Middle East

News

December 15, 2025

The Middle Eastern oil market has weakened in recent weeks on concern that regional supplies will outstrip demand, adding to signs of a softening global picture that’s weighed on benchmark crude futures.

News

December 11, 2025

Dana Gas has confirmed a significant 15–25 Bcf gas discovery at the North El-Basant 1 exploratory well in Egypt’s onshore Nile Delta. The find supports the company’s $100 million drilling program, with production expected to exceed 8 MMscf/d once tied into the national gas network.

News

December 11, 2025

DNO has restarted drilling in the Kurdistan region after surpassing 500 MMbbl of cumulative production at the Tawke license. Two rigs will drill eight wells through 2026 as the operator targets increasing gross output to 100,000 bopd across the Tawke and Peshkabir fields.

News

December 09, 2025

Kistos has made its first move into the Middle East, agreeing to acquire onshore interests in Oman’s Blocks 9 and 3 & 4 in a $148-million deal with Mitsui. The transaction adds immediately cash-generative, liquids-weighted production and over 25 MMboe of net reserves.

News

December 08, 2025

A Qatar-based offshore operator has selected Vissim to deploy a digital vessel collision avoidance system, enhancing real-time maritime monitoring and safety at an offshore field under a three-year technology agreement.

News

December 04, 2025

Saudi Aramco has slashed its Arab Light crude price to the lowest level since 2021, signaling mounting global oversupply and softer demand as OPEC+ prepares for a slower start to 2026.

News

December 03, 2025

Aramco has started gas production from the first phase of its Jafurah shale project, delivering 450 MMcfd as the company targets 2 Bcfd and major unconventional growth.

News

December 02, 2025

ABL and Petroleum Marine Services have partnered to launch a unified rig-moving service covering the Red Sea and Gulf of Suez—aimed at cutting downtime, strengthening safety and bringing global-standard execution to one of the region’s busiest offshore basins.

News

December 01, 2025

Iraq is moving to reshape ownership of the giant West Qurna-2 field, launching direct talks with select U.S. oil companies to acquire Lukoil’s sanctioned stake. Baghdad says a U.S. operator would strengthen market stability and deepen energy ties with Washington.

News

November 28, 2025

OPEC+ confirmed it will pause planned output hikes in early 2026, citing weakening demand and a looming global surplus. The alliance also advanced a sensitive review of member production capacities—an issue that could reshape quotas heading into 2027.

News

November 26, 2025

ADNOC Gas has signed a landmark 20-year, up to $4.2 billion natural gas supply agreement with EMSTEEL, securing long-term feedstock for one of the UAE’s largest industrial producers and reinforcing the company’s role in powering the nation’s manufacturing and economic growth.

News

November 24, 2025

Abu Dhabi’s ADNOC will maintain its $150 billion spending plan over the next five years as the company ramps up oil and gas capacity and accelerates global expansion through its fast-growing XRG investment arm.

News

November 20, 2025

HKN Energy and Iraq’s Ministry of Oil have finalized technical terms for the Hamrin oil field, advancing the project toward a full contract and future production growth.

News

November 19, 2025

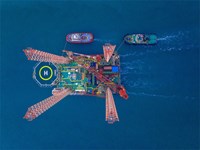

Pakistan Petroleum Ltd. is constructing an offshore artificial island in the Arabian Sea to support continuous oil and gas exploration. The island—located 30 km off Sindh’s coast—will enable round-the-clock drilling operations as Pakistan accelerates its offshore program following renewed interest in its resource potential.

News

November 18, 2025

ExxonMobil, Chevron, ADNOC and Carlyle are evaluating parts of Lukoil’s international portfolio as U.S. sanctions set to take effect in December accelerate the Russian producer’s efforts to divest global assets, including stakes in Iraq’s West Qurna 2 field and operations in Uzbekistan.

News

November 14, 2025

ADNOC Gas reported the strongest third-quarter results in its history, delivering $1.34 billion in net income—an 8% year-over-year increase—driven by robust domestic gas demand and improved commercial terms. Year-to-date profit reached $3.99 billion, up 10% from 2024, despite lower average oil prices.

News

November 14, 2025

ADNOC has secured conditional EU approval for its $13.9 billion acquisition of Covestro after offering commitments to address subsidy and competition concerns. The deal advances ADNOC's global chemicals and materials strategy while opening Covestro patents to European market participants for the next decade.

News

November 11, 2025

ADNOC Logistics & Services reported record nine-month 2025 results with revenue up 39% and net profit up 9% year-on-year, supported by strong Q3 performance and growth across all business lines. The company raised its full-year dividend 20%, secured major contracts, and advanced digital and fleet expansion initiatives.

News

November 11, 2025

Governments across Europe and the Middle East are scrambling to maintain operations at Lukoil’s global oil assets after the U.S. Treasury sanctioned Russia’s number two oil producer and blocked a proposed sale to Gunvor Group.

News

November 10, 2025

Lukoil has declared force majeure on oil shipments from Iraq’s West Qurna 2 field following new U.S. sanctions, marking the first major disruption to the Russian producer’s international operations.

News

November 06, 2025

TotalEnergies has awarded Vallourec a new contract to supply 30,000 tons of tubular solutions for Iraq’s Gas Growth Integrated Project (AGUP2 phase).