Western Europe: The downward trend continues

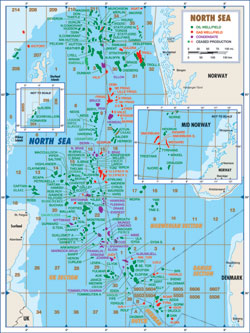

International Outlook: Western EuropeThe downward trend continuesDespite strong oil prices, declining drilling, production and reserves all reflect a mature North SeaNorth Sea portions written by Deloitte & Touche-Petroleum Services Group, London United Kingdom. The Twentieth Offshore Licensing Round, was announced in the first quarter of 2002. Almost 300 blocks and part-blocks were made available. There were 29 applications for 36 blocks or part-blocks in the second quarter. Twenty-five licenses comprising 36 blocks or part-blocks were awarded in the third quarter to 33 different companies. Awardees included more established majors together with six new entrants to the offshore UK sector – OilExCo, CMS (subsequently acquired by Perenco), Montrose and Reach, with existing onshore players Egdon and Warwick moving offshore.

The Department of Trade and Industry (DTI) proposed a series of measures to modify current licensing procedures by introducing the new promote license. Under this scheme, a promote license would be awarded to a company, which would develop a prospect using existing seismic or that acquired under the license. The promote license would not require the usual commitments to undertake seismic exploration or drilling programs at an early stage. The licensee would have an exclusive interest in the full production license following the agreement of a work program and the possible collaboration of other partners. In February, DTI invited applications for licenses in the 21st Seaward Licensing Round. Along with the traditional production license, Energy Minister Brian Wilson launched the new promote license. All applications for the traditional Seaward Production Licenses (30) and promote licenses (40) were accepted in early May. These applications covered 140 blocks (reportedly the largest number applied for since the early 1970s). Seventy-five companies, 36 of which are potential newcomers to the North Sea, participated. Following the implementation of several incentives to increase exploration on the UKCS in the first quarter of 2002, 2003 saw a number of fallow acreage blocks and fallow discoveries made available. It is hoped that the Fallow Initiative will encourage existing players on the UKCS as well as attracting new entrants from other parts of the globe. Six fields were given development approval between July 2002 and June 2003. These were Ardmore, Carrack, Clapham, N4 from the Nuggets Complex, Rhum and Seymour. These fields have combined reserves of 60 MMbbl and 800 Bcf. During this same period, 13 fields started production, including Bains, Caledonia, CMS III, Maclure, Madoes, Minerva, Mirren, Otter, Penguin Cluster, Tullich, Viscount, Whittle and Wollaston. Reserves in these fields total 200 MMbbl of oil and 1.24 Tcf of gas. Nine of the fields have been developed as subsea tie-backs; the other four are steel platform developments. The CMS III development was the largest to start production with 430 Bcf of gas. It includes five gas fields in the vicinity of Caister-Murdoch field. These are Hawksley (on stream Sept. 02), McAdam (on stream Apr. 03), Murdoch K (on stream Dec. 02), Boulton H and Watt. Onshore, DTI this year invited applications for licenses in the 11th Landward Licensing Round.

Norway. In October 2002, applications were invited for 109 blocks or part-blocks. In March 2003, it was reported by the Ministry of Petroleum and Energy that nine companies would be offered participation in 15 blocks or part-blocks held in 11 new production licenses. It was also reported that Petra would be offered additional acreage, which it had applied for out of round. Norsk Hydro, ExxonMobil and DONG have each been awarded operatorship in two licenses, with Statoil, Norsk Agip, DNO, Pertra and RWE DEA each awarded a single license. In early March, the Energy Ministry formally invited oil companies to nominate blocks they would like to include in the 18th Licensing Round. The ministry invited nominations for both the North Sea and Norwegian Sea, with the deadline being August 1, 2003. Nominations will be announced in second-half 2003, with licenses awarded before summer 2004. The Energy Ministry announced a licensing system change in another attempt to stimulate more efficient exploration in mature parts of the Norwegian continental shelf. It is expected that from 2004 on, companies will be able to apply for exploration acreage on an annual basis, from January to October, with the applications being considered and licenses awarded by the end of the year. Total acreage announced includes 143 blocks or part-blocks. The deadline for submission of applications is October 1, 2003, with the awards planned for sometime in December 2003. A total of 22 new Norwegian wells were spudded between June 2002 and May 2003, of which 13 were exploratory and nine were appraisals. Statoil was the most active operator drilling nine wells. Seventy-seven percent of the new spuds were located in the North Sea, with the remainder in the Norwegian Sea. During the past year, Statoil made a number of new finds in the Gullfaks area, including Dole (33/12-8 S), Ole (33/12-8 A), Dolly (34/10-47 S) and 34/10-45 A. The company also had some success in the Norwegian Sea with well 6608/10-9, which found oil in the secondary objective of the Lerke prospect. In the same period, Norsk Hydro found oil the J structure of the Oseberg area and Marathon discovered oil in the Kneler prospect with well 25/4-7. Successful appraisal drilling took place on; the Gullfaks Area (Statoil), Kameleon (Marathon), Ormen Lange (Norsk Hydro), Skarv (BP), Tryihans South (Statoil) and Varg South (Pertra). Between 2002 and June 2003, development approval was granted for three fields in the Norwegian part of the North Sea. These were Skirne/Byggve, Snoehvit Area and Svale. All three will de developed as subsea tie-backs; Skirne/Byggve and Svale are due to come on stream in 2004, with Snoehvit Area on stream in 2006. Ormen Lange, which is the second largest gas discovery on the Norwegian shelf is expected to gain development approval towards the end of 2003 and start producing in 2007. Three fields started producing in the same period. These were Sigyn, Tune and Vale. Sigyn is a subsea tie-back to Sleipner A on Sleipner East, where the light oil is blended with the Sleipner liquids. In 2002, Norwegian oil production reached 1,195 MMbbl – an average of 3.3 MMbpd and a 4% decrease on the previous year’s production. Gas production increased 15% to a 2.36 Tcf, or 6.5 Bcfd. For 2003, the trend continued with oil production dropping to an average of 3.1 MMbpd, while gas production reached 7 Bcfd. Denmark. Four exploration wells and seven appraisal wells were spudded in Denmark between June 2002 and May 2003. Both DONG and Maersk drilled five new wells each, with DONG announcing two discoveries – Sofie and Svane. The company also carried out successful appraisal drilling on Cecilie, Nini and Stine 2. In 2002, development plans were approved for several new fields in the Siri area. Stine-1, Nini and Cecilie are expected to be tied back to the Siri platform. These fields have combined reserves of 64 MMbbl of oil. Nini and Cecilie are expected on stream in August 2003. Stine-1 will start producing at the end of 2003. These tie-backs are expected to increase the field life of Siri. Seventeen fields contributed to Danish oil production in 2002. However, the majority (86%) came from just 6 fields – Dan, Gorm, Halfdan, Siri, Skjold, and South Arne. Total Danish oil production in 2003 is expected to reach 137 MMbbl, or 375 Mbpd. Oil production is expected to remain fairly constant until 2006, after which a steady decline is anticipated. Gas production during 2002 totalled 274.4 Bcf, or 751.7 MMcfd. Production in 2003 is expected to reach 325 Bcf, or 891 MMcfd.

Netherlands. Wintershall was awarded production licenses on Blocks E/15a, E/18a, F/13a and F16 (E/15a and E/13a were spontaneous – an exploration license wasn’t held prior to the production license being awarded). Wintershall was also awarded a production license on F/13b, ahead of Total due to the submission of a more extensive work program. NAM was awarded an exploration license on Block F/6b. Denerco Oil A/S was awarded two exploration licenses on Blocks F/9 and G/7, with Intrepid Energy North Sea participating with a 50% interest. Under terms of the awards, the licenses are valid for six years after the award date. Results of a 3D seismic survey are required within one year, and the first well should be drilled within four years. Twelve exploration and appraisal wells were started between June 2002 and May 2003. Five wells were drilled by NAM and four were operated by Wintershall (including Clyde, which is now a subsidiary of Wintershall). During the period, exploration wells G/14-2, G/14-3 and K/15-FA106, operated by NAM, were revealed to have encountered gas. Wintershall drilled successful appraisal wells D/12-6 and L/5-10. Wintershall’s Q01-B and L05-B fields, with reserves of approximately 370 Bcf and 170 Bcf, respectively, are expected to come on stream in second-half 2003. K01A field, operated by Total, started production in March 2002 with recoverable reserves currently set at 460 Bcf. Total’s L4-G field (100 Bcf) is expected to commence production in 2004. Also expected to commence production in the second half of 2004 are both the K2-FA and G16-FA fields operated by NAM. Dutch offshore liquids production is expected to increase by 5% in 2003 to around 45,100 bpd, from the 2002 average of 42,900 bpd. Gas production is also expected to increase 4%, from 2.12 Bcfd in 2002 to 2.20 Bcfd in 2003.

Italy. Drilling activity declined last year despite continued appraisal and development of Tempa Rosa and Val d’Agri fields onshore in the southern Appenines region. However, the area offshore Sicily is paying off. Eni drilled the Panda 1 discovery offshore of southern Sicily during Arpil 2002. The well tested 19 MMcfgd and early reserve estimates are 350 Bcfg. In the Po Valley, several exploration prospects have resulted from newly awarded permits. Two tests will target deep oil, while as many as nine tests will search for shallow gas. Drilling is expected next year after regional and environmental authorities grant approval. In the Adriatic Sea, activity will continue to suffer as a result of a law blocking all E&P from the Po Delta northward. Val d’Agri production should peak at 104,000 bpd in 2004. Tempa Rosa is expected to come on stream in 2005 at over 22,000 bpd and peak at 49,000 bpd in 2009. In southern Italy, Miglianico field should add another 8,000 bpd by 2010. Germany. Exploration continued at about the same level as in 2001. The total exploration license area was reduced. The most important changes occurred in the North Sea, where large licenses around the Horn Graben and in the north & western part of the Entenschnabel have been relinquished. Seven exploration wells were drilled. Five were new-field wildcats, but unsuccessful. Results of the remaining two wells (new tectonic block test, shallower pool test) were not available at press time. All of the fourteen development wells were successful – nine found oil, five found gas. About 40% of the total footage was drilled in Mittelplate oil field, primarily by land-based extended reach wells. Gas production remained level with the prior year, but reserves dropped for a second year. Only a small share of gas production could be replaced by new reserves, which did not result from exploration but by reassessment of producing fields. Oil production rose again in 2002, as production from Mittelplate field increased. Reserves also grew because of Mittelplate. France. During 2002, exploration expenditures in France and its overseas territories was ten times less than the year before. This year, spending should rise, thanks to the probable drilling of four exploratory wells. Development and production expenditure was 43% lower in 2002 as well, since only four wells were drilled, compared to 24 in 2002. Several prospects have been defined by operators, but no exploration activity (drilling or seismic) occurred during 2002. Offshore, exploration acreage was awarded in the Mediterranean Sea (Gulf of Lions). And, an application was filed in the Bay of Biscaye. Of the four development wells were drilled in 2002 (all in Paris basin), three are producing, which helped to reduce the decline in oil production. Gas production in 2002 averaged 265 MMcfd, down 2.8% from the previous year). Ireland. Toward the end of the third quarter 2002, the Minister of State for Communications, Marine and Natural Resources announced a new initiative aimed at increasing exploration for oil and gas off the Irish coast. Large offshore areas are to be opened up for exploration, in four tranche rounds. One new exploration well was drilled between June 2002 and May 2003. This was Enterprise’s (now a subsidiary of Shell) deepwater Dooish well 12/2-1, which found a substantial column of hydrocarbons. Ireland has two gas fields on production – Ballycotton and Kinsale Head. Gas production in 2002 reached 30 Bcf, or 81 MMcfd. Gas production is expected to reach 28 Bcf, or 76.5 MMcfd in 2003. Gas production should rise during the fourth quarter of 2003 when Ramco Energy’s Seven Heads field commences production. Further increases are expected when Corrib field comes on stream. However, approval for the onshore terminal was refused in May 2003. Greenland. In April 2002, the Greenland Licensing Round officially opened offshore western Greenland between latitudes 63°N and 68°N. EnCana Corp. was the only company to apply for acreage. EnCana was awarded a license with Nunaoil A/S as partner in the fourth quarter of 2002. |