JIM REDDEN, Contributing Editor

|

| A Schlumberger HiWAY fracing configuration at a BHP Eagle Ford location. Photo courtesy of BHP Billiton Petroleum. |

|

Firmly etched in Richard Stoneburner’s psyche is Oct. 11, 2008. On that doubly memorable Saturday, while the University of Texas aficionado was watching his football team dismantle then number-one-ranked Oklahoma University in their annual grudge match, word came down that the textbook geological evaluation of a young South Texas shale that he helped orchestrate had, likewise, delivered a winner.

Flash forward nearly four years and the former president of Petrohawk Energy Corp., which Australian behemoth BHP Billiton Petroleum acquired last August, does not appear the least bit surprised that year-on-year drilling and production records have become givens in the Eagle Ford shale play. After all, he says, by virtually any standard of measurement, the triple-window Eagle Ford meets most of the criteria for an idyllic hydrocarbon province.

“You have very brittle rock, geopressure, thickness, net-to-gross ratio of 95 to 100% — everything you want from a rock standpoint. Then, you throw in the liquid component and the marketability, and it just doesn’t get any better than that,” says Stoneburner, now president of the North America Shale Production Division of BHP Billiton Petroleum.

After Petrohawk’s 11,300-ft #1H STS 241 discovery well effectively opened up the prolific Hawkville field in LaSalle and McMullen counties, the rush was on throughout many of the 24 largely rural counties comprising the abnormally thick shale play. Petrohawk followed up Hawkville with the 60,000-net-acre Black Hawk field to the north in DeWitt County, which Howard Weil Inc. last year extolled as having “the best drilling results and implied economics in the play to date. We view this acreage as the core of the Eagle Ford.”

MIXED SIGNALS

Since the Eagle Ford stampede with its distinctly international flavor began in earnest in 2010, the well-documented economic fallout of continuously escalating E&P, and mushrooming local facility and pipeline investments, has been nothing short of staggering. Takeaway, water and personnel irritations aside, the most recent statistics suggest the kitty is expected to be well-fed for some time to come. “What can I say about the Eagle Ford, except that it’s an 800-lb gorilla developing into a 1,000-lb gorilla,” Mark Papa, CEO of EOG Resources Inc., the play’s largest leaseholder, said following the release of first-quarter 2012 earnings.

Since then, a precipitious drop in active rig count suggests that some of the bloom may be coming off. According to Baker Hughes, the play’s active rig count dropped to 258 in mid-June from the 271 that were working in late May. The steep drop followed on the heels of a newly released, monthly Texas Petro Index report from the Texas Alliance of Energy Producers, which suggested that falling crude oil prices and sustained gas weakness are feeding anxiety over another economic slowdown, which could translate into Texas drilling taking a hit.

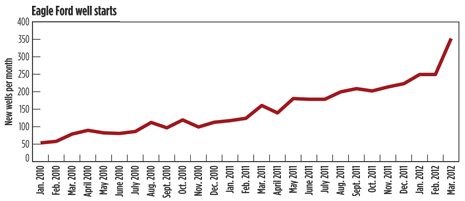

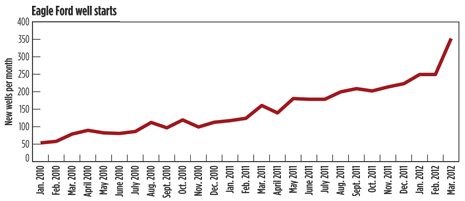

However, despite the anxiety over prospects that the faltering global economy is starting to creep into the Eagle Ford and elsewhere in Texas, it appears, for the time being at least, that the gorilla Papa referred to will, indeed, continue to put on weight. A joint U.S. Energy Information Administration (EIA) and Bentek Energy LLC study revealed recently that 856 new wells were spudded between January and March, representing an incredible 110% increase over the 407 new drills during the same period last year (Fig. 1).

|

| Fig. 1. First-quarter 2012 well starts are up 110% from the same period in 2011. Source: U.S. Energy Information Administration (EIA), Bentek Energy LLC. |

|

The Texas Railroad Commission (TRRC), which oversees all things petroleum within the state’s boundaries, reported that cumulative 2011 oil production from the Eagle Ford reached a new peak of 30.5 million bbl, representing a more than seven-fold increase over the 4.4 million bbl produced in 2010. As of April, the EIA said crude and condensate production was averaging more than 500,000 bpd, compared to the 182,000 bpd average production during first-quarter 2011. Trevor Sloan, director of energy research for ITG Investment Research, said Eagle Ford producers are on track to reach the elusive 1-million-bopd mark by 2016.

Meanwhile, 2011 aggregate gas production jumped to 243 Bcf from 108 Bcf produced the previous year, when commodity prices were significantly higher. The EIA/Bentek examination said about 2 Bcfgd was being moved by early April.

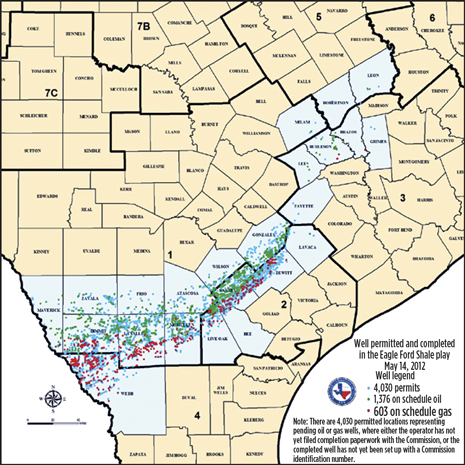

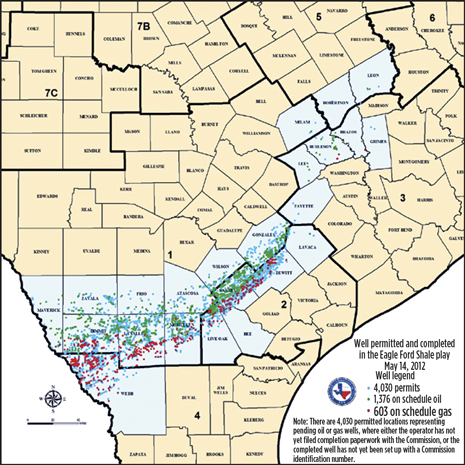

In addition, the number of drilling permits that the TRRC issued between January and April in Eagle Ford counties suggests the aggregate 2011 mark will be eclipsed by a wide margin (Fig. 2). In the first quarter, the TRRC approved 1,452 permits, compared to 2,826 issued for all of last year. By comparison, in 2010 only 1,010 permits were issued for Eagle Ford wells.

|

| Fig. 2. The number of Eagle Ford drilling permits issued in first-quarter 2012 is running way ahead of the 2011 pace. Source: Texas Railroad Commission. |

|

For the once economically distressed ranching communities lying within its perimeter, the fiscal windfall continues to capture headlines. A newly released University of Texas at San Antonio (UTSA) study stated that by 2011, Eagle Ford activity had pumped $25 billion in economic development and generated 48,000 jobs in what was once the poorest region in Texas. “The numbers sort of speak for themselves. They’re growing literally in an exponential fashion,” said the study’s author, Dr. Thomas Tunstall, director of the UTSA Center for Community and Business Research.

NOT YOUR TYPICAL SHALE

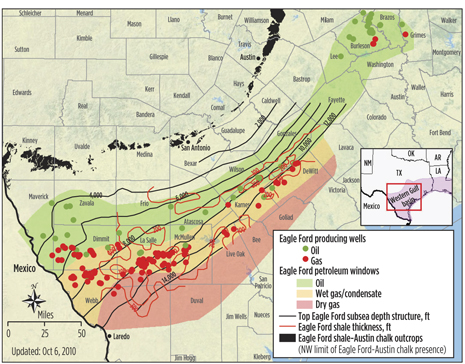

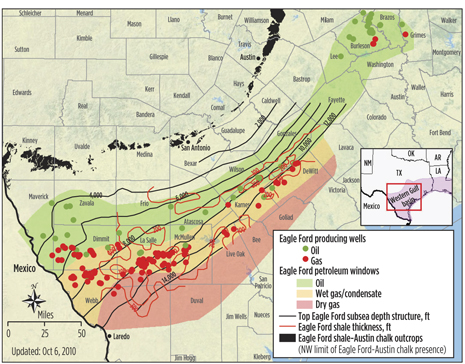

The carbonate-rich Eagle Ford shale is the world-class source rock for the overlying and heavily explored Austin Chalk formation. The Eagle Ford, which overlies the Buda Limestone, has well-defined oil, wet gas and dry gas zones, stretching some 400 mi. from the Texas/Mexico border, with outcrops running as far north as Dallas-Fort Worth (Fig. 3). Setting it apart from other North American shales, the Cretaceous formation has average thickness of 250 ft, with some sections as thick as 330 ft.

|

| Fig. 3. The Eagle Ford is differentiated from other U.S. shale plays by its greater average thickness. Source: U.S. Energy Information Administration (EIA), using data from Petrohawk (BHP Billiton Petroleum), HPDI, EOG and TNRIS. |

|

While not a pure matrix carbonate, Stoneburner said the Eagle Ford, nonetheless, contains an extremely high percentage of carbonate material embedded within the shale. He added that the Eagle Ford presents, what he calls, a “very chattery” gamma ray signature, and collective core evaluations can show upward of 70% carbonate material and as little as 10% to 12% clay materials.

“If you have pure shale that does not necessarily have that high a percentage of carbonate material, you will see a very high gamma count throughout the shale section. In the Eagle Ford, you have a relatively low gamma count that is very chattery. You’ll see some points in the gamma ray that are clean enough to appear to be a thin-bedded limestone member, but in fact, it’s just the variability of carbonate material. Vertically, you have layers that are probably 80% carbonate and other layers that are 40% carbonate,” he said.

The Petrohawk discovery well was completed with a 10-stage frac in the earlier mapped Hawkville basin with a reservoir comprising anonymously thick facies of porous shale. The Hawkville basin lies between the separate Edwards and Sligo shelf margins that Stoneburner said tend to converge to the north at the Pawnee field of Bee and Live Oak counties. “South and west of there, they diverge so you have a divergent shelf margin that created a natural basin.”

Throughout the play, the nature of the harvest depends on where one decides to put a rig. The southernmost horizon produces mainly dry gas, while oil is predominant in the more than 50-mi-wide northern region. The central window brings up mainly wet gas and condensates. “When you’re exploring, of course, you don’t know exactly what you’ll find,” Stoneburner said. “As it turns out, we found a little bit of everything in the Eagle Ford.”

Last month, the Federal Reserve Bank of Dallas gave jittery producers some encouragement, concluding that the clear-cut liquids and gas windows should allow operators in the Eagle Ford to adjust better than those in other areas to the vagaries of the global commodity markets. According to the report, producers easily can change course and exploit whichever product offers the most favorable return.

BHP Billiton, for one, says it is shifting its drilling plans to focus its capital in the wet gas, or liquids-rich, portion of the play. While there are some obligations to drill in the dry gas window of Hawkville, to meet the continuous development requirements of some leases, BHP says it has the flexibility to focus the vast majority of its Eagle Ford drilling and completion capital to the updip portion of Hawkville and Black Hawk.

BRIEF, BUT INTRIGUING HISTORY

Although the Eagle Ford is one of North America’s newest entrants to the unconventional shale rush, how the play came about is an intriguing case study, worthy of discussion in any business school. While San Antonio’s Lewis Energy, which has since teamed up with BP, is credited with completing the first Eagle Ford well in 2002, the Hawkville field was the springboard. Leading up to completion of the discovery well is a tour de force of how best to carry out a multi-disciplinary investigation and capitalize on long-established relationships. The genesis of the Eagle Ford also included not a little bit of stealth, strikingly reminiscent of a bygone era that in today’s information-saturated world would seem impossible to pull off.

It all began in January 2008, when Petrohawk CEO Floyd Wilson approached Stoneburner about locating another shale play in hopes of replicating the operator’s success in the Fayetteville and Haynesville shales. The Petrohawk president immediately contacted his close friend, Gregg Robertson of Corpus Christi, an independent geologist who had the supporting data to back his long-held belief that the deeper Eagle Ford was a high-potential prospect. A deal was quickly made, and Robertson and the Petrohawk exploration team went to work collecting and analyzing the subsurface data.

“We’d gotten heavily involved in the Haynesville that had some of the youngest rock ever discovered,” Stoneburner said. “We felt we could look at other younger age rocks. We really were just focusing on quality rock, and that’s where Gregg came in. We had all worked the Austin Chalk, and we knew that the Eagle Ford sourced the Austin Chalk.”

Stoneburner said initial subsurface work consisted of examining virtually every earlier penetration in the Eagle Ford from Mexico to Louisiana, in hopes of identifying a quality section. During that investigation, they came upon a conventional log suite from a well that Swift Energy drilled in LaSalle County in the 1980s. “We acquired all the available log suite, and when we examined it, and without knowing the geochemistry, we thought this had to work if the geochemistry supported it,” he said.

Needing geochemical data to back up the petrophysical support, Robertson, Stoneburner and company turned to another well drilled in the early 1950s. Although, as Stoneburner said, the credibility of geochemical analysis of well cuttings “is not the greatest,” the team obtained samples from the more than 60-year-old wellbore. A subsequent geochemical analysis yielded positive total organic carbon (TOC) and thermal maturity results. “Those were the two key geochemical answers we were looking for, but based just on maturity, it didn’t provide enough clarity on the product. It was kind of in the in-between range of liquids and gas.”

Nonetheless, with all the subsurface and geochemical data in hand, Petrohawk then faced another dilemma: With only two control points in an area comprising many thousands of acres, it needed to narrow down a precise location to lease. In second-quarter 2008, the operator acquired an extensive 2D grid of seismic data of what would evolve into the Hawkville field.

“Subsequent, if not contemporaneous, to the subsurface and geochemical review, we saw how thick the section was and thought we should be able to see a geophysical signature to this thick section. Lo and behold, once we got the grid together, we could map on an isopach time basis the entire Hawkville field that’s greater than 150 ft, and that became our lease outline,” he said. “There’s nowhere else in the Eagle Ford trend where you find 300 ft of porous Hawkville facies. We mapped it geophysically and the next stage was to turn the landmen loose.”

Owing to its track record in the Fayetteville and later the Haynesville plays, Petrohawk knew that if it went on a public acquisition binge, a run-up in acreage costs would quickly follow. Consequently, landmen Robert Graham and Burke Edwards quietly acquired mineral rights under Robertson’s geological consultancy, First Rock.

|

| “We found a little bit of everything in the Eagle Ford” – Richard Stoneburner |

|

“We did it under the radar, and nobody knew we were there,” Stoneburner says. “The real advantage was that we were dealing with very large ranches, so it was easy to piece together the framework of a position, which was about 160,000 acres, in a very short period of time. We did that in about three months with no competition. We added another 75,000 acres subsequent to the discovery, but had a sizeable enough position to drill the discovery well and still be able to act on the balance of the leases we had post-discovery.”

“We spudded the well in July and completed it on Oct. 11, 2008, and we continued on. The coolest thing about this whole discovery process was that from the time we were given the charge in January 2008, we went through each sequential phase and made the discovery in 10 months.”

Petrohawk followed Hawkville with the shallower Red Hawk field in Zavalla County, but results have been sub-par. The opposite occurred in the operator’s next acquisition, which again, largely resulted from a relationship that Stoneburner had forged years earlier. He had helped close friend Ben Weber of Weber Energy Co. engineer a completion design for a planned well in the estimated 60,000 acres his company held in DeWitt county. Stoneburner said the results of the initial well were “mind boggling” and he told Weber, half-seriously, that if he ever wanted to unload the property Petrohawk would be interested. Two weeks later, a deal was struck and Petrohawk acquired what would become the highly fertile Black Hawk field.

“Black Hawk is probably the crown jewel of my business development career at Petrohawk. I have a strong belief that the Black Hawk component of Petrohawk was probably a key reason BHP saw the value they did,” he says. “And, it came about because of my relationship with Ben.”

OPERATORS REMAIN BULLISH

In the years since the Hawkville discovery, scores of small, mid-sized and super major companies, both from the U.S. and abroad, have joined the wholly-leased Eagle Ford play as operators or equity interest holders. While the BHP Billiton acquisition grabbed most of the attention, a host of international operators have gained a foothold, including China’s CNOOC, India’s Reliance Industries, Korea National Oil Corp. and Norway’s Statoil, which formed a joint venture with Talisman Energy of Canada last year after acquiring 15,400 net acres from SM Energy. An updated sampling of some of the largest, most-stablished leaseholders shows that for now, enthusiasm of the play continues unabated, despite the economic anxiety.

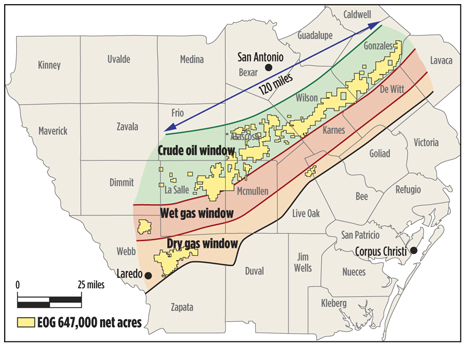

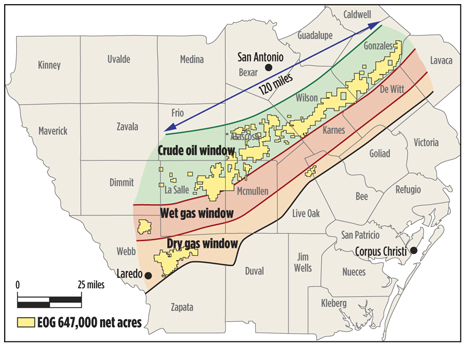

EOG Resources, Inc., holds a premier lease position, with a cumulative 647,000 net acres, 572,000 of which are in the oil window (Fig. 4). In early 2012, the operator raised the estimated reserve potential of its Eagle Ford holdings to 1.6 billion boe from 900 MMboe, with net oil-in-place estimated at 27.9 billion boe. As of March, Eagle Ford production had ramped up to approximately 77,000 boed, with 90% liquids.

|

| Fig. 4. EOG Resources’ acreage position in the Eagle Ford oil, wet gas and dry gas windows. Courtesy of EOG Resources Inc. |

|

In what EOG describes as its “best asset in North America,” initial production (IP) from its most recent Eagle Ford wells has exceeded 3,000 bopd, with “very strong” 30-day averages. In first-quarter 2012, EOG produced a cumulative 449,000 boed, compared to 409,000 boed in the like period a year ago.

The Houston-based independent operates 23 rigs and, beginning in 2012, plans to drill 300 net wells per year, in the up to 3,200 prospective drilling sites it has identified. EOG contends that it has the potential to sustain that annual drilling rate for 11 years. Last year, EOG reduced well spacing from 130 acres to 65-to-90 acres. This year, the company plans to continue to test tighter spacing. In 2013, EOG also plans to initiate a dry gas injection pilot project.

Chesapeake Energy Corp. is the second-largest leaseholder in the Eagle Ford with 475,000 net acres, primarily in the oil and wet gas windows. As part of its campaign to transition to liquids, the nation’s second-largest gas producer entered the play in 2009 with a major lease acquisition strategy. In November 2010, Chesapeake formed a $2.16-billion joint venture with China’s CNOOC that encompasses 200,000 net acres of its holdings in the oil window of Webb, Dimmit, LaSalle, Frio and McMullen counties.

The embattled operator told investors in June that 30% and 40%, respectively, of its 2012 and 2013 drilling budgets have been earmarked for the Eagle Ford, where it intends to average 30 rigs this year. Chesapeake said its year-to-date gross oil production in the Eagle Ford more than doubled from 25,000 bopd in second-quarter 2011 to 55,000 bopd, with first-quarter 2012 production increasing 35% sequentially to 23,000 bopd. Chesapeake, which has been in the midst of a shareholder squabble for most of the year, said it brought 60 Eagle Ford wells online in the first quarter, with eight of those delivering peak production rates of 1,000 bopd.

BHP Billiton Petroleum CEO J. Michael Yeager said at May’s Australian Petroleum Production and Exploration Association (APPEA) convention in Adelaide that last year’s $12.1-billion Petrohawk acquisition is paying off in a big way, as he fully expects its Eagle Ford holdings to yield some 150,000 boed within the next five to seven years. Current net production comprises more than 50% liquids, he said, from its core Black Hawk field in DeWitt County and the landmark Hawkville complex to the south. BHP Billiton holds 345,000 net acres, third highest in the play.

BHP’s Stoneburner said further development has been suspended in the Red Hawk field in Zavala County, where early results have been less than encouraging. “We knew it was challenged by relatively low-gravity (crude) with a very low gas-oil ratio and low bottomhole pressure,” he said. “Those combinations typically are not very good for extracting out of shale, but we’d pieced together that play through options and farm-outs, so we had acquired about 75,000 acres with little front-end capital exposure. We drilled a handful of wells. The second one was pretty good, but the rest were sub-par.”

In late May, BHP was operating 24 rigs and plans to peak out at 32 within the ensuing 12 months, split evenly between the Black Hawk and Hawkville fields.

Marathon Oil Corp. has been on a buying spree since entering the Eagle Ford in November 2010 and, after its acquisition of Hilcorp Resources last summer, has now assembled a 300,000-net-acre position. In May, Marathon signaled its intention to buy Houston independent Paloma Partners II, which, once finalized, would add another 17,000 acres to its Eagle Ford portfolio. The deal, which is expected to close in the third quarter, includes fields producing some 7,000 boed.

At year-end 2011, Marathon was operating 14 rigs, with plans to increase the fleet to 20 by the end of 2012 (Fig. 5). Over the same period, it intends to double to four its dedicated pressure pumping crews. During 2012, the operator says it intends to drill 160 to 185 net wells and record net average production of 30,000 boed, with expectations to increase production by 2016 to 100,000 boed, net.

|

| Fig. 5. Four of the 14 rigs drilling for Marathon Oil Corp. Photo courtesy of Marathon Oil Corp. |

|

Anadarko Petroleum Corp. continues to operate a 10-rig drilling program in the 200,000 net acres it controls, primarily in the Maverick basin. In late May, the operator said it had increased its net Eagle Ford resource base to more than 600 MMboe and had doubled its identified drilling sites to more than 4,000. Anadarko said its first-quarter 2012 sales volume comprised more than 65% liquids.

Anadarko spudded 69 wells in the first quarter, completed 74 and achieved first production on 59 wells. The operator’s average sales volume for the quarter was 27,300 boed, representing a 64% increase over first-quarter 2011 deliveries. In June, Anadarko began construction of its Brasada gas plant in LaSalle County, which will have the capacity to process 200 MMcfd when it begins operation next April.

In March 2011, Anadarko agreed to a joint venture with Korea National Oil Corp. (KNOC) that involves 80,000 net acres within its liquids-rich inventory.

ConocoPhillips, through its 2006 acquisition of Burlington Resources, was one of the first majors to get a foothold in the Eagle Ford. It now holds 220,000 net acres, primarily in the liquids-rich fairway.

By the end of 2011, the major had grown production to more than 50,000 boed, and it plans to double its output to 100,000 boed by the end of this year. ConocoPhillips has 16 rigs spread out among DeWitt, Live Oak, Karnes and Gonzales counties, and believes it can have upward of 1,000 wells onstream in five to 10 years.

Talisman Energy/Statoil JV now operates 85,000 net acres after entering the play in May 2010 with the acquisition of Common Resources’ acreage. The acreage is concentrated mainly in Karnes, La Salle and McMullen counties, where the JV was running 12 rigs as of early June. The alliance ended 2011 with 10 rigs active.

Pioneer Natural Resources and its partner, Reliance Industries, drilled 28 wells in the first quarter, with 26 put on production. The alliance has a 12-rig drilling program underway on its jointly-held 212,000-net-acre position.

Swift Energy is drilling wells in the shale oil, wet gas and dry shale gas windows of the Eagle Ford. The Houston-based company is also actively targeting the Olmos tight gas formation in South Texas. Much of the company’s acreage in McMullen County is prospective for horizontal development in both the Eagle Ford Shale and the Olmos Sands, particularly in the AWP field.

During fourth-quarter 2011, Swift drilled eight operated horizontal development wells in the Eagle Ford shale portion of the company’s South Texas core area, in McMullen, Webb and LaSalle Counties, along with two non-operated development wells in McMullen County. By comparison, during first-quarter 2012, Swift drilled nine horizontal development wells in the Eagle Ford shale. During both quarters, six operated rigs were drilling in the South Texas core area, in both the Eagle Ford and Olmos formations.

TECHNOLOGIES TARGET FRACS, WATER

While EOG, SM Energy and other operators are experimenting with down-spacing and longer laterals to reduce well costs and increase production, most of the new technologies introduced in the Eagle Ford focus on improving multi-stage frac completions. In addition, while the primarily rural operating environment of the Eagle Ford shields it from many of the regulatory restrictions of its more-urban counterparts, with most of Texas slowly recovering from the record drought of last year, it’s not surprising that water consumption is a key technology focus.

Nearly all of the service/supply giants, like Halliburton, Schlumberger, Weatherford, Baker Hughes Inc. and others, are either in the process of opening or have opened major technical facilities to serve the Eagle Ford shale. “We want them to bring their R&D efforts to improve performance and make the technology breakthroughs that we know are there,” said Stoneburner.

Prior to the BHP Billiton acquisition, Petrohawk had field-tested the Schlumberger HiWAY flow-channel hydraulic fracturing technology and has since converted 100% of the frac services that Schlumberger provides to this technique. Schlumberger says the technology is engineered to increase effective reservoir volume by creating stable channels and limitless fracture conductivity.

In one well, the HiWAY completion technology helped to increase initial gas and oil production by 37% and 32%, respectively, as well as the field’s estimated ultimate recovery (EUR).

Meanwhile, in Webb and Dimmit counties and other portions of the play with intrinsically high condensate volumes, multiphase flow into the created fractures requires that special attention be paid to the conductivity of the proppants used. For those applications, Houston’s CARBO Ceramics’ lightweight ceramic technology has provided an effective alternative to conductivity challenged sand and resin-coated sand materials.

In one condensate-rich Webb County field, the operator chose the lightweight ceramic proppant after an economic conductivity analysis of its slickwater and crosslink hybrid simulation program concluded that sand-based material would restrict hydrocarbon flow. In the targeted development program, wells ranged from 7,000 to 8,000 ft, TVD, with laterals averaging 4,000 ft with 12 to 16 stages, four clusters per stage and producing around 30% oil cut. Owing to the use of its lightweight ceramic proppants, the operator’s wells reportedly saw a 40%-to-60% increase in six-month cumulative production, compared to direct offset operators that employed sand-based materials. According to CARBO, the operator noted that production from its wells incorporating ceramic proppants also improved over time.

In a related development, CARBO intends to have a new distribution center in operation by the end of the year in nearby Alice. The center will have 55 million lb of fixed storage in the form of five 11-million-lb silos, with plans in place to expand to 100 million lb, if needed.

To address the water issues, Calgary’s GasFrac Energy Services Inc. brought its patented liquefied petroleum gas (LPG) gel fracturing technology to the Eagle Ford (Fig. 6), which it describes as a waterless method of transporting proppant while stimulating higher output. The Canadian company is working under a two-year contract with BlackBrush Oil & Gas LP, where marketing manager Kyle Ward said it has completed 12 frac jobs to date in the play.

|

| Fig. 6. GasFrac Energy Services LPG frac system on location for BlackBrush Oil & Gas LP. Photo courtesy of GasFrac Energy Services. |

|

Like Carbo, GasFrac plans to open a 10,000-sq-ft operations center by October on a 20-acre site that it owns in Floresville, southeast of San Antonio. Ward says the waterless technology has shown its capacity to increase production rates. “We feel like we have great environmental benefits to bring to the table, but we’re also getting better production rates,” he said.

As for drilling, contractor Orion Drilling of Corpus Christi introduced its newly engineered Gemini 550 class “walking rig” to the play as part of a three-rig newbuild package for SM Energy (Fig. 7). Elsewhere, Fort Worth bit company Ulterra last year introduced its VCL line of PDC bit technology in the eastern section of the Eagle Ford, where an 8¾-in version successfully completed the vertical, curve and lateral sections without requiring a trip. The longer and thicker sections, primarily in Karnes and DeWitt counties, had forced operators to make up to three bit trips to reach TD, said application engineer Jacob Wendt.

|

| Fig. 7. Orion Driling Co’s newbuild Perseus Gemini 550 rig on location for SM Energy near Encinal in the Eagle Ford. Photo by Eddie Seal for Orion Drilling Co. |

|

FUTURE REMAINS BRIGHT

With their close proximity to the petrochemical plants, natural gas liquids (NGL) processing facilities in Corpus Christi and Gulf Coast refineries, Eagle Ford producers are impervious to the price differentials confronting their brethren in the Bakken shale, where bottlenecks force them to discount relative to West Texas Intermediate. Nevertheless, the rapid uptick in production sufficiently overwhelmed the existing pipeline network, forcing many operators to ship liquids by truck or rail.

A number of takeaway projects are underway or recently completed, including the newly operational Kinder Morgan Energy Partners LP cumulative 178-mi crude and condensate pipeline. The $215-million project, which includes 65 mi of new-build and 113 mi of converted gas pipelines, will carry up to 300,000 bopd to Gulf Coast refineries and petrochemical plants.

That project nearly coincided with first deliveries from Enterprise Products Partners L.P. Phase 1 Eagle Ford crude oil system that likewise began operating in June. The system runs from Wilson County and extends 147 mi to Sealy, where it can carry a capacity of 350,000 bopd.

San Antonio’s NuStar Energy LP said it will spend $400 million over the next three to four years to develop additional pipeline infrastructure to carry Eagle Ford oil and gas to Gulf Coast refiners, says CEO Curt Anastasio.

The authors of the Federal Reserve Bank report said that with these projects and the tremendous facility investments, the South Texas economy should continue to grow for at least the foreseeable future. “Energy prices are difficult to predict. However, the billions of dollars that large energy companies are committing to expand infrastructure for delivering hydrocarbons to the Texas Gulf Coast signal anticipation of strong production from this region for many years to come,” they concluded.

|