|

Crude and condensate. Although oil prices have generally sagged below 2011 levels, U.S. crude oil and NGL production increases accelerated in 2012. Year-over-year, production volume rose almost 13% overall, led by the Gulf Coast and, increasingly, the Mid-Continent region, with its skyrocketing shale activity.

|

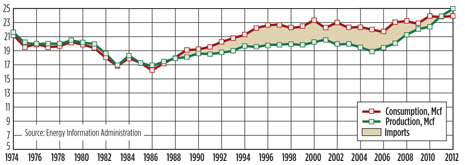

| U.S. gas consumption and marketed gas production, Tcf |

|

The Gulf Coast continued to shine in 2012 (see map, page 63). Both new and mature oil fields in Texas were another bright spot in the overall domestic picture. The Lone Star state stepped up production to over 2.18 million bopd in 2012, an increase of more than 26%. The liquids-rich Eagle Ford shale play attracted the lion’s share of attention, but the traditional oil fields of the Permian basin also saw an enormous surge in activity, contributing, not coincidentally, to employment in the region, which is reaching boomtown levels. Louisiana, including federal offshore output, is still a strong oil producer at almost 1.2 million bpd, but this represents a decline of some 4% over 2011.

In the West Coast region, Alaska continued its steady decline, a trend that shows little sign of reversing in the near future. Even the prospect of offshore drilling in the Arctic, which is challenging both technologically and politically, is unlikely to contribute to the total production for some years. The fact that World Oil has traditionally broken out and separated Total U.S. and Lower 48 production is a reflection of the giant role that Alaska once played in the total picture (the North Slope contributed over 2 million bopd at its peak in the late 1980s).

In the Mid-Continent, North Dakota led the way with a stunning increase of over 56%, averaging almost 654,000 bopd in 2012. This prolific rate moves the state into the position of number three oil producer in the country, leapfrogging over Alaska and California, which fell to 530,000 and 583,000 bpd, respectively. Oklahoma is the second largest producer in the region, with improved output at a significant, if modest, level. The state contributed 233,000 bopd in 2012, a 14% jump. Similarly, Kansas stepped up liquids output to just under 120,000 bopd, an improvement of 5.6%. All in all, the Mid-Continent region surged over 35%.

The Rocky Mountains, the country’s fourth most prolific region, improved production by some 12%. Colorado’s shale plays led to a 12.5% increase in oil production, for an average 120,000 bpd. Likewise, Wyoming made a strong showing with a 12,000-bpd increase, for an average 162,000 bopd. New Mexico led the Rocky Mountains region with a very strong performance in 2012, as the flurry of activity in its part of the Permian basin caused production to rise 16% to 226,000 bopd.

The Midwest, which plays a comparatively limited role in the nation’s energy mix, still managed an increase of 5.5% last year, to 73,000 bpd, led by the old oil provinces of Illinois (27,000 bpd) and Ohio (13,600 bpd). On the East Coast, Pennsylvania managed a respectable 10% increase to around 10,000 bopd.

Natural gas. The story of natural gas in 2012 was same song, same verse. Gas prices managed a small increase to finally crack the $3/Mcf level, but not enough to change the trend away from gas toward more-profitable liquids. The U.S. produced an estimated average 65.5 Bcfd of natural gas in 2012, for a total of just under 24 Tcf for the year. This represents a 4.8% increase over 2011’s revised total of 22.9 Tcf. There is still a small spread between 2012 production and consumption, which reached an estimated 24.9 Tcf in 2012 (see chart).

| U.S. crude and condensate production by region |

|

|

Even as operators shift away from natural gas drilling, rising demand is beginning to have a positive effect. Ongoing efforts to develop a U.S. LNG export market provide hope to those companies with large gas reserves that an incentive to produce may be around the corner.

|