in the Ula formation, and provided key data regarding reservoir distribution and communication. The King Lear and Julius discoveries are situated in one of the most important parts of the NCS. Statoil, the operator, estimated volumes in Julius to be between 15 MMbbl and 75 MMbbl of recoverable oil-equivalent.

The drilling of wildcat well 30/9-27 S was completed last September. It was drilled about 4 mi west of Oseberg Sør field in the northern North Sea. The Statoil well encountered a 111.5-ft oil column in sandstone with moderate-to-good reservoir quality, about 10,636 ft below sea level. Estimates put the size of the discovery at approximately 6.30 MMbbl to 12.60 MMbbl of recoverable oil equivalent, and plans were made to develop it with the Oseberg Delta 2 project.

In April, Statoil hit oil about 21 mi southwest of Oseberg South field. Wildcat wells 30/11-11 S and 30/11-11 A proved sandstones with moderate-to-good porosity in the Ness formation. The wells were drilled to respective MD of 11,961 ft and 13,080 ft below sea level.

Well 30/11-11 S encountered an 82-ft oil column in the upper part of the Tarbert formation, of which 72 ft had moderate-to-good reservoir properties. Well 30/11-11 A encountered a corresponding reservoir in the Tarbert formation, but it was classified as dry. The size of the discovery was estimated between 1.26 MMbbl and 3.15 MMbbl of recoverable oil.

Shortly thereafter, in June, Statoil reported that it had completed the drilling of wildcat well 30/11-13. It was drilled approximately 16 mi south of the Oseberg South facility. The well encountered gas columns at two levels in the top half of the Tarbert formation—totaling 16.4 ft and 101.7 ft, respectively. Estimates show that the discovery is between 6.30 MMbbl and 18.90 MMbbl of recoverable oil-equivalent. It will be included in an evaluation of a new field developments. This is in addition to previous discoveries in the area.

Also in June, Statoil’s Rutil development—a gas-filled structure at Gullfaks South, in the Tampen area of the North Sea—received consent from the Norwegian Petroleum Directorate (NPD) to start-up facilities and begin producing. In-place volumes are estimated at 632.1 Bcf of gas, and 12.5 MMbbl of condensate. Recoverable reserves are estimated at 74.9 MMboe.

Developed with a standard subsea template and four well slots, Rutil will be tied into the existing infrastructure on the Gullfaks A facility for processing and export. Production is scheduled to begin in August or September of this year, which is several months earlier than planned.

Faroe Petroleum reported a discovery in its Brasse exploration well in PL740 in June. Drilled to a TD of about 9,120 ft, the well encountered approximately 59 ft of gross gas-bearing formation and approximately 68 ft of gross oil-bearing Jurassic reservoir. Faroe is the operator and holds a 50% stake in the license, while partner Point Resources holds the remaining 50%. The partnership has announced plans to drill a sidetrack to aid in confirming reservoir distribution and hydrocarbon contacts.

OFFSHORE IRELAND

As part of phase two of the 2015 Atlantic Ireland licensing round, Europa Oil & Gas accepted the award of four new Licensing Options (LO), including LO 16/19 in the South Porcupine basin; LO 16/20 and LO 16/21, both of which are situated near Corrib gas field in the Slyne basin; and LO 16/22 in the Padraig basin.

Between these new LOs and Europa’s existing licenses—LO 16/2, FEL 2/13 and 3/13—offshore Ireland, the company estimates up to 4 Bboe and 1.5 Tcf of gross, mean prospective resources.

UK NORTH SEA

The UK Oil & Gas Authority approved the development of Culzean field in the UK central North Sea in August 2015. The Maersk Oil-operated HPHT field is the largest discovery in the region for a decade, and could potentially meet 5% of total UK demand at peak production by 2020. Additionally, Culzean is the largest gas field sanctioned since East Brae in the 1990s.

Since its discovery in 2008, resources in the gas condensate field have been estimated at 250 MMboe to 300 MMboe. Maersk Oil and its JV partners, JX Nippon and BP, are investing about $4.5 billion in the field’s development, which is scheduled to begin production in 2019. BP doubled its interest in the Culzean development in May, as it acquired an additional 16% interest from JX Nippon. The acquisition brings BP’s interest in the development to 32%.

Deirdre Michie, chief executive at Oil & Gas UK, said, “This investment by Maersk Oil and its co-venturers, in this technically demanding HPHT field, is very encouraging at this challenging time for the industry, and reinforces the fact that the UK Continental Shelf continues to have much to offer.”

In October 2015, INEOS corroborated that confidence in the UKCS with the acquisition of natural gas assets from a UK subsidiary of DEA Deutsche Erdoel AG. The annual production of these gas fields, which include Breagh and Clipper South fields in the southern North Sea, account for 8% of the UK’s annual gas production. They are positioned close to the company’s sites in the North East of England, as well as in Scotland.

While INEOS has publicized its goals to become a leading onshore gas developer, it aims to use the North Sea prospects as an opportunity to further advance its new subsidiary, INEOS Upstream.

In late December, Abu Dhabi National Energy Company PJSC (TAQA) made significant progress at Cladhan field, approximately 62 mi northeast of the Shetland Islands. First oil was announced from the field, which is developed as a subsea tie-back to the TAQA-operated Tern Alpha platform. In a water depth of 492 ft, the development consists of two producing wells and one injection well.

TAQA serves as the field’s operator, with a 64.5% interest. Its partners, Sterling Resources and MOL Group, hold 2% and 33.5% interests, respectively. In addition to acting as operator of the Brent pipeline, TAQA operates five platforms, which produce from 13 fields across the northern and central North Sea.

Unfortunately, not all producers have adapted so well to the price slump. In February, First Oil Expro’s interest in numerous UK North Sea assets, including subsidiaries First Oil and Gas and Antrim Resources NI, were sold to Zennor Petroleum. Additionally, First Oil and Gas approved the sale of its interest in Kraken field to partners Cairn Energy and Enquest. This is a particularly critical sale, as Kraken field is expected to produce first oil next year.

Royal Dutch Shell, too, has been browsing for potential buyers for some of its North Sea assets. Since the company’s $54-billion acquisition of BG Group and its significant increase in debt, it has been re-evaluating its various global portfolio opportunities.

BG-operated assets in the UK North Sea include the Armada project, as well as Everest and Lomond fields in the central North Sea. These are in addition to stakes that it has in fields operated by other companies, including Nexen’s Buzzard field in the Outer Moray Firth, and Total’s Elgin and Franklin projects in the Central Graben Area, about 149 mi east of Aberdeen. ![]()

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)