JIM REDDEN, Contributing Editor

If the Three Forks/Bakken shale sounds awkward now, allow it to sink in.

To be sure, no one expects the core Middle Bakken formation to take a backseat anytime soon, but indications are mounting that a role reversal of sorts may happen. Between a newly released doubling of recoverable reserve estimates, and a premier operator’s recent flowrates from a previously unexplored lower zone, it would not be entirely farfetched to envision the underlying Three Forks/Sanish emerging as a horizon of choice in the more-than-200,000-sq-mi, liquids-rich hybrid play.

For starters, the erstwhile stepchild was the featured attraction in the eagerly awaited United States Geological Survey (USGS) re-assessment, released on April 30, which doubled, to a minimum of 7.4 billion bbl, the mean undiscovered and technically recoverable reserve base of the Bakken/Three Forks. Of that figure, the aggregate resource assessment plants a conservative estimate of 3.73 billion bbl in the Three Forks, which was not included in the original 2008 USGS reserve study, as it was then considered largely non-commercial. The updated assessment followed on the heels of Bakken pioneer Continental Resources unveiling impressive test results from a once-virgin third bench of the lower Three Forks.

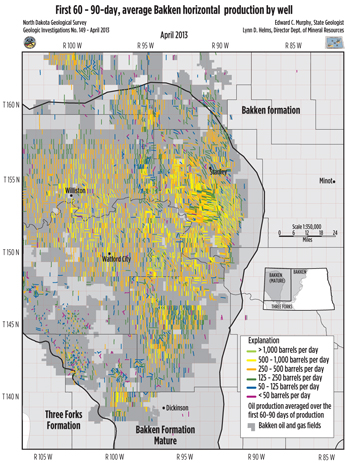

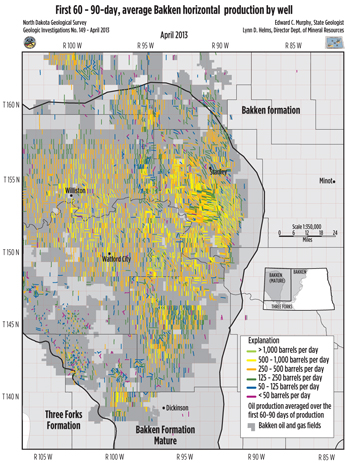

For the foreseeable future, however, the inter-country Williston basin phenom remains the Bakken/Three Forks shale. Regardless of how you label it, the North Dakota epicenter of the extremely organic-rich, low-permeability play continues to rewrite production records. Latest statistics available from the North Dakota Industrial Commission’s Department of Minerals Resources (DMR) show producers setting monthly records for both oil and gas in March, with an average 782,812 bopd and an estimated 846.9 MMcf, respectively, from 8,634 wells, Fig. 1. The state expects operators to book up to 850,000 bopd by year-end.

|

| Fig. 1. A December 2012 update plotting initial Bakken production. Source: North Dakota Geological Survey, April 2013. |

|

Fortunately, this ever-increasing production flows into an infrastructure that finally is showing signs of keeping up, thanks to an expanded railway crude delivery network. Takeaway bottlenecks earlier forced Bakken operators to discount as much as $28/bbl, relative to West Texas Intermediate (WTI). Yet, in the first quarter, the price differential had narrowed to an average $3.52/bbl, according to the U.S. Energy Information Administration (EIA). In addition, further relief is in the offing, with three refineries in various stages of development that will process a cumulative 60,000 bopd within the heart of the Bakken/Three Forks.

RIGS, COSTS DROP

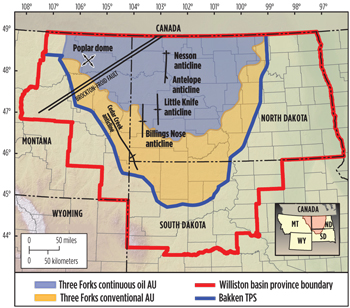

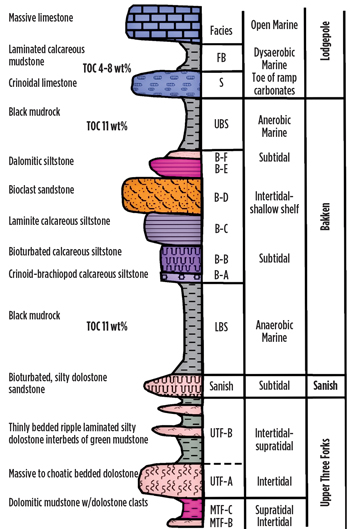

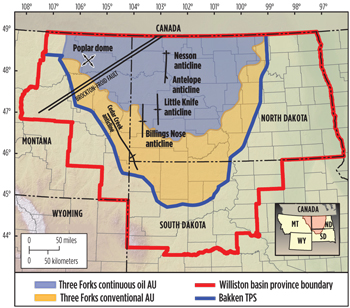

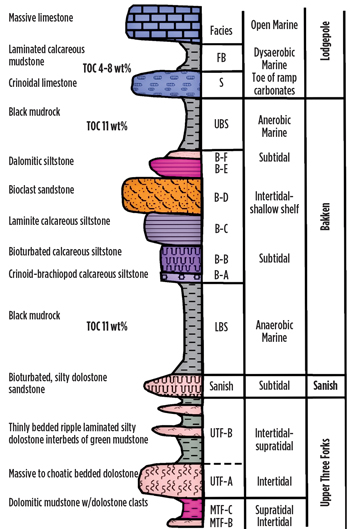

Variously described as a carbonate sandwiched between two source shales, the Bakken/Three Forks underlies most of western North Dakota, eastern Montana, and northern South Dakota and across the Canadian border, into Saskatchewan and Manitoba, Fig. 2. As presently delineated, five discrete stratigraphic units comprise the Upper Devonian and Lower Mississippi-age Bakken petroleum system. They include the uppermost Lodgepole Limestone, the upper, middle and lower Bakken Shale members and the underlying Devonian Three Forks/Sanish formations, Fig. 3. Depths range from around 3,000 ft in the northern limit, to more than 11,000 ft in the center of the play. On average, Bakken formation thickness ranges from 80 ft to a high of about 145 ft in westernmost North Dakota.

|

| Fig. 2. Currently delineated geographic boundary of the Bakken/Three Forks play. Source: US Geological Survey (USGS) |

|

|

| Fig. 3. Detailed lithofacies of the Bakken formation provide a framework for the Bakken exploration model and reservoir geo-model. Source: Colorado School of Mines for U.S. Department of Energy (DOE) National Energy Technology Laboratory (NETL), issued March 2012. |

|

According to Baker Hughes, as of May 20, 190 active rigs were at work, mainly targeting horizontal liquids-rich zones in the U.S. portion of the Bakken/Three Forks, with all but 11 of those drilling in North Dakota, Fig. 4. Across the border, the Canadian Association of Oilwell Drilling Contractors (CAODC) lists six rigs active in the core Saskatchewan fairway of the Bakken, down from 19 during the similar 2012 timeframe. Nearly all Canadian Bakken activity is centered on the Fairfield area near the U.S. border.

|

| Fig. 4. New Bakken drilling location along Interstate 94, six mi east of Belfield, ND. Photo by David Ferderer, U.S. Geological Survey (USGS) |

|

Like Canada, the most recent U.S. tally was down from the 216 rigs actively making hole in the like period last year—a decline most consider an offshoot of the increased attractiveness of multi-well pad drilling, improved overall efficiencies and operators’ continuing efforts to rein-in high well costs. The lower rig count also has been blamed on a terribly strained infrastructure that has limited operators’ abilities to bring in more rigs and crews. Going forward, the North Dakota DMR issued 621 new drilling permits during the first three months, compared to 460 during the first quarter of last year, most of which are for multi-well pads.

It is the escalation of multi-well drilling pads, along with renegotiated short-term contracts for contractors and other service providers, that are helping lower what historically have been some of the nation’s highest costs for unconventional wells. The costs of constructing comparatively deeper Bakken wells, with as many as 40 frac stages in laterals that reach 9,500 ft or longer, have exceeded $11 million in some cases. Over the past year, however, costs have started to retract.

For example, major local player Oasis Petroleum credits intensified pad drilling operations, lower service costs, and optimized well and completion designs, as contributors to a 16% drop in its per-well costs during second-half 2012. The operator says its well construction costs dropped from $10.5 million to $8.8 million at year-end, and has set a 2013 target of $8 million/well.

Continental Resources, which employs its so-called ECO-Pad multi-well drilling methodology, said in its fourth-quarter 2012 earnings call that it remains on track to reduce average well costs by $1 million to $8.2 million by the end of this year.

In a related development, the U.S. Bureau of Land Management (BLM) pocketed $644,000 from a May sale of 32 federally controlled parcels in North Dakota and Montana. North Dakota independent Irish Oil & Gas Inc. was the high bidder, paying $280,800 for a 71-acre lease in northeastern Montana. Results of the latest federal auction are paltry compared to the $11.4 million that the BLM netted in a January sale covering more than 2.8 million acres in North Dakota. Slawson Exploration of Kansas was the top buyer in that offering, shelling out nearly $1.6 million for an 80-acre parcel in Mountrail County, ND. A third BLM sale is scheduled for July 16.

‘THE BIG UNKNOWN’

Historically, the primary, oil-bearing Middle Bakken member, which first produced in the late 1990s as a secondary target in the prolific Elm Coulee field in Richland County, MO, has been the principal production zone. Shortly after the Montana debut, operators shifted gears to North Dakota where the Middle Bakken is comparatively thicker. However, with further delineation, northward activity is expected to steadily increase in Montana. As of May 20, 10 rigs were active in the Montana Bakken. The Montana Board of Oil & Gas Conservation recorded more than 143 million bbl of oil and nearly 122 MMcf of gas delivered, as of May 3, from 1,031 producing wells in the state’s slice of the Bakken.

Through all of this, the Three Forks, which unconformably underlies the Bakken and is separated by the thin and dolomitic Sanish sandstone, was once considered nothing more than a drain trap for its celebrated counterpart. Unlike the highly impermeable Bakken, where more than 30 frac stages are commonplace for full reservoir drainage, the lower Three Forks/Sanish sands are higher in porosity and permeability values. Operators say the formation is well-suited for single or dual completions, in tandem with the Middle Bakken.

Nevertheless, at the time of the 2008 USGS assessment that first pegged the Bakken’s cumulative recoverable reserves at a mean 4.3 billion bbl, only small amounts of exploration data were available on the Three Forks, and it generally was considered uneconomic and, thus, not considered in the analysis. Buoyed by subsequent Three Forks drilling and production test results, which showed higher comparative recovery rates than its overlying megastar, state and federal officials, led by U.S. Sen. John Hoeven (Rep. – N. D.), called for the USGS to update its reserve assessment and include the Three Forks in the mix. The results speak for themselves, with the Three Forks now believed to hold more than half of the entire play’s mean undiscovered and technically recoverable reserves. On the high end, the USGS study has Bakken/Three Forks undiscovered reserves possibly reaching a collective 11 billion bbl, far less than the 24 billion boe that Continental Resources estimated in 2010 would eventually flow out of the play, given continual technological advancements.

“The Three Forks was the big unknown,” Brenda Pierce, USGS energy resources program coordinator, said upon the April release of the new assessment. “Since then (2008 study), there’s been an explosion of interest. The Bakken is still big, but the Three Forks is the up-and-coming (play).”

Prospective expectations were further cemented in December, when Continental released results from the first well to test the third bench of the Three Forks. The Charlotte 3-22H in McKenzie County, N. D., flowed 953 boed at 1,700 psi on a 28/64-in.choke in its initial one-day test period, according to Continental. The well was drilled to 21,324 ft, TD, including a 9,701-ft lateral, and completed with 30 frac stages.

In 2011, Continental became the first to establish commercial production from the second bench of the Three Forks, after having earlier proven the productive potential of the first bench. Continental says its 1,280-acre Charlotte unit is the first in the Bakken/Three Forks play to have wells producing from the Middle Bakken, as well as the second and third benches of the Three Forks.

Saying the third-bench well “could be a real game-changer,” Continental Chairman and CEO Harold Hamm said the Charlotte 3-22H is the first in a planned 14-well drilling program that the operator intends to complete by year-end to further test the lower Three Forks. The drilling campaign will also include the fourth bench of the Three Forks, as it attempts to more fully define the productive extent of the emerging play.

Immediately after the third-bench production results were announced, North Dakota’s top regulator predicted that the Charlotte 3-22H would be a defining moment in the already storied annals of the Bakken/Three Forks. “This is one of those signposts in the Bakken Petroleum System, and one of those significant wells that everybody will look back to and say, ‘that was a major event in terms of figuring out the Bakken Petroleum System,’” DMR Director Lynn Helms told a Bismarck television station.

In its first-quarter 2103 earnings report, Continental listed six wells producing in the lower benches, with average initial production (IP) rates of 1,170 boed. Those six wells, Continental says, are producing in-line with typical Middle Bakken and first-bench Three Forks producers.

TAKEAWAY IMPROVING

By far, the biggest headache stressing Bakken/Three Forks producers has been takeaway bottlenecks into the primary gathering hub at Cushing, Okla. However, as illustrated in the improving price differentials, the problem is easing, thanks largely to railroad expansion projects that began in second-half 2012. While plans for additional pipeline capacity have been announced, for the time being well over a quarter of all Bakken/Three Forks crude is delivered by rail.

Primary shipper, Burlington Northern Santa Fe (BNSF), plans to spend “a couple hundred million dollars” on capital improvements that will boost Bakken oil shipments 40% this year, the railroad said. BNSF expects Bakken shipments to increase to 700,000 bopd by the end of 2013.

Canadian Pacific Railway, which operates 1,000 mi of track in the Bakken/Three Forks, said it hopes to increase its capacity to about 70,000 carloads, amounting to about 125,000 bpd—a more than five-fold increase over its total Bakken shipments of two years ago.

While transportation infrastructure is expanding, three separate partnerships are taking an opposite approach to the difficulties of moving product to the market: Bring the market to the product. Three North Dakota refineries, which are the first to be built from the ground up in the U.S. in more than 35 years, are in early construction, in and around the Bakken/Three Forks. When up and running, each would refine some 20,000 bopd into diesel and kerosene, which are in heavy demand in the area.

Ground was broken in May for the 100% Native American-owned Thunder Butte Petroleum Services Refinery, southwest of Minot, N. D., which is to be completed in phases over the next two years. In March, construction also began on the Dakota Prairie Refinery near Dickinson, which is a JV between MDU Resources Group and Calumet Specialty Products. The partners, likewise, expect the refinery to be processing at least 20,000 bopd within two years. Dakota Oil Processing LLC is in the design stages of a reported $200-million refinery to be built near Trenton, N. D., that also will have an initial 20,000-bopd capacity and produce ultra-low sulfur diesel.

Meanwhile, ExxonMobil subsidiary, XTO Energy, signed the first takeaway agreement for a Bakken pipeline being constructed by a CenterPoint Energy subsidiary. The pipeline will have the capacity to move 19,500 bopd when completed.

SEVEN SISTERS

In his year-end 2012 review, DMR Director Helms singled out seven operators—Continental Resources, Hess, Whiting Petroleum, Statoil, Oasis Petroleum, Marathon and EOG Resources—as accounting for up to 65% of Bakken drilling. A summary of 2013 exploration and development plans suggests that this percentage will not drop in the near-term.

Continental Resources, with its 1.1-million net acres, remains by far the predominant leaseholder in the Bakken/Three Forks, where it plans to complete 245 net and 790 gross wells this year. During the first quarter, the Oklahoma City-based operator produced a record net production of approximately 121,500 boed, which comprised 71% crude oil.

Including its continuing lower Three Forks drilling program, Continental completed 66 net (162 gross) wells in the first quarter, with 80 gross wells awaiting completion. North Dakota wells completed in the first quarter averaged initial one-day tests of 1,125 boed, while operated wells in Montana averaged initial flowrates of 670 boed, which included 87% oil.

Continental will complete a 47-gross-well pilot density program this year, to determine optimum well spacing and patterns for ultimate recovery from the Bakken/Three Forks. As of the first quarter, the operator was drilling its ninth well on its 320-acre pilot density project at the Hawkinson pad in Dunn County. Drilling also is underway on the 13-well, 160-acre pilot on the Wahpeton pad in McKenzie County and the 12-well, 320-acre pilot on the Tangsrud pad in Divide County. An additional 320-acre pilot program will spud in second-half 2013 at the Rollefstad pad. Owing to steady efficiency gains, the company plans to reduce its operated rigs to 20 units for the remainder of the year.

Whiting Petroleum controls 704,525 net acres in the play and recorded just over 66,155 boed in the first quarter. Whiting started the year with 20 rigs and plans to drill up to 148 net wells this year, with much of its activity centering on its Sanish, Pronghorn and Lewis & Clark prospects.

In the second quarter, Whiting planned to initiate a higher-density pilot program in the Sanish field. If successful, the program could add 191 new Middle Bakken locations. The operator said it also intends to re-frac several Sanish wells during the year.

Elsewhere, in the operator’s 65,481-net-acre Missouri Breaks holdings, the Miller 34-8-1H was completed in March at a field-best 1,475-boed production rate. Whiting said its Southern Williston basin Pronghorn and Lewis & Clark prospects netted average first-quarter production of 13,800 boed—a 52% increase over the first quarter of last year.

Hess, at the end of 2012, had booked net Bakken production of 56,000 boed, compared to 30,000 boed at the end of the previous year. Last year, Hess brought 206 new wells online within the 725,000 net acres that it holds in the North Dakota fairway. Much of the focus last year was on infrastructure projects, including expanded export capability at the Tioga rail terminal and the Tioga gas plant expansion. The former began operation in April, while the expanded gas plant is expected to start up in the fourth quarter.

Hess moved to pad drilling during the fourth quarter and expects a temporary flattening of production until mid-2013, after which output should average between 64,000 and 70,000 boed for the full year. Hess plans to operate 14 rigs this year.

EOG Resources plans to complete 53 net wells this year in its core Bakken Parshall field and the Antelope extension in northeastern McKenzie County. At last count, the independent held approximately 600,000 net acres in the play, from which it booked 167 MMboe of proved reserves at the end of 2012.

Like Continental, EOG is exploring the lower benches of the Three Forks, and in the first quarter released production test results from its first second-bench well. The Riverview 03-3130H was completed to sales at 3,150 bopd, and EOG plans to continue testing the second bench in the same area this year. Also in McKenzie County, the West Clark 101-2425H was completed in the first bench of the Three Forks at an IP rate of 2,205 bopd.

In the core Parshall field, EOG said its move to 160-acre spacing is delivering attractive IP rates. EOG has singled out the Wayzetta 136-2127H that was completed at an IP rate of 1,910 bopd, and the Fertile 53-3024H that went online at 1,725 bopd. EOG said if crude oil prices hold up, it will increase its North Dakota drilling in 2014.

Oasis Petroleum has a 335,000-net-acre leasehold in the Williston basin, of which some 305,000 acres are in the core Bakken/Three Forks fairway. The independent is operating nine rigs and plans to complete 103.4 net wells this year. Oasis is shifting to full-pad development in much of its Indian Hills and Cottonwood properties in the Western Williston and East Nessons areas of the basin, respectively.

In 2012, Oasis increased production by 110% to an average 22,469 boed, compared to the like period in the prior year. Last year, Oasis completed 117 gross operated wells and increased proven reserves by 82% to 143 MMboe. The drilling mix included 13 wells in the first bench of the Three Forks.

Oasis plans to drill 20 Three Forks wells this year outside Indian Hills and South Cottonwood, as it better defines the areal extent of the lower formation across its acreage position. In addition, the company said it is analyzing cores and logs from six pilot wells to evaluate the lower Three Forks benches. In 2011-2012, Oasis added 183 Three Forks wells to its primary operated inventory base.

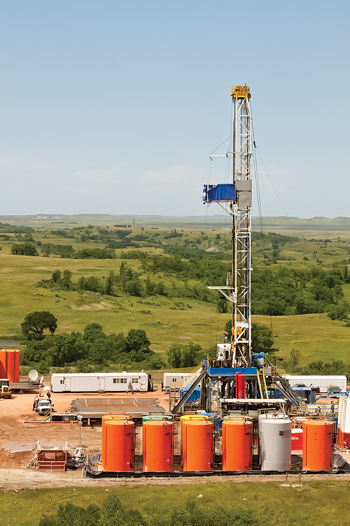

Marathon Oil holds about 410,000 net Bakken/Three Forks acres, spread out between North Dakota and eastern Montana. Marathon says its 2P net resource holdings stand at 565 MMboe. The operator drilled 18 gross wells last year, but no specific 2013 drilling plans have been released, Fig. 5.

|

| Fig. 5. A Marathon Oil-operated rig at work in North Dakota. Courtesy of Marathon Oil. |

|

Net production for 2012 averaged 28,000 bpd of liquids and 8 MMcfd of gas, representing 26% and 2% of Marathon Oil’s total U.S. liquid and gas sales, respectively. Marathon plans to drill 300 gross operated wells over the next four years, and expects Bakken production of 50,000 to 60,000 boed by 2017.

Owing to strong well results, Marathon increased its Bakken guidance for 2013 to approximately 40,000 net boed, 14% higher than the original guidance.

|

| Fig. 6. A Statoil rig on location on the Norwegian operator’s Williston Basin holdings. Photo by Ole Jørgen Bratland, Statoil ASA. |

|

Statoil, through its 2011 acquisition of Brigham Exploration Co., holds more than 375,000 net-acres in the core Bakken/Three Forks. While no 2013 drilling plans have been released, the Norwegian operator reportedly is running 12 rigs and is looking at drilling up to seven wells per pad in some parts of the play, Fig. 6.  |