Digitalization may unlock $320 billion in oil and gas savings by 2030, analysts say

The oil and gas industry could capture more than $320 billion in savings over the next five years by accelerating digital adoption across core operational domains, according to new analysis from Rystad Energy. The findings underscore how digital technologies—once considered optional enhancements—are rapidly becoming essential tools for efficiency, resilience and long-term competitiveness.

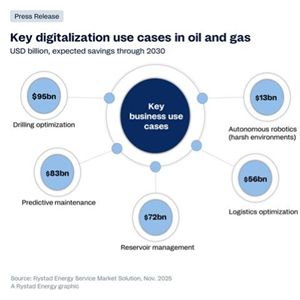

Rystad identifies five priority areas where digitalization can deliver the largest near-term gains: drilling optimization, autonomous robotics, predictive maintenance, reservoir management and logistics optimization. Together, these technologies could reshape cost structures for operators and oilfield service (OFS) companies as they contend with shifting market conditions and tighter capital discipline.

“We estimate that $320 billion is a modest figure,” said Binny Bagga, Senior Vice President, Supply Chain at Rystad Energy. “Broader digital adoption across additional business domains could generate even greater value. To realize this, executives will need to deliberately prioritize digital transformation by fostering a less risk-averse business culture.”

Digitalization’s growing influence is increasingly reflected in financial reporting across the OFS sector. While most service providers do not yet break out standalone digital revenue, that is beginning to change. SLB now reports results for its digital division, which is expected to reach a 35% margin in 2025. Technology and geoscience firm Viridien reported $787 million in digital, data, and environmental revenue last year, growing 17% with strong EBITDA performance.

According to Rystad, investors are rewarding companies that articulate credible, scalable digital strategies. Energy-technology narratives are commanding higher valuation multiples, but only when companies demonstrate that new platforms and software-based revenue streams can scale.

Still, digital transformation is not without challenges. High upfront hardware and software costs, cybersecurity requirements, and aging infrastructure continue to complicate adoption—particularly for smaller operators and service companies. To overcome these barriers, many mid-tier OFS firms are selectively adding digital capabilities, while niche players are offering modular software solutions tailored to specific operational needs.

A significant trend highlighted in the report is the accelerating pace of partnerships between OFS companies and external technology providers. Collaboration across oilfield engineering, automation, AI, cloud, and data-management firms has surged since 2021, driven heavily by SLB, Halliburton, NOV and Baker Hughes.

Rystad concludes that the OFS ecosystem is entering a new phase defined by digital-first business models, deeper technology integration, and a heightened focus on recurring revenue streams—marking a structural shift in how services will be delivered across the upstream value chain.