Forecast

News

March 17, 2021

Global oil demand won’t return to pre-pandemic levels until 2023, and growth will be subdued thereafter amid new working habits and a shift away from fossil fuels, the International Energy Agency said.

Article

February 2021

Following a tumultuous 2020, global drilling rates outside the U.S. are a bit of a mixed bag for 2021. Lingering economic effects from shutdowns and travel restrictions are impeding recovery in regions like Africa and Eastern Europe, while Western Europe and South America are finding their stride.

Article

February 2021

U.S. proved reserves effectively unchanged

Article

February 2021

Despite an historically low, 54% decline in drilling activity, U.S. oil production was down just 7.6% on a year-over-year basis, averaging 11.318 MMbopd in 2020. The loss in U.S. output could have been more drastic, but OPEC+ did a masterful job of curtailing production during the year to support benchmark prices.

Article

February 2021

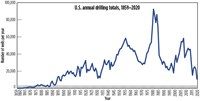

U.S. rig counts crash to historic lows

Article

February 2021

A meaningful recovery in U.S. drilling activity during 2021 will be hampered further by President Biden’s Executive Order that indefinitely blocks new leases and drilling permits on federal lands and waters for up to a year.

Article

February 2021

Worldwide E&P expenditures should increase 6.8% in 2021, recovering partially from a 25.3% collapse in 2020. The first coordinated global upturn since 2018 will be led by a stronger rebound in select International regions.

Article

February 2021

The oil and gas business had an exceedingly difficult time in 2020. There are signs that activity may be improving, but it’s hard to compare against a year that felt like rock bottom, and to forecast in the shadow of a pandemic.

Article

February 2021

On his first day as President, Biden recommitted the U.S. to the Paris Climate Agreement, rescinded the construction permit for the Keystone XL oil pipeline, and ordered federal agencies to begin reinstating over 100 environmental regulations rolled back by Trump—including ones governing methane leaks from O&G wells and greenhouse gas (GHG) emissions from vehicle tailpipes.

News

February 09, 2021

Supply from new oil wells will exceed declining flows from wells already in service, raising overall crude production from the second half of this year, the U.S. Energy Information Administration said in its Short-Term Energy Outlook.

News

January 14, 2021

Over the long-term, the impacts of behavioral shifts due to COVID-19 are minor compared to “known” long-term shifts such as decreasing car ownership, growing fuel efficiencies and a trend towards electric vehicles, whose impact is estimated to be three-to-nine times higher than the pandemic’s by 2050.

Article

December 2020

It is an understatement, to say that 2020 is the year that people want to forget—most people were “done’ with this year by about August. Nevertheless, it’s hard to ignore a year that was filled with so much impact, and which was deadly (Covid-19), tumultuous (oil market and prices) and unpredictable (politics, elections and regulation), often all at the same time. There were unprecedented social and business lockdowns in response to Covid-19 that killed demand. There were record-low oil prices and record-low rig counts that slashed activity. And there were record-high vote totals in the U.S., amid an election that just finally resolved itself on Dec. 14.

Against this background, a core group of our editorial advisors has worked to assess the global E&P industry during the last 12 months, and attempted to foresee what may take place in the coming year. Some of the subjects tackled by our advisors include a look at how to boost the global LNG market; continued uncertainty for the UK Continental Shelf; the carbon intensity of reserves, as the next step to net-zero; the role that Norwegian firms are playing in developing technology that will help the industry to prosper; a look at some talented leaders that are impacting the industry in its time of need; the true impact of digital oilfield technology; and a look at an Arctic oil field of the future, which is developing now. We encourage you to read forward for all the details.

Article

September 2020

Most regions will see significant reductions in activity, although the Middle East and China seem to be faring better.

Article

September 2020

The catastrophic demand decline initiated by coronavirus lockdowns significantly damaged the U.S. oil industry, with oversupply, historically low storage capacity, and low prices. Operators responded by stacking rigs and shutting-in production.

Article

September 2020

As the world holds its collective breath over Covid-19, Canada’s oil patch has shifted drastically to pure survivalism. Most measuring sticks of industry health show historic lows, while lack of market access continues to hurt producers.

News

September 21, 2020

World Oil has finished compiling the 2020 mid-year forecast update for drilling and production and, if projections hold true, the number of oil wells drilled in the U.S. annually will reach lows not seen since the 1930s, or even further back.

Article

February 2020

Global capex to grow moderately,

but less than last year

Article

February 2020

Spending discipline slows drilling activity in shale plays

Article

February 2020

U.S. reserves reach new record-high

Article

February 2020

U.S. crude output surges,

overproduction wallops gas prices

Article

February 2020

Canada re-adjusts to low prices, limited access