KURT ABRAHAM, Executive Editor

Although World Oil’s annual tabulation of drilling, production and reserve statistics shows continued, strong upstream activity worldwide, there are some indications that the industry may be butting up against capacity constraints, unless the service/supply sector expands further. However, the other part of that equation requires sufficient manpower to run the extra capacities. As everyone knows, staffing remains a major issue.

Last year, worldwide E&P again achieved (as predicted) increases in all three major statistical categories—drilling, production and reserves. Drilling was up 2.8% over 2011’s figure, at 104,649 wells. This year, we forecast that the pace of drilling increase will slow to a trickle, rising 0.2%, to 104,888 wells. Growth in global production of crude and condensate picked up last year, increasing 2.2%, to 76.712 million bpd.

Some key activity findings include:

- The U.S. continues to drill between 42% and 44% of all wells globally.

- Among the world’s top four drilling countries, the U.S. is first, followed by China, Canada and Russia. Together, these four nations will drill 86% of all wells, worldwide.

- Russia has again bested Saudi Arabia as the world’s top oil producer. Russian output is at its highest level since 1988.

- The top four drillers are also the top four nations, in terms of oil wells actively producing. Together, the U.S. (560,330 wells), China (247,147), Russia (162,800) and Canada (82,801, including in situ wells) account for more than 1 million wells—1,053,078, to be specific.

- Reserve figures remain problematic in a number of countries, due to lack of reliable verification.

The following regional reports give perspective to the statistical findings.

| World crude/condensate production, 2012 versus 2011 |

|

|

Estimated proven world reserves,

2012 versus 2011 |

|

|

| Forecast of 2013 world drilling-comparisons with 2012 and 2011 |

|

|

| Forecast of 2013 world drilling-comparisons with 2012 and 2011 |

|

|

NORTH AMERICA

Suffice to say, 2012 was another banner year for North America. Although drilling last year was down 1.4%, regional oil production was up 9.2%, at 12.223 MMbpd. In addition, oil reserves were 1.5% greater, while gas reserves jumped 9% higher.

Canada. According to the Canadian Association of Petroleum Producers (CAPP), increasing oil sands and conventional oil production continues to strengthen Canada’s position as a preferred supplier to North American and other global energy markets. CAPP expects Canadian output to more than double to 6.7 MMbopd by 2030. Last year, Canadian production was 3.07 MMbopd, up 6.8%. Although oil reserves were down slightly, gas reserves gained 7.2%. Drilling was down 13%, but a 6% rebound is expected this year. For more details on Canada, please see World Oil, August 2013, p. 69.

Mexico. Last month, Mexico’s new president, Enrique Peña Nieto, proposed to partly reverse more than 50 years of state-owned oil production, and allow foreign private oil companies to partner with national oil company Pemex in sharing profits from exploration. If realized, this would be an historical milestone, since Mexico was the first country to nationalize its oil industry, in 1938.

Mexican drilling last year was up 19.7%. This year, according to the government, drilling will slow down considerably. Oil production continues to be problematic, slipping below 2.6 MMbpd. For more information on Mexico, please see World Oil, August 2013, p. 70.

U.S. Although drilling has flattened out at around 44,000 to 45,000 wells annually, new individual wells, particularly in the shales, are more productive than ever. Meanwhile, U.S. production continues its great comeback, thanks to gains made in the shales. Output averaged 6.50 million bopd in 2012, up 14.9%. Already, this year, production is well above 7 MMbopd. Figures released recently by the U.S. Energy Information Administration show that 2011 oil reserves shot up 15%, to 28.95 billion bbl. Gas reserves were also up 9.8%, to 348.81 Tcf. For more details on the U.S., see World Oil, August 2013, p. 65.

SOUTH AMERICA

Regional drilling was up 5% during 2012, and an additional 6.6% jump is expected this year. Oil reserves eked out a very small gain, while gas reserves improved to 407.4 Tcf. Unfortunately, oil production declined to 7.31 MMbpd.

Brazil. Several more discoveries have been announced offshore, including an oil and gas find in August by Brazilian company QGEP Participacoes in a pre-salt area of the Jequitinhonha basin, off the eastern coast. Another pre-salt oil discovery was announced at the end of May by Petrobras, when the firm completed a formation test at a well in the Transfer of Rights area of the Santos basin, 128 mi offshore Rio de Janeiro state. Petrobras plans to drill an appraisal before year-end 2013.

Meanwhile, state regulatory agency ANP announced that it has scheduled, for Oct. 21, its 1st Pre-Salt Licensing Round, which will award development of the country’s largest pre-salt discovery, Libra field, to the highest bidder. Another auction will be ANP’s 12th Oil and Gas Bid Round, consisting of 240 onshore gas blocks, scheduled for November.

Petrobras has an incredible backlog of field development projects underway or planned, with 25 projects slated to complete between now and the end of 2017. And between 2017 and the end of 2020, another 13 projects are lined up. Meanwhile, OGX Petroleo e Gas SA was forced in July to slash capital spending and pull the plug on three offshore oil development projects, to avoid financial collapse. OGX has been harmed by poor performance at its first offshore field, Tubarão Azul.

Venezuela. Following the death of former President and strongman Hugo Chavez on March 5, 2013, former Vice President Nicolas Maduro became president on an interim basis, and then won election (on April 14) in a tight race to a six-year term in his own right. Maduro is considered a left-wing ideologue, who is likely to continue a good 90% of Chavez’s agenda, including E&P.

State firm PDVSA claims that 13 new oil and gas deposits were found last year, resulting in new reserves totaling 126 MMbbl of oil and 306 Bcm (10.8 Tcf) of natural gas. In all, nine exploratory wells were drilled last year. Overall, PDVSA drilled 469 wells on its own. Another 421 wells were drilled in partnerships and JVs with foreign operators, resulting in a grand total of 890 wells and 5.82 MMft of hole.

Crude and condensate output averaged 2.91 MMbpd, down 2.7%. In light of the 13 discoveries, the firm also raised its already inflated oil reserves another 0.1%, to 297.74 billion bbl.

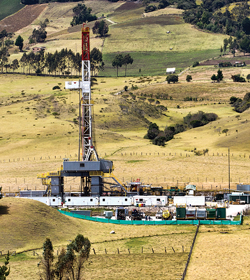

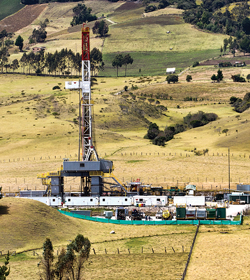

Colombia. Drilling rose 4% last year, and another five-well increase is expected this year, Fig.1. Oil production increased 2.5%. Oil reserves were up 6.6%, and gas reserves gained 8.1%.

|

| Fig. 1. Exemplifying Colombia’s steady drilling rate, a Nexen-operated rig works at the Carupa 1A shale gas wellsite, 90 km north of Bogota, in early 2013 (photo courtesy of Nexen). |

|

The reserves increase, according to market analysis house, Stockbridge, has almost entirely resulted from re-evaluations of existing deposits, accounting for 90% of the upward trend. The remainder, 10%, comes as a result of efforts to explore for new discoveries.

WESTERN EUROPE

As expected, regional drilling decreased below 540 wells last year, to 534. A small gain to 538 wells is expected this year, due strictly to increases in the UK and Denmark. Oil production dropped even more precipitously during 2012, losing 15.1%.

UK. Measures taken by the government to shore up E&P, particularly tax breaks, appear to be helping. After having fallen in 2010, drilling stabilized last year and posted a small gain. This year, if the current pace is maintained, there will be a 10% improvement. Meanwhile, British oil production plunged yet again, losing 14.5% and averaging just 920,440 bpd. Predictably, oil reserves declined. Gas reserves almost held steady.

In the largest new offshore oil development on the UK Continental Shelf (UKCS) in more than a decade, Statoil is proceeding with work at Mariner heavy oil field, 140 km southeast of the Shetland Islands. The company and its partners made the final investment decision last December, and the UK government approved the plan last February. The firm expects to start Mariner’s production in 2017, with average output estimated at around 55,000 bopd over the plateau period from 2017 to 2020. Expected total recovery may be more than 250 MMbbl.

The Scottish government this summer established the Independent Expert Commission on Oil and Gas. This body was created to advise on the technical application of policy for the sector, if Scotland becomes independent. The matter of Scotland’s potential independence from the UK will be put to a referendum of the Scottish electorate on Sept. 18, 2014.

Norway. Once again, Norway enjoyed an increase in natural gas output, averaging 314 MMcfd, for a 12.9% gain. On the other hand, crude and condensate production fell 17.6%. The news is better for reserves, with the oil figure rising 8.6%. Gas reserves increased 1.0%.

Drilling declined 7.2% last year. During 2013, activity will remain flat, with 168 wells expected by the Norwegian Petroleum Directorate (NPD). NPD last year approved the plans for development and operation (PDOs) for Skuld, Jette, Åsgard (subsea compression), Martin Linge, Edvard Grieg, Bøyla and Svalin fields. The PDOs for Gina Krog, Ivar Aasen and Aasta Hansteen fields are awaiting NPD’s approval. In 2013, development plans are expected for Zidane, Flyndre and Oseberg Delta 2 fields.

Italy. Drilling totaled 37 wells, compared to 33 in 2011. This year, drilling will be down slightly, to 35. Oil production was up again, gaining 1.4% to 100,729 bpd. Oil reserves also improved. Gas reserves, on the other hand, lost 10.0%.

Development of Total’s Tempa Rossa onshore oil field, in the southern state of Basilicata, began during second-half 2012. It is the largest proved and undeveloped onshore oil field in Western Europe. Recoverable reserves are estimated to be about 440 MMboe, with a peak daily output of 50,000 bopd. In addition, Edison, carried out re-development operations at Rospo Mare oil field, offshore the Abruzzo coast in the Adriatic Sea. To stop declining production, two new infill wells were drilled during first-half 2013.

EASTERN EUROPE/FSU

The overall region saw drilling jump 13.4% higher. Another 7% gain is forecast this year. Oil production was also up 0.4%. Oil reserves were up by a higher proportion, totaling 124.92 billion bbl. Natural gas reserves rose less than 1%.

Russia. For several years in a row, Russia has led the world in crude and condensate output. Last year’s average was 10.289 million bpd (up 1.1%). Per that figure, Rosneft accounts for 23% of Russian oil production, followed by Lukoil (16%), TNK-BP (14%), Surgutneftegas (12%) and Gazprom (6%). Rosneft acquired TNK-BP earlier this year, so its next set of annual figures will show a sharp increase.

In June 2013, Russian oil production hit 10.53 MMbpd, its highest level since 1988, when the all-time record of 11.03 MMbpd was reached. The number of oil wells actively producing in Russia rose 1.4%, to 160,500.

Drilling last year was up 16.7%, with a 7.2% gain expected during 2013. In July, the Russian National Resources Ministry made official estimates of reserves available for the first time. Once the probable and possible numbers are taken out of the overall figures, the best that one can, the resulting numbers are 84.12 billion bbl of oil and 1,726.6 Tcf of gas.

Other FSU countries. Drilling in Former Soviet countries outside of Russia was down 3.5% last year, but an 8.7% gain is expected this year. Oil production averaged 2.75 MMbpd, down about 2.2%. Oil reserves were up slightly. Gas reserves were 0.2% higher.

Kazakhstan was again the leading producer, at 1.56 MMbopd. Azerbaijan remained the second-largest producer, although output fell 4.9%, to 863,858 bopd.

AFRICA

Drilling across Africa increased about 11% last year. This year, drilling should rise another 8.1%. The continent’s oil production was up 6.4%, due mostly to restoration of Libya’s normal level. Additional offshore gas discoveries continue to be struck, up and down Africa’s eastern coast, Fig. 2.

|

| Fig. 2. The Deepsea Metro I is a sixth-generation drill ship that can drill in water depths up to 10,000ft. BG Group and partners have contracted the vessel to drill exploratory wells and appraisals offshore Tanzania (photo courtesey of BG). |

|

Nigeria. Drilling rose 44% to 138 wells. This year, a further rise to 154 wells is expected. Despite several field development projects underway offshore, Nigerian oil production declined 3.7%. Yet, oil reserves remained virtually unchanged, and gas reserves gained just under 1%.

As evidenced by the high drilling rates, several large offshore field development projects are due to come onstream, but they are running behind schedule. Accordingly, Nigerian oil output should remain somewhat weak until 2014, when several projects will go on-line and spark a significant ramp-up in output.

Algeria. Drilling was up 19% last year. An even greater gain of about 23% is forecast for 2012. Crude and condensate output was up slightly last year. Oil reserves gained 1.1%. Natural gas reserves remained around 159.1 Tcf.

The killing of foreign oil workers at the In Amenas field area last January does not seem to have affected activity, as originally feared. Several field developments are slated to go onstream late this year and into 2014, with production gains of up to 335,000 bopd expected.

Egypt. There are strong concerns within the industry about whether Egypt’s ongoing governmental instability will imperil upstream activity over a several-year period. Drilling had remained steady last year, versus 2011’s rate, but an 18% decline is expected this year. Oil production was off 1.5% last year, at 715,000 bpd.

Mozambique. Last month, Eni struck yet another gas discovery at its Agulha prospect, in Area 4, offshore. There are initial estimates that Agulha might hold 5 to 7 Tcf of gas-in-place. Eni is evaluating the results to decide on an appraisal strategy. The Angulha discovery has unlocked a new exploration play, where the drilling of three more wells is anticipated in 2014.

MIDDLE EAST

The breaking of drilling records in the Middle East continues unabated. Last year, a record-high 3,012 wells were drilled. This year, a 2% gain is forecast. Output across the region averaged 24.9 million bpd of crude and condensate, up 2.7%.

Saudi Arabia. State firm Saudi Aramco continued field development across the kingdom last year. The firm also focused on exploring frontier areas in the Red Sea, and complex reservoirs onshore and offshore. Discoveries included one oil field, Aslaf, and two gas fields, Sha’ur and Umm Ramil. Sha’ur was the first discovery in the shallow waters of the Red Sea. Maximum daily sustainable crude oil production capacity remained at 12.0 MMbpd last year.

Considered by Saudi Aramco to be its “flagship achievement of 2012,” the Manifa field development went onstream early during last April, Fig. 3. It includes 27 drilling islands, 13 offshore platforms and 15 onshore drilling sites. By the time it reaches full output at the end of 2014, Manifa will produce 900,000 bpd of crude, 90 MMcfgd, and 65,000 bcpd. In addition, the kingdom’s first non-associated, offshore gas field, Karan, has helped to boost gas production. Discovered in 2006, Karan was completed last year, and production has reached full capacity at 1.8 Bcfgd.

|

| Fig. 3. Manifa field is a massive development project just completed by Saudi Aramco last year, and which went onstream last April, ahead of schedule (photo courtesy of Saudi Aramco). |

|

UAE-Abu Dhabi. National firm, Adnoc, failed to raise oil production to 3 MMbpd by the end of 2012. Instead, the goal will be reached later this year. Nevertheless, Adnoc and its subsidiaries did raise production to beyond 2.6 MMbopd while expanding capacity from 2.7 MMbopd to 2.8 MMbopd, as part of a five-year plan to boost capacity to 3.5 MMbopd. The majority of last year’s capacity increase came from the Zakum oil fields offshore. In addition, output increased at the Murban-Bab field complex onshore.

Iran. New Iranian President Hassan Rouhani returned former Oil Minister Bijan Zanganeh to his former post. Zanganeh had served eight years as oil minister, until the regime of former President Mahmoud Ahmadinejad came into power during 2005. Zanganeh is well-respected in the global oil community, having successfully attracted billions of dollars of foreign investment into Iran’s oil and gas sector.

Zanganeh’s immediate challenge is to strengthen the struggling oil and gas industry, as he wrestles with crippling economic sanctions imposed by the U.S., the UN and the European Union over Iran’s controversial nuclear program. Zanganeh told reporters in Tehran that a return to oil production of more than 4 MMbopd is needed to overcome these sanctions. Indeed, Iran’s oil output slipped 14.1% last year. Meanwhile, Iran raised its proved oil reserves figure 2.3%, to 154.6 billion bbl.

Iraq. Drilling is estimated to have nearly doubled last year, and an increase of just over 50% is forecast this year. Last May, the joint management committee at giant Rumaila oil field told Reuters that BP would issue three tenders for the drilling of 150 new oil wells in the second half of this year. Also, more than 20 firms were competing to build a 300,000-bopd production facility for the field. A decision on that project is expected in early 2014.

Across Iraq, oil production averaged 2.97 million bpd last year, up 12.6%. Oil reserves were down 1.2%. Natural gas reserves remained unchanged.

FAR EAST/SOUTH ASIA

On the strength of increased Chinese drilling, regional wells drilled increased 8.4% last year. This year, a 2.9% gain is forecast. Regional oil production grew 1.4%.

China. Over the last decade, China’s three major companies, combined, have routinely set new, annual drilling records, and 2012 was no exception. Last year, according to figures from CNPC, Sinopec and CNOOC, China drilled 26,349 wells, up a surprising 8.4% from the previous record of 24,314 set during 2011. By all indications, Chinese operators will break that record this year. Meanwhile, Chinese production engineers worked their magic yet again, boosting the country’s oil output 2.6%. However, oil reserves declined, while gas reserves improved.

China’s largest firm, CNPC, has stepped up exploratory efforts, focusing on natural gas and unconventional resources, including tight oil, tight gas and shale gas. Meanwhile, Sinopec increased activity in several key areas, including 2D seismic acquisition (up 26%), 3D seismic acquisition (up 4%), and footage drilled (up 17%).

Offshore, CNOOC’s exploration hit record highs. About 16,100 sq km of 2D and 26,700 sq km of 3D seismic were acquired last year, and 99 exploratory wells were drilled. Twelve new discoveries were struck, and 14 structures were appraised.

India. Wells drilled were up 24% last year, at 756. This year, that level will remain virtually unchanged. India’s oil production stayed consistent despite some industry naysayers, averaging 774,289 bopd.

Indian exploration picked up considerably in July and August 2013. State firm ONGC reported two new fields found and three new pools discovered offshore. Meanwhile, in June 2013, ONGC spudded the 1-D-1 well in 10,411 ft of water, off India’s East Coast. This enabled ONGC to surpass its own, earlier world record set in January 2013, for drilling a well in the deepest water depth.

In July, operator Cairn India said it would invest $3 billion in further field development, to increase production from, the Barmer oil fields. The company wants to increase production about 20%, to more than 210,000 bopd.

Indonesia. The agency that regulates oil and gas, SKK Migas, appears to be making the very mistakes that prompted the dissolution of its predecessor agency, BP Migas, by Indonesia’s Constitutional Court in December 2012. On Aug. 14, SKK Migas chairman Rudi Rubiandini was arrested for taking an alleged bribe from an executive with a Singapore energy trading company. On Aug. 19, the agency suspended all oil, condensate and natural gas sale tenders in the wake of Rubiandi’s arrest, and the scandal widened to include three other top SKK Migas officials.

Another black eye for SKK Migas occurred back in June, when 12 foreign operators sustained combined losses of $1.9 billion after failing to discover economical reserves in 16 deepwater exploration blocks. These failures occurred from 2009 into 2013 and included 25 exploratory wells. Nevertheless, there was some good news. In late spring, regulators reported that Indonesia’s oil production rate quit falling and actually began to increase during first-quarter 2013, averaging 840,000 bopd in March.

Drilling was down, and a 12% decline is expected this year. In contrast, oil reserves gained 4.7%, while gas reserves plummeted 25.5% in a major revision.

SOUTH PACIFIC

Drilling across the region was up 30.6% last year. A further increase of 15.2% is expected this year. Regional production of crude and condensate slipped 6.5%. Likewise, oil reserves shrank 3%, to 5.12 billion bbl. The good news is that gas reserves have mushroomed to 230.0 Tcf.

Australia. Drilling jumped 44.5% higher, to 237 wells, on the strength of greater onshore activity. Further growth, to 259 wells, is forecast this year. Crude and condensate production continued to disappoint, falling 5.7% to a mere 379,345 bpd. However, oil reserves declined only 2.3%, to about 4.0 billion bbl. There was a major upward revision in gas reserves, with the new total coming in at 205.0 Tcf.

LNG exports continue to be the primary driver of Australian upstream activity. Almost $200 billion are being invested in oil and gas projects across Australia, including seven major LNG projects.

In August 2013, the federal government announced the establishment of an Oil and Gas Industry Innovation Partnership (OGIIP) between officials and the industry. The OGIIP will be headquartered in Perth.

New Zealand. Wells drilled were down 14%, but regulators predict a strong rebound in 2013. Oil production fell again, losing 12.1%. Oil and condensate reserves also took a tumble. The industry has now operated in New Zealand’s sole producing province, Taranaki, for more than 100 years. Nevertheless, crude oil production and exports in the December and March quarters were at their lowest levels since mid-2007.

|