Regional Report: Eastern Mediterranean

What a difference a giant discovery makes. Eni’s 30-Tcf discovery offshore Egypt has given an electric jolt to government officials in Israel to entangle Noble Energy from regulatory hurdles and begin the development of its 22-Tcf Leviathan field, allowing the Jewish state to place the first stake in the Eastern Mediterranean gas export market. Noble also has filed a development plan for Aphrodite field in Block 12, offshore Cyprus, and brought in the BG Group as a partner.

Meanwhile, Greece has received three bids in response to its international licensing round. It remains to be seen how low oil and gas prices will impact E&P activity in the Eastern Mediterranean. Here’s a country-by-country report on recent exploration, field development and production operations in this region of significant growth potential.

EGYPT

Unlike Israel and Cyprus, Egypt has a mature offshore sector with decades of E&P activity, albeit without any sensational discoveries until Zohr. The major IOCs active in the area include Eni and BP.

- The Italian operator’s discovery well, Zohr 1X NFW, was drilled in late August 2015 to a 4,757-m water depth, in offshore Egypt’s Shorouk Block. The lease for the block was signed in January 2014 with the Egyptian Ministry of Petroleum and the Egyptian Natural Gas Holding Company (EGAS), following a competitive international bidding round. According to Eni, the well passed through a 630-m hydrocarbon column in a carbonate sequence of Miocene age, with excellent reservoir characteristics (400 m of net pay). Based on well-log and seismic data, the discovery could hold a potential of 30 Tcf of lean gas-in-place (5.5 Bboe) across an area of about 100 km2.

Eni is planning an immediate appraisal of Zohr field as part of an effort to accelerate a fast-track development of the discovery, utilizing its existing offshore and onshore infrastructure. Eni’s appraisal wells will target Zohr’s structure that has a deeper Cretaceous upside. Within days of the discovery, Eni CEO Claudio Descalzi travelled to Cairo to update Egyptian President Abdel Fattah Al-Sisi, Prime Minister Ibrahim Mahlab, and Minister of Petroleum and Mineral Resources Sherif Ismail, on the importance of the discovery for Egypt’s energy security. President Al-Sisi has agreed to remove any political obstacles, to allow Eni to commercialize the field by 2018.

According to an economic analysis by GlobalData consultancy, Zohr will yield an internal rate of return of 25%, assuming a flat gas price of $5.88/Mcf and recoverable reserves of 22 Tcf, justifying a fast-track development. GlobalData’s base case analysis assumes an initial production rate of 50 MMcfgd, consistent with other producing wells in the vicinity, and that approximately eight wells will be brought onstream annually, until 2026. Peak production would be achieved in 2026 at 3,052 MMcfgd. The base-case estimate for capital expenditure is $7.69 billion. In comparison, Noble Energy’s Leviathan gas field, which has 22 Tcf of estimated recoverable reserves, is expected to cost $8.9 billion over the full cycle of a stand-alone project.

In October, Eni was awarded two new exploration licenses—North El Hammad and North Ras El Esh—offshore Egypt in the Mediterranean Sea, as a result of the 2015 EGAS bidding round. Eni has been awarded a 37.5% participating interest and operatorship in North El Hammad, where it is partnering with BP (37.5%) and Total (25%), and a 50% participating interest in North Ras El Esh, where it partners with BP (50%), which will act as the operator. The two blocks are in the shallow waters of the Mediterranean Sea, facing the Nile Delta, and southwest of the Temsah area and west of the Baltim area, where Eni operates existing fields and production facilities.

BP. In March 2015, BP Egypt made a significant gas discovery in the East Nile Delta. The deepwater exploration well, named Salamat, is the deepest well ever drilled in the Nile Delta. Drilled to a TD of 7,000 m, the discovery well confirmed the presence of gas and condensate in 38 m, net, of Oligocene sands. Further appraisal will be required to better define the field resources and to evaluate field development options. The Salamat discovery is 75 km north of Damietta city and 35 km to the northwest of the Temsah offshore facilities. BP has 100% equity in the discovery.

In March 2015, BP also announced the signing of the final agreements of the West Nile Delta (WND) project to develop 5 Tcf of gas resources and 55 MMbbl of condensates with an estimated investment of around $12 billion by BP and its partners, Fig. 1. Production from WND is expected to reach up to 1.2 Bcfd, equivalent to about 25% of Egypt’s current gas output. With production expected to start in 2017, all the output will be fed into the country’s national gas grid. Gas will be produced from two BP-operated offshore concession blocks, North Alexandria and West Mediterranean Deepwater.

BP also has signed an agreement with Minister Ismail regarding the accelerated development of the recent Atoll gas discovery. The agreement is expected to enable first production to be expedited, from an estimated 1.5 Tcf of gas resources and 31 MMbbl of condensates in Atoll field, to the domestic market, with production anticipated to begin in 2018. Full-field development of Atoll is expected in two phases. The first phase will consist of two development wells tied back to existing infrastructure, with production expected to start up in 2018. Success of this first phase is expected to trigger additional investment and the drilling of more wells to increase production.

ISRAEL

Back in 1973, Israeli Prime Minister Golda Meir had complained that after 40 years of wandering, Moses had brought the Israelites to the one place in the desert that had no oil. U.S. independent Noble Energy, active offshore Israel since 1998, transformed Israel’s energy outlook by drilling 11 exploration and appraisal wells to discover a natural gas resource base of 40 Tcf in the Levant basin. Israel appeared sufficiently grateful to allow Noble and its partners to deliver the first supply of domestic natural gas from Mari-B field in 2004 and 10-Tcf Tamar field in 2013. In August 2015, natural gas sales in Israel set a record, as the Tamar platform averaged more than 1 Bcfgd, with nearly 100% uptime.

As Noble prepared to start development of 22-Tcf Laviathan field in 2014, Israel’s Anti-trust Authority threw a regulatory roadblock by insisting on creating a more competitive E&P sector. In August, the Israeli cabinet approved a regulatory blueprint, by a vote of 17-1, for developing the country’s natural gas fields, backed by Prime Minister Benjamin Netanyahu. The framework will now go for a final vote in Israel’s Knesset, where Netanyahu’s coalition holds a one-seat majority.

Under terms of the framework, Noble will have to reduce its stake in Tamar, Delek must sell all of its interests in the field, and both companies will have to sell off two smaller gas fields, Karish and Tanin. The framework also establishes a price ceiling and an indexing mechanism to regulate gas prices, and sets milestones for the companies’ development of the fields. Noble Energy has taken preliminary steps to fulfill its portion of the framework by selling its 47% interest in the Alon A and Alon C licenses, which include Tanin and Karish fields, to the Delek Group for a total deal value of $73 million.

In anticipation of Leviathan field development, Noble and its partners have entered into non-binding negotiations with Dolphinus Holdings, Ltd., in Egypt, to supply as much as 4 Bcm of natural gas annually for a period between 10 and 15 years. Dolphinus is a consortium of large, non-governmental gas consumers and distributors headed by Egyptian businessman Alaa Arafa.

On the political front, Prime Minister Netanyahu hopes to apply the country’s natural gas export potential to create a trade opening with Turkey. Russia supplies 60% of Turkey’s natural gas imports. Netanyahu is intent on exploiting rising tensions between Turkey and Russia over air-space violations related to the aerial bombing campaign in Syria.

CYPRUS

Exploration activity offshore Cyprus has been disappointing, ever since Noble Energy’s 2011 discovery of 4-Tcf Aphrodite field in Block 12. Both Total and Eni have drilled in adjacent blocks without success. In early December 2015, Total renewed its licenses for another two years. The French operator did cede back its license for Block 10 and 25% of Block 11, which lies 6 km from Eni’s Zohr discovery.

Meanwhile, Noble has filed a preliminary field development plan for Aphrodite field. Additionally, Noble has brought in the BG Group as a partner through a 35% farm-out interest for cash consideration of $165 million. BG is planning to take up Aphrodite gas to feed its LNG plant in Idku, offshore Egypt. Noble will remain the field operator.

A major political roadblock in the development of Cyprus’ offshore resources has been decades-long political tensions between the divided island’s Greek and Turkish sectors. In early December 2015, U.S. Secretary of State John Kerry paid a working visit to the UN-mediated talks underway in Nicosia between Cyprus and Turkish Cypriot officials. A reunification of the island should help eliminate strife with Turkey over gas developments offshore Cyprus.

GREECE

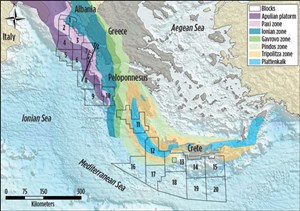

E&P activity offshore Greece is focused on Energean’s Prinos field in the Gulf of Kavala. Beset by financial crises, successive Greek governments have tried to draw international interest in developing its offshore resources. Greece held its second offshore licensing round in second-half 2014, offering 20 new license blocks in the underexplored southern and western regions. The blocks stretch across more than 200,000 km2 in the Ionian Sea, and Mediterranean Sea south of Crete, Fig. 2. In March, the new left-wing government extended the deadline for the submission of bids by two months to July 14 in an effort to attract more interest in the tender. In April, Greece invited both Chinese and Russian operators to bid. Despite these efforts, only three bids were received. The names of the bidders will not be disclosed until tender documents are unsealed, the Energy Ministry said.

Athens awarded the first drilling licenses for the offshore Patraikos Block in the Gulf of Patra in July 2013 to Hellenic Petroleum—in a venture with Italy’s Edison and Ireland’s Petroceltic—and the country’s sole oil producer, Energean Oil & Gas. The block covers an area of 1,892 sq km in water depths of 100 m to 300 m. In December 2015, Petroceltic, which put itself up for sale, transferred its rights to the license to its consortium partners.

Greece’s offshore production comes from Prinos field in the Gulf of Kavala. The field covers an area of 4 km2, about 8 km northwest of the island of Thassos and 18 km south of the mainland. Prinos 2P reserves were estimated initially at 60 MMbbl. The field already has produced almost 110 MMbbl since 1981. Prinos’ oil production averaged 1,300 bopd in 2014 from 12 producing wells and three wells injecting sea water. Additionally, South Kavala gas field has produced more than 850 MMcmd since 1981. It is an almost depleted gas field and is considered suitable for conversion into an underground storage facility.

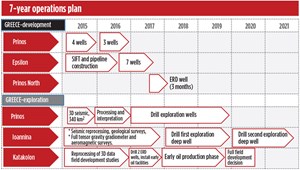

In July 2015, Energean completed a new 3D seismic survey over Prinos oil field and its surrounding licenses, in the Gulf of Kavala. The seismic data covered an area of 340 km2 and included a complex undershooting operation below the producing field. Through the new 3D acquisition, Energean aims to improve the imaging of the prospects already identified and explore new prospects as part of a seven-year exploration and field development program, Fig. 3.

LOW-PRICE ENVIRONMENT

Ambitious plans abound for field development throughout the Eastern Mediterranean, from Egypt to Israel, Cyprus and Greece. If the operators in the region keep their sights on the long horizon that is beyond the current low-price environment, we may see the region emerge as a leading gas production sector. Over the next five years, production should begin from Eni’s Zohr field offshore Egypt, Noble’s Leviathan field offshore Israel and Aphrodite field, offshore Cyprus. ![]()

- What's new in production (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- Dallas Fed: E&P activity essentially unchanged; optimism wanes as uncertainty jumps (January 2024)

- Quantum computing and subsurface prediction (January 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)