Canada

News

February 17, 2026

The offshore industry is marking the anniversary of the Ocean Ranger disaster, remembering the 84 crew members lost in 1982 and the lasting impact on offshore safety standards worldwide.

News

February 14, 2026

Canada’s energy minister says carbon capture investments and the Pathways Alliance project will help secure the long-term future and global competitiveness of the country’s oil sands industry.

News

February 06, 2026

Canadian crude markets are showing signs of oversupply as widening Western Canadian Select discounts, rising storage incentives and increased competition from Venezuela pressure oil sands producers despite expanded export capacity.

News

February 05, 2026

VAALCO Energy has agreed to sell its non-core producing assets in Canada for approximately $35 million, allowing the company to refocus capital on higher-impact drilling and development opportunities across its core portfolio.

News

January 22, 2026

A worker death at Suncor Energy’s oil sands operations near Fort McMurray is under investigation by Alberta regulators, marking the company’s first fatality since 2022.

News

January 07, 2026

Canadian heavy crude prices weakened after the Trump administration said it would market Venezuelan oil globally, raising concerns about renewed competition for US Gulf Coast refiners and wider heavy crude price discounts.

News

January 07, 2026

Energy NL has announced the passing of Bob Cadigan, its CEO from 2008 to 2017, remembering his advocacy for offshore Newfoundland and Labrador suppliers and his drive to expand local expertise into global markets.

News

December 16, 2025

Bonterra Energy delivered its strongest Charlie Lake well results to date, announced a $15.7-million bolt-on acquisition in northwest Alberta, and outlined preliminary 2026 guidance targeting up to 16,400 boed as it continues to scale its core Charlie Lake position.

News

December 08, 2025

Fluor and JGC have completed Train 2 at LNG Canada, marking the end of Phase 1 for the country’s first LNG megaproject and advancing a major new source of Canadian LNG to global markets.

News

November 26, 2025

PipeSense has signed an exclusive agreement with Indigenous-owned Monitor Emissions to expand advanced leak detection, pig tracking, and hydrotesting technologies across Canada’s pipeline network—strengthening national integrity, safety and emissions reduction efforts.

News

November 17, 2025

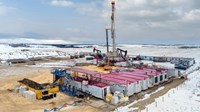

Canada’s oil sands are seeing renewed growth as U.S. shale output plateaus, with production hitting record highs following the Trans Mountain pipeline expansion. Improved heavy-oil pricing and rising U.S. investor interest are driving a resurgence among major oil sands producers through 2030.

News

November 13, 2025

Cenovus has officially closed its acquisition of MEG Energy, adding 110,000 bpd of low-cost oil sands production and consolidating a key thermal hub in Alberta. The deal strengthens Cenovus’s long-life asset base and positions the company for new synergies ahead of its 2026 budget update.

News

November 06, 2025

Aker Solutions has secured a five-year brownfield services contract from ExxonMobil Canada for the Hebron platform offshore Newfoundland and Labrador. The significant NOK 1.5–2.5 billion award extends Aker Solutions’ long-running EPC and maintenance work on the platform, reinforcing its strong presence in Atlantic Canada’s offshore sector.

News

November 05, 2025

Energy NL CEO Charlene Johnson said Canada’s 2025 federal budget shows promising support for resource and infrastructure projects, but urged clarity on the emissions cap timeline. She highlighted tax incentives for carbon capture and LNG as positive for Newfoundland and Labrador’s energy industry.

News

November 05, 2025

Ovintiv will acquire NuVista Energy in a $2.7 billion cash-and-stock deal, adding 140,000 net acres and 100,000 boed of production in the Montney while planning to divest its Anadarko assets to strengthen its balance sheet.

News

October 28, 2025

Canadian oil sands emissions increased by less than 1% in 2024 even as production rose 150,000 bpd, S&P Global Commodity Insights reports. Efficiency gains cut greenhouse gas intensity by 3% to 57 kgCO₂e per barrel.

News

October 13, 2025

Carnelian Energy Capital has closed a $600 million oversubscribed fund aimed at upstream oil and gas investments in Canada, signaling renewed private equity confidence in the region’s energy sector.

News

October 10, 2025

Strathcona Resources Ltd. has formally withdrawn its takeover bid for MEG Energy Corp., citing new terms in MEG’s revised agreement with Cenovus Energy Inc. that render the proposed acquisition no longer feasible.

News

October 09, 2025

Baytex Energy Corp. is considering divesting its Eagle Ford shale operations in south Texas, potentially fetching up to $3 billion, as the Calgary-based producer shifts strategic focus back to its Canadian oil portfolio.

News

October 08, 2025

Cenovus Energy has raised its takeover offer for MEG Energy to C$7.6 billion, sweetening terms ahead of a delayed shareholder vote. The deal would expand Cenovus’s footprint across Alberta’s Christina Lake oil sands, where MEG produces about 100,000 bpd.

News

October 06, 2025

Shell-led LNG Canada is preparing to load its first cargo from Train 2 this month, marking the next phase of Canada’s expanding LNG export capacity.