Jerry Greenberg, Contributing Editor

|

Giambattista De Ghetto is the head of the Technology Innovation and Research Department of Eni’s E&P division. He joined Eni in 1979 after graduating in chemical engineering from the University of Padua. Dr. De Ghetto is the author of more than 30 publications on oil deposits, production and offshore development and has taught petroleum engineering at the University of Parma. He has been a distinguished lecturer for the Society of Petroleum Engineers. |

An integrated energy company headquartered in Rome, Eni is active in 77 countries around the world with a staff of about 80,000 people. During the first half of 2010, its E&P division increased its resource base by 600 million bbl through exploration successes, notably in Angola, Venezuela, Pakistan, Norway and Indonesia, and brought five new fields into production in Italy, Congo, Algeria and Tunisia. Eni has led the majors in production increase over the past decade (+49%), growing from 1.187 million boepd in 2000 to 1.769 million boepd in 2009. Technological innovation is a pillar of its broader strategy of sustainable growth. Giambattista De Ghetto, Senior vice president for technology innovation and research, conducted an e-mail interview recently with World Oil about Eni’s strategic efforts to meet challenges such as access to mineral resources through technological innovation.

|

|

Eni’s drilling operations in Kashagan Field in Kazakhstan.

|

|

World Oil: The upstream business scenario has evolved rapidly over the past few years; how has this impacted Eni’s E&P technology strategy?

Giambattista De Ghetto: The business context for operators has undergone profound changes since the middle of the last decade, beginning with the strong rise in oil and gas prices. The sharp swings in price over the past three years have done nothing to change the fundamental fact that access to hydrocarbon resources is controlled by governments that have many options for the development of their national treasures. In Eni’s view, this obliges operators to demonstrate an understanding and respect for the ambitions of these countries and the communities contacted by the E&P activities, and to present their case based on the advantages they offer to the NOC. First and foremost among these advantages are efficiency and technical leadership.

Within this broad context, Eni has profoundly revisited its R&D strategy and activities since 2005. Our investments have increased significantly since then, stabilizing at a value well over three times the previous level. More importantly, our spending is focused on a much more limited number of themes that are strategic to our business, and aimed at creating a competitive advantage in key areas, through the development of proprietary technologies.

WO: What are some of the new geographical areas in which Eni is moving and what are the main projects and challenges you face?

De Ghetto: In terms of geographic presence, new areas in which we are strongly engaged include the Arctic, with field developments in Alaska (Nikaitchuq), the Barents Sea (Goliat) and Russia (Samburgskoye). In addition to the logistical and technical challenges of operating in this climate, it is also a pristine and sensitive environment, which demands extreme attention to planning and monitoring the impact of operations. Eni is also active in ultradeep water in the Gulf of Mexico and West Africa, where the main challenges are reducing exploration risk and improving drilling safety. These drilling challenges are also present offshore North Africa.

Two projects stand out above all the others: the giant Junin 5 block, in the Orinoco belt of Venezuela, and Zubair, in Iraq. Technology will play a key role in ensuring that the economic performance targets are met. In the case of Zubair, we are committed to ramping up production from less than 200,000 bopd today to 1.2 million bopd by 2016. Together with the usual E&P challenges connected with a giant development project go a number of specific challenges on the ground. Our renewed engagement in Venezuela brings challenges associated with ultra-heavy oil production, including the development of technology to push the recovery factor well above current levels, and the possibility of deploying innovative upgrading processes to maximize the value of the produced oil.

Eni is also planning major investments in its operations worldwide to maximize production and profitability. The planned capex for production optimization initiatives alone is on the order of $2 billion for each of the next four years. New and emerging technologies will be aggressively tested and deployed to maximize the benefits of this investment.

|

|

Eni’s drilling operations in Bir Rebaa Field, Algeria, where it is the most active international oil company.

|

|

WO: What are the major areas of research and development focus for Eni?

De Ghetto: We are fortunate to face our future challenges and pursue new opportunities starting from a technology portfolio that is solid across the entire E&P chain. In the exploration area, for example, Eni possesses consolidated proprietary imaging technologies such as common reflection surface seismic (CRS) and has already industrialized a fully functional version of depth velocity analysis (DVA); we are bringing along our own solutions to reverse time migration, and are vigorously pursuing new high-power computing solutions that will allow us to fully integrate these leading imaging tools into our routine workflow.

Of course, no company can do it all on its own, so our investments in proprietary technologies are coupled with aggressive capture and uptake of third-party technologies. The best example of this is our use in Indonesia of the new “coil shooting” seismic technology with Schlumberger. This, the industry’s first acquisition made with the method, has provided improved imaging of complex geological structures through full-azimuth data acquisition and has given us a long head start on the technology.

WO: What drilling technologies are being investigated to meet the main challenges for HPHT, deepwater and ultra-deepwater projects?

De Ghetto: Eni has established an enviable record of drilling innovation over the past two decades, including development, with Baker Hughes, of the Autotrak and Vertitrak systems. In 2008, we invented and industrialized a new process for managed pressure drilling—Eni Near Balance Drilling (ENBD)—that we believe redefines the state-of-the-art. It allows continuous circulation throughout all phases of a drilling section, overcoming difficulties of drilling challenging wells, such as in cases where the difference between the fracture gradient and the mud weight is narrow, as frequently encountered in HPHT wells. Furthermore, it provides greater control in the drilling of overpressured zones compared to existing solutions where restarting of the fluid following pipe connections subjects the formation to a pressure spike, which can lead to fracturing of the formation. Application of this technology also provides better hole cleaning due to the uninterrupted fluid circulation throughout all of the drilling section.

ENBD technology has already been used to drill a series of challenging wells in North Africa, West Africa and Italy, unlocking new reserves while improving well control and safety. Looking to the challenges of developing both marginal and complex assets, we believe that well construction costs have to be reduced. One important contributor is nonproductive time, a theme to which we are dedicating renewed attention.

In light of the recent Gulf of Mexico blowout, well control and safety in drilling operations are likely to dominate the attention of the industry and the public in the coming years. While Eni’s track-record of well incidents over the past decade is better than the industry average, we have, nevertheless, worked continuously since 1999 to develop additional instruments to further reduce risks in this area. In addition to the technologies already mentioned, we have developed with major contractors, and are presently preparing field tests of, several drilling safety systems that promise to provide redundancy in mechanical safety devices.

|

|

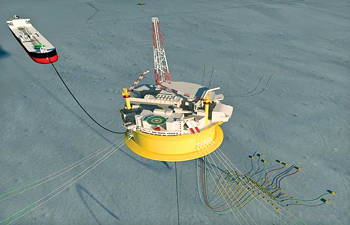

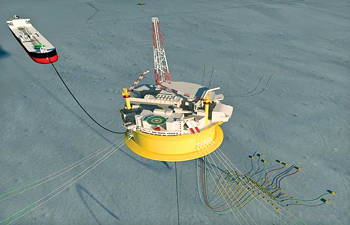

Eni has selected an innovative circular FPSO design for Goliat Field in the Barents Sea. The first oil from this field is expected in 2013.

|

|

WO: How is Eni advancing in the area of unconventional hydrocarbons?

De Ghetto: We are pursuing a number of unconventional resource opportunities in which technology will play a key role in achieving profitability. These include low-permeability gas and gas condensate reservoirs in our international operations and shale gas in the US, where we have entered into a joint venture with Quicksilver Resources in the Barnett Shale. The large extra-heavy oil accumulations in fractured carbonates in Italy—total OOIP is more than 6 billion barrels—have been produced since the 1950s, but there is an enormous potential for this resource provided that the right technologies can be developed. We are continuously evaluating new solutions in the field, including EOR processes and new well completions to boost production of this oil and increase the recovery factor, which, at present, is lower than 10%. We are also studying a broad family of technologies—well architecture and formation heating—that can unlock important heavy oil resources offshore West Africa.

WO: What about remote/marginal gas accumulations?

De Ghetto: In order to commercialize stranded gas reserves, we are examining developments based on floating LNG and compressed natural gas (CNG). A proprietary solution to monetize associated and stranded natural gas available to Eni is its gas-to-liquid (GTL) technology, developed in cooperation with IFP-Axons. We have recently completed the development of this process, based on Fischer-Tropsch synthesis, working on a commercial development plant at the Sannazzaro refinery, and we believe that it will offer new business opportunities to unlock large gas reserves.

WO: Carbon management is a theme of growing importance today; how is Eni moving in this area?

De Ghetto: Eni is strongly committed to fighting climate change, and for this reason, we have developed a carbon management strategy that combines operational and management initiatives with the development of innovative technologies.

Focusing on the E&P sector, our main goal for the next few years is to reduce gas flaring emissions 70% by 2012 with respect to emission levels of 2007. Moreover, we are promoting initiatives to reduce CO2 emissions associated with typical oil and gas operations by promoting a wide range of energy-saving initiatives in order to improve the efficiency of our industrial facilities. Optimizing energy consumption not only affects greenhouse gas emissions reduction, but also offers good opportunities to reduce costs and increase project revenues. On this theme, we are implementing in the field a novel organic Rankine cycle to generate electrical energy from flue gas and a new system for recovering energy from high- wellhead-pressure wells.

Finally, in the area of renewable energy, Eni has identified solar and biomass as the energy sources that show the most potential for large-scale, economically sustainable exploitation in the medium term. Focusing on solar technologies, possible applications of photovoltaic and concentrating solar power are under evaluation in order to develop new cost-effective solutions to support our business, especially in the more favorable geographic areas where we operate, such as North African countries. The first solar system will be installed next year in Egypt to provide energy for electrical submersible pumps of three remote wells.

WO: Can you bring us up to date on Eni’s proprietary technology for heavy oil upgrading?

De Ghetto: Eni Slurry Technology (EST) is a novel hydrocracking method employing a very active nano-sized hydrogenation catalyst and an original process scheme, allowing the total conversion of petroleum residues, extra-heavy oils and bitumen to high-quality distillates without producing coke or fuel oil. These peculiar characteristics provide superior economic performance compared to current technologies, and for this reason, we believe that EST can generate opportunities for oil producing countries with large reserves of unconventional oils. The outstanding EST upgrading performance has been demonstrated in more than four years of prolonged test runs with different feedstocks in a 1,200-bopd commercial demonstration plant at Eni’s Taranto refinery. The next important step in the development of this process is the construction of a 23,000-bopd industrial plant at Eni’s Sannazzaro refinery. Plant startup is scheduled for the fourth quarter of 2012.

WO: What about more fundamental research activities?

De Ghetto: We support fundamental research and, in particular, research committed to generating and incubating innovative ideas. With our long-term technological objectives and the never-ending challenges of E&P activities in mind, we are actively exploring opportunities deriving from emerging technologies in a broad array of fields. This activity is facilitated through two permanent technological observatories that we have established at two universities in Italy: Politecnico di Milano and Politecnico di Torino. The main task of these observatories is to help us to monitor the universe of science and technology, looking for new ideas and emerging technologies that could have a significant impact in our business. This is followed up with fundamental research to incubate and assess the potential of these ideas; in favorable cases, this gives rise to long-term, high-risk/high-reward projects.

Among the topics we are engaged with are satellites and nanotechnologies. In particular, in the area of nanotechnology we are rapidly progressing toward our first field trials of a wireless network platform integrated with personal safety nano-sensors. Following the excellent results obtained in the lab, we are also preparing field trials of a family of novel nano-fluids, which we are developing for a range of oilfield applications, from chemical delivery to heavy oil EOR.

WO: How do you present the R&D value proposition to your management?

De Ghetto: There is strong appreciation by senior management for the role that technological leadership will play in future competition in the oil and gas industry. We have responded by focusing our R&D portfolio on two complementary objectives: satisfying the needs of our business units and development of technologies with the potential to create value and competitive advantage. We have sharply increased investments in technology transfer, which is fundamental for getting ideas out of the lab or office and into the field. Also, we are increasingly setting quantitative objectives for the R&D spending in the short, medium and long term.

Nevertheless, numbers speak louder than words. So, over the past year, we have defined a methodology for determining the tangible returns generated by our portfolio of technologies and by the know-how generated through R&D investments. We plan to share this methodology with the sector in the future; let me say here that it is based on a case-by-case analysis of the cost of the best alternative for achieving the same industrial results. In this way we have been able to document a direct economic benefit, which is several times greater than the current level of R&D spending.

So far, the most important returns from technologies developed in our R&D programs have concerned reducing exploration risk, reducing drilling costs and production optimization. In addition, there is a very large basket of other economic results associated with new technology applications, for which it is more difficult to clearly assign the economic return to R&D investments.

WO: How do you assure that the value created by R&D is harvested, so to speak, by your operations?

De Ghetto: We give great attention to capturing opportunities provided by the market and to transferring the technologies generated in-house into the field. We have, in fact, created a fund dedicated to financing wholly or in part the costs of trials of new technologies in the field, not limited to those generated internally. This corresponds to about one-third of our total R&D spending, and is a dynamic, opportunistic portfolio, which is appreciated by our technical staff and by our business units alike. The ability to compensate for the technical risk inherent in new technologies or first applications by Eni of technologies in the market is the key to the success of this program.

Of course, the biggest opportunity to impact development project costs and value is by ensuring that innovative technologies are considered and compared with more conventional choices from the earliest phase of a project. We have mechanisms in place to ensure that innovative solutions are given proper consideration from the earliest phases of a project. We can use R&D resources to test technologies and run technical and economic feasibility studies necessary to make a business case for their adoption.

|