|

JIM REDDEN, Contributing Editor

|

| A Zodiac Exploration-operated rig targets the underlying Kreyenhagen formation in the Calgary-based operator’s San Joaquin basin holdings (photo courtesy of Zodiac Exploration Co.). |

|

The headline in the Sept. 23 issue of The Wall Street Journal says it all: “So much shale oil—but, so hard to get.”

That pithy recap puts into clear perspective the current state of California’s prodigious Monterey/Santos shale, where an estimated two-thirds of remaining U.S. onshore oil reserves are trapped in a near-impenetrable geologic and regulatory quagmire. Despite the relative success of ultra-active, local player Occidental Petroleum, what was once heralded as a shale boom-in-waiting still shows no signs of materializing on a significant scale. This is thanks primarily to age-old tectonic activity that left behind a heavily faulted, naturally fractured geological framework that has proven extremely difficult to crack. Aside from the geological cordon, operators also have to contend with equally seismic environmental resistance.

In mid-October, no less than the venerable Harold Hamm, CEO of Bakken shale pioneer Continental Resources, gave a less-than-encouraging opinion on the near-term prognosis for the comingled Monterey/Santos shale that snakes some 1,752 sq mi through the California interior, Fig. 1. “It’s just been tough to break the code on how to get that. Everybody thought they could, and it hasn’t worked out,” Hamm told the National Journal last month during a Washington, D.C., media confab with a group of independent operators. “It might have a lot of potential, but there are reasons why it’s not being produced.”

|

| Fig. 1. Delineated boundary of 1,752-sq-mi Monterey/Santos shale (map sourced from AAPG). |

|

Occidental Petroleum, for one, would take exception to that observation. The state’s most prolific operator reported increased onshore production by some 10,000 boed, saying in its second-quarter earnings call that nearly one-third of its current output comes from the Monterey and other unconventional plays in the shale-rich state.

Aside from daunting geology, the estimated 15.4 billion boe that the federal government says resides within the Monterey/Santos still remains largely in-situ, because they had the misfortune of being ensnared within what has historically been the nation’s most obsessive “anti-all-things-petroleum” environment. In late September, California enacted what has been described as the nation’s strictest fracing regulations, adding even more oversight to what is inarguably one of the most stringent regulatory regimes. However, owing to its muddled geological structure that makes fracing extremely difficult and costly, comparatively few Monterey/Santos wells have undergone frac stimulation, forcing operators to look at alternative EOR techniques, such as cyclic steam injection.

In what is yet another obstacle, a considerable percentage of prospective Monterey/Santos acreage is under federal control, which presents an entirely new suite of accessibility and regulatory challenges. The U.S. Bureau of Land Management (BLM) last December auctioned off some 18,000 acres in central California, despite environmentalists’ attempts to block the lease sale. Furthermore, proposals to impose new fracing regulations for wells on federal property are currently under debate.

Throughout California, however, harsh economic realities appear to be setting in, and over the past year, drilling opposition has softened to a degree. A growing number of voices within the state cite the identified reserves of the Monterey/Santos, as well as the multiple associated shale targets, as the prospective elixir for California’s notorious budget ills that, in recent years, have led to a handful of municipal bankruptcies. Those voices were augmented with the October release of an economic study commissioned by the Sacramento-based Western States Petroleum Association (WSPA) that calculates development of the Monterey/Santos and adjoining source shales could have an aggregate $28.7-billion impact to the San Joaquin Valley, which accounts for upwards of 75% of the state’s current oil production.

Well before those economic estimates can be realized, however, operators must first universally break the code that Hamm referenced. Thus far, horizontally accessing the purportedly gargantuan reserves has proven to be an overtly taxing proposition. “My view is that we do the easy oil first, like the Bakken,” AllianceBernstein analyst Bob Brackett wrote in a critical 2012 evaluation. “But, time will bring us back to the Monterey.”

RIGS, PERMITS UP SLIGHTLY

In 2011, the U.S. Energy Information Administration (EIA) estimated the technically recoverable oil reserves in the Monterey/Santos to be more than double those of the Bakken and Eagle Ford, combined. That assessment validated the potential of the well-known source rock for practically all of California’s oil production, including the more-than-100-year-old Midway-Sunset, South Belridge, and Oxy-operated Elk Hills fields in the San Joaquin basin.

Originating to the north in Sacramento, the play runs alongside the infamous San Andreas Fault, as it extends southward through the San Joaquin, Santa Maria and Los Angeles basins, where it reaches offshore and onto the outlying islands. The prospective core, however, is centered in the San Joaquin Valley’s Fresno, Kern, Kings, Madera, Merced, San Joaquin, Stanislaus, and Tulare Counties.

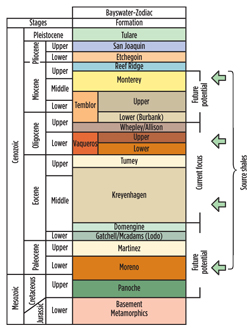

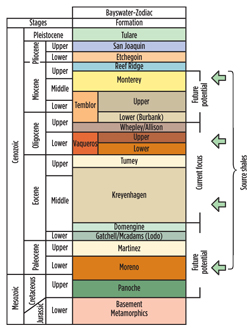

The Upper and Lower Miocene Monterey, and the heavily fractured Santos actually comprise the most notable segment of a multi-layered petroleum system (Fig. 2) that takes in multiple, potential shale and source rock targets. The less-celebrated outliers include the overlying Reef Ridge (home of the tremendously tight Diatomite reservoir) and Antelope shales, and the underlying Eocene Kreyenhagen, Moreno and Sacramento shales. Calgary’s Zodiac Exploration Inc., for instance, continues to focus on stacked pay potential, with an ongoing Monterey/Kreyenhagen exploration program near Kettleman City in the San Joaquin basin.

|

| Fig. 2. Regional stratigraphy, showing the multiple onshore resource prospects (source: Zodiac Exploration Inc.) |

|

Younger than typical North American shales, the biogenic-rich Monterey and Santos typically have been drilled and produced vertically, at well depths of around 11,250 ft, with thickness that varies throughout the play, up to 1,875 ft.

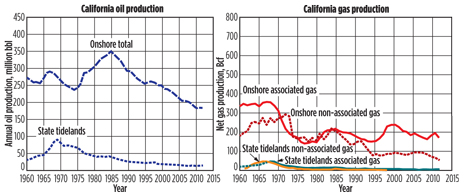

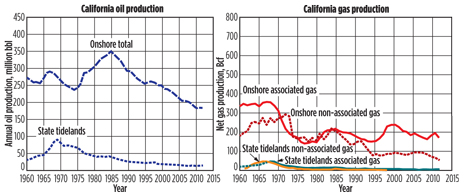

Owing to consecutive year-on-year declines in conventional oil production, California last year dropped, to become the fourth-largest U.S. oil producer behind Texas, North Dakota and Alaska. According to the California Oil, Gas and Geothermal Commission (COGGC), 2012 ended with a modest improvement, as overall oil production totaled roughly 197.5 million bbl, up from the 196.8 million bbl recorded in the prior year, Fig. 3. On the downside, for the fifth consecutive year, onshore production declined slightly, to 184.3 million bbl from the 184.5 million bbl produced in the previous year.

|

| Fig. 3. California’s 2012 oil and gas production and historical trends (charts courtesy of California Department of Conservation, Division of Oil, Gas and Geothermal Resources). |

|

The Midway-Sunset complex continued as the state’s top producing field, with 29.3 million bbl produced last year, which nonetheless was down year-on-year by some 1.3 million bbl. As of July, California’s oil daily oil production was estimated at 585,000 bpd, up from 582,000 bpd in the like period last year.

Although not broken out to designate horizontal Monterey/Santos targets, both the onshore rig count and new drilling permit authorizations are inching upward this year. According to Baker Hughes, 38 rigs were active onshore California as of Oct. 11, compared to 34 during the same period last year. Going forward, the COGGC had approved 2,083 onshore drilling permits as of October, an increase from the 1,958 authorizations that the state’s chief regulator issued by last October. Of the drilling permits issued this year, 1,964 were for wells in COGGC District 4, which takes in prolific producer Kern County, in the heart of the Monterey/Santos San Joaquin Valley fairway.

In 2012, California operators drilled an estimated 3,177 wells and appear on pace to reach the 3,300 wells that World Oil’s mid-year forecast predicts will be drilled in the state this year.

DUBIOUS NEAR-TERM PROSPECTS

Despite the EIA’s delineation of Monterey/Santos reserves as “technically recoverable,” Hamm and Brackett join a group, who seem to view that designation as a misnomer-of-sorts, at least for now.

One drawback centers on its proximity to the San Andreas Fault, which, over eons, subjected the formation to intense seismic activity, leaving shale layers that are atypically thick and folded together. Some have described the Monterey stratigraphy as resembling an accordion. Consequently, horizontal Monterey/Santos wells generally are difficult, and expensive to drill and frac, requiring stimulation from deeper zones than other unconventional targets. Thus, operators have turned to evaluating other EOR technologies, including acid, steam and CO2 injection.

While homegrown Chevron controls significant onshore California acreage, the major, nevertheless, has cooled on the unconventional play, for the time being focusing on prospects that it says are much easier to access and are more profitable.

“I think the jury’s out a little bit on the Monterey Shale,” CEO John Watson told reporters in late May, following the company’s annual meeting. “I don’t think we’ve completed—the industry has completed—the assessment enough to reach a conclusion. Others have been very bullish and have spoken out on this. We haven’t seen the same economics that others have, up to now.”

The same goes for once-active Venoco Inc. of Los Angeles, which, after drilling some 29 Monterey shale wells over a two-year period, said late year that it had uncovered no “material levels of production or reserves.” On Dec. 31, the independent announced the $250-million sale of its Sacramento basin producing properties and essentially all of its prospective Monterey acreage in the San Joaquin basin. The acquisition by an unnamed buyer, however, excludes the Venoco-operated Sevier field.

On the other hand, Occidental Petroleum, the premier leaseholder and the most active onshore player by a wide margin, has renewed its focus on the Monterey shale, which it first began evaluating at Elk Hills as early as 1998. As part of a major business unit restructuring late last year, one of three asset teams established by Occidental will focus entirely on its unconventional prospects.

“The team will focus on unconventional development opportunities to optimize recoveries from the Monterey and other key shale plays in California,” Vicki Hollub, Oxy executive vice president and head of California Oil and Gas, told analysts in the second-quarter earnings call. “We believe this structure gives us the ability to grow our California operations more efficiently, maximize the benefits from the improvement in operating and capital costs that we’ve already achieved, and drive additional improvements in our cost structure.”

Despite its progress in exploiting Monterey acreage compared to other operators, Occidental’s plans to spin off its California operations into a stand-alone company nevertheless ran into a shareholder wall last month. Dissenting investors specifically cited less-than-encouraging results from Oxy’s efforts to tap the prolific shale, suggesting to Bloomberg on Oct. 28 that patience is needed to reap the best value from a spinoff or initial public offering (IPO).

Oxy CEO Stephen Chazen began talking to investors and analysts in April, regarding the splitting of its California holdings into a separate company. He has since said that a slow permitting process and high costs have hindered Occidental from increasing production more rapidly in the state.

To help offset the costs and difficulties inherent in fracing Monterey/Santos laterals, Occidental has reported positive results from its deep acid injection tests. Further, at its Elk Hills shale program, Occidental is running mostly slotted, rather than cemented, liners, which it claims is saving upwards of $1.5 million per well “with no degradation in production.”

‘TOUGH’ FRACING RESTRICTIONS

In late September, California Gov. Jerry Brown (Dem.), who the industry says has been reasonably supportive, nonetheless signed into law sweeping frac regulations that impose what have been described as the nation’s toughest restrictions. While ostensibly regulating fracing, the WSPA says the new law also requires state supervision of acid injections.

According to the WSPA, the regulations will require more permits, more monitoring, more water testing, more disclosure and more notification of activities. Among the new requirements, before commencing a frac job, operators must now notify nearby property owners, who can request a baseline water test.

Ironically, the seemingly all-inclusive legislation did not include a final mechanism for awarding permits. Brown has said that gap will be closed when, as instructed, the California Department of Conservation develops “a permitting process that takes both geological conditions and environmental consequences into account.”

“Now comes the hard work of trying to understand all of the ramifications of this sweeping legislation,” said WSPA President Catherine Reheis-Boyd. “But, one thing is crystal clear—California now has the most stringent and farthest-reaching regulations of hydraulic fracturing, and other oil and natural gas production technologies, of anywhere in the country and probably the world.”

However, considering the relatively small percentage of Monterey/Santos wells that lend themselves to successful fracing, some look at the legislation as much ado about little. Even Mark Nechodom, director of the Conservation Department and the state’s chief regulator, conceded that California “might see around 650 hydraulic fracturing jobs a year,” which would represent a fraction of the cumulative wells drilled, Fig. 4. The WSPA said its member operators typically average a combined 628 frac jobs annually.

|

| Fig. 4. Only about 650 of 3,000-plus wells, drilled and completed each year in California, undergo frac jobs. |

|

“Fracing isn’t something that we use to a great degree at all,” says Venoco CEO Edward J. O’Donnell. “The only fracing that we really have done recently is in the Sevier prospect, in the onshore Monterey, and that’s limited, of course. And, that’s on federal acreage there, so it’s really more tied to what the BLM does. So, the only impact we would have would be a little bit in Sevier, probably.”

Despite the new law being characterized as overly restrictive, environmental groups and their legislative allies deride the law as not going nearly far enough. Environmentalists have repeatedly called for an outright ban, which given California’s infamously sick budget, has been falling on more deaf ears of late.

“There is no longer a place in California for the emotion-fueled demands for a moratorium on hydraulic fracturing,” said Reheis-Boyd. “Continued demands for moratoria and other extreme measures have no audience in the Capitol.”

INDEPENDENTS HOLD SWAY

Apart from Occidental, the play’s most active player by far, nearly all activity is in the hands of a few medium- and small-sized independents, many of which are privately held. Owing largely to continual permitting issues and stiff competition for acreage, most of these players keep their activities close to the vest. However, a sampling of the public data available show many firms targeting multiple shale resource prospects.

Occidental Petroleum controls more than 2.1 million net acres, making it the largest leaseholder by an unapproachable margin. Within its total leasehold, Oxy says more than 1 million acres are prospective for the Monterey and other unconventional resources. Last year, the operator drilled more than 760 wells in the state and increased production to 148,000 boed, from the 138,000 boed produced during 2011, with a growing portion coming from the Monterey and other unconventional plays.

Occidental EVP Hollub said the operator plans to drill more than 70 unconventional wells this year, 53 of which will target the Monterey and other shales around its graybeard Elk Hills field in Kern County. “Our ongoing program around Elk Hills is expected to increase our ultimate recovery by about 150 MMboe,” she told analysts.

Outside of Elk Hills, Oxy also is targeting unconventionals with an ongoing drilling and development program at Rose field, acquired in 2009. In 2012, Occidental drilled eight development wells in Rose, where it plans to drill six horizontal wells this year. Oxy says that roughly 40% of its 2013 capital spend in California will be earmarked for water and steam flood projects.

Venoco Inc., which liquidated the bulk of its prospective Monterey shale holdings on Dec. 31, continues to operate Sevier field in the western San Joaquin Valley. Before the sale, Venoco said that $20 million, or 41% of its capital expenditures, in third-quarter 2012 were directed to the Monterey shale, including nine wells drilled in Sevier field. No information was available on 2013 plans.

Underground Energy Corp. of Santa Barbara holds 40,350 net acres, of which 6,200 net acres are in its Zaca field extension that targets the Monterey in the Santa Maria basin. In January, Underground signed a farm-out agreement with AmRich Energy that gives the latter a 75% working interest in 1,063 acres in the central southern section of the Zaca field extension.

Under the farm-out agreement, AmRich initially will drill and complete three wells, with plans for a fourth to be drilled before Dec. 31, 2014, Underground says. The farm-out targets the Upper Monterey, which historically has been the primary producing zone in Zaca field.

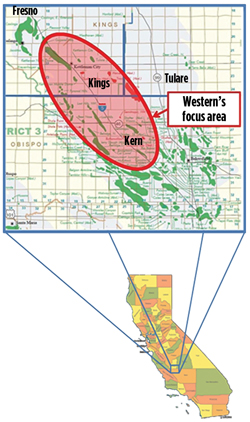

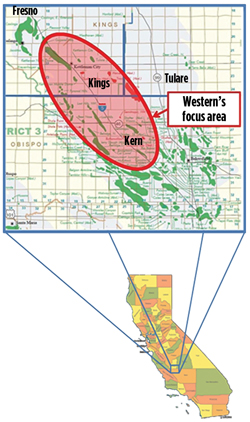

Zodiac Exploration holds some 72,000 net acres in Kings and Kern Counties in the San Joaquin basin, where it primarily targets the Monterey and the underlying Kreyenhagen shales. Zodiac estimates its Monterey and Eocene Kreyenhangen leasehold contains 10 billion boe of gross reserves. Zodiac says it also is exploring stacked resource potential in the Whepley, Vaqueros and Moreno formations, which were evaluated in a 14,950-ft vertical well drilled in 2010. Zodiac is directing much of its activity on its Panther prospect, which is appraising both the Monterey and Kreyenhagen shales, with each formation having gross thicknesses of more than 1,000 ft.

In the fourth quarter, Zodiac agreed to a farm-out with Aera Energy LLC, the privately held JV of Exxon Mobil and Shell. The farm-out covers nearly 20,000 acres on Zodiac’s Mortgage block. As with Phase one of the farm-out, the second phase also includes one horizontal and one vertical well, with drilling to commence before Dec. 1, Zodiac says.

Western Energy Production, LLC of Rancho Santa Fe, Calif., holds 125,000 net acres in the San Joaquin basin, focusing primarily on the stacked pay potential of the Monterey, Tumey, Kreyenhagen and Moreno shales, Fig. 5. Western, likewise, has a farm-out arrangement with Aera Energy that covers more than 85,000 net acres. As part of its farm-in, Aera has received drilling permits for five wells, two of which had reached TD this year. The two designated Aera Brooks wells were scheduled for completion this summer.

|

| Fig. 5. Western Energy focus area, including acreage within the Aera Energy farm-in (map courtesy of Western Energy Production). |

|

“The drilling activity on our California asset is proceeding as scheduled, with both Brooks wells reaching TD as planned,” Western President Steven Marshall said in the April 15 update. “The wells are currently being evaluated and tested, and stimulation and completion should take place sometime this summer.”

Santa Maria Energy, LLC, continues an extensive development program on 11-year-old Orcutt field in Santa Barbara County, where it targets the Monterey and the Sisquoc diatomite formation of the upper Reef Ridge shale. The private operator is employing cyclic steam EOR in the extremely tight dolomite reservoir, which will be exploited with 136 producing wells.

Development plans call for the drilling of an additional 110 wells, two steam generators, pipelines and oil processing facilities.

Linn Energy, LLC, in February finalized its reported $4.3-billion acquisition of Berry Petroleum Co., which held 7,184 gross development and undeveloped acres overlying prospective Monterey and other shales. Berry had estimated 1 billion bbl of oil-in-place within its leasehold. Like Santa Maria Energy, Berry had focused primarily on the diatomite prospects in its North Midway-Sunset (NMWSS) complex in the San Joaquin Valley, Fig. 6. In 2012, Berry drilled 94 new producers and 26 replacement wells, and continued to expand the NMWSS infrastructure. In the fourth quarter, Berry said average diatomite production reached 3,855 boed, a 10% increase from the previous quarter. The combined company will be based in Houston.

|

| Fig. 6. Several operators are exploring Monterey prospects in the western San Joaquin basin of the Monterey shale. |

|

Amerada Hess opened an office in Bakersfield during 2011, leading to speculation that it would be transferring its experience in the Bakken, Eagle Ford and other shales to the Monterey/Santos. No information on acreage acquired or activity plans has been made available.

ECONOMIC IMPACT STUDY

Last month’s release of the WSPA-sanctioned economic impact study showed development of the Monterey/Santos by 2030 would potentially deliver up to 195,000 new jobs, more than $22 billion in personal income and $6.7 billion in new taxable revenue for the San Joaquin Valley, Fig. 7. The study was conducted by economists from California State University in Fresno and presented at the Oct. 18 West Kern Petroleum Summit.

|

| Fig. 7. Much like finding the elusive end of the rainbow, the Monterey shale has yet to demonstrate its full potential, although there are hopeful signs. |

|

“Unlike much of the rest of the state, my constituents are still feeling the effects of one of the worst economic recessions in California history. I am committed to taking the findings of this report back to Sacramento and continue to work on policies that will ensure we can capitalize on this resource in a safe and responsible manner,” said California Assembly member Adam Gray.

With California’s numerous budgetary woes, an increasingly swelling tide is beginning to sweep over the state, drowning out some of the anti-drilling opposition. Even the state’s media have gotten into the act of late, reflected in an October editorial in the U-T San Diego (formerly the San Diego Union-Tribune), which encouraged California to do what it takes to reap the economic benefits that shale plays bring to North Dakota, Texas and elsewhere. “Something amazing is happening in the American economy. It’s time California got on the bandwagon,” the editorial concluded.

|