JIM REDDEN, Contributing Editor

|

| An Anadarko Petroleum rig making hole in the Wattenberg field, north of Denver. Photo courtesy of Anadarko Petroleum. |

|

The Niobrara tight oil shale play is the oilfield equivalent of the young athlete, who is built up as having world-class potential, only to struggle in meeting the lofty expectations. To be sure, the near-universal euphoria that accompanied high initial flowrates a couple of years ago has been replaced with cautious optimism, as operators work to further their understanding of the complex organic-rich play in the heart of the U.S. Rockies.

Nevertheless, despite a comparatively brief, and at times fickle, horizontal exploration and production history, and ever-increasing environmental challenges, the independent, largely home-grown operators dominating the liquids-rich Niobrara continue to maintain reasonably stable drilling programs. In the meantime, geophysical investigations are underway to get a better grasp of the highly variable natural fracturing, to help operators uncover the secrets to increasing the drainage of horizontal and multi-frac wellbores in what was once hyped as the “Bakken-lite.”

DRILLING ACTIVITY

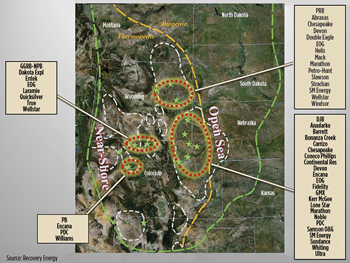

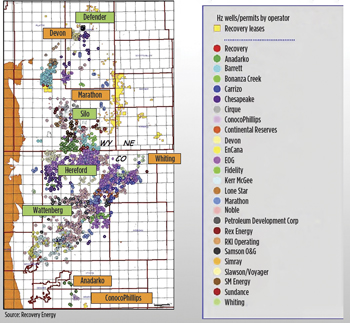

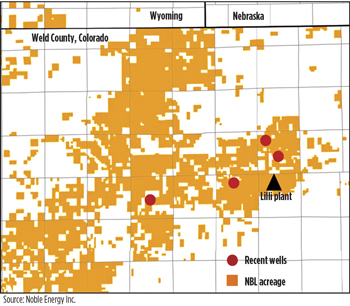

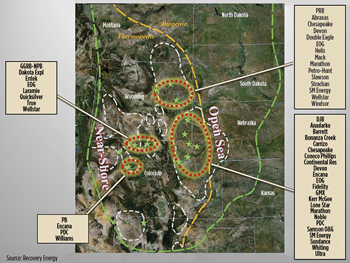

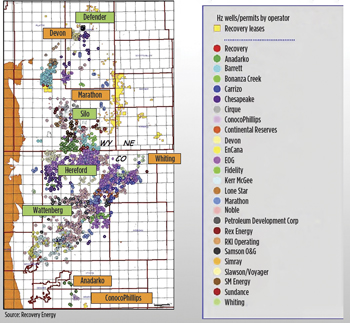

Owing to its fairway in the Denver-Julesburg basin, and its often equal billing with the underlying and correspondingly prospective Codell sandstone, the multi-horizon play is known interchangeably as the DJ-Niobrara and the Niobrara-Codell. As delineated, the thermally mature Niobrara shale (which vertically ranges in thickness from 275 to 400 ft) and its myriad sub-plays extend geographically across northeastern Colorado, northwestern Kansas, southwestern Nebraska and southeastern Wyoming. However, up to now, the overwhelming majority of activity has centered in Colorado and, to a much lesser degree, Wyoming, mainly in and around the prolific Silo field, Fig. 1. Colorado’s Weld County, home turf of the billion-bbl Wattenberg field and the spark for the Niobrara horizontal tight oil play, is the epicenter for the lion’s share of active rigs and approved drilling permits, Fig. 2.

|

| Fig. 1. Activity in the Niobrara play, to date, focuses exclusively on the Denver-Julesburg basin (DJB), the Powder River basin (PRB), the Park basin (PB) and the Greater Green River/North Park basin (GGRB/NPB). |

|

|

| Fig. 2. Horizontal drilling and permitting activity in the DJ-Niobrara play. |

|

The uncertainties notwithstanding, the active year-on-year rig count has increased slightly over the 2011 tally. As of Aug. 17, Baker Hughes data show 45 rigs active in the core DJ-Niobrara, an increase of four over the same period last year, Fig 3. Of these, 40 were making hole in Weld County, with the remainder drilling in Adams, Freemont and Lincoln counties. In Wyoming, only two rigs were reported to be drilling new wells in that state’s portion of the DJ-Niobrara, one each in Goshen and Laramie counties. However, state officials reported 25 rigs drilling in the Powder River basin, but no breakdown was available on how many were actually targeting Niobrara wells. Chesapeake Energy told investors in August that it, alone, has eight rigs drilling Niobrara prospects in the southern Powder River and plans to have 11 on location by year’s end.

|

| Fig. 3. Drilling location for the Bonanza Creek Energy North Platte 44-11-28 well in Wattenberg field. The Denver operator plans to drill 24 Niobrara wells this year on the 62,000 net acres it controls in the DJ and North Park basins. Courtesy of Bonanza Creek Energy. |

|

Owing to the distinctive complexity of the Niobrara petroleum system, collecting cumulative data is not nearly as clear-cut as the more clearly defined North American shale plays. However, of the 2,432 drilling permits that the Colorado Oil and Gas Conservation Commission (COGCC) had approved as of Aug. 7, 665 were issued specifically for horizontal wells, with an additional 1,418 permits approved for directional wells from common drilling pads. In 2011, the COGCC issued 4,659 permits, of which 878 and 2,778 were for horizontal and multi-well pad directional projects, respectively.

Thus far in 2012, Colorado’s Weld County is the runaway winner of the permitting sweepstakes, with 1,169 new wells approved, compared to 2,262 approved last year. The COGCC reports that as of Aug. 7, Weld County held 18,623 of the state’s 48,192 active wells, making the construction of new horizontal wells particularly vulnerable to communication with the many vertical wellbores constructed previously. Consequently, accurate wellbore placement is a paramount challenge for operators drilling horizontal wells in the tight and previously highly-explored areas within the Niobrara structure.

The COGCC says it does not have the capability to separate Niobrara oil production, as it typically is comingled with that from the Codell, which historically has been the primary pay zone for the Wattenberg. The underlying Codell is now the target for horizontal exploration and development outside its core perimeters. For the first seven months of 2012, agency data showed the Weld County core produced a total of nearly 11.5 million bbl of oil, compared to just under 26.5 million bbl in 2011. Gas production, thus far, has totaled nearly 101.4 MMcf, compared to approximately 238.4 MMcf last year.

Meanwhile, in 2012, COGCC’s Wyoming counterpart has issued 430 permits for new Niobrara wells in Campbell and Converse Counties, compared to 485 approved permits for all of 2011. Tom Doll, then-supervisor for the Wyoming Oil and Gas Conservation Commission (WOGCC), told a key state legislative committee last October that only 66 wells were actually completed in the main fairway at the end of last year.

Doll told the legislators that the disparity between permits issued and wells completed is proportional to average lackluster production rates. “The reason we’re not seeing a lot of drilling activity in the Niobrara is those wells are not coming in as strongly as people thought,” he told the state legislature’s Joint Minerals, Business and Economic Development Interim Committee.

While Wyoming operators historically have held individual well production close to their vests, state records show that the Niobrara produced more than 500,000 bbl of oil last year. However, Niobrara production was less than a third of the 1.5 million bbl produced from the Sussex formation, and only slightly more than the 480,000 bbl that the Frontier formation yielded in 2011. During the first half of 2012, the Sussex produced upwards of 900,000 bbl, compared to 515,000 bbl from the Niobrara, according to WOGCC.

Despite the less-than-stellar early production rates, Wyoming officials say they expect activity to pick up over the next year, mainly because many operators are nearing the expiration of their three-year lease requirements. Nearly 4 million producing acres within Wyoming are under the jurisdiction of the U.S. Bureau of Land Management (BLM), compared to some 1.5 million acres in Colorado.

In late July, the WOGCC released a new policy to open the books on individual well results, which operators traditionally had not made public to maintain their competitive leasing positions. The regulatory agency said that it is in the process of releasing previously confidential information on more than 900 oil and gas wells. According to WOGCC, the newly released data, which are being presented on the agency’s website, will include production rates for hundreds of oil wells drilled 7,000 ft and deeper into the Niobrara Shale.

COMPLEX GEOLOGICAL MAKE-UP

Far from a recently discovered commodity, the Niobrara has been producing from vertical wells for the better part of a century. Horizontal drilling, likewise, is not new to the Niobrara, but in late 2009, horizontal well paths were combined with multi-stage fracing, and the preliminary results led many to believe that they were on the cusp of the next great unconventional play. Typical drilling depths for Niobrara wells range from 7,000 ft to more than 8,000 ft with variable geopressures.

A self-sourcing unit of alternating chalk and shale, the Niobrara formation has long been known as the source rock for the prolific Wattenberg and Silo fields. While the geological characteristics are anything but uniform, the Colorado Geological Survey says every sedimentary basin in that state includes some Niobrara or equivalent rock. The three primary carbonate-rich benches of the Niobrara average from 10–25 ft thick with 5–10% porosity.

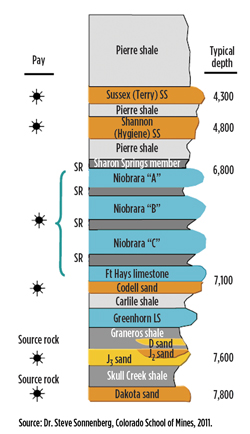

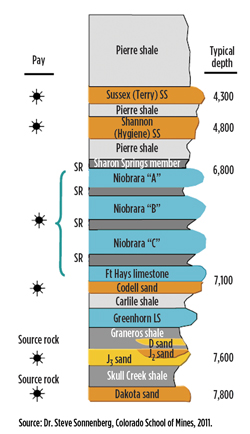

The Niobrara, which has been well-documented in the literature, has been described as a Cretaceous hybrid shale/carbonate reservoir deposited in a deep marine environment, with areal variations in reservoir properties and tectonic overprint. More recently, a number of various sub-plays are undergoing continuing development efforts, including the Codell, Fig. 4.

|

| Fig. 4. Detailed Niobrara stratigraphy. |

|

Although generally identified as shale, the play’s reservoir rock primarily comprises limestone or chalk intervals, says Dr. Steve Sonnenberg, professor of petroleum geology at the Colorado School of Mines, and one of the principals of the school’s multi-faceted Niobrara Research Consortium, whose membership comprises a who’s-who of operators active in the play. “The formation demonstrates facies changes that range from limestone and chalk in the eastern end to calcareous shale in the middle and eventually transitioning to sandstone farther west,” Sonnenberg wrote in a June 2001 issue of the American Association of Petroleum Geologists’ AAPG Explorer, “Depth and thickness are highly variable.”

As is the natural fracturing of the structure, which Mick Domenick, senior geologist for Recovery Energy of Denver, describes as the “single, most critical component of successful Niobrara oil production for all reservoir types, including proven calcareous mudstone reservoirs, such as Silo, Wattenberg and Hereford.” In a presentation to the Tight Oil Niobrara Congress 2012, last May in Denver, Domenick concluded that productive Northwest DJ basin wells tend to benefit from high, natural fracture density, while reservoirs with lower fracture density yield higher water cuts and reduced production rates.

Like its natural fracturing, the intrinsic total organic carbon (TOC) content of the Niobrara varies from area to area, says the state’s chief geological agency. While a 5% TOC composition generally is considered advantageous for a “good source rock,” the Geological Survey said that in the northeastern portion of the DJ basin, the clay-rich limestones and shales of the Niobrara can contain more than 8% TOC, but carbon contents drop to between 1% to 4% farther to the west.

BAKKEN COMPARISONS PREMATURE

Comparisons of the Niobrara to the Bakken shale began hitting the mainstream in October 2009 after EOG Resources brought in its Jake horizontal well in Weld County, which is still producing 50,000 bbl/month. Jake was followed in early 2010 by Noble Energy’s Gemini well, also in Weld County, which was completed with a 16-stage frac treatment and produced 1,100 bopd at its peak. The results of these wells, in tandem with attractive commodity prices and comparatively low-entry costs, triggered forecasts that the Niobrara would become a premier unconventional oil producer, second only to the Bakken. “This is a known petroleum system and is very regional. I think it is probably one of the most important plays in North America, other than Bakken,” Sonnenberg, one of the play’s most recognized authorities, told Reuters in April 2011.

The buoyancy was fueled even further in December 2011, when Anadarko Petroleum said that horizontal wells and multi-frac completions promise to uncover an additional 500 million to 1.5 billion boe in its Wattenberg holdings, Fig. 5. “The Wattenberg HZ (horizontal) is a billion-bbl opportunity in an existing core area, making the field one of the largest and most cost-efficient onshore oil and natural gas projects in the U.S.,” said Jim Kleckner, VP of operations for Anadarko’s Rockies Region.

|

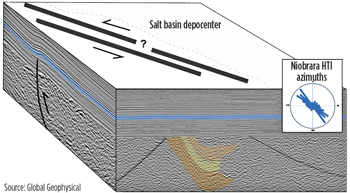

| Fig. 5. Global Geophysical says its multi-client 3D survey offers the potential to combine azimuthal anisotropy results with an analysis of the regional structural framework, basement and salt deformation, and stress field. |

|

Yet, disappointing well results elsewhere, especially in the Wyoming sector of the DJ-Niobrara, have since tempered that passion with even the CEO of the operator that ignited the play, saying it’s time to take a breath and a closer look. Last year, EOG Resources chief Mark Papa, whose company was one of the first to gain an acreage position in the Niobrara, told investors that while he remained “cautiously optimistic,” more data were required before the prospects of the still-emerging play could be fully evaluated.

Citing “disappointing well results,” Chesapeake Energy, another early Niobrara player and major leaseholder, announced earlier that it was putting 503,863 net acres of the DJ basin on the block. The story is quite different, however, in the more than 350,000 acres that Chesapeake holds in the Powder River basin, where the operator is conducting an aggressive drilling program. “In the Powder River Niobrara play, we’ve finally cracked the code with numerous recent wells,” Steven Dixon, Chesapeake’s COO and VP of operations and geosciences, told investors.

INCREASING EUR

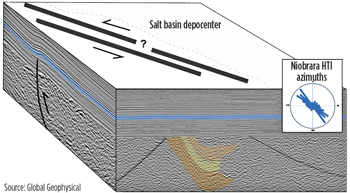

Much of the additional data that Papa said is required, involve getting a better handle on the intricate geological structure to increase both production rates and the estimated ultimate recovery (EUR). To that end, Global Geophysical recently completed an extensive, multi-client, full-azimuth, 3D seismic survey, encompassing more than 800 sq mi in Silo field, in southeastern Wyoming.

In a presentation at last month’s World Oil Shale Tech Conference in Houston, Galen Treadgold, vice president of the Weinman GeoScience division of Global, said that the survey serves as the basis for a regional structural interpretation and azimuthal velocity analysis of the Silo segment of the Niobrara. The ultimate aim, he said, is to improve overall well results that remain extremely variable.

The Global Geophysical study integrates seismically-derived rock attributes, and well and production data, in an integrated, regional structural interpretation to better understand the Niobrara’s natural fracturing and to reduce drilling risk, Fig. 6. The cause of the natural fracturing, explained Treadgold, holds considerable influence over both production rates and EUR. This interpretation has been debated extensively and attributed to a host of variables, including basement faulting, salt dissolution, lithology variations, compaction over basement highs, hydrocarbon expulsion, strike-slip faulting, uplift and the present-day stress regime. “Our results suggest that the Niobrara has been a difficult play, because fracturing is highly variable and may not be caused by a consistent set of variables everywhere. By understanding the structural segmentation of the area and combining that with rock property results, azimuthal anisotropy products and well data, we explain past well performance and predict areas of future potential,” he said.

|

| Fig. 6. Noble Energy has the leading acreage position in the Niobrara shale play. |

|

In the meantime, operators are working to improve immediate production rates in a formation, where the unique fracturing characteristics require special attention to completion practices, says Mark Davies, business development manager of Packers Plus Energy Services. “Microdarcy permeability, low porosity and high-capillary pressure make it difficult to ensure high production and economic wells. The subject area is also prone to diagenisis, which causes the already low porosity of the rock to become more compacted, making it more difficult to ensure an economical flowback,” he said. “The challenge is to effectively capitalize on the multiple natural fractures found throughout the formation while establishing communication with the rest of the rock.”

TECHNOLOGY APPLICATIONS

Packers Plus recently employed its StackFRAC open-hole, multi-stage frac system to increase drainage from a Niobrara well in Weld County. The technology uses the company’s external and hydraulically set RockSEAL II packers, rather than cement, to isolate sections while the proprietary FracPORT sleeves, which rely on size-specific actuation balls, create openings between the packers to facilitate fracture stimulation. The balls, he explained, create internal isolation from stage to stage, eliminating the need for bridge plugs.

Davies said the StackFRAC technology allowed the subject Weld County well to increase production to an estimated 1,110 boed, with more than 100,000 boe produced in four months. “With 60,000 boe in its first 60 days, it quickly became the operator’s best producing well in Weld County and one of the most successful in the Niobrara to date,” Davies said.

Elsewhere, Pathfinder, a Schlumberger North American land directional drilling company, utilized real-time images from the Micro-Scope resistivity and imaging-while-drilling services to help a Niobrara operator maximize wellbore intersection with natural fractures to optimize recoveries in a highly faulted zone. Pathfinder said the technology allowed the operator to successfully place the horizontal lateral within the predefined target interval to successfully complete the well. The Micro-Scope service was credited with enabling the operator to better understand the structural complexity of the reservoir to optimize well placement.

WATER WOES AT FOREFRONT

As studies continue to expand the geological learning curve, the industry also must confront an ever-increasing regional threat from opponents objecting to its water consumption. Not surprisingly, with the Niobrara theater ensnared in the severe drought gripping much of the U.S., and Colorado experiencing catastrophic wildfires earlier this summer, water has become an even more precious and closely guarded resource.

Colorado is somewhat unique, in that water is either “allocated,” which is diverted to municipalities, or “unallocated” and available to the highest bidder. In April, operators were the high bidders for unallocated water supplies from the Colorado River basin that historically had gone to farmers and ranchers, which further ignited long-running complaints. Late last year, the Colorado Department of Natural Resources and the Colorado Oil and Gas Association made a preemptive strike by jointly establishing a groundwater quality sampling program. Under the program, operators will voluntarily collect groundwater samples both before and after drilling.

In a related development, the COGCC filed suit against the city of Longmont, which spreads across Weld and Boulder Counties, over the municipality’s banning of all fracing in residential areas. The agency argues that the restrictions by Longmont and other municipalities conflict with state regulations. Across the border, WOGCC Supervisor Doll was forced to resign his post in June after asserting at a conference that “greed and desire for compensation” were the primary motivators for those contending that hydraulic fracturing has contaminated their groundwater.

OPERATOR ACTIVITY

Though Shell Exploration and Production earlier this year announced plans to drill up to 11 wells in Wyoming’s Routt and Moffatt counties, and ConocoPhillips established an acreage position, the Niobrara is indicative of most emerging shale plays, in that independents comprise the main players. A handful of international operators also have varying stakes in the play, including Australia’s Samson Oil and Gas, Canada’s Encana and China’s CNOOC, which has a 33% joint venture with Chesapeake. Samson holds interest in about 144,000 acres in the Hawk Springs area of Goshen County, Wyoming, where, if approved, it plans to drill a planned 9,000-ft lateral later this year. Encana is operating two rigs and plans to drill 12 net wells this year on its 49,000-net-acre position in the DJ basin.

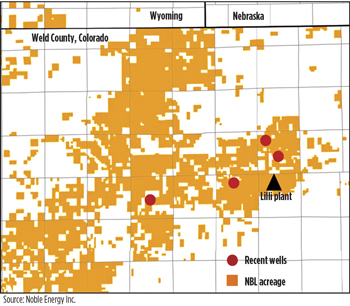

Noble Energy, with holdings of some 860,000 net acres, is the largest leaseholder in the DJ basin by a wide margin. It plans to more than double its drilling activity this year, with about 170 horizontal wells planned, compared to 80 last year, Fig. 7. During the year, Noble says it will accelerate development of the estimated 400,000 net acres it holds in the Wattenberg —its largest U.S. onshore field —as well as test exploration opportunities in its DJ holdings in northern Colorado and southern Wyoming. The Houston-based operator plans to operate five to six rigs throughout the year, and will complete eight to 10 Niobrara wells a month, including 12 to 15 extended-reach laterals. Thus far in 2012, Noble has placed 38 Niobrara wells on production with expected estimated ultimate recoveries (EUR) of 340,000 boe, up from 315,000 boe last year.

|

| Fig. 7. A rig at work on Denver-based PDC Energy holdings in the Wattenberg field. Photo by David Tejada of Tejada Photography for PDC Energy. |

|

Anadarko Petroleum holds nearly 350,000 net acres, primarily in the Wattenberg, where it targets the liquids-rich Niobrara and Codell formations below 6,000 ft. Anadarko says its 2012 Wattenberg horizontal drilling program will employ seven rigs to drill 160 wells, up significantly from the 40 it drilled last year. The operator has identified between 1,200 and 2,700 future drilling locations, with EUR of 300,000 to 600,000 boe per well.

EOG Resources says it has proven up roughly169,000 acres of the 220,000-acre position that it holds in the Niobrara, much of which is Weld County. The company said upon releasing its 2011 earnings, that the focus this year will be on completing and evaluating a number of wells drilled last year. EOG says it has identified an estimated 150 drilling locations and plans to operate two rigs in 2012, which will drill up to 24 gross wells.

Quicksilver Resources of Fort Worth, Texas, holds 260,000 net acres in the Sandwash area of the Green River basin, of which it believes some 210,000 net acres are situated in the Niobrara and Lower Mancos oil windows. Quicksilver has an estimated resource potential of 100 million boe within its holdings. The operator drilled six vertical wells in the play last year, and plans to drill up to seven vertical and horizontal wells in 2012.

Whiting Petroleum holds about 105,000 gross acres in the DJ basin and will focus much of its 2012 activity on evaluating its Redtail prospect in Weld County, which targets the Niobrara B bench. Whiting says it will utilize one rig and recently acquired 3D seismic data to drill eight wells at the Redtail prospect this year. The project will include a three-well development between its Wildhorse and Horsetail properties.

Synergy Resources holds 186,215 net acres in the DJ basin, where its drilling strategy had focused primarily on low-cost and low-risk vertical wells. Synergy says it has identified 156 net potential horizontal wells in the Niobrara and Codell formations, with four wells per 320-acre spacing and 64 net horizontal locations in the Greenhorn area. Synergy believes it can maximize per-well production by drilling first to the J-Sand before plugging and moving up to the Codell and Niobrara zones.

Ultra Petroleum of Houston controls 136,000 net acres in the DJ basin, where it is targeting liquids-prone Niobrara reservoirs. Ultra estimates its holdings have a resource potential of 200,000 to 400,000 bbl per well, with attractive potential in all three of the resistive benches. While no precise well count is available, the operator was to have begun a horizontal evaluation program during the second half of this year.

Marathon Oil, which in April 2011 sold a 30% working interest in its Niobrara holdings to Japan’s Marubeni, said the two firms intend to operate two rigs and drill 17 to 24 net wells this year. The 70/30 joint venture holds 144,000 net acres of prospective Niobrara holdings in southeastern Wyoming and northern Colorado, with most of the companies’ activity focused in the Weld County area. As of March, six Niobrara wells had been put onstream, with observed rates as high as 500 bopd per well. Six additional wells were scheduled for completion at that time.

Recovery Energy operates 115,000 net acres, most of which are contiguous with long-term leaseholdings. The Denver independent has identified more than 130 Niobrara horizontal drilling locations. Recovery estimates its holdings contain risked unconventional resource potential of 50 to 100 million bbl of oil.

PDC Energy says it will earmark nearly all of its $184-million 2012 capital budget toward developing its core Wattenberg holdings. There, the Denver-based independent plans to operate two rigs and drill 27 horizontal Niobrara wells, and refrac and recomplete up to 263 vertical wells in the Wattenberg. In April, PDC completed an estimated $327-million acquisition of additional acreage from an undisclosed private party, which now gives the company about 74,000 net acres in the Wattenberg.

Carrizo Oil and Gas owns 61,500 net acres primarily in Weld County, where it is targeting the 80% liquids Niobrara play. As of June, Carrizo had drilled 19 horizontal wells with 18 on production containing 48 MMboe of net reserves. The Houston independent said the average well is tracking a 250,000-boe EUR-type curve. Carrizo, which has identified 242 drilling locations, is running one rig in the Niobrara, where it plans to invest $43 million this year compared to the $39 million expended last year.

POTENTIAL FOR GROWTH

Whatever one chooses to call the Niobrara, the overall E&P projects planned by these and a host of other, often home-grown independents suggests that the play is not about to fall to the wayside anytime soon. Denver’s Bill Barrett, chairman, CEO and president of his namesake Bill Barrett Corp., perhaps best summed up the prospects upon announcing his company’s first-quarter earnings. “It is too early to determine corresponding EURs from results to-date, yet horizontal success in the Niobrara opens the potential for sizable expansion of the DJ Program,” he told investors.

REFERENCES

1.Sonnenberg, Stephen A., Colorado School of Mines, “Petroleum geology of the Niobrara formation, Silo field, Wyoming,” AAPG Search and Discovery, Article No. 20115, September 2011.

2.Domenick, Michael A., Recovery Energy, “Understanding the geologic variability of the Niobrara to maximize production rates in the Denver-Julesburg basin and beyond,” presented at the Tight Oil Niobrara Conference, Denver, Co., May 24, 2012.

3.Treadgold, Galen; Gloria Eisenstadt, John Maher, Joe Fuller and Bruce Campbell , Global Geophysical Services, “Niobrara fracture prospecting through integrated structural and azimuthal seismic interpretation, Silo field area, Wyoming,” presented at the World Oil Shale Tech Conference, Houston, Aug. 20-22, 2012.

|