Defining our next normal

Innovate or die—This blunt ultimatum has infiltrated global industry for more than a decade. But unlike most corporate jargon, it’s retained both power and relevance—because it’s true.

Armed with creative determination and ingenuity, problem-solvers have transformed how we live, work, learn and survive since the Stone Ages. Today, the impacts of innovation are inescapable. We’re equipped with seemingly endless resources, information and capabilities that allow us to function at a heightened level of productivity, with greater accuracy, speed, flexibility and confidence.

The oil and gas industry’s history is decorated with critical innovations that have morphed operations and propelled progress.1 From sanctioning horizontal drilling, to the introduction of today’s universal top drive drill. The evolution of 2D seismic to 3D and 4D, to optimize reservoir management. Reaching incredible deepwater drilling depths with tension leg platforms and spurring the shale revolution with slickwater fracturing and intelligent completions. Every game-changing development has helped paint our current landscape, with more breakthrough advances on the horizon.

Yet, regardless of want or need, not all innovation is successful. History is littered with failed attempts to transform industries, influence lifestyles, or simply capture a slice of market share. These cautionary tales have cultivated a widespread adoption of incremental innovation.

The prevailing approach implements changes through steady progression to prevent change saturation and extreme pivots that turn performance and productivity risks into reality. Common sense and long-term strategic planning tell us this isn’t only reasonable, but necessary.

However, incremental innovation and change aren’t always enough. Sometimes we’re thunderstruck with such abrupt, unforeseen circumstances that a revolutionary shift is the only way forward. Many may contend, that time is now.

DEFINING OUR NEXT NORMAL

Adding to a long legacy of profitable booms and industry-rattling busts, U.S. crude oil production exceeded 10 MMbpd in November 2017—a feat that hadn’t been accomplished since 1970, just prior to the 1973 oil embargo. This pushed the U.S. ahead of Saudi Arabia and Russia to become the world’s largest oil-producing country in 2018 and 2019.

Overcoming the 2014 economic downturn with this run of positive momentum presented a healthy upswing in 2019, as prices stabilized and investments increased. An air of hopeful optimism, with an ever-present dash of realistic caution, prevailed as we entered 2020.

On Jan. 3, WTI crude oil was $63/bbl; a nice bump from 2019’s average, just shy of $57. The industry mood was steady vigilance. Forecasted weak economic growth, trade headwinds, increasing supply security, decreasing demand, expectations for increased efficiencies, and global political unknowns meant decisions and actions needed to be well-calculated and implemented, to avoid tipping the scales too far in any one direction.

However, lurking in the shadows, was a crippling variable that blindsided the entire sector—the dizzying downward spiral in demand, triggered by the global COVID-19 pandemic. As international borders closed and travel bans, shelter in place guidelines, and self-quarantine restrictions were enacted, worldwide transportation fell silent.

The unprecedented travel trough hit right as spring break getaways and summer vacations would typically ramp up, leading to record-low commodity prices and an unrecognizable demand shortage. WTI crude prices plummeted into negative pricing for the first time ever, before crawling back into the low-$40 range.

Following the International Energy Agency’s May announcement that 2020 was on track to become the worst year in the industry’s history,2 oil and gas companies continue to dust themselves off with a slow, but seemingly steady rebound. Hints of discrete optimism can be seen amid efforts to fine-tune the supply-and-demand balance.

Ongoing unknowns surrounding COVID-19 hold a firm grip on 2020, which presents longer-term considerations for 2021 and beyond. Not just for resilience and recovery, but as a game-altering opportunity for those bold enough to seize it. Those who can’t sit idly by to wait and see, but are ready to define our “next” normal.

LEADING OUR DIGITAL REVOLUTION

Digital innovations have infiltrated and transformed nearly every aspect of our lives. They’ve boosted communication, dissolved borders and boundaries, amplified productivity, streamlined quality, and expanded education.

Seeing lucrative benefits for the industry, oil and gas visionaries introduced the concept of digital oil fields in the early 2000s as a revolutionary approach for automating oil and gas exploration, well construction, completions and production. This was a significant leap forward from the then-current efforts and healthy investments in disconnected technology systems that produced ample data, but didn’t “talk” to one another. Useful, actionable information fell by the wayside, because companies couldn’t consolidate and extract the data’s true value.

Missed opportunities were further compounded with consistent price fluctuations, margin pressures and calls for more environmentally responsible practices. These gaps reinforced the industry’s need for the right combination of processes, resources and technologies to ultimately do more—and do it more efficiently and accurately—with less.

Digital oil fields and their supporting technologies can unlock that combination. By automating and integrating workflows with powerful edge computing directly in the field, the highly coveted benefits go beyond just being useful. They become transformative.

Information transformation. Gone are the days of disconnected, misaligned and unused data. Digital oilfield technology streamlines data collection, analysis and application both in far-off field locations and oil company offices. Edge computing—which places physical computer hardware and software applications directly on or within close proximity to the data source—makes this possible.

By relocating the computing from the data center to the field, embedded AI-enabled automation can capture, analyze and act upon critical operating data, such as drilling parameters, hydraulic fracing applications, downtime, and pressure readings in real time. Likewise, the technology can boost access to oil and gas reserves through seismic exploration and discovery, and advanced recovery practices.

On the back end, information from individual field locations can be collected and sent to the company network. From here, it can be consolidated for broader assessment across all field operations, including completions, and shared with multiple users and departments to track short- and long-term trends. Being equipped with consistent data sets improves awareness and alignment, so intelligent process refinements factor in potential ramifications both upstream and downstream, prior to implementation.

Historical trend data also can be used for predictive modeling to circumvent impending operational problems. Using preventative maintenance to service or upgrade equipment before a break occurs is much easier and significantly less detrimental in terms of cost and downtime.

Operational transformation. For processes and productivity, employing intelligent automation is vital to delivering reliable repeatable performance. It ensures standardized processes and workflows are executed with consistency and precision, to improve recoveries and keep operations moving with predictable results.

In addition to elevating operating efficiencies with greater accuracy, AI algorithms enable the systems to recognize and adapt to shifting conditions without human intervention. With fewer people needed to facilitate operations, opportunities to minimize errors, improve quality and reduce overhead costs increase dramatically. This also impedes safety and health risks, as fewer people are needed to conduct the most dangerous aspects of field work.

The reflex reaction to automation sparks fears of job loss, as work once carried out by people transitions to technology. However, to make fully operational digital oil fields a reality, people remain the greatest asset. The shift lies in needing different roles and skill sets, which we’re already seeing, as current job opportunities and targeted skills weigh heavily in demand of data analytics, change management and communication.

Financial transformation. As logic would dictate, reaping the lofty benefits of both innovative information and operations solutions redefines cost structures that translate into increased profitability (Fig. 1.). Reduced overhead and streamlined operations maximize uptime and lower production costs. Paired with consistent productivity and reliable performance, they collectively deliver increased margins and better earnings, which catch the eyes of shareowners and enthusiastic investors.

Recently, industry companies, like BP, ExxonMobil, Halliburton, Schlumberger and Weatherford, have taken noticeable steps toward digital oilfields.3 But with such compelling benefits, why aren’t we farther along in our global transformation?

WHEN CREATIVITY AND CAPABILITY COLLIDE

Ideas and intent can only carry progress so far. Without the right buy-in, infrastructure, investments, and risk threshold, disruptive innovation will starve. Like most novel approaches, the digital oilfield concept has faced a wealth of barriers from the start.

One argument was that the financial value wouldn’t play through across distributed operations or “one off” projects. Supplier fragmentation and complexities, along with misaligned skill sets, also bubbled up, while immediate pressures to extract barrel of oil equivalents (BOEs) posed an ironic roadblock.

A limited number of investors with the right industry and technology knowledge have hindered funding for such an unknown approach. And while attaining the attractive benefits of digital oilfields lingered in the background, investors and executives wanted the reassurance of proven results before overhauling operations, based only on theoretical gains.

Vital technology gaps also justified the wide-spread hesitation. While automated processes and workflows can be managed from a central operations facility, the hundreds or thousands of miles between there and live field operations presented an unacceptable lag for transmitting data. Bringing automation capabilities onsite would eliminate that lag, but the lack of sufficient digital infrastructure for field automation and real-time AI left a gaping hole.

Available VSAT links can’t transmit the extreme amount of data fast enough to enable on-the-spot decision-making. Even with cloud computing, the latency is just too large. Insufficient security measures to prevent hacking into well operations also posed a growing threat, considering the potentially catastrophic impacts an attack can have on supply, demand, costs and trade. Combined with the previously mentioned inability to gain any value from disconnected data systems, these weak, vulnerable and disparate systems simply can’t handle the tremendous responsibility of bringing automation to the edge.

Technology issues have been compounded further by limited options for reliable, cost-effective solutions. Automation and AI technology is available, but it’s not designed for remote and demanding on- or offshore conditions. The equipment requires a consistent temperature-controlled data center environment.

If oil and gas companies venture to put this traditional computer hardware in the field, ongoing system failures would plague operations and productivity. In addition to unpredictable weather conditions, the harsh environmental factors, like shock and vibration, salt fog, corrosion, humidity, and dust, would wreak irreparable havoc on stability and performance.

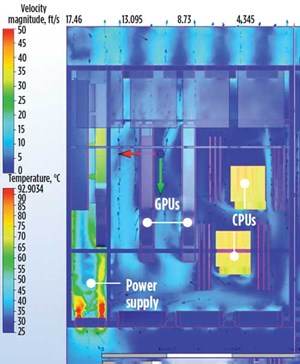

Another critical, yet overlooked, factor is heat, which poses its own unique twist. The tremendous burden of executing pre-programmed operating instructions, along with instantaneous data monitoring, processing and decision-making, requires substantial processing power. Based on the number and combination of heat-generating components, such as CPUs, GPUs, FPGAs and power supplies, packed in a single system to accommodate the amount of “work” it must perform, the more heat it generates. If the heat isn’t managed properly, it can throttle, potentially shutting down the entire system. And with limited staff or support resources onsite to maintain the onboard computer systems, an outage of this magnitude could take days or weeks to correct.

Faced with both culture and technology obstacles mixed with year-over-year market volatility, the risk/reward equation was skewed too far in the wrong direction for a welcome migration to digital oil fields. But considering how much, and how fast, things can change, the staggering scope of challenges has eroded.

WE’RE READY

As point solutions for specific computing tasks and applications have matured, we’ve evolved to smarter, more comprehensive levels of automation. In addition, remarkable advancements in AI and MLare delivering significant value through asset tracking and data inference for ongoing automation refinement.

Enabling technologies, like NVIDIA® Data Center GPUs, bring the ability to capture and analyze extraordinary volumes of sensor data to the individual server level. With powerful speeds and accuracy in a now-mobile format, we can move beyond standard data centers and into the field. Similarly, Intel’s® ongoing mastery of bolstering core processors means their internal computing workhorses can easily handle ever-increasing and demanding workloads.

Having intelligent, robust software and hardware components that can propel the revolutionary change-up to smart digital oilfield operations, including completions, is reassuring—but there’s a fundamental element of the equation that’s been missing.

Consider how important the design and construction of a tension leg platform is to the safe, reliable operation of an offshore drilling rig. Installing the intricate mooring system assesses a web of interconnected factors, like climate, geography, seismic activity and load, to properly secure the foundation to the seabed, allowing for horizontal movement, but no vertical bobbing. Likewise, edge computing must also have a strong foundation, because even the best software and hardware components become irrelevant if the hardware appliance isn’t designed and built specifically for the heightened demands of edge environments. Fortunately, companies like Crystal Group are leading the way in this vital discipline.

Their proficiency in designing and manufacturing rugged, high-performance computer hardware enables successful execution of industrial and military applications across multiple land, air and sea environments, where safety, accuracy and efficiency are paramount. This includes automated oil and gas field operations in well drilling, completions and production, mobile fracing command centers, and monitoring solutions for real-time gas leak detection.

The reliability ensures the backend control system and monitoring software operate effectively and without disruption throughout well development and completion, despite potential disruptions from seismic activity, extreme rig vibration, dust, lightning, or salt fog corrosion. The seamless efficiency seen in today’s well completion and operation practices will enable tomorrow’s automated digital oil fields. But not without help.

Identifying and integrating the precise configuration of software, storage, processing power, networking, and cybersecurity is a team sport. Strong collaboration with partners, including NVIDIA, Intel, VMware, Racktop and CommScope, allows Crystal Group to deliver integrated solutions that encompass all the essential components to execute the desired application with flawless precision. This level of planning is critical, because it’s not enough to just have the right pieces of the technology puzzle. The real sophistication is ensuring that all the pieces fit and work together properly in a compact, mobile footprint, suited to withstand harsh conditions when failure isn’t an option.

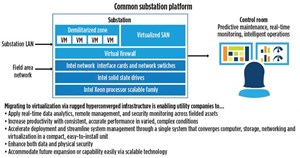

The power industry is reaping the benefits of this intelligent integration as it works to modernize and expand the U.S. Smart Grid. Struggling to keep up with increasing demand, traditional control rooms designed for one-way distribution are phasing out, as substations are equipped with independent computer systems.

Using rugged hyper-converged infrastructure systems, common substation platforms (Fig. 2) host hardware virtualization of substation support and auxiliary systems through an intricate combination of rugged hardware, Intel Xeon® Scalable processors, and prominent data security features. Armed with the power, capacity and reliability to execute automation and AI algorithms, virtualization delivers real-time operation, situational awareness and decision making at the edge, when time and accuracy are of the essence. With this level of automation, systems can facilitate two-way flow from distributed energy sources, trigger alarms, adjust control set points, and help define tailored operating modes for emergency situations without costly delays or disruptions. Over time, trend data will help establish preventative maintenance schedules to minimize costly repairs.

This design also incorporates redundancy for a fail-over if a problem occurs within the hardware and established security parameters. Ultimately, this multi-tasking architecture maximizes overall performance by integrating speed and data assurance, redundancy, and security in a smaller footprint for lower total cost of ownership. That sounds a lot like doing more—and doing it more efficiently and accurately—with less.

This is especially true since it also addresses the obstacles posed by potentially debilitating heat generation within a unit. As experts in thermal management, Crystal Group has refined the art of solving perplexing heat-generation challenges to keep critical components running smoothly while preventing the computer hardware from throttling, due to excessive heat. With options ranging from liquid, fan and fan-less sealed chassis cooling techniques, every solution optimizes the unit’s thermal performance to protect power-hungry components for seamless reliability and operational life.

Nowhere is this challenge more present than in autonomous vehicles where the tremendous amount of computing generates heat similar to a 1,500-watt space heater. If that heat isn’t rejected to the ambient environment outside the vehicle, it stays trapped inside, increasing the overall temperature and decreasing operating performance.

One technology company advancing self-driving technologies for commercial trucking needed to equip its fleet of autonomous semi-trucks with rugged servers capable of processing real-time sensor, camera and radar data accurately and seamlessly, regardless of ever-changing physical conditions. With proven performance using the liquid-cooled Crystal Group RIATM, followed by a customized air-cooled 5U server (Fig. 3), the two companies are now refining the next generation of the server. The new liquid-cooled system has an expanded range of cooling to accommodate increased power from three GPUs.

These advanced computer systems that incorporate high-performance automation and AI technology with rugged hardware built specifically for the edge are the game-changers that digital oilfields have long awaited.

IF NOT US, THEN WHO?

IF NOT NOW, THEN WHEN?

The oil and gas industry has been at a crossroads for decades. Fluid variables and evolving pressures across technology, politics, foreign relations, global finance and the environment created unsettling, sustained volatility. Yet, optimism that prevailing efforts would suffice mixed with hesitation to launch into bold transformation amid such uncertainty stifled any major shifts.

Some may argue that now isn’t a “good” time given the instability of 2020. But perhaps the timely intersection of this year’s jarring wake-up call with revolutionary technologies designed for edge computing is presenting the oil and gas sector with the “right” time to define its next normal.

As with any bold, disruptive change, there will be obstacles. However, the weight of past challenges has eased to tip the scales in favor of audacious action. Given the lucrative information, operational and financial benefits, industry leaders are already crossing into the digital playing field.

Let’s make this our time to accelerate and expand these efforts for the collective good and prosperity of the entire oil and gas industry. Let’s not only define our next normal—let’s define our future.

REFERENCES

- Edmundson, H, “Ten technologies from the 1980s and 1990s that made today’s oil and gas industry,” Journal of Petroleum Technology, March 2019, vol. 71, issue 3.

- https://www.nsenergybusiness.com/features/2020-oil-crisis-recovery-coronavirus/

- https://www.offshore-technology.com/comment/digital-oilfield-leading-companies/

- Digital transformation/Late-life optimization: Harnessing data-driven strategies for late-life optimization (March 2024)

- The reserves replacement dilemma: Can intelligent digital technologies fill the supply gap? (March 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- Digital transformation: Digital twins help to make the invisible, visible in Indonesia’s energy industry (January 2024)

- Digital transformation: A breakthrough year for digitalization in the offshore sector (January 2024)

- Quantum computing and subsurface prediction (January 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)