Digitization and management: Considerations for efficiency, safety and profit gains

Like many industries, upstream oil and gas has been gradually embracing the benefits of digitalization and automation over recent years. And just like other industries, upstream oil and gas has been pitched unceremoniously into uncharted waters, as a result of depressed demand for oil and gas resulting from the Covid-19 pandemic—with the added blow of increased crude supply putting further downward pressure on commodity prices. Now, more than ever before, safely producing more barrels at a lower cost, while not damaging long-term prospects, is of key importance to our industry. Any reduction in cost per barrel must be sustainable in the long term. The best way to achieve this objective is through the development and implementation of value-adding technology.

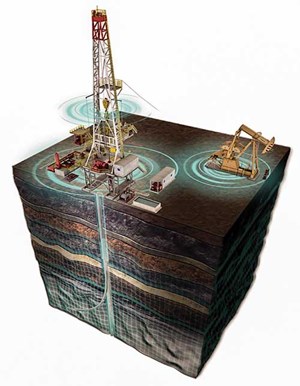

DIGITAL OIL FIELD

The long-term value of digitalization and automation is clear. I’ve written at length before about the on-going benefits of wells that are drilled and completed, using these advanced technologies, Fig. 1. Smooth wellbores with minimal undulation and tortuosity can significantly reduce costs of, and risks involved, in drilling and completion, while simultaneously making production more reliable and even increasing production rates, potential reserves and ultimate recovery. The introduction of automated geosteering and reservoir navigation technologies will ensure that reservoir exposure is such that wells can be drilled in a way that the reservoir will produce to its maximum potential. And the introduction of digitalization and automation into the production space is allowing operators to realize increasing returns from the existing assets, critical to financial stability, as new capital spending is curtailed.

Digitalization and automation also offer clear benefits to health and safety by reducing people on board and taking people out of the red zone during critical operations. Risk of unplanned events and non-productive time is reduced by making operations much more consistent and repeatable. Emissions will be reduced by having fewer people on board and by reducing the need for back-up equipment, as automation makes tools more reliable—saving on transportation emissions. And, of course, having fewer people at the rig site, and more remote monitoring and control, will enable social distancing, both as the Covid-19 pandemic is overcome and in preparation for future, similar events, as we learn the value of preparedness.

Even though this is current, existing, technology, many of the benefits highlighted above are future benefits. Very real, very tangible, but of the future. At this point, the reader might ask, “where will the money come from?” Our industry is likely to be capital-constrained in the immediate future, and longer-term benefits might be seen as a luxury and not a necessity. The answer—there are significant long-term benefits to using digitalization and automation, but there are also real, clear and present benefits. I will describe a few examples in this article.

AUTOMATED SOLUTIONS

Weatherford has many offerings in the digitalization and automation space. There are automated solutions to improve the efficiency and safety of drilling and completion operations. Some of these are enhanced by sophisticated models of the real world, themselves improved by superimposing millions of hours of data on these physical models, which allow very accurate predictions of real-time events, based on limited data acquisition. For example, the Victus Managed Pressure Drilling system is able to predict and mitigate potential influxes, circulating them out if necessary, based only on surface measurements as a result of its sophisticated and trained algorithm.

At the core of Weatherford’s offering are two platforms that can be used to acquire, display, interpret and distribute all the data gathered from well construction through to production. Although these two platforms overlap somewhat, the Centro platform is used primarily for well construction operations and ForeSite is primarily for managing production operations. Each of these platforms has shown themselves to be capable of providing real, immediate and significant savings.

CASE STUDIES

Case 1. Centro is Weatherford’s digital well construction optimization platform. It accepts real time data and can convert input into actionable insights to anticipate and avoid operational risks, while optimizing well construction. It can aggregate data from multiple rigs and multiple sources to enable directional drilling optimization, and correlation of offset well data to anticipate drilling issues. It has real-time engineering software that allows calculations, such as hydraulics and torque/drag, to be updated in real time. In the Permian basin, the challenge was to drill the last 5,878 ft of a lateral, when the technical limitations of the existing BHA and of the rig had already been reached, potentially leaving undrilled footage.

Using Centro, in conjunction with the company’s Magnus rotary steerable system and support from the Real Time Operations Center (RTOC), the operator was able to extend the technical limits of the well, while using Centro’s advanced alert notification capabilities. This created a greater awareness of downhole events that could impact the RSS’s ability to deliver a quality wellbore, Fig. 2. At 18,132 ft, MD, Centro instantly detected diagnostic issues, which, if left unchecked, would leave the BHA short of reaching the planned section TD. This, in turn, enabled immediate notification to the RTOC, allowing the engineers to troubleshoot operations to minimize downtime and mitigate the issue before a downhole tool failure. This alert from Centro, combined with the actions of the RTOC personnel, allowed drilling of another 5,878 ft to TD without any problems, avoiding a full 24 hrs of non-productive time.

Case 2. In Colombia, ForeSite was used to review production from approximately 600 wells, in the first phase of a planned installation of 3,000 wells. The assessment of the first 600 wells identified candidates for production enhancement, and as a result, electrical submersible pump (ESP) parameters were adjusted, resulting in a verifiable increase in production of 5%, or $3.25 million per year, Fig. 3. Additional optimization work is expected to ultimately result in a 25% increase in production, worth $16 million per year. These efficiency gains were achieved without a penny in capital expenditure. In the same application, there was a recent power blackout resulting from seasonal rains. ForeSite was able to identify the blackout within two minutes, and also indicated when power was back online. Once power was restored, the operator simply hit a “start” command to get wells back online, in an average of just two minutes per well. When putting a large field back to production, every minute of downtime results in a meaningful loss of revenue.

Case 3. In another Permian basin case, ForeSite was installed on an 80-well pilot in a 4,000+-well field. The pilot included natural flow, reciprocating rod lift, gas lift, plunger lift and ESP. ForeSite seamlessly integrated with existing data management and planning systems, allowing visibility of the 800 wells and identification of poor performers. Opportunities for uplift of production were identified, including recommendations to increase uptime and production in underperforming wells.

The pilot exceeded all key performance indicators (KPI) and resulted in a 1,000-well Phase 1 rollout. This enabled production optimization across all forms of lift, while maximizing personnel efficiency and equipment uptime. The operator expects to realize benefits of at least $17.7 million per year, including $5.4 million in additional revenue from wells that transition earlier from natural flow to artificial lift. An additional $5.8 million in personnel savings and $6.5 million in improved equipment reliability and utilization is also expected.

Again, this was achieved with no capital spending. This gain, from a relatively small project in the Permian, suggests that the potential benefit to the entire industry, as a result of autonomous lift optimization, could be measured in the billions per year, a benefit that can be realized with existing technology and no capital investment.

Case 4. A Middle East operator selected ForeSite to manage lift on over 1,700 wells. The batch included integration of data from disparate systems with known data quality issues, which would require predictive failure management, based on pattern recognition. The tailored solution provided real-time production predictions, together with 12 alarm and opportunity alerts. In the first six months of implementation, the recommended improvements were applied to 10% of the wells and resulted in increased production of 2,000 bopd. To date, the overall increase in production has been 5,734 bopd, representing a $52-million increase in potential revenue for the operator. Asset downtime was reduced by 30% and data quality KPI compliance by 95%. No capex was required to achieve these gains.

VALUE ADDED

These four examples illustrate how real performance improvements can be captured immediately, with no operator capex required. Although, as mentioned above, there are many automation and digitalization offerings in well construction and intervention that can produce better, more productive wells in the future, immediate improvements—including the ones described above—can be realized without capital investment. Significant gains from digitalization and automation do not need to wait for the industry to recover. In fact, they can be realized right now, and as a result of the immediate gains realized, they can directly help the industry recover.

Necessity creates opportunity. The upstream industry has not been the fastest to embrace new technologies. Compared with other technology-based industries, where the consequential cost of failure is high, we have been very conservative and resistant to change. It’s easy to defend and cling on to the status quo when times are good. But our current situation is anything but good. And if some benefit comes from this crisis, it could be that necessity will accelerate adoption of technologies that will improve financial performance during these difficult times, but will also drive efficiency and sustainability gains in better times that are surely to come. We have a clear and present opportunity for permanent, positive change with better, more productive and more profitable wells, if we embrace digitalization and automation across our upstream industry.

- Digital transformation/Late-life optimization: Harnessing data-driven strategies for late-life optimization (March 2024)

- The reserves replacement dilemma: Can intelligent digital technologies fill the supply gap? (March 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- Digital transformation: Digital twins help to make the invisible, visible in Indonesia’s energy industry (January 2024)

- Digital transformation: A breakthrough year for digitalization in the offshore sector (January 2024)

- Quantum computing and subsurface prediction (January 2024)