ShaleTech: Bakken/Three Forks

If the Saudis thought they could shut down the Bakken/Three Forks play by flooding the global market with crude, they don’t know about Yankee ingenuity and the spirit of independence that drives U.S. shale operators. Like the proverbial Timex watch that takes a beating, but keeps on ticking, the leading operators in the Bakken/Three Forks play have made prudent cutbacks in the face of the rapid decline in crude oil prices. Most of the operators in the play have reduced rig count, deferred some of their completions and retreated E&P activity to the core sweet spots. They’ve also achieved tremendous improvements in E&P efficiency to lower their break-even point. From a low of $43.16/bbl late last year, the WTI price already has crept back to nearly $60/bbl. If the price nears $65/bbl, the Bakken/Three Forks will be back in business, from the core to the fringes.

PUTTING ON THE BRAKES

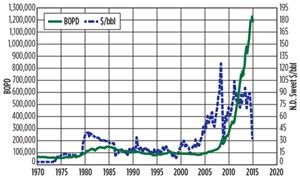

The Bakken/Three Forks play has been such a powerful engine of oil production that it will take several months to slow down output after operators began to reduce drilling and completion activity. In March 2015, the North Dakota Department of Minerals reported production growth to 1.215 MMbopd from 1.203 MMbopd in February, Fig. 1.

CUTTING BACK TO THE CORE

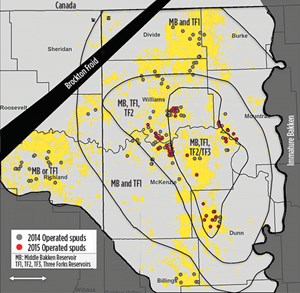

The Baker Hughes rig count for the entire Williston basin was 79 on May 15, 2015, a drop of 104 from the count a year ago. Drilling operations have been withdrawn from 12 counties in Montana and North Dakota at the outskirts of the play, and concentrated in the oil-saturated core. According to Global Data, much of the activity is now concentrated in Mountrail and Mckenzie counties, which have median IP30 (30-day initial production) values of 550 bopd, between 17% and 50% greater than the other productive Bakken counties. Figure 2 shows how one operator—EOG Resources—has reduced its 2015 activity to the core areas, as opposed to the Bakken-wide program that the company undertook during 2014.

BIG SKY RESOURCE

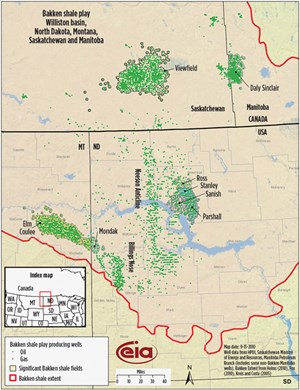

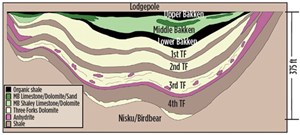

The state slogan for Montana is “Big Sky Country.” Stretching across Montana, North Dakota and South Dakota, and even the Canadian provinces of Saskatchewan and Manitoba in the Williston basin, the Bakken/Three Forks play is truly a Big Sky resource, Fig. 3. In its 2013 assessment, the U.S. Geological Survey (USGS) estimated mean undiscovered volumes of 7.4 Bbbl of oil, 6.7 Tcf of associated/dissolved natural gas, and 0.53 Bbbl of NGLs in the U.S. portion of the Bakken and Three Forks formations. Operators are able to target multiple stacked formations in these formations. The total shale can be as thick as 375 ft, Fig. 4.

BREAK-EVEN PRICE?

Just how much of the 7.4-Bbbl Bakken/Three Forks resource potential will the shale operators be able to exploit? It all depends upon the profitability of their operations in 2015, and beyond, in the light of low crude oil prices. According to the North Dakota Industrial Commission, the wellhead price that operators are getting has touched $30/bbl. Hedges and swaps are protecting many of the operators, such as Whiting Petroleum, to crude prices just $5-$6/bbl less than the NYMEX prices, as far into the future as 2020. With significant cost reductions, a few of the operators, such as EOG Resources, are suggesting that their economics are better at a $65/bbl crude oil price than they were when the price was $95/bbl. Meanwhile, ConocoPhillips says its full-cycle finding and development (F&D) cost in the Bakken is only $20/bbl. As such, industry analysts, who’ve suggested the decline and fall of the Bakken/Three Forks play, may be premature in their

pessimistic assessments.

OPERATOR ACTIVITY

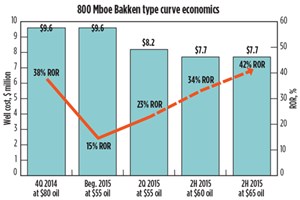

Continental Resources. The leading operator in the Bakken, Continental Resources holds 1.15 million net acres. Continental’s completed well cost was $9.6 million at year-end 2014, and the firm is targeting a 20% reduction during 2015. At the reduced well cost of $7.7 million, Continental expects to achieve a 42% return on revenue, at a crude oil price at $65/bbl, Fig. 5. On average, Continental is drilling 9,800-ft laterals with a target EUR of 800 Mboe. For 2015, Continental has allocated $1.55 billion for the Bakken to drill 191 net wells using 10 rigs and three completion crews. These will be 30-stage completions at 660-ft to-880-ft inter-well spacing. The wells are in the core counties—Williams, Mountrail, McKenzie and Dunn, a significant retreat from the 2014 activity.

XTO Energy. A subsidiary of Exxon Mobil, XTO holds 845,000 acres in the play—531,000 acres in North Dakota and the rest in eastern Montana. During 2014, XTO operated 12-15 rigs in North Dakota and one rig in Montana. Through pad drilling and proprietary technologies, XTO has reduced the number of drilling days by 35%, increased productivity, on average, from 750 boed to 1,200 boed, and cut completion costs from $250,000/stage to $150,000/stage.

Whiting Petroleum. One of the earliest movers in the Bakken, Whiting Petroleum holds 774,022 net acres throughout the Williston basin. During first-quarter 2015, Whiting’s production from the Bakken/Three Forks averaged a record 133,500 boed, an 82% increase over first-quarter 2014, prior to the Kodiak acquisition in December 2014, which added 41,190 boed. At the end of 2014, Whiting had an estimated 7,541 gross drilling locations, of which 60% targeted the Bakken and the remaining 40% focused on the Three Forks formations. Whiting holds some of the high-producers in the play. The wells are in Tarpon field in McKenzie County, N.D. The Flatland Federal 11-4TFH produced at an initial rate of 7,824 boed during a 24-hr test of the Three Forks formation. The Flatland Federal 11-4TFH well was completed with a cemented liner and a 104-stage coiled tubing frac.

ConocoPhillips. The Houston-based IOC holds 620,000 net acres that are either held by production or a mineral fee. ConocoPhillips is operating five rigs in 2015, but expects the count to double by 2017. With a 10-year inventory of drilling locations, ConocoPhillips is drilling and completing its well locations at 160-acre spacing with a finding and development cost of $20/boed. The company has achieved significant cost-savings from 2011 to 2014—a 40% reduction in drilling days and a 50% reduction in completion cost per unit of proppant. ConocoPhillips reports that 90% of 2015 wells will benefit from multi-well pad drilling.

Hess Corporation. Holding 615,000 net acres in the core Bakken/Three Forks play, Hess produced 95-105 Mboed during first-quarter 2015, which was 70% more than the production during first-quarter 2014. The company objective is to produce 175 Mboed by 2020 from its inventory of 4,000 drilling locations. Hess has reduced its rig count from 17 in 2014 to 12 during the first quarter, and expects to reduce the count still further to 8 during the rest of 2015. Nevertheless, Hess has allocated a $1.7-billion budget for 2015. As have other operators in the play, Hess has reduced its drilling and completion cost per well from $7.5 million to 6.8 million.

Marathon Oil. The independent operator holds 370,000 net across the Bakken play. With the drop in the sale of its crude oil price from $61.74/bbl in fourth-quarter 2014 to $39.92/bbl in first-quarter 2015, the company has reduced its rig count in the play to only two units. Marathon plans to complete 26-36 wells during 2015, with its annual budget set at $645 million.

Statoil. Through its 2011 acquisition of Brigham Exploration, Statoil gained access to 330,000 acres in the Bakken play. The IOC has cut its U.S. E&P budget for 2015 by 25%, though the specific financial amount was not announced.

EOG Resources. With 90,000 acres in the oil-saturated portion of the Bakken play, Houston-based EOG Resources has an inventory of 580 well locations, which the company estimates will require seven years to drill. As part of its efficiency drive, EOG has reduced its completed well cost in the Bakken from $9 million in 2014 to $8 million in first-quarter 2015, with a target of $7.4 million. From 2012, the company has reduced its average drilling days (spud-to-TD) from 22.7 days in 2012 to 10.4 days in fourth-quarter 2014, while setting a record at 7.1 days. EOG is now focusing its activities on its Parshall County core acreage, where 500-ft spacing program averaged IP rates per well of 1,235 bopd, 110 bpd of NGLs and 0.5 MMcfgd. Additionally, EOG completed a three-well pattern (Parshall 42-2117H, 43-2117H and 67-2117H), which had average IP rates, per well, of 1,345 bopd, 110 bpd of NGLs and 0.5 MMcfgd.

TECHNOLOGY APPLICATIONS

With the decline in oil prices serving as a powerful incentive, operators in the Bakken are applying a variety of technologies to improve operator efficiency.

SmartDrill process. Hess Corporation launched its Smart Drill process in 2011 to improve drilling ROP and efficiency. This is a continuous improvement method to identify and remove ROP limiters. The program was implemented on nine rigs in the Bakken to help improve performance 30%. The ultimate goal is to drill a 10,000-ft horizontal section with a single-bit run. The SmartDrill process consists of four basic steps: 1) use real-time surveillance of mechanical-specific energy (MSE) to maintain maximum drilling efficiency; 2) analyze MSE data to track the issues discovered, document lessons learned, and distribute the knowledge to the entire drilling and completions team; 3) investigate limiters encountered and, when possible, develop mitigating solutions to mitigate them; and 4) take steps to improve drilling performance, including the design of optimum bits, bottomhole assemblies, drilling parameters

and procedures.

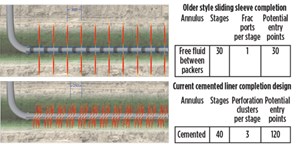

Cemented liner completions. Whiting Petroleum switched from openhole, sliding sleeve completions to cemented liner completions. As a result, Whiting was able to increase the number of stages from 30 to 40 and the number of perf clusters from one to three and the number of entry points from 30 to 120, Fig. 6. Driven largely by cemented liner completions, Whiting achieved a 27% performance increase during 2014.

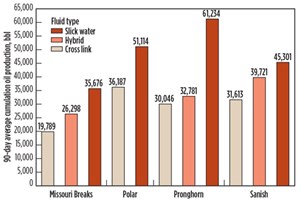

Slickwater fracs. In July 2014, Whiting Petroleum implemented slickwater completions at Pronghorn field in Stark County. Of the 15 slickwater wells, on average they had 90-day rates of 832 boed, a 51% increase over the 42 offsetting wells completed with crosslink fluid, Fig. 7. The company has achieved similar productivity improvements in the Missouri Breaks, Polar and Sanish formations.

CO2 production uplift. Statoil has awarded a major CO2 supply-and-service contract to Denver-based Ferus LP. The liquid CO2 will be used in a test well to evaluate the potential production uplift, and partially replace water in a large, multi-stage, hydraulic fracturing operation in a horizontal oil well. The use of CO2 as an energized fluid is common in the Western Canadian Sedimentary basin, but this will be the first major application of liquid CO2 to displace slickwater during the hydraulic fracturing process in the Bakken. In collaboration with the University of Texas at Austin (joint industry project on hydraulic fracturing), Ferus and Statoil have demonstrated, through numerous technical studies, the potential for CO2 to enhance well productivity, while significantly reducing freshwater usage.

RAIL BEATS PIPE

Due to the lack of pipeline infrastructure in the remote expanses of the Bakken play, operators in the region first turned to rail as the only option to transport their crude to the refineries. In 2014, the railroads transported 493,126 carloads (355 MMbbl), a 20% increase over 2013. BNSF Railway and Canadian Pacific (CP) have built oil-loading infrastructure throughout the Bakken fields. Together, these railroads fan out to refineries in northeastern Canada, the U.S. East Coast, northwestern Washington state and even the Gulf Coast. Railroads are also being used to carry frac sand into the oil fields. While pipelines are on their way, rail has the advantage of flexibility. Depending on the prices they are able to get, Bakken operators are can use rail to adjust their shipments between various refineries. In mid-December, Enterprise Products Partners decided not to move forward with the development of its proposed Bakken-to-Cushing crude oil pipeline. Commitments received from potential shippers during the open season were not sufficient to support the project, the company said. The 30-in. diameter pipeline would have extended approximately 1,200 mi to the Cushing hub in Oklahoma, with initial capacity of approximately 340,000 bopd, expandable to more than

700,000 bopd.

If the railways are to maintain their oil transportation business, they will have to improve their safety record. In the latest incident on May 6, a train carrying 107 cars of Bakken crude and two loaded with frac sand, derailed near Heimdal, N.D. No one was hurt, but the residents of Heimdal had to be evacuated for a day. Just five days earlier, the U.S. Department of Transportation, along with other federal agencies, issued its “final rule” for safe rail transportation of flammable liquids. Key points of the rule include rugged high-hazard flammable train (HHFT) cars, enhanced braking, reduced operating speeds and more accurate classification of unrefined petroleum products.

REGULATORY AFFAIRS

North Dakota’s natural gas flares are visible to imaging satellites and astronauts in the International Space Station. Lately, the North Dakota Industrial Commission (NDIC) has imposed regulations to reduce flaring of the associated gas. Effective April 1, 2015, new regulations require oil producers to gradually reduce flaring to no more than 10% of all produced gas by 2020. During 2014, North Dakota operators cut flaring from 36% to 24%, despite the fact that about 7% of the state’s wells are not connected to gas pipelines. A few operators, such as Whiting Petroleum, are capturing 85% of their gas production.

NDIC also has imposed new regulations to improve transportation safety through crude oil conditioning. It is now necessary to reduce the vapor pressure of crude oil at the point of sale or transport to less than 13.7 psi, by the removal of lighter fluids, such as propane, butane and pentane.

CRUDE OIL EXPORTS

Since 1975, the U.S. has had in place, a ban on the export of crude oil, except for certain exceptions for Alaskan crude oil and exports to Canada. The ban affects shale oil producers, as they’ve become captive suppliers to U.S. refineries. Shale oil producers invariably have to sell their crude at a discount, even though light shale oil should be selling at a premium. Several Bakken executives, such as Continental Resources CEO Harold Hamm and ConocoPhillips CEO Ryan Lance, have testified repeatedly before congressional committees and industry forums for a repeal of the export ban. Their efforts have been championed by U.S. Sens. Lisa Murkowsky, R–Alaska and Heidi Heitkamp, D–N.D. through a bipartisan bill to repeal the ban.

STUFF OF MOVIE LEGENDS

Through its ups and downs, the Bakken play has assumed a prominent place in the American public’s consciousness, and its billionaire CEOs, Harold Hamm in particular, have become the subject of social media gossip. This fall, ABC broadcasting company will premiere a primetime drama centered in North Dakota’s shale oil boom. “Oil” (shades of “Dallas”) stars former “Miami Vice” star Don Johnson, a greedy oil baron, as he comes into contact with a young couple seeking their own fortune. Improvements in drilling and completion efficiencies, and rising crude oil prices, suggest that the Bakken play will have a long life. The fortunes of the TV series, however, are quite uncertain. ![]()

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- U.S. upstream muddles along, with an eye toward 2024 (September 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)