Industry Trends

News

January 27, 2026

Cognite has partnered with Snowflake to help oil and gas operators deploy industrial AI at scale by unifying IT, OT and operational data to improve asset performance, resilience and operational decision-making.

News

January 23, 2026

Abu Dhabi School of Management and Saal.ai have formed a strategic partnership to integrate AI-driven decision intelligence into leadership and executive education programs.

News

January 23, 2026

Upstream operators are accelerating adoption of AI, automation and predictive maintenance software to modernize assets and boost reliability. New ISG research highlights how digital platforms are reshaping oil and gas operations.

Article

Sponsored Content

January

Closed-loop automation delivers real-time control, proven return on investment, and a new global standard for hydraulic stimulation.

News

January 23, 2026

SLB closed 2025 with signs of stabilizing upstream activity across global markets. The company is leaning into production optimization, digital growth and offshore developments as it looks toward 2026.

News

January 22, 2026

U.S. crude oil production is expected to stay near its 2025 record through 2026 before declining in 2027, as lower prices slow drilling, EIA forecasts.

News

January 21, 2026

Halliburton closed out Q4 2025 with stronger margins and rising international activity, offsetting weaker North American stimulation. International markets drove sequential revenue growth, while higher-margin completion tools, wireline services and software sales lifted profitability and cash flow.

Article

December 2025

In this 2026 outlook, Molly Determan, president of the Energy Workforce & Technology Council, examines why oilfield service crews—leaner, more technical and globally integrated—remain the quiet backbone of reliable energy supply, regardless of price cycles, policy shifts or technology hype.

News

January 19, 2026

Baker Hughes says power generation and artificial lift equipment could drive near-term growth in Venezuela as oil producers seek to revive output amid renewed U.S. engagement and Chevron-led expansion.

News

January 14, 2026

Oil-Royalties says its Virtual Auction Marketplace is introducing standardized data, objective valuation tools and automated workflows aimed at improving transparency and reducing uncertainty for buyers of U.S. oil and gas royalty assets.

News

January 14, 2026

EWTC’s latest jobs report shows U.S. oilfield services employment ended 2025 slightly lower than earlier highs, highlighting a year shaped by market uncertainty and shifting labor conditions.

Article

December 2025

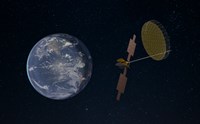

This article explores how advanced space technology and resilient satellite connectivity can support the development of autonomous oil rigs by addressing connectivity challenges in remote, hazardous environments. Improved remote monitoring, control and autonomous tools have the potential to enhance safety, increase operational efficiency and strengthen resilience across the energy sector.

News

January 13, 2026

Speaking at Abu Dhabi Sustainability Week 2026, UAE Energy Minister Sultan Al Jaber said surging AI and data-center demand will drive long-term growth in power consumption, with oil and gas continuing to supply most global energy needs alongside expanding renewables.

Article

December 2025

In the Middle East, operators are leveraging underbalanced coiled tubing drilling (UBCTD) to reduce formation damage, improve reservoir connectivity, and deliver higher production with lower completion complexity.

News

January 07, 2026

Siemens and NVIDIA expanded their industrial AI partnership at CES 2026, unveiling new digital twin and AI tools aimed at improving lifecycle efficiency across energy and infrastructure assets.

Article

December 2025

Progressive cavity pump applications are being redefined by with revolutionary electric submersible progressive cavity pump (ESPCP) systems.

Article

December 2025

This article examines Halliburton's data-driven approach to well control audits that use artificial intelligence (AI)-supported workflows, real-time data, and historical records to identify at-risk wells, streamline compliance, and reduce nonproductive time.

News

January 06, 2026

Expectations that Venezuela could quickly rebound to historic output near 3 MMbpd are running into hard infrastructure and capital barriers, according to commentary from global analyst firms.

Article

December 2025

Uncertainty continues to cloud investment on the UK Continental Shelf, as high taxation, limited licensing, declining production and policy shifts reshape the UK energy outlook to 2050.