JIM REDDEN, Contributing Editor

|

| Underground Energy’s Chamberlain 4-2 well, which descovered a new subthrust block of Monterey shale at the Zaca Field Extension Project. This well was drilled in the Santa Maria basin to a depth of 6,679 ft. Photo courtesy of Underground Energy, Inc. |

|

In his introduction to United States Geological Society (USGS) Bulletin 268, Stanford University Professor J. C. Banner noted a peculiarity in the samples of Miocene-age forams that he extracted at a ranch in San Luis Obispo, Calif. “It is of interest to note that nearly all of the Monterey shale in this neighborhood contains a notable amount of hydrocarbon, enough, at least, to cause it to burn with a flame when placed in a hot fire. I have had the hydrocarbons determined in two typical samples of the shale.”

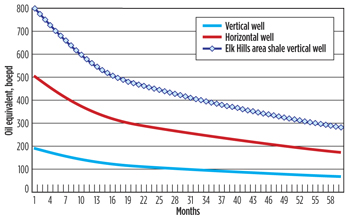

Well over a century after publication of “Miocene Formaminifera from the Monterey Shale of California with a Few Species from the Tejon Formation,” the good professor’s cursory observation in 1905 has been substantiated to the nth degree. In mid-2011, the U.S. Energy Information Administration (EIA) in its latest assessment of the nation’s shale reserves estimated that the stacked Monterey/Santos shale that stretches rib-like along much of the California interior (Fig. 1) conservatively holds more than 15.4 billion bbl of technically recoverable reserves. If that assessment is even close to the actual mark, the volumes, nevertheless, are more than double those estimated in the Eagle Ford and Bakken shale plays, combined, and equal roughly two-thirds of all the U.S. shale oil resources.

|

| Fig. 1. Extent of the 1,752-sq-mi onshore Monterey/Santos shale play, highlighting core Oxy acreage. Source: U.S. Energy Information Administration (EIA) |

|

The EIA’s prodigious estimation came as no surprise to those most familiar with a long-identified, but essentially overlooked, source rock for virtually all of California’s, and some of the country’s, oldest, most prolific oil producers, including the legendary Midway-Sunset, South Belridge and Elks Hills fields in the San Joaquin basin. Individually, these fields have been delivering crude for more than 100 years. Unfortunately, transferring the gargantuan Monterey/Santos shale reserves directly from the highly fractured and exceptionally heterogeneous formations and into one of the nation’s most established, albeit disruption-prone, refining infrastructures has proven to be another matter altogether.

The largest onshore oil reserves in the U.S., unfortunately, are ensnared in a regulatory quagmire, fueled by what inarguably can be described as one of the country’s most fervent anti-drilling environments. Operators have long found themselves stymied by environmental resistance, access restrictions, high costs and an excruciatingly sluggish permitting process, though many are guardedly optimistic that a regulatory shake-up late last year will accelerate the issuance of new drilling permits. As for the accessibility issues, a considerable chunk of comingled Monterey/Santos prospective acreage is under the jurisdiction of the U.S. Bureau of Land Management (BLM), which has scheduled a major lease offering for Dec. 12, its second in as many years.

Regulatory and economic issues aside, nature also has thrown a wet blanket over what California’s premier operator, Occidental Petroleum, boldly predicted in 2010 would become its “largest business unit within 10 years.” Owing to a frustratingly complex and highly faulted stratigraphic framework, typical flowrates from the largely vertical and non-fraced wellbores that specifically target ultra-tight Monterey/Santos horizons have, to date, been much less than expected, forcing operators to revisit their geological drawing boards. Though the EIA 2011 assessment forecast estimated ultimate recovery (EUR) rates of 550 million bbl per well, operators today are reporting typical flowrates averaging only around 350 to 400 bopd.

All this has combined to prolong continual year-on-year declines in oil production, sliding to the point that earlier this year North Dakota and its Bakken shale supplanted budget-challenged California as the nation’s third largest producing state. Though no data are available on actual production from Monterey-specific wells, according to the California Oil, Gas and Geothermal Commission (COGGC), onshore oil production at the end of 2011 stood at 184.5 million bbl, marking no less than 11 consecutive years of downward crude production. The state’s beleaguered chief regulator reported a reversal of sorts with its most recently available data that have onshore oil production increasing to just under 504,000 bpd in June, representing a 4,900-bpd increase over May. Meanwhile, total associated and non-associated gas production, most of which comes from the Oxy-operated Elk Hills field , likewise dropped to around 244.4 Bcf in 2011 from 255.4 Bcf the previous year.

As with production, the active onshore rig count also has dropped to an October tally of 36, compared to 50 units working during the like period of 2011, according to Baker Hughes. The overwhelming majority of those rigs are in the hands of Occidental and Aera Energy LLC, a private jointly held subsidiary of ExxonMobil and Shell, but no breakout is available on how many are specifically targeting the Monterey/Santos shale.

Nevertheless, California operators expect to drill a cumulative 2,800 onshore and offshore wells this year, which would represent a 22.1% increase over the 2,294 wells drilled in 2011. As of early October, COGGC data show 2,217 permits for all well types were issued for the core Monterey/Santos onshore fairway, compared to 2,599 for all of the previous year. Of those, 1,885 permits have been approved in COGGC’s District 4, which includes Kern County, the state’s foremost oil and gas producer.

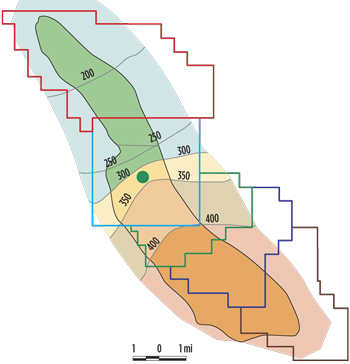

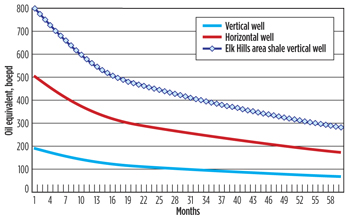

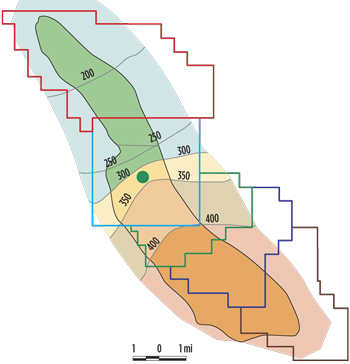

ATYPICAL PLAY

Onshore, the active area of sprawling Monterey/Santos shale originates in north-central California (Fig. 1.), and from there snakes southward through the San Joaquin and Los Angeles basins. In the latter basin, it extends offshore and onto the outlying islands. Together, the so-called Miocene Monterey and the shallower and exceedingly fractured Santos reservoir have little in common with what most define as an unconventional shale play. For starters, it is comparatively younger than typical North American shales and most Monterey/Santos targets are drilled and produced conventionally, Fig. 2. Furthermore, Professor Richard Behl of the Department of Geological Sciences at Cal State University, Long Beach, contends that only a “minor fraction” of the biogenic-rich formation can be considered true shale.

|

| Fig. 2. Representative type curve reported by Oxy for a vertical well, horizontal well, and for the Elk Hills Area shale vertical well within the Monterey/Santos shale. Source: EIA from OXY data |

|

The Monterey/Santos also is unique in that unlike most E&P theaters abutting a coast, full development of the play first occurred offshore before being delineated inland, rather than the other way around. A case-in-point is newly privatized Venoco, Inc., which first began producing the Monterey from its South Ellwood and Sockeye fields off Santa Barbara, later transferring its experience with the shale to its onshore Sevier field in the western San Joaquin Valley. “We plan to use the expertise we have developed with the fractured Monterey shale formation from our work in the offshore South Ellwood and Sockeye fields to facilitate our acquisition, exploration, exploitation and development of onshore properties with similar characteristics,” the Denver operator said last November in its last annual report before going private.

On average, Monterey/Santos shale targets are exploited vertically at around 11,250 ft, with varying thickness up to 1,875 ft, Fig. 3. However, Calgary’s Zodiac Exploration went against the regional grain earlier this year with a 15,000-ft, multi-stage, fraced horizontal well in the underlying Kreyenhagen shale in Kern County. Zodiac has provided no results from the Upper Kreyenhagen horizontal well or a nearly 17,000-ft vertical well drilled earlier.

|

| Fig. 3. Gross thickness of Monterey shale interval within Seneca Resources/National Fuel Gas’ holdings in the Beldridge complex. Source: Seneca Resources/NFG |

|

What can best be described as a lithostratigraphic mishmash, the heavily faulted and folded Monterey/Santos immediately underlays the Pliocene Etchegoin and the extremely low-permeability, but highly prospective, Diatomite reservoir of the Reef Ridge Shale that requires thermal stimulation to produce. While the Monterey/Santos formation can be relatively deep in one location, geologists have observed surface outcropping 100 mi away, and areas where tilting is thrown into the mix render the drilling of horizontal wellbores for drainage impractical, they say. The Monterey/Santos also finds itself locked in an area with famously documented seismic activity.

Though largely ignored as a reservoir rock, the Monterey/Santos is typical of siliceous shales and is variously described as thinly laminated, with porosities higher than 30%, comparatively low permeabilities, total organic content (TOC) of 6.5% and extremely small pore throats. In the Elk Hills field, Occidental geologists Stephen Reid and Jana McIntyre said at the 2012 AAPG convention that Monterey porcelanite production occurs from intervals that have quartz-phase mineralogy. They explained further, however, that the characteristics differ from the formation’s chert and porcelanite reservoirs on the coast in that “matrix porosity is more typical of the opal-CT phase, petroleum storage is mostly in the matrix, and natural fracture patterns are dominantly small-scale.”

FRAC FUROR

With the eight-stage frac job on its Kreyenhagen horizontal well, Zodiac has been the regional exception. Few Monterey/Santos wells have required any fracing, and those that do consume, on average, less than 165,000 gal of water, says the Western States Petroleum Association (WSPA) of Sacramento. These volumes represent a fraction of those used in the multi-stage fracs characteristic of many of the shale plays.

Nonetheless, it has not stopped the anti-fracing crowd from demanding the authorities step in before operators figure out the geological intricacies and hydraulic fracing becomes commonplace. The anti-fracing frenzy reached a head in mid October when Earthjustice, the Center for Biological Diversity (CBD), the Sierra Club and other environmental groups collectively sued the COGGC, accusing the regulator of approving drilling permits without first requiring adequate environmental reviews, according to Reuters.

Owing to the few wells requiring frac stimulation, California authorities up to now have had no reason to impose any restrictions on the practice. In December, however, the Santa Barbara County Planning Commission passed a requirement that before an operator conducts an onshore frac job within its jurisdiction, it must get the commission’s formal approval.

Recognizing the growing sentiment, California Gov. Jerry Brown (Dem.) has proposed that the COGGC formulate rules to regulate fracing within the state, which the regulator is now fashioning. Even though at least two bills that would have given the state more oversight over fracing failed in the last legislative session, the WSPA says the industry continues to face political resistance.

“We know there is a great deal of interest in the state, and some exploration into whether or not hydraulic fracturing will be successful in unlocking that resource,” WSPA spokesman Tupper Hull told World Oil. “Our view is, at this point, that the jury is out on that question. In addition to the technical challenges to fracing in the Monterey shale, we also are experiencing tremendous political opposition to hydraulic fracing that is making it difficult for companies to utilize the technology. The state is in the process of developing new regulations that will undoubtedly address some of the issues around hydraulic fracturing, such as mandatory disclosure of the chemicals involved, and some form of prior notification before a well can be fraced.”

Since California has yet to adopt regulations to oversee fracing, the Center for Biological Diversity (CBD) filed notice on Aug. 29 of its intention to file suit against the BLM in the lead-up to next month’s lease offering covering 17,847 federally controlled acres in Fresno, San Benito and Monterey counties. The environmental advocacy group complained that the prospects for wholesale fracing in the state would impact some six endangered species, including the California Condor and Giant Kangaroo Rat.

The CBD and Sierra Club joined forces last year to protest a significantly smaller BLM Monterey/Shale offering. The September sale, which covered 5,179 acres in Kings and Kern counties, proceeded on schedule, though nearly a year later none of the lease winners reportedly had received a drilling permit.

UNLEASHED POTENTIAL

Much of the efforts of late have focused on better understanding of the Monterey/Santos as a reservoir rock in hopes of increasing the less-than-stellar per-well flowrates. Last year, Oxy and Venoco teamed up for a joint proprietary 3D seismic survey over a 500-sq-mi portion of the play in hopes of identifying horizontal placements, as they develop their acreage. Since then, the industry has organized a number of conferences and local workshops devoted to the play, the latest of which was “Tight Oil Reservoirs California 2012: Monterey and Surrounding Sediments,” held in May in Bakersfield. According to organizers, the first-ever conference of its type was held to further understanding of the “heterogeneity and complex geology of the fractured Monterey formation, oil-rich Diatomite and surrounding Californian sediments.”

The Department of Geological Sciences at Cal State University, Long Beach, also is studying the play through its exhaustive Long Beach Monterey and Related Sedimentary rocks (MARS) Project that Behl said is examining the “stratigraphic, geochemical, diagenetic and structural aspects of this important formation.”

“Hopefully, with success in these endeavors, the Monterey formation, with its varied composition and stratigraphic character, can serve as a valuable analog for other “shale” and non-conventional resource plays,” he said.

In the meantime, Schlumberger said it is working with operators in proprietary evaluations to accelerate understanding of the reservoir potential and provide a sound technical basis to support drilling and infrastructure investment. The company’s Monterey resource assessment service utilizes an established suite of proprietary unconventional reservoir evaluation workflows to provide a prospect and acreage rationalization for the entire basin, paired with EUR predictions for a given reservoir and completion quality. “The outcome is a product to guide the operator’s technical, operational and business decisions, so as to maximize their ability to reduce production variability while increasing return on investment throughout the lifecycle of the play,” Schlumberger says.

The initiative comprises two phases. The Phase I result is a basin-scale 3D earth model that characterizes heterogeneity of the reservoir and completion quality, while the second phase addresses well productivity through engineering analysis. The successful results of the Phase I earth model, which includes geomechanical modeling of the complex stress environment in the area, is engineered to allow for detailed analysis of stimulation optimization and production performance prediction in individual wells within target areas, according to Schlumberger.

BIG ROLES FOR SMALLER PLAYERS

The vast majority of prospective Monterey/Santos onshore acreage is controlled by a handful of larger players, with Occidental holding the largest property base by an unapproachable margin. After Amerada Hess opened an office in Bakersfield last year, speculation was rampant that the New York-based operator would be transferring its experience in the Bakken to the Monterey shale, but Hess has not disclosed the number of properties that it holds onshore or its planned activities in the play.

Owing to the continuing permitting difficulties, a collective hush seems to have fallen over California operators. However, public data available show that while the bulk of the leased acreage is in the hands of larger operators, the most intriguing developments are being carried out by the much smaller, lesser-known players.

Occidental Petroleum Corp. holds 1.7 million, largely net acres, of which some 873,000 overlay Monterey shale prospects, according to the EIA 2011 assessment. The Los Angeles-based operator said its 2011 California production amounted to 138,000 boed, more than a fourth of which came from its shale holdings. At the end of 2010, Oxy reported California production of 139,000 boed.

During 2011, Oxy operated between 26 and 30 rigs, closing the year with the drilling of some 675 new drills and nearly 500 workovers throughout the state. The operator said 330 of those new wells were drilled on its flagship Elk Hills complex, but it has not disclosed how many shale-specific wells it intends to have drilled by the end of this year. The operator has suggested, however, that it will be applying expertise acquired from drilling and producing the various shale zones at Elk Hills to its other California shale assets in the Los Angeles, Ventura and San Joaquin basins.

In reporting second-quarter earnings, Occidental President and CEO Stephen Chazen told analysts that the operator would first concentrate on its more accessible prospect before tackling the deeper and more technically challenging Monterey acreage it holds in the central San Joaquin Valley.

Venoco Inc., which finalized its go-private transaction in early October, holds approximately 312,000 gross acres in California, in which 46,000 net acres overlying the Monterey shale are held by production. Before going private, Venoco said in its second-quarter earnings report that it has allocated expenditures of $223 million to Southern California, with $100 million of that earmarked for onshore Monterey shale activities.

Venoco is operating one rig and in the first half of the year had completed five wells in its Sevier field in the western San Joaquin Valley, Mike Edwards, vice president of investor relations, told World Oil. “In the Salinas Valley, we decided to suspend drilling until we got 3D data over the area. We completed a 28-sq-mi shoot in the second quarter and are processing the data. We have very little activity on any other onshore Monterey acreage,” he said.

Edwards added that Venoco recorded peak field production of 325 boed for first-half 2012, with an average of 175 boed. “On the second-quarter call, we talked about needing to get pipelines in place for natural gas, as our air permits limit our ability to flare associated gas,” he added.

Berry Petroleum Co., a pioneer of California oil production, holds 7,184 gross development and undeveloped acres overlying prospective Monterey shale, and has reported an estimated 1 billion bbl of oil-in-place now under development.

Denver-based Berry Petroleum is conducting a major drilling campaign at its über-tight Diatomite holdings in the North Midway-Sunset asset in the San Joaquin Valley after the COGGC’s long-awaited, but more stringent, approval of a full-field steamflood development program. “The approval contained operating requirements that were significantly more stringent than similar specifications contained in prior approvals from DOGGR,” the operator said in a statement afterwards.

Berry had said it intends to drill some 70 new producing wells and 20 replacement wells at its Diatomite asset this year, which has seen cumulative production steadily rise to about 2,970 boed.

Seneca Resources Corp., the exploration and production arm of New York-based National Fuel Gas Co. (NFG), holds 11,833 net acres and operates 1,322 wells in California, where it produced an aggregate 3.2 million boe over last year.

Statewide, parent NFG told the Barclays Conference in September that its E&P segment recorded year-end 2011 California oil production of 9,209 bopd, which includes its interest in 215 active Monterey shale wells in the South Lost Hills field in the San Joaquin Valley.

Seneca has not disclosed how many rigs that it is operating in California, or how many wells this year will specifically target Monterey shale prospects.

Underground Energy, Inc. has assets in California and Nevada totaling nearly 64,000 net acres. The Santa Barbara, Calif.-based firm’s focus is the Monterey shale, particularly at its Zaca Field Extension Project in the Santa Maria basin. In November 2011, Underground acquired an 80% working interest at its Zaca asset and now controls a total of 10,482 net acres. This asset surrounds the existing, 61-well Zaca oil field, which has historically produced more than 32 million bbl of oil since 1942. Underground identified several new structures through reprocessed, recently acquired seismic data and has completed permitting for two well pads and 13 wells. An Aug. 24, 2012, resource report completed by Netherland, Sewell, and Associates, Inc., concluded that Underground’s Zaca asset has 493 million bbl of total petroleum initially-in-place (PIIP). The report also stated that Underground holds best estimates of 12.3 million bbl of contingent and 37 million bbl of prospective oil resources at its Zaca Field Extension Project.

Underground drilled its first well, Chamberlin 4-2, at Zaca last February, which encountered 900 ft of continuous live oil shows and discovered a new, lower subthrust block. Core samples showed a high density of natural fractures, and testing has concluded that the subthrust oil reservoir is abnormally high in temperature. Underground then drilled the Chamberlin 3-2 well to directly target the newly discovered East Chamberlin subthrust fault block. Production testing confirmed that the lower reservoir is pressurized, indicating it is isolated from the depleted upper reservoir block, which contains the field’s existing wells. Underground will continue the full development of its Zaca Asset.

|

| Fig. 4. Underground Energy’s Chamberlin 1-2 well (front) was drilled in August 2010 as a 10-acre offset to the Carranza 22 well (behind) that produced in excess of 550,000 bbl, to date. Photo courtesy of Underground Energy, Inc. |

|

Santa Maria Energy, LLC, plans a major development program on the undisclosed number of acres it holds within the 11-year-old Orcutt field onshore Santa Barbara County. The privately held Santa Maria-based independent said its development project includes the construction of 136 production oil wells, two steam generators, connecting pipelines, oil processing facilities and related ancillary equipment to produce oil from the Sisquoc diatomite formation that overlies the Monterey.

Aera Energy LLC and Plains Exploration and Production, likewise, are listed as major leaseholders in prospective Monterey/Shale acreage, but neither has disclosed any specific drilling or development plans. Aera primarily produces heavy oil from its assets in the North and South Belridge, Midway-Sunset, Lost Hills, Cymric, and McKittrick fields. In the COGGC’s latest weekly summary on Oct. 6, Aera was listed as receiving 33 recent notices to drill. Aera reportedly operates an average of 11 rigs.

REALITY CHECK?

Operators are holding out hope that California’s powers-that-be will soon realize that encouraging production would help ease an ultra-severe budget crunch that has seen no less than four municipalities file for bankruptcy since June, according to the Wall Street Journal. The industry was heartened in November, when the state’s left-leaning governor dismissed the two top regulators, citing a reported 73% drop in new drilling permits issued since 2008.

“The industry was having a great deal of difficulty with permitting from DOGGR when the division was headed up by an individual who did not feel she had the authority to permit many of the activities that had traditionally been handled expeditiously by DOGGR.,” said WSPA spokesman Hull. “That individual and her boss at the Department of Conservation were replaced by the governor late last year, and the industry is now satisfied that the department is acting responsibly and professionally in the review and approval of drilling permits.” Operators now are saying that the firings appear to be delivering tangible results.

|