|

June 2000 Vol. 221 No. 6

Feature Article

|

SPECIAL REPORT: Southeast Asia Part 5

Conoco’s West Natuna project proceeds with creativity

While some Southeast Asian gas proposals languish in this high oil

price era, creative business moves and innovative technology are spurring development of large gas reserves

offshore Indonesia and construction of the region’s largest international gas supply system

Kurt S. Abraham, Managing/International Editor

aving done

business in Indonesia for 31 years, Conoco is one of the country’s major offshore operators. Although the

firm holds an inactive block onshore Irian Jaya, all of Conoco’s expenditure and activity is focused in

the Natuna Sea. aving done

business in Indonesia for 31 years, Conoco is one of the country’s major offshore operators. Although the

firm holds an inactive block onshore Irian Jaya, all of Conoco’s expenditure and activity is focused in

the Natuna Sea.

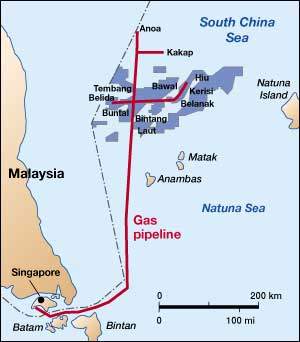

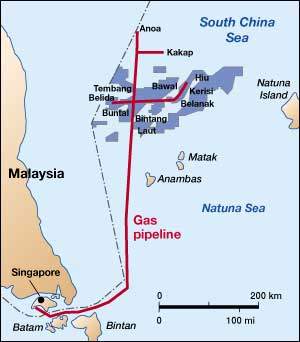

Centerpiece of Conoco Indonesia Inc.’s (CII’s) current efforts is

the West Natuna Gas Transportation System, a major project to develop natural gas in the firm’s Block B

concession and transport the production 330 mi to Singapore, Fig. 1. The project involves development of a

series of small-to-medium-sized gas fields in Block B and construction of a pipeline route from there to

Singapore. To bring the project forward, CII has had to show some creativity, in terms of commerciality and

technology.

|

|

Fig. 1. The West Natuna Gas Transportation System project is

developing natural gas reserves in Conoco’s Block B concession and building a pipeline to

transport production about 330 mi to Singapore. |

|

Background

Successful negotiations by CII last year resulted in an agreement that will

lead to the first sale of pipelined gas from Indonesia to another country. The 22-year, West Natuna Sea sales

contract will provide Singapore with gas to be used primarily for generating electric power for industrial

purposes. The project will create the longest international natural gas supply and delivery system in the

Asia-Pacific region. It also is expected to stimulate gas demand in the region, as well as development of

proven gas reserves in the West Natuna Sea.

"The initial gas supply contract to Singapore is on a take-or-pay basis

at 325 MMcfgd," said Jim McColgin, CII’s president and general manager. "To secure this

contract, the commercial considerations required us to aggregate sufficient reserves to get a high-enough

production rate that would justify building a pipeline system. To do this, we formed the West Natuna Group,

consisting of the Conoco Block B partners, Premier Oil’s Block A partners and the Gulf Canada Kakap Block

partners."

Additionally, the project required finding a sufficient market to purchase the

gas, a task ably handled in Singapore by Sembgas. The ability to deliver on time also had to be assured. "The

commitment to deliver gas is July 2001, and we hope to have some gas in the system before then," said

McColgin. "The fact that Indonesia

is gas-prone helped to spur CII to put in the new pipeline. I think our mission here in the future

will be a mixture of oil and gas."

Pipeline Construction

The pipeline portion of the West Natuna project involves installing a 22-in.

gas pipeline from producing fields to the Belida / Belanak fields tie-in and then a 28-in. line from there to

Singapore.

Actual pipeline capacity without added compression is 750 MMcfgd. With

additional compression, it will be able to run 1 Bcfd. The pipeline contract was awarded to McDermott in May

1999. Dredging in the Singapore Straits began last September and finished in February 2000. All of the line

pipe has been manufactured, and most of it has been coated and is ready to be laid, Fig. 2.

|

| |

Fig. 2. Manufacturing and coating of line pipe is mostly

complete, with laying of the line well underway. |

|

Welding and laying of the pipe began last January. Currently, McDermott’s

KP-1 barge is laying the 28-in. trunkline that runs from Singapore out to Block B, Fig. 3. The DB-26 barge is

in the field area, laying about 40 mi of smaller lateral lines that tie the three initial gas production

locations to the trunkline. As of late April, the KP-1 had laid about 300 km (186 mi) of the 472-km (293-mi)

trunkline.

|

| |

Fig. 3. At press time, a pipelay barge had completed the

laying of about two-thirds of the 472-km trunkline. |

|

"The difficult portion of the pipeline is the crossing of the Singapore

Straits," said McColgin. "This is a very busy shipping fairway. The pipeline will be ‘armored’

across the Straits to protect it from ship anchors. About 2 million t of rock will be required for the

armoring. Additionally, it was necessary to dredge portions of the route, so that the pipeline would be deep

enough to not affect shipping."

Once it is laid, the pipeline will need to be hydrotested and dried. In

addition, the receiving terminal and control systems will have to be completed and tested prior to shipping

gas to end-users.

Development Scheme

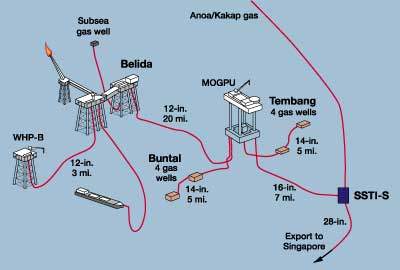

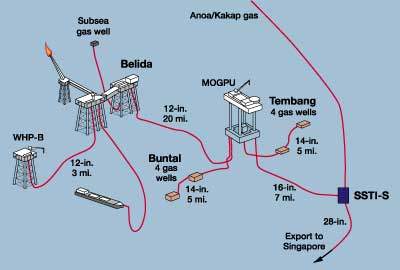

CII’s gas supply responsibility for the West Natuna system is tied to

initial development of gas reserves in Block B. Plans call for output to be established at three fields –

Buntal, Tembang and Belida – during Phase 1 development, Fig. 4.

|

|

Fig. 4. CII’s contribution to the West Natuna system’s

gas supply will come initially from three fields (Belida, Buntal and Tembang) in Block B. |

|

The smaller size of fields in the western portion of the West Natuna area,

like Buntal and Tembang, has prompted CII to design and build a purpose-built, jackup, movable, offshore gas

production unit (MOGPU), Fig. 5. McColgin said this jackup will produce gas initially from Tembang and Buntal

fields. As output declines and peaks in different fields, the unit could conceivably move location two or

three more times in its 30-year life.

|

| |

Fig. 5. In support of the Singapore gas supply contract,

Conoco designed a Movable Offshore Gas Production Unit (MOGPU) for use in Block B of Indonesia’s

West Natuna Sea. Shown under construction, the unit can be relocated within the block as older

reserves are depleted. |

|

"We started fabrication of our MOGPU last February," said McColgin. "It

is being built by Hyundai Heavy Industries at their yard in Ulsan, South Korea. The unit is not scheduled to

go to the field until 2001, and, as it is in the early stages of construction, there is not a whole lot to see

just yet.

"Eventually, it will be shaped like a barge and look largely like a

production platform, with a 250-MMcfgd capacity," added McColgin. "It’s really a large dry-gas

vessel with walls on the sides, capable of floating to the next location."

Plans call for developing four gas wells at Buntal, as well as putting another

four wells onstream at Tembang. All eight wells will produce to the MOGPU. In addition, a subsea gas well will

be drilled and brought onstream at Belida. It will be tied back to the field’s central platform, Fig. 6.

|

| |

Fig. 6. The central Belida platform will process output tied

back from a new subsea well. |

|

"We will begin development drilling for the project in the third quarter

of this year," said McColgin. "However, we have not started any of the wells at this time. We will

use the

Stena Clyde rig, which is the same unit that we used in Block B last year (Fig. 7). It is currently at

work on exploration and field delineation wells in Block B."

|

| |

Fig. 7. CII’s development drilling for the West Natuna

gas supply project will begin in third-quarter 2000 from this semisubmersible rig. |

|

In anticipation of growing demand, Conoco’s drilling campaign offshore

Indonesia was increased during 1999. This activity resulted in new discoveries that will allow the company to

double its Indonesian gas reserves. These new reserves, and the excess capacity being built into the pipeline

to Singapore, will improve Conoco’s ability to supply the region’s future demands for natural gas.

Acknowledgment

The author would like to thank CII President and General Manager Jim McColgin

and his staff for their assistance in providing further documentation and photos for this article.

|