ShaleTech: Eagle Ford/Pearsall

Operators in the triple-window Eagle Ford shale these days seem to have one eye squinted on commodity prices and the other clearly fixed on invoices from service and equipment providers.

Indeed, with the former in retreat and showing no signs of a sustained recovery anytime soon, operators see that their best opportunity for generating a facsimile of reasonable returns is to continue hammering down well costs, while concentrating strained resources on the sweetest of spots, leaving more marginal prospects, like the underlying Pearsall shale, for a more prosperous day.

Today, operators report year-over-year total well cost reductions as high as 40%, and, with enduring pricing pressures, some analysts say breakeven costs could sink to as low as $41/bbl by next summer, further reinforcing the Eagle Ford as one of the most economical of the unconventional plays. That economic reality apparently hit home with Noble Energy, Inc., which on May 11 snapped up Rosetta Resources Inc. in a $2.1-billion all-stock transaction that gives the Houston independent 50,000 net acres in the Eagle Ford, along with a leasehold in the Permian basin.

While the picture was much brighter in June 2014 when Encana Oil & Gas (USA) also entered the Eagle Ford with its $3.1-billion acquisition of the 45,500 net acres held by Freeport-McMoRan, the Canadian operator shows no hint of buyer’s remorse.

“It’s been a good acquisition for us. It’s an area that even in the current price environment, we’re able to be profitable,” said spokesman Doug Hock. “We continue to look at ways to reduce costs and, at the same time, increase our productivity and efficiency. We’ve been successful at both, and have gotten to the point that we’ve managed to shave about $1 million off our drilling and completion costs.”

With a plethora of new-well drilling, and with steadily increasing production rates yesterday’s news, the inseparable dual-focus throughout today’s version of the Eagle Ford is cutting costs and enhancing completion efficiencies as players try to squeeze more with less.

ConocoPhillips, Fig. 1, and Marathon Oil Corp. are among the most active of the stacked play advocates, with the latter adopting what it colorfully terms “stack and frac,” which combines the upper and lower Eagle Ford with the overlying Austin Chalk.

ROOM TO RUN

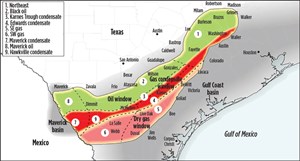

Though the well-delineated Eagle Ford, Fig. 2, with its distinct oil, gas and condensate windows, is in full-blown development mode “plenty of running room” remains, said Wood Mackenzie analyst Jonathan Garrett at a May media briefing in Houston, where he particularly cited the Edwards Condensate and Karnes Trough subplays.

Yet, if the current rig count is any indication, many of those prospects likely will remain undrilled for a while, as operators opt to jog in place rather than run. The week of July 19 saw the rig count drop to double digits, sliding to 98 active units, down four from the previous week, according to Baker Hughes. It represented the second consecutive week of declines, which have seen a cumulative eight rigs idled.

Owing to the pace of new drilling permits authorized in the first six months of 2015, it appears highly doubtful that many of those idled rigs will find work as the year progresses. Between Jan. 1 and July 13, the Texas Railroad Commission (TRCC), the state’s chief regulator, issued 1,998 drilling permits for the 13 counties comprising the Eagle Ford core, which is nearly half the 3,463 drilling authorizations awarded in the first six months of 2014. Last year, 5,613 drilling permits were issued, an Eagle Ford record.

Given this outlook, Pioneer Natural Resources Co. is definitely an outlier with its July announcement that it plans to actually increase drilling in the play this year, thanks largely to the June sale of its midstream asset. Shortly after Pioneer and its JV partner, India’s Reliance Industries, sold their pipeline and processing network to Enterprise Product Partners for a reported $2.15 billion, the Irving, Texas-based independent said it intended to add two rigs in the Eagle Ford, giving it an eight-rig fleet. Pioneer plans to put 95 to 100 wells in production in 2015. “Our strong balance sheet, combined with a strong derivatives position for 2015 and 2016, provides us with the financial firepower to ramp up drilling activity,” CEO Scott Sheffield said.

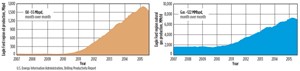

Meanwhile, if the latest best guesstimate from the U.S. Energy Information Administration (EIA) can be considered a harbinger, production rates may be starting to keep pace with the dwindling well construction. The EIA expects oil output to drop by 55,000 bpd in August to around 1.54 MMbpd, with gas production declining by 122 MMcfd, Fig 3.

If these estimates are relatively close to the mark, and the trend continues, EOG Resources will be among the first to applaud. The Houston independent has remained committed to a strategy of drilling, but deferring completions (DUC). “We have no interest in accelerating oil production at the bottom of the commodity price cycle. Instead, we are drilling but deferring completions on a significant number of wells until oil prices improve,” CEO Bill Thomas repeated during the first quarter earnings call. “A $10 increase in the price of oil, with a six-month deferral adds about $300,000 of net present value to a typical well.”

For the moment, while drilling and completions folks may be finding the sledding tougher, the near-term picture is a bit brighter for those involved in infrastructure-related activities. “Right now, we’re doing a lot of flow gathering and saltwater disposal wells,” said Michael Adams, sales manager for NOV Tuboscope’s Zap-Lok weld-free line pipe connection technology. “We’re in the process of building a three-mile pipeline for an operator there to handle saltwater disposal, and we’ll probably do 1 million ft of pipe for another operator this year.”

OPERATOR SNAPSHOTS

With most second quarter earnings to be released this month post-deadline, operators are keeping guidance for the remainder of the year close to their vests. Therefore, owing to the intrinsic fluidity of the unconventional sector, especially in today’s environment, the current plans of the most active players must be tempered as they could change appreciably going forward.

EOG Resources—its DUC wells notwithstanding—reigns as the premier producer with an equally commanding 632,000-net-acre position, and as of now will average 15 rigs and complete around 345 net wells this year. EOG ended 2014 with 23 rigs and drilled an estimated 520 net wells.

Eagle Ford pioneer BHP Billiton, which holds about 300,000 net acres, plans to run seven rigs in FY16, with all but one making hole in its liquids-rich Black Hawk field, where the operator says it is generating competitive returns at current commodity prices. Operated in a 50-50 JV with Devon Energy, the field is producing more than 120,000 boed with costs significantly lower through a number of productivity initiatives, the operator said.

Elsewhere, BHP Billiton plans to run a single rig in its gassier Hawkville field in LaSalle and McMullen counties. Along with stubbornly low gas prices, the operator cited “more complex geology and associated higher lifting costs” for the July 15 write-down of the asset. “We continue to be optimistic about our ability to economically develop the Hawkville when prices recover. In the near term, we are minimizing spending in this low-price environment,” BHP Billiton President Tim Cutt said in a statement.

Encana is running two rigs and is still on target for drilling between 60 and 70 wells this year, mostly in its higher-return holdings in Karnes, Wilson and Atascosa counties, which produced 42,000 boed in the first quarter.

Anadarko Petroleum Corp. said of the more than 200 wells it still plans to drill this year, 30 or more will go uncompleted. For the time being, Anadarko is running five rigs, half of what it averaged in 2014.

ConocoPhillips is testing the triple-stack development potential within its 220,000 net-acre leasehold. “In the upper Eagle Ford, we are running seven different pilots and across different parts of the Eagle Ford to test the triple-stack concept,” Matt Fox, executive V.P. of E&P, told analysts in the first-quarter call.

ConocoPhillips, which planned to average seven rigs this year, pumped around 175,000 bopd in the first quarter.

Along with ramping up drilling, Pioneer Natural Resources says it expects to increase production more than 9% this year, and plans to increase condensate export volumes in the second half. Pioneer exported 20,000 bpd gross of condensate during the first three months of the year.

The latest information available has Marathon Oil Corp. still planning to operate 10 rigs across its 204,000-net-acre-position, Fig. 4, where the company’s first quad “stack-and-frac” pilot was put on line earlier this year. “Our first quad stack-and-frac pilot, which includes one Austin Chalk, one upper Eagle Ford, and two lower Eagle Ford wells, is online, and early performance is encouraging. We also placed five upper Eagle Ford wells online in the [first] quarter,” President and CEO Lee Tillman said.

Production in the last quarterly reporting period averaged 147,000 boed net, up 53% over first-quarter 2014. Guidance to date has 196 to 206 gross wells being drilled this year.

Devon Energy, which entered the play in February 2014 with its $6-billion acquisition of GeoSouthern Energy, in May said it will operate a single rig this year on its 82,000 net acres, and participate in another 11 with JV partners, including BHP. Devon said 79 lower Eagle Ford wells were brought online in the first quarter, averaging 2,100 boed, with cumulative production averaging a record 122,000 boed. Second-quarter guidance places Devon’s Eagle Ford producing at between 115,000 to 125,000 boed, implying nearly 85% year-over-year growth.

Cabot Oil & Gas is running a single rig on its 66,000-net-acre leasehold and on target to drill 20 wells this year.

HIGH-DENSITY COMPLETIONS

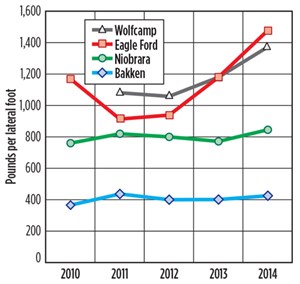

With fewer wells being drilled, the near-constant strategy aimed at draining as much reservoir as possible, typically translates into high-density stimulation and completion designs with dense slickwater fracs and tremendous volumes of small-diameter, usually 100-mesh, sand proppant. That trend explains why Eagle Ford wells pump by far the highest poundage of sand proppant than any of their U.S. counterparts, Fig. 5. Frac sand demand may be down overall this year, but per-well usage averages 4.2 million lb, according to the San Antonio Business Journal, referencing a June 11 report by global investment bank Jefferies. Of that, the Eagle Ford is far and away the highest consumer per lateral foot, says Garrett, the Wood Mackenzie analyst.

A clear Illustration of the regional demand was the July arrival of 140 train cars loaded with Minnesota frac sand at the Mission Rail Terminal in Elmendorf, Texas, which sand producer Unimin Energy Solutions of The Woodlands, Texas, claimed was a record-long for a single delivery, Fig. 6.

As for the end users, EOG says that while deferring completions on a number of wells, those that will be readied for production will be prepped with the high-density methodology. “When we compare wells with high-density completions versus wells with low-density completions, we see a 23% increase in cumulative oil production in the first 90 days. We also see that that production rates are holding up longer,” said Thomas. “With this success, we plan to complete about 95% of our 2015 Eagle Ford wells with high-density completion designs. With lower declines, production growth will be easier to achieve than in previous years, and returns on investment will continue to increase as we move forward.”

As deferring completion is not its style, Encana likewise is taking an aggressive approach in its completion strategies. “That [DUC] is not a strategy we’ve pursued anywhere, and certainly not in the Eagle Ford,” said Hock. “We’re being aggressive in terms of looking at downspacing, perforation clusters and how much frac sand we use.”

Penn Virginia Corp. is one of the few exceptions, having reduced proppant/stage from around 400,000 lb to 300,000 lb, while also adjusting frac stage spacing from 225 ft to 250 ft.

Complementing high-density completions, the re-fracing also is beginning to take hold in the Eagle Ford. Hock said Encana has identified a number of potential re-frac opportunities within its leasehold. “We did one additional re-frac last quarter,” he said in late July.

Besides consuming more proppant and water, historical production matching suggests pumping high-rate slickwater frac jobs with reduced fracture spacing and more proppant/cluster is not the most efficient mechanism for maximum reservoir drainage, said Bob Shelley, director of engineering for STRATAGEN, a CARBO business. “They’re getting higher initial production rates, but the fractures appear to be fairly short and inefficient. Along a horizontal wellbore, you can put in many inefficient fracs that may deliver 10 to 15 bbl per treatment, and when you add them up, you have increased production. That’s why we see higher initial production with these large slickwater fracs. However, if you pump more improved frac designs that generate longer effective fracture lengths, you could be doing even better,” he said.

Moreover, he said neural network modeling, as well as bivariate and multivariate statistical analysis, have borne out that pumping tremendous volumes of small-particle 100-mesh sand proppant in every cluster is largely inefficient and a poor return on investment. “Sometimes, you need the 100-mesh to condition the fracture so you can transport the larger 40/70, 30/50 or even 20/40-type proppants down through the fracture,” Shelley said. “In the Eagle Ford, and the Pearsall especially, you have comparatively higher fracture gradients, pressures and stresses, and you also are getting the effects of bedding planes, which gives a mass of narrow fractures. So, it takes 100-mesh and significant volume to overcome those and then allow you to place the more conductive-type proppant.”

MEXICO CONNECTION

With Mexico finally putting out the welcome mat to its long-closed petroleum sector, operators for now are not so much interested in mobilizing rigs into the neighboring portion of the Eagle Ford as they are in delivering gas into the country. In late June, Howard Energy Partners of San Antonio released plans to build a 200-mi natural gas pipeline between Eagle Ford gathering systems and Monterrey, Mexico. According to the San Antonio Business Journal, the 30-in. pipeline is expected to be completed in July 2017 with a capacity of up to 600 MMcfd. The network is expected to hook up with Mexico’s National Pipeline System in Monterrey, and will allow Eagle Ford producers to move gas even farther south. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- What's new in production (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)