|

A sustained high oil price is leading major oil and gas companies to reassess their mature assets, which traditionally would have been sold to smaller operators, when the decline in production reduced the operating margins for the asset. These smaller operators are simply able to exploit their lower operating costs to make production profitable from reserves that may still have as much as 70% of the original oil-in-place (OIP) present. However, the greater return resulting from oil at around $100/bbl means that big producers can consider using advanced enhanced oil recovery (EOR) processes potentially capable of unlocking an additional 15%-20% of the initial OIP.

|

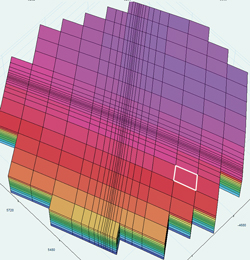

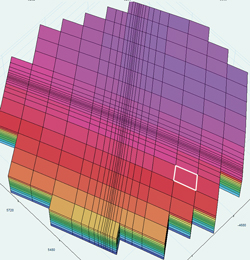

| Fig. 1. Higher resolution applied to sector model using a tartan grid. |

|

An EOR process typically involves the injection of one or more chemicals into an oil field in an attempt to improve the oil’s mobility. The injection of polymers has been used in several fields to help improve the efficiency of traditional water flood injection schemes. More advanced processes include surfactant injection and alkali/surfactant/polymer (ASP) schemes. The volume of chemicals required for any process is large, so a sustained, suitable price for the additional oil recovered is required, if the process is to be economically viable.

|

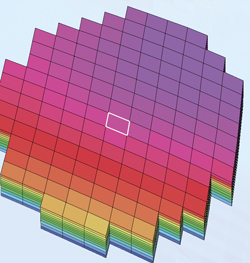

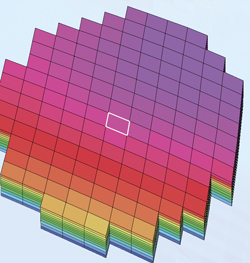

| Fig. 2. Sector model created directly from the full-field model. |

|

The initial evaluation of EOR starts with the creation of a model of the process, which includes a geometrical and geological description of the formation that contains the oil. The properties of the chemicals to be used are supplied, along with the volume to be injected and the time for which they will be injected.

This model provides the input data for a specialist reservoir simulation tool, which will simulate the chemical processes involved in the chosen EOR method and provide an estimate of the additional oil that could be recovered. Identifying the optimal EOR scheme could provide a significant return on the investment on the cost of the chemicals involved.

In 2012, the UK government-funded Technology Strategy Board (TSB) announced a £1-million ($1.5-million) competition to help fund innovative projects that could assist with improving oil recovery from mature assets, especially those in the UK sector of the North Sea. This move reflected rising awareness of the economic benefits of innovative engineering on existing assets, where the initial capital outlay for establishing the infrastructure required for production has been recovered.

The cost of bringing a new field online continually rises, since new discoveries typically lie in difficult natural environments, and significant investments in new infrastructure are required before a single barrel can be produced. The TSB recognized that promoting innovation by small companies could lead to the rapid development of new ideas for existing fields, since small companies are typically able to respond to market changes faster than large enterprises.

Sciencesoft, a Scottish-based petroleum engineering software company, bid successfully, in partnership with the University of Glasgow, for £75,000 in funding for a seven-month long project entitled “Construction of fine scale EOR/IOR simulation models from full field reservoir simulation models.” This work concentrates on taking the results of several years of simulations of existing assets and using them to build new models of EOR processes that will enable engineers to make commercial decisions on the economic viability of the proposed scheme.

Cutting-edge modeling of EOR processes is dominated by university-based research. The state-of-the-art simulator for modeling EOR processes, UTCHEM, was created at the petroleum engineering faculty at the University of Texas at Austin. However, by its nature, research is focused on the implementation and evaluation of unique EOR processes, which means that there are no commercial tools available to help build the model from scratch. Discussions with the professors responsible for UTCHEM revealed that the creation of a typical UTCHEM model, which is based on an existing full-field model, takes around three weeks for an experienced engineer. In addition, the EOR model generally describes a single well, since the effects of EOR processes are local, meaning that multiple EOR models will be required for a typical multi-well reservoir. This all adds up to a significant manual bottleneck to the evaluation of EOR schemes.

Sciencesoft realized that a combination of its expertise, especially in the support of UTCHEM, along with expertise within the engineering faculty of Glasgow University, would significantly reduce the risks and development time involved in creating a bespoke tool that would enable engineers to build and model EOR processes in a fraction of the three weeks currently required. In 2012, Sciencesoft launched two new products, S3sector and S3control, which enable extraction of information from the full-field model required to build a basic EOR model. Using this approach, engineers can construct a template for modeling an EOR process in minutes, rather than three weeks. This provides a major leap forward in productivity.

However, the techniques used could only inherit information from the geometry and properties of the simulation cells of the existing full field model, so the EOR model was basically a child of the original parent model. If the geometry of the EOR model was to be significantly different, as might be required to accurately describe the process, then methods would have to be developed to support this.

The engineering faculty at Glasgow University contains a wealth of knowledge and expertise on taking the spatial location and values of a property, such as pressure, and using these data to create a 3D mesh that follows the geometry and physical properties of the system being modeled. Combining this knowledge with Sciencesoft’s petroleum engineering expertise is enabling the creation of new methods to rapidly build EOR models. These promise to enable oil producers to evaluate the suitability of EOR for all of their assets, instead of using the existing piecemeal, labor-intensive manual approach.

If successful, this project could establish EOR as a mainstream process that could revolutionize the production and lifetime of mature assets.

Sciencesoft is a Glasgow, Scotland-based leader in 3D visualisation and analysis software for the global oil and gas industry. Brothers and physicists, Dr, Lindsay Wood, research and development director, and William Wood, sales and marketing director, co-founded Sciencesoft in the late 1990s and launched S3GRAF, its flagship product for the oil and gas industry, in 2000.

The company’s Reservoir Simulation Suite of products helps engineers analyze the results from reservoir simulators by quickly producing 3D images of a company’s oil or gas field, enabling engineers to make multi-million-dollar field planning and development decisions. Sciencesoft’s future plans include doubling its current workforce in the next two years.

|

The author

DR. LINDSAY WOOD is research and development director of Sciencesoft Ltd. Prior to founding Sciencesoft, he worked as a research physicist, including a fellowship at the international research facility, CERN, in Switzerland, before moving into the oil and gas industry. Dr. Wood was one of the developers of the world’s leading commercial oil and gas reservoir simulator. In the last 10 years, he has overseen the launch of a series of innovative products for Sciencesoft. |

|