Activity outside North America is no great bonanza

The global upstream industry has gone through unprecedented financial and operating conditions, generated by last spring’s double-hit of the Covid-19 pandemic and the oil dumping exercise/price war engaged in by Saudi Arabia and Russia. What has resulted is perhaps the bleakest episode in the post-World War II E&P market, leaving virtually no operator, equipment/service company, drilling contractor or other industry firm untouched.

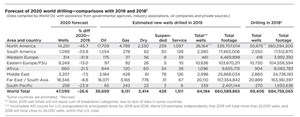

That having been said, some regions are doing better than others. For example, in the Middle East, while state firms have cut their capex a bit, they remain committed to multi-year projects and have a steadier flow of capital. Hence, their combined drilling is only expected to fall 7.5%. The situation is similar in China, where drilling is forecast to decline just 8.0%. However, that country’s dominance of the Far East/South Asia region is masking a more dire situation for other countries. Meanwhile, double-digit percentage reductions—some quite severe—are on tap for activity in all other regions.

Global figures. World Oil forecasts that global drilling will be down 26.6%, to 47,099 wells. The U.S., Canada, Russia and China will account for 84% of all drilling. It also appears likely that for the first time that anyone can remember, China will surpass the U.S. in total wells drilled during 2020. But then again, it isn’t every year that the U.S. drills its fewest wells since 1898.

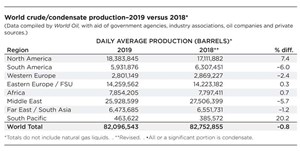

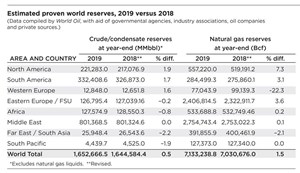

Meanwhile, before the pandemic hit, global crude and condensate production during 2019 was down just 0.8%, at 82.096 MMbpd. Oil and gas reserves were both up incrementally. Crude and condensate reserves rose 0.5%, to 1.653 trillion barrels. Gas reserves increased 1.5%, to 7,133 Tcf.

NORTH AMERICA

With significant declines expected in the U.S. and Canada, regional drilling will be down 45.7%. North American oil production improved 7.4%, to 18.4 MMbpd during 2019. The pandemic has since eroded all of that gain, although output is now beginning to build back.

Canada. These are difficult times for the E&P sector, as operators have shifted into survivalist mode. We expect Canadian drilling to be down about 33% in 2020. Oil production last year improved 2.9%. It will no doubt be lower this year. For further details, please turn to the Canadian discussion on p. 42.

Mexico. President Andres Manuel Lopez Obrador‘s (AMLO) apparent effort to restore state firm Pemex to its pre-reform status seems to be continuing unabated. Yet, a Pemex effort to drill new wells at 20 “priority” fields by using smaller, local service contractors failed in early 2020, and the company said it would re-bid some of the work later this year.

Given AMLO’s determination to make Pemex the centerpiece of Mexican energy efforts once again, we anticipated early in the year that drilling might rise as much as 20%. Now, given the multiplying problems, we predict just a 6.1% increase, Fig. 1. Further complicating the picture, Pemex in late April reported a $23.6-billion first-quarter loss, thanks to the Covid-19 pandemic and depressed global oil demand. Mexico’s oil output had fallen another 7.6% during 2019.

And then in June, to cut spending, Pemex suspended contracts with service providers and suppliers, triggering 8,000 job losses, various sources told Bloomberg. Most of the cancellations were for offshore maintenance work in shallow-water areas. The budget cuts resulted in the cancellation of 45 contracts worth about $160 million.

SOUTH AMERICA

This region is one of the hardest-hit areas, save for Brazil. Evercore ISI predicts that South American operators will decrease capex 24% in 2020. We predict that regional drilling will plummet 53.8%, to just 1,099 wells. Regional oil production dropped 6.0%, to 5.932 MMbpd.

Brazil is experiencing a relatively satisfying 2020. As of August, offshore rig activity was up 38%, compared to the 2019 average. Accordingly, we predict that drilling will rise 36.3%, in line with data provided by regulator ANP. Oil production rose 7.3% last year.

Drilling gains can be traced to state firm Petrobras, which has increased spending and is engaged in several development projects. The company also plans to shoot new 3D seismic in mature Campos basin fields, where two new FPSOs will be deployed to help aging fields. In addition, Petro¬bras was expected to sell off holdings in some non-core exploration acreage in the Espirito Santos basin.

Argentina’s outlook remains dismal. Just two years ago, analysts and officials labeled the Vaca Muerta shale (which means “dead cow” in English) as “the Permian basin of Argentina.” At the end of 2018, foreign investment (mostly in the Vaca Muerta) had jumped to about $12 billion, reserves were up 25%, and oil output had risen 5%. Those days are now gone. Sucker-punched by the Covid-19 virus and low oil prices, Argentina’s E&P sector is also victim to its own seemingly incompetent government, leaving investors with little confidence.

But national debt had piled up, triggering a financial crisis in 2019 and causing pro-business President Mauricio Macri to lose his re-election bid, with candidate Alberto Fernandez elected president. This was yet another negative factor, and Argentina’s E&P work began to decline, exacerbated by Covid-19 and low oil prices. Fernandez implemented steps to help the industry, including setting a minimum domestic Brent sale price of $45/bbl and reducing export taxes on oil and/or refined products to zero. Nevertheless, we project a 65.1% drilling decline.

Guyana. On Sept. 8, Hess Corporation announced that it and operator ExxonMobil struck another oil discovery at the Redtail-1 well, the 18th discovery on the Stabroek Block. This will add to the block’s previous recoverable resource estimate of more than 8 Bboe. The well is 1.5 mi northwest of the Yellowtail discovery. In addition, drilling at Yellowtail-2 resulted in the discovery of additional reservoir intervals (the block’s 17th discovery) adjacent to and below the Yellowtail-1 discovery.

Guyana’s drilling remains at a pace level with 2019. Oil production from ExxonMobil’s first development phase started up last December at an initial 38,000 bpd.

Venezuela. The country’s E&P sector, in general, has nearly cratered under direction of the once-great state firm, PDVSA. After starting 2020 at about 890,000 bopd, Venezuelan production was down to just above 400,00 bopd in June, and then it reportedly sank to around 300,000 bopd in July. An August estimate pegged the rate at some figure above 200,000 bopd.

Factors behind falling output include a shortage of storage capacity, difficulties in exporting oil because of U.S. sanctions, lower demand stemming from Covid-19, manpower shortages, equipment breakdowns, electricity blackouts, and a shortage of diluent that is needed to loosen 8o-10°API Orinoco crude and make it exportable. For 2020 as a whole, we forecast Venezuelan drilling will be down 66%. During June through August, only one rig ran in the country.

WESTERN EUROPE

Except for Norway, 2020 has not been kind to Western Europe. Upstream budgets in most countries have been cut back extensively. We believe that regional drilling will plunge 31.9%, to 314 wells. However, if Norway is taken out of the tabulations, then the rest of Western Europe will be down 51.3%. Regional oil production slipped 2.4%, to 2.801 MMbpd.

Norway. One of the smartest decisions made by anyone this year was the move by Norway’s ruling Conservative Party to temporarily ease tax rules for operators. This prevented a collapse in investments, due to the coronavirus and low oil prices. Indeed, the Norwegian Petroleum Directorate (NPD) tells us that drilling will be down only 11.9% for 2020.

The plan aimed to boost operators’ liquidity by up to 100 billion Norwegian crowns ($9.7 billion) from 2020 through 2021. Companies are allowed to write-off investments more quickly, effectively postponing tax payments until later years. Then, in early June, parliament granted additional tax relief to operators that covered projects sanctioned by authorities until the end of 2023.

Meanwhile, Norway, cooperating with OPEC+, cut oil output by 250,000 bpd in June and by 134,000 bpd during second-half 2020. In addition, several field projects will delay going onstream until 2021, including Equinor’s Martin Linge, Njord and Bauge; ConocoPhillips’ Tor; and Repsol’s Yme.

On the exploration front, Neptune Energy and partners on Aug. 4 confirmed a significant oil discovery at the Dugong well (PL882) in the Norwegian North Sea, Fig. 2. It is the largest discovery in Norway, so far this year, in the range of 40 MMboe to 120 MMboe.

United Kingdom. It is a different story on the other side of the North Sea. Hit with a triple-whammy of Covid-19, very low oil prices, and the worst natural gas prices in 10 years, British operators have slashed their activity and spending. In March, the government included upstream workers in its furlough program, whereby personnel laid off are supported financially, until their companies reinstate them. Then, on May 12, the furlough program was extended until October, in recognition of the continuing effects of Covid-19, as well as low commodity prices. Based on first-half well totals and the ongoing rig count, World Oil projects that UK drilling will be down 54.8%. Oil production, however gained 1.1% last year.

Meanwhile, the Oil & Gas Authority (OGA) on Sept. 3 offered for award 113 license areas over 260 blocks or partial blocks to 65 companies in the 32nd Offshore Licensing Round. The round offered blocks in mature, producing areas close to existing infrastructure, under the flexible Innovate License. And on Sept. 10, OGA published its latest reserves and resources report, which estimates that 10 Bboe to 20 Bboe (or more) of recoverable resources remain on the UK Continental Shelf.

EASTERN EUROPE / FSU

Production growth in the region slowed considerably last year. Oil and condensate output, combined, grew just 0.3%, to 14.259 MMbpd. Operators continued to optimize production from existing assets while also working to develop unconventional and Arctic resources. Accordingly, their use of new technologies from Western service firms increased. We predict that Eastern European/FSU drilling will fall 13.0%, to a total of 9,249 wells.

Russia. Having been accused by Saudi Arabia of failing to honor its OPEC+ commitment to reduce oil production, Russia found itself on March 8 in a price war and dumping contest with the Kingdom. Thankfully, by early April, cooler heads prevailed, along with pressure exerted by U.S. President Donald Trump, and the two countries reached an agreement for oil production cuts on April 9. But by then, the damage had been done, and it was extensive, particularly for U.S. shale producers.

By the same token, Russian operators have hardly been unscathed. Estimates of capex reductions at large Russian and other FSU companies range from 18% to 31%. Be that as it may, World Oil predicts that Russian wells drilled will be down just 11% from 2019’s level, Fig. 3. One reason for this is that operators want to keep their skilled drillers working and not lose them to other segments of the economy. A second reason is that Russian operators are also taking advantage of lower equipment and service costs to drill cheaper wells, much like their American counterparts. Thus, for both reasons, operators are drilling quite a few wells without completing them.

On the production side, there is great concern about how best to bring back shut-in oil wells. As one veteran Russian manager explained to Bloomberg, “Mass sealing of oil wells is a much more serious thing than short-term idling” in Russia’s frigid conditions. “It’s by far not a given that, after a well has remained shut-in for so long, it will pump at the same levels as before.” Russian oil output was up 0.9% last year, but as of mid-summer, that production rate was down about 17% from 2019’s level.

Other FSU countries. We forecast a 29.8% drop from last year’s 886 wells. The group’s oil production lost 2.0%. Kazakhstan’s largest oil field, Chevron-operated Tengiz, imposed production cuts as part of the country’s obligations to meet OPEC+ quotas. In addition, a major Covid-19 outbreak at the field site earlier this year disrupted a $45.0-billion expansion project. The work was expected to lift output to 900,000 bopd in 2023.

BP has been a fixture in Azerbaijan since the Soviet Union broke up, but the firm expects to pull out of the country completely. This move is part of its effort to sell certain assets, to generate more money to invest in renewables.

AFRICA

Impacts from coronavirus lockdowns and subsequent reductions in economic activity hampered new oil and gas investments during 2020. Evercore ISI expects spending by select African companies to decline 43% in 2020, with the year-over-year decline the worst of any international region. We project a 21.5% decrease in drilling on the continent during 2020. Regional production was up less than 1%, at 7.854 MMbopd.

Angola. Service providers see a positive future for Angola’s offshore programs, securing new long-term service contracts and expanding in-country capabilities to meet growing demand. The Angolan government has committed to meeting its mandated OPEC+ production targets, with production figures demonstrating both compliance with current figures and additional reductions as penalties for prior overages. Drilling is projected to decline 17.6%.

Nigeria. Challenging OPEC+ production commitments and difficulties in securing financing led the managing director of Nigerian National Petroleum Corporation to call for a cut of production costs to $10/bbl or less. High costs and persistent security issues have led several majors to sell assets, including Chevron, which plans to divest eight onshore and shallow-water blocks. Total will sell its 12.5% stake in Block OML 118, which includes the prolific Bonga, Bonga Southwest and Aparo fields. ExxonMobil also looks to sell assets in Nigeria and Chad. We project Nigerian drilling to decline 24.2% in 2020. Oil output was up 1.9% in 2019.

Algeria. Occidental Petroleum made an effort in first-half 2020 to divest Algerian assets acquired in the Anadarko merger, but the collapse of a deal with Total, coupled with pushback by the Algerian government, led Oxy to cancel the sale. Drilling in Algeria is projected to decline by 22.2% in 2020. Oil and condensate production was down 1.5%.

Others. Ghana and Kenya saw postponements and outright cancellations of major development projects, Total’s finalization of its $16-billion Mozambique LNG project financing, along with renewed efforts to explore new opportunities offshore South Africa, stood out as bright spots in the region. Namibia expects three exploration wells, two onshore and one offshore.

MIDDLE EAST

Holding most of the levers that control OPEC production in a year of market turmoil is taking its toll on drilling activity across the Middle East. With some nations going beyond mandated cuts to try to balance oil prices amid record low demand, exploration spending is expected to decline 12.5% for the year. As the first round of OPEC+ production cuts begins to expire, wobbly demand is already leading Saudi Arabia and Russia to consider extending the agreement. World Oil projects a 7.5% drilling decline in the region during 2020. Regional oil output was down 5.7% during 2019.

Saudi Arabia is bearing the brunt of the coronavirus-fueled demand decline and associated OPEC+ production cuts, going so far as to exceed its prescribed reductions by 180,000 bopd this summer. This is an effort to bolster prices and serve as an example to recalcitrant member countries. Kingdom output was down 5.3% in 2019. New offshore opportunities are gaining attention, with Saudi Aramco moving ahead on a new shipyard to manufacture jackups and land rigs. The company is also considering long-term offshore maintenance contracts involving Marjan oil field, which could be valued at $1.5 billion to $2 billion annually. However, the Kingdom deferred plans to FID the $5-billion Zuluf field until at least fourth-quarter 2021. Drilling in Saudi Arabia (Fig. 4) is forecast to decline 15.2% in 2020.

UAE-Abu Dhabi. Despite the travails of oil and gas production in 2020, ADNOC continues to make progress toward its strategy of achieving crude production capacity of 5 MMbpd by 2030. Building on previous seismic developments and long-term OCTG supply contracts, Abu Dhabi has merged its two major service companies into a single unit. A $5.5-billion real estate investment trust has been tapped by ADNOC, monetizing its property holdings to fund future growth. In spite of these advancements, drilling in UAE is projected to decline 10% in 2020.

Iraq. Reliable enforcement of OPEC+ production targets has challenged Iraq. The government directly requested that BP reduce flow at its Rumaila field, the nation’s largest, by 10%, in a bid to comply with cuts. These efforts brought Iraq to within 90% of its commitment, earning leadership a congratulatory phone call from Saudi Arabian Crown Prince Mohammed bin Salman in July. Drilling in Iraq is projected to decline 36.9%, while oil production was up 3.2%.

Iran. Anticipating an eventual end to sanctions, Oil Minister Bijan Namdar Zanganeh is expanding production capacity in Iran via Persia Oil and Gas Industry Development Co.’s $463-million agreement with state-run National Iranian Oil Co. The deal concerns operating and further developing Yanan oil field. The deal should raise the field’s output by about 40 MMbbl over a 10-year period.

FAR EAST/SOUTH ASIA

Decreases in spending across the Far East and South Asia will depress drilling activity as a whole, but a few bright spots exist in the region’s larger producing and consuming countries. A 4% increase in the Baker Hughes rig count in 2019 will be offset by a World Oil-projected 8.8% decrease in wells drilled during 2020. If China is taken out of the equation, then regional drilling will be down 18.4%. Dominated by China, regional oil production was down 1.2% in 2019.

China. The Chinese government continues to press its ownership interests in the South China Sea, logging a significant offshore, condensate, oil and gas discovery in the shallow-water area of the Pearl River Mouth basin as part of a plan to double its domestic reserves. In addition to domestic capacity, China has been a swing buyer of both Middle Eastern and U.S. crude this year, with its recovering economy driving increased consumption. With tank farms and “teapot” refiners reaching storage limits, plans are underway to increase national storage capacities by as much as 40%, to expand strategic reserves. World Oil projects drilling in China to decrease 8.0%. Chinese oil production grew 1.1%, overall, in 2019, Fig. 5.

Indonesia. Exploration programs in Indonesia are set to continue their multiple-year decline. Drilling, overall, is projected to decrease 6.6% in 2020. Oil output was down 3.5% in 2019.

India. As the world’s third-largest oil consumer, India is taking steps to increase its storage capacity and play a larger role in the market. Declining production from the country’s more prolific fields, discovered in the 1990s, and their replacement by smaller finds, is also driving this trend. India’s drilling should decrease 9.4% in 2020.

Malaysia. Natural gas exploration has been a primary activity for Malaysia, with much of the efforts focusing on the South China Sea. With an estimated recoverable gas resource of up to 3 Tcf, Kasawari field is one of Malaysia’s most significant gas discoveries, set to produce up to 900 MMscfd. Drilling in Malaysia is set to decline 15.3% in 2020.

SOUTH PACIFIC

With technical issues and economic factors impeding the region’s goal of becoming the world’s largest LNG exporter, South Pacific drilling activity is expected to decline 23.9% in 2020. Regional oil output actually rose 20.2% in 2019, to 463,622 bpd.

Australia. Setbacks from domestic gas price spikes and supply shortages are driving a debate between the pro-fossil fuel government and environmentalists over the role that gas should play in the country’s energy future, Fig. 6. Meanwhile the pandemic has cast doubt on long-term projections for the fuel and is causing billions in write-downs on the country’s once-vaunted gas assets. World Oil forecasts a 24.1% drilling decline for Australia during 2020.

New Zealand. Despite most Asian companies cutting capex budgets for new exploration, New Zealand Oil & Gas is on the lookout for new producing assets and development projects, as well as exploration prospects. Drilling is projected to decline just 8.3% during 2020. The country’s production of oil and condensate was nearly unchanged at just above 24,000 bpd, and gas output was up 5.6%, much of it offshore. Fig. 7.

- The last barrel (February 2024)

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)

- First oil (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)